Athabasca Minerals Inc. Announces Q3 2018 Financial Results

10 November 2018 - 8:30AM

Athabasca Minerals Inc. (“Athabasca” or the “Corporation”) (TSX

Venture: ABM) announces its financial results for the third quarter

ended September 30, 2018. The Corporation’s financial statements

and management’s discussion and analysis (“MD&A”) for the

quarter ended September 30, 2018 are available on SEDAR at

www.sedar.com and on the Athabasca Minerals Inc. website at

www.athabascaminerals.com.

2018 Q3 Highlights

- Susan Lake Closure Plan is under review with Alberta

Environment and Parks (“AEP”). Milestones for progressively closing

the Susan Lake gravel pit will continue into 2019. Susan Lake

Closure will result in an estimated incremental liability of $1.4M,

with the majority of cost to be incurred from Quarter -2 to Quarter

– 4 of 2019.

- Susan Lake gravel pit remains operational under Overholding

Tenancy status. Athabasca continues to collect volume-based pit

management fees (net of Provincial Government Royalties) for the

three months and nine months ended September 30, 2018 of $1.2

million and $2.4 million respectively;

- Continued progress in enhancing the business enterprise and

valuation of AMI Silica Inc. “AMI Silica”, a wholly-owned

subsidiary, in providing premium domestic frac sand for the oil and

gas sector in Western Canada;

- Equipment and site selection have been finalized for AMI

Silica’s planned processing facility in Mayerthorpe, AB;

- AMI Silica submitted its Development Permit application in late

July for review and approval by the Town of Mayerthorpe and is

working on a long-term lease agreement with the property owner and

actively having discussions with capital firms with respect to

financing of the Firebag frac-sand project;

- Gross profit improved by 59% and by 133% for the three and nine

months ended September 30, 2018 to $1.2 million and $1.3 million

respectively (three and nine months ended September 30, 2017: $0.8

million and $0.6 million respectively);

- General and administrative expense decreased by 17% and 12% for

the three and nine months ended September 30, 2018 to $0.7 million

and $2.0 million respectively (three and nine months ended

September 30, 2017: $0.9 million and $2.2 million respectively);

- Working capital of $6.0 million; current lease obligation of

$0.05 million; non-current lease obligation $nil;

- Debt to equity ratio of 0.4; total liabilities of $5.8 million;

total shareholders’ equity of $14.2 million.

Financial Highlights

|

($ thousands of CDN, except per share amounts and tonnes sold) |

Three Months Ended Sept 30, 2018 |

Three Months Ended Sept 30, 2017 |

Nine Month Ended Sept 30, 2018 |

Nine Month Ended Sept 30, 2017 |

|

Aggregate management fees - net |

$ |

1,186 |

|

$ |

1,452 |

|

$ |

2,418 |

|

$ |

2,503 |

|

|

Aggregate sales revenue |

$ |

1,769 |

|

$ |

2,027 |

|

$ |

2,024 |

|

$ |

2,730 |

|

|

Revenue |

$ |

2,955 |

|

$ |

3,479 |

|

$ |

4,441 |

|

$ |

5,233 |

|

|

Gross profit |

$ |

1,273 |

|

$ |

802 |

|

$ |

1,323 |

|

$ |

567 |

|

|

Total loss and comprehensive loss |

$ |

(782 |

) |

$ |

(431 |

) |

$ |

(1,577 |

) |

$ |

(1,958 |

) |

|

|

|

|

|

|

|

Loss per share, basic and fully diluted ($ per

share) |

$ |

(0.023 |

) |

$ |

(0.013 |

) |

$ |

(0.047 |

) |

$ |

(0.059 |

) |

2018 Operational Outlook

Over the next 12 months, the Corporation is

actively addressing and working on various strategic and

operational initiatives relating to the following:

- Resolution of the Syncrude lawsuit;

- Conclude the Susan Lake Management Renewal Contract and execute

the closure program of the Susan Lake Gravel Pit (still pending

approval by AEP);

- Secure financing for AMI Silica’s development project;

- Develop strategic trucking partnership to optimize logistics

operating cost for AMI Silica;

- Conclude long-term lease agreements for land positioning in

Mayerthorpe, AB for AMI Silica;

- Obtain pre-orders for year one of planned AMI Silica

production;

- Sell existing stockpiled inventories of sand and gravel from

Athabasca corporate pits;

- Selectively pursue conventional aggregate companies for

potential acquisition;

- Replenish aggregate inventories at the Conklin hub to meet

local construction annual demand; and

- Further develop the Aggregates Marketing arm to broker sales of

3rd party inventories to a larger market and expanded customer base

in Western Canada.

About Athabasca Minerals

The Corporation is a resource company involved

in the management, exploration and development of aggregate

projects. These activities include contracts works, aggregate pit

management, aggregate production and sales from corporate-owned

pits, new aggregate development and acquisitions of sand and gravel

operations. The Corporation also has industrial mineral land

holdings for the purpose of locating and developing sources of

industrial minerals and aggregates essential to high growth

economic development.

For further Information on Athabasca, please

contact:

Dean StuartT: 403-617-7609E: dean@boardmarker.net

Robert BeekhuizenT: 780-465-5696

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

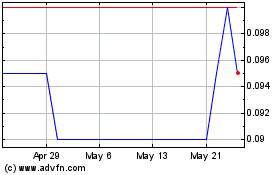

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

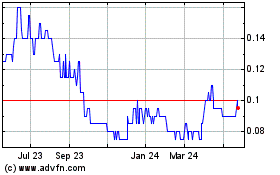

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025