Steppe Gold Ltd. (TSX: STGO) (OTCQX: STPGF) (FSE: 2J9)

(“

Steppe Gold” or the “

Company”)

is pleased to announce the filing of an updated preliminary

economic assessment (the “

Technical Report”)

regarding its 100% owned Tres Cruces Oxide Gold Project located in

Peru (“

Tres Cruces”).

Chairman and CEO of Steppe Gold, Bataa

Tumur-Ochir commented, “We are delighted to announce this updated

technical study for the Tres Cruces project. Tres Cruces is

strategically located in a highly prospective geological belt that

hosts the Lagunas Norte and La Arena mines, both with multi-million

ounce gold production. The Tres Cruces deposit contains oxide plus

sulphide indicated resources of 2,474,000 ounces with a grade of

1.65 g/t gold, inclusive of 630,000 ounces contained within

leachable gold oxide mineralization with a grade of 1.28 g/t gold.

Located in the La Libertad, Peru, surrounded by operating mines

with the attendant infrastructure and talent pool, this asset shows

great potential as a new production zone for Steppe Gold. We are

excited with the strong economics confirmed by recent drilling and

metallurgical testing, as well as the exploration potential across

the license area.”

TECHNICAL REPORT HIGHLIGHTS

- Infill drilling completed in 2022

confirmed continuity of mineralization.

- Metallurgical test work returned

average recoveries of 82% Au, confirming design assumptions.

- Construction costs escalated 4.5%

based on market data to reflect inflationary pressures.

- The initial capital expenditure

estimate increased by $6 million to $131 million driven by

equipment and labor costs.

- Operating costs rose 3.6% due to

consumables, reagents, contract mining services.

- Life of mine operational

expenditure estimate is now $297 million, up 3.6% from the

Prelimary Economic Assessment dated effective March 14, 2022.

- Operational expenditure per tonne

processed is now estimated at $19.93/t.

- At $1700/oz gold, the after-tax net

present value is $158 million with 30.9% IRR.

- Despite the cost increases, the

project economics remain robust with significant upside

potential.

- Mine schedule unchanged with Phase

1 focused on maximizing value from the oxide gold cap.

- Experienced team continues to

systematically advance the oxide project.

- Significant exploration potential

remains with mineralization open at depth.

|

TECHNICAL REPORT ASSUMPTIONS

AND RESULTS |

|

Description |

Units |

|

|

Net Present Value (NPV 5%) Pre-Tax |

US$ (million) |

$294.3 |

|

Net Present Value (NPV 5%) After-Tax |

US$ (million) |

$158 |

|

After-Tax Internal Rate of Return (IRR) |

% |

30.9 |

|

Payback Period |

Years |

2.1 |

|

LOM Cumulative Cash Flow |

US$ (million) |

$235.6 |

|

LOM All-In Sustaining Costs (AISC) |

US$/oz |

$734 |

|

Pre-Production CAPEX |

US$ (million) |

$125.2 |

|

Sustaining CAPEX (LOM) |

US$ (million) |

$5.2 |

|

Mine Life |

Years |

7 |

|

Average Processing Rate |

Tonnes/day |

5,800 |

|

LOM Strip Ratio |

|

2.89:1 |

|

Average Gold Recovery |

% |

81.7 |

|

Average Annual Gold Production |

Oz/year |

68,000 |

|

Total LOM Gold Production |

Ounces |

481,000 |

Mineral Resource Estimate

The current resource prepared by Jeffrey Rowe

and James Gray (Advantage Geoservices), published in March 2021,

was an update of the Technical Report by Lacroix and Associates

(L&A) dated September 2012 for previous owner New Oroperu

Resources (which is now a wholly-owned subsidiary of the Company).

The estimate used the geologic models of lithology and alteration

that were developed for the L&A resource, but divided the

deposit by mineralization type (oxide, transition, or sulphide).

Gold grade correlation based on geology was not readily apparent

and the decision was made to use a 0.2 g/t grade shell as control

for grade estimation. This shell was generated using an indicator

estimation method. A total of 327 holes have been used for this

estimate, of which 159 were RC holes and 168 were core holes.

Sample grades were composited to a down-hole length of 3 m. Assays,

subdivided by grade domain, were capped in a conventional manner

prior to compositing.

Gold grades were estimated inside and outside

the mineralized grade shell by ordinary kriging, into blocks with

dimensions of 10m x 10m x 5m (X/Y/Z). Average density values were

assigned by lithology based on 2,700 core density measurements.

The resource has been classified based on

spatial parameters related to drill density and configuration, and

the generation of an optimised pit. Blocks were initially

classified as Inferred where the average distance to the closest

three holes is within 80 m, and as Indicated where the average

distance to the closest three holes is within 50 m. Pit

optimization included variable cost and recovery values dependent

on mineralization type. All material included in the Mineral

Resource Estimate is contained within the optimized shell.

|

Mineral Resource

Estimate |

|

Resource Classification |

Indicated |

Inferred |

|

Tonnes (1000's) |

Au (g/t) |

Oz Au

(1000's) |

Tonnes (1000's) |

Au (g/t) |

Oz Au

(1000's) |

|

Oxide (0.3 g/t cut-off) |

9,636 |

1.37 |

425 |

487 |

0.75 |

12 |

|

Transition (0.3 g/t cut-off) |

5,707 |

1.12 |

205 |

361 |

0.60 |

7 |

|

Sulphide(0.9 g/t cut-off) |

31,132 |

1.84 |

1,844 |

1,713 |

1.55 |

85 |

|

Total |

46,475 |

1.65 |

2,474 |

2,561 |

1.26 |

104 |

The Technical Report only considers mining and

processing of leachable oxides and transition materials from the

Indicated and Inferred resource categories. Sulfide mineralization

is considered a future opportunity and does not currently factor

into mine planning, processing or financial results as reported in

this PEA.

DISCLOSURE

The Technical Report results are summarized for

purposes of this press release. Further details on the Technical

Report are available under the Company’s profile on SEDAR+ at

www.sedarplus.ca and on the Company’s website at

www.steppegold.com.

The Technical Report is preliminary in nature

and it includes inferred mineral resources that are considered too

speculative to be used in an economic analysis except as allowed

for under National Instrument 43-101 – Standards of Disclosure for

Mineral Projects (“NI 43-101”). There is no

guarantee that the inferred mineral resources can be converted to

Indicated or Measured mineral resources, and as such, there is no

guarantee the project economics described in this release will be

achieved.

QUALIFIED PERSONSThe following

persons, all of whom are qualified persons under 43-101, have

approved the disclosure contained within this release:

|

Name of Qualified Person |

Company |

Qualification |

|

John Woodson |

M3 Engineering & Technology Corporation |

P.E. |

|

Laurie Tahija |

M3 Engineering & Technology Corporation |

QP-MMSA |

|

Jeff Rowe |

Independent Geologist |

P.Geo. |

|

Adam Johnston |

Transmin Limited |

FAusIMM CP(Met) |

|

James N. Gray |

Advantage Geoservices Limited |

P.Geo. |

|

John Nilsson |

Nilsson Mine Services Ltd. |

P. Eng. |

The Technical Report was prepared in accordance

with NI 43-101. The study was prepared by M3 Engineering and

Technology Corporation of Tucson, Arizona and Arequipa, Peru, in

cooperation with Nilsson Mine Services of Pitt Meadows, BC,

Transmin Ltd., of Lima, Peru, Advantage Geoservices Ltd. of

Chilliwack, BC, and Jeffrey Rowe of Surrey, BC.

About Steppe Gold

Steppe Gold is Mongolia’s premier precious

metals company.

For Further information, please

contact:

Bataa Tumur‐Ochir, CEO and

Chairman

Shangri‐La office, Suite 1201, Olympic

Street 19A, Sukhbaatar District 1,Ulaanbaatar

14241, MongoliaTel: +976 7732 1914

Cautionary Statements Regarding

Forward‐looking Information

This news release contains “forward‐looking

information” which may include, but is not limited to, statements

with respect to the future financial or operating performance of

the Company and its projects. Often, but not always,

forward‐looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “continues”,

“scheduled”, “estimates”, “forecasts”, “intends”, “potential”,

“anticipates”, or “believes” or variations (including negative

variations) of such words and phrases, or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will” be taken, occur or be achieved. Forward‐looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by the

forward‐looking statements. Forward‐looking statements contained

herein are made as of the date of this press release and the

Company disclaims any obligation to update any forward‐looking

statements, whether as a result of new information, future events

or results or otherwise. There can be no assurance that

forward‐looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. The Company undertakes no

obligation to update forward‐looking statements if circumstances,

management’s estimates or opinions should change, except as

required by securities legislation. Accordingly, the reader is

cautioned not to place undue reliance on forward‐looking

statements.

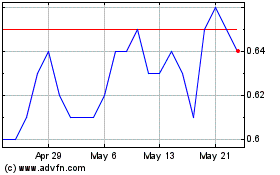

Steppe Gold (TSX:STGO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Steppe Gold (TSX:STGO)

Historical Stock Chart

From Mar 2024 to Mar 2025