Steppe Gold Ltd. (TSX: STGO) (OTCQX: STPGF) (“Steppe Gold” or the

“Company”) today reported strong financial and operational results

for the third quarter of 2024.

Highlights:(all figures

in US$000’s)

Strong Operational Performance:

Both Boroo Gold LLC (“Boroo Gold”) and Steppe Gold delivered solid

production and sales results. Total revenue for the three and nine

months ended September 30, 2024, amounted to $37,331 and

$131,912, respectively.

- Revenue for Boroo Gold for the

three and nine months ended September 30, 2024, amounted to

$27,397 and $121,978 on sales of 12,607 and 57,114

gold ounces and 2,833 and 11,833 silver ounces.

- Steppe Gold's revenue from August

1, 2024, to September 30, 2024, amounted to $9,934

on sales of 3,769 gold ounces and 20,078 silver ounces.

- Average realized prices for Boroo

Gold for the three and nine months ended September 30, 2024, were

$2,167 and $2,131 per gold ounce and $28 and $25 per silver ounce,

respectively.

- Average realized prices for Steppe

Gold for the period from August 1, 2024, to September 30, 2024,

were $2,623 per gold ounce and $24 per silver ounce.

Robust Financial Results:

Revenue and earnings increased significantly compared to the

previous quarter. Total operating income before depreciation and

depletion for the three and nine months ended September 30, 2024,

amounted to $21,487 and $88,148.

- Operating income from Boroo Gold’s

mine operations for the three and nine months that ended September

30, 2024, were $16,786 and $83,447.

- Operating income from Steppe Gold’s

mine operations for the period from August 1, 2024, to September

30, 2024, was $4,701.

EBITDA for the three and nine months

ended September 30, 2024, amounted to $19,453 and

$82,687.

Low-Cost Production: All-in

Sustaining Costs remained low, enhancing profitability.

- In Sustaining Costs for Boroo Gold

were $1,095 and $961 per ounce

sold for the three and nine months that ended September 30,

2024.

- All in Sustaining Cost for Steppe

Gold from August 1, 2024, to September 30, 2024, were $1,610 per

ounce sold.

Company outlook:

The acquisition of Boroo Gold was a

transformational step for the Company. It accelerates the path to a

multi-asset Mongolia-focused mining group and, importantly, is

projected to immediately provide strong cash flow to support growth

plans, further improved with the recent strong gold prices.

The near-term focus for the Company is on

maximizing production and cash flows at both producing mines and

executing on successful completion of the Phase 2 Expansion.

The Company’s condensed interim consolidated

financial results for the quarter ended September 30, 2024 have

been filed on SEDAR+. The full version of the condensed interim

consolidated financial statements and associated management's

discussion & analysis can be viewed on the Company's website at

www.steppegold.com or under the Company's profile on SEDAR+ at

www.sedarplus.ca.

Steppe Gold Ltd.

Steppe Gold is Mongolia’s premier precious

metals company.

For Further information, please

contact:

Bataa Tumur-Ochir, Chairman and CEO

Elisa Tagarvaa, Investor

Relations elisa@steppegold.com

Shangri-La office, Suite 1201, Olympic Street19A, Sukhbaatar

District 1,Ulaanbaatar 14241, MongoliaTel: +976 7732 1914

Non-IFRS Performance

Measures

The Company uses the following non-IFRS

measures: Adjusted EBITDA, EBITDA and AISC. EBITDA is earnings

before interest, taxes, depreciation and amortization. Adjusted

EBITDA is defined as adjusted earnings before interest, taxes,

depreciation and amortization. AISC is calculated using cash costs

in addition to general and administration, asset retirement costs,

and sustaining capital, less certain non-recurring costs (notably

exploration costs at the Mungu deposit) to provide an overall

company outlook on the total cost required to sell an ounce of

gold.

Management believes that these non-IFRS measures

provide useful information to investors in measuring the financial

performance of the Company for the reasons outlined below. These

measures do not have a standardized meaning prescribed by IFRS and

therefore they may not be comparable to similarly titled measures

presented by other publicly traded companies and should not be

construed as an alternative to other financial measures determined

in accordance with IFRS. The Company believes that these measures,

together with measures determined in accordance with IFRS, provide

investors with an improved ability to evaluate the underlying

performance of the Company. The inclusion of these measures is

meant to provide additional information and should not be used as a

substitute for performance measures prepared in accordance with

IFRS. These measures are not necessarily standard and therefore may

not be comparable to other issuers. Further details of non-IFRS

measures noted above can be found in the Company’s management's

discussion & analysis for the six months ended June 30,

2024.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains certain statements or

disclosures relating to the Company that are based on the

expectations of its management as well as assumptions made by and

information currently available to the Company which may constitute

forward-looking statements or information (“forward-looking

statements”) under applicable securities laws. All such statements

and disclosures, other than those of historical fact, which address

activities, events, outcomes, results, or developments that the

Company anticipates or expects may, or will occur in the future (in

whole or in part) should be considered forward-looking statements.

In some cases, forward-looking statements can be identified by the

use of the words “continued”, “focus”, “scheduled”, “will”,

“projected”, “opportunity”, “expected”, “planned” and similar

expressions. In particular, but without limiting the foregoing,

this news release contains forward-looking statements pertaining to

the following: the anticipated cash flow and other benefits of the

Boroo Gold transaction; the potential for value creation to Steppe

Gold’s shareholders; the strengths, characteristics and potential

of the resulting company and discussion of future plans,

projections, objectives, estimates and forecasts and the timing

related thereto, including with respect to the Phase 2 Expansion

and the ATO gold mine.

The forward-looking statements contained in this

news release reflect several material factors and expectations and

assumptions of the Company including, without limitation:

management team and board of directors of Steppe Gold; material

adverse effects on the business, properties and assets of the

Company; changes in business plans and strategies; market and

capital finance conditions; risks inherent to any capital financing

transactions; changes in world commodity markets; currency

fluctuations; costs and supply of materials relevant to the mining

industry; change in government and changes to regulations affecting

the mining industry; discrepancies between actual and estimated

production and test results, mineral reserves and resources and

metallurgical recoveries; and such other risk factors detailed from

time to time in Steppe Gold’s public disclosure documents,

including, without limitation, those risks identified in Steppe

Gold’s annual information form for the year ended December 31,

2023, which is available on SEDAR+ at www.sedarplus.ca

Forward-looking statements are based on

information available at the time those statements are made and/or

management’s good faith belief as of that time with respect to

future events and are subject to risks and uncertainties that could

cause actual performance or results to differ materially from those

expressed in or suggested by such forward-looking statements.

Forward-looking statements speak only as of the date those

statements are made. Except as required by applicable law, Steppe

Gold assumes no obligation to update or to publicly announce the

results of any change to any forward-looking statement contained or

incorporated by reference herein to reflect actual results, future

events or developments, changes in assumptions or changes in other

factors affecting the forward-looking statements. If Steppe Gold

updates any one or more forward-looking statements, no inference

should be drawn that the company will make additional updates with

respect to those or other forward-looking statements. All

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

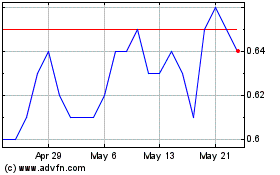

Steppe Gold (TSX:STGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Steppe Gold (TSX:STGO)

Historical Stock Chart

From Feb 2024 to Feb 2025