Amazon Mining Closes Cdn$4.5 Million Private Placement Financing

31 December 2010 - 1:17PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Amazon Mining Holding Plc (TSX VENTURE:AMZ) ("Amazon" or the "Company") is

pleased to announce that it has completed its previously announced "best

efforts" private placement financing with Ocean Equities Ltd. ("Ocean") pursuant

to which 1,080,000 ordinary shares of the Company were sold at a price of $4.17

per share for gross proceeds of $4,503,600.

Amazon paid to Ocean a commission of $270,216, being 6.0% of the gross proceeds

of the private placement, and has issued 64,800 broker's warrants to Ocean,

entitling Ocean to acquire 64,800 shares of the Company, being 6% of the number

of shares issued pursuant to the private placement. The broker warrants are

exercisable up to 5:00 p.m. on December 30, 2012 at an exercise price of $4.17

per share.

The net proceeds of the private placement will be applied to the general working

capital of the Company and the development of its Cerrado Verde potash project.

All securities issued in connection with this private placement will be subject

to a statutory hold expiring on May 1, 2011 in accordance with Canadian

securities legislation.

About Amazon Mining

Amazon Mining is a mineral exploration and development company founded and led

by Brazilians since 2005. The company is focused on the development of the

Cerrado Verde project. Cerrado Verde is source of a potash rich rock from which

Amazon plans to produce a slow-release, non-chloride, multi-nutrient, fertilizer

product. Amazon Mining is a UK public company with shares listed on the TSX

Venture Exchange since November 2007.

On behalf of the Board of Directors of Amazon Mining Holding Plc, Cristiano

Veloso, President and CEO.

Cautionary Language and Forward Looking Statements

THIS PRESS RELEASE CONTAINS CERTAIN "FORWARD LOOKING STATEMENTS", WHICH INCLUDE

BUT IS NOT LIMITED TO, STATEMENTS WITH RESPECT TO THE FUTURE FINANCIAL OR

OPERATING PERFORMANCE OF THE COMPANY, ITS SUBSIDIARIES AND ITS PROJECTS,

STATEMENTS REGARDING USE OF PROCEEDS, EXPLORATION PROSPECTS, IDENTIFICATION OF

MINERAL RESERVES, COSTS OF AND CAPITAL FOR EXPLORATION PROJECTS, EXPLORATION

EXPENDITURES, TIMING OF FUTURE EXPLORATION AND PERMITTING, REQUIREMENTS FOR

ADDITIONAL CAPITAL, GOVERNMENT REGULATIONS OF MINING OPERATIONS, ENVIRONMENTAL

RISKS, RECLAMATION EXPENSES, TITLE DISPUTES OR CLAIMS, AND LIMITATIONS OF

INSURANCE COVERAGE. FORWARD LOOKING STATEMENTS CAN GENERALLY BE IDENTIFIED BY

THE USE OF WORDS SUCH AS "PLANS", "EXPECTS", OR "DOES NOT EXPECT" OR "IS

EXPECTED", "ANTICIPATES" OR "DOES NOT ANTICIPATE", OR "BELIEVES", "INTENDS",

"FORECASTS", "BUDGET", "SCHEDULED", "ESTIMATES" OR VARIATIONS OF SUCH WORDS OR

PHRASES OR STATE THAT CERTAIN ACTIONS, EVENT, OR RESULTS "MAY", "COULD",

"WOULD", "MIGHT", OR "WILL BE TAKEN", "OCCUR" OR "BE ACHIEVED". FORWARD LOOKING

STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS

WHICH MAY CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE COMPANY

TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS

EXPRESSED OR IMPLIED BY SAID STATEMENTS. THERE CAN BE NO ASSURANCES THAT

FORWARD-LOOKING STATEMENTS WILL PROVE TO BE ACCURATE, AS ACTUAL RESULTS AND

FUTURE EVENTS COULD DIFFER MATERIALLY FROM THOSE ANTICIPATED IN SAID STATEMENTS.

ACCORDINGLY, READERS SHOULD NOT PLACE UNDUE RELIANCE ON FORWARD-LOOKING

STATEMENTS.

Readers are cautioned not to rely solely on the summary of such information

contained in this release and are directed to the complete set of drill results

posted on Amazon's website (www.amazonplc.com) and filed on SEDAR

(www.sedar.com) and any future amendments to such. Readers are also directed to

the cautionary notices and disclaimers contained herein.

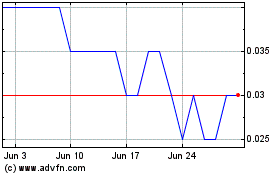

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Azucar Minerals (TSXV:AMZ)

Historical Stock Chart

From Dec 2023 to Dec 2024