Acceleware Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), is

pleased to provide an update on the status of the heating well

workover program at its commercial-scale RF XL pilot project

at Marwayne, Alberta (the “Pilot”). The Company is also announcing

a non-brokered private placement of units (the “Units”), at a price

of $0.23 per Unit (the “Unit Price”), for gross proceeds of up to

$2,000,000 (the “Private Placement”).

Pilot Update

The RF XL team has continued to work through the

heating well workover project since closing the last financing of

the Company for $1.8 million in November 2022. At that time, the

Company was also seeking non-dilutive financial support from

partners and funders. As a result, Acceleware was able to secure

$900,000 in non-repayable funding from Alberta Innovates (announced

December 2022) to help cover the cost of the workover. The Company

continues to actively source additional non-dilutive funding.

During the Pilot workover project, the team was

able to complete an inspection of the removable and non-removeable

components of the proprietary down-hole RF XL system. The

inspection activities included visual inspection, various

electrical and mechanical measurements, down-hole video analysis

and other engineering techniques to obtain detailed data on the

condition of the components. This inspection enabled the team to

identify several opportunities that are expected to improve the

performance of the RF XL system and rectify issues that required

repair. These upgrades and repairs would not have been possible

without pausing operations to perform the replacement of the

distributed temperature sensing system (“DTS”) and have resulted in

the addition of valuable IP.

“The Acceleware team has performed extensive

analysis and planning, working closely with service partners and

operating partners to develop an appropriate rework and upgrade

plan for this final stage of repairs,” said Geoff Clark, Chief

Executive Officer of Acceleware. “Having proven our Clean Tech

Inverter functionality for over six months at the RF XL pilot site

in 2022, we are keen to get the downhole portion of the RF XL

system back up and heating as soon as possible to accomplish our

goals for the pilot.”

The requisite upgrades and repairs are being

completed in conjunction with the original DTS replacement work.

Upon successful completion, the Company expects to be able to

restart heating at the site.

Dr. Michal Okoniewski, Chief Scientific Officer,

said “We have a high degree of confidence that the due diligence

involved in this workover will allow us to achieve our goal of

continuing to increase the amount of power we can inject into the

reservoir, and in turn show a meaningful increase in reservoir

temperature within a few months of restarting operations.”

Clean Tech Inverter (CTI)

Update

As announced on September 7, 2022, Acceleware is

working to adapt the Clean Tech Inverter (“CTI”) used at the Pilot

to decarbonize and lower the cost of other heavy emitting

industrial heating applications.

The Company is working on a collaboration with

Aurora Hydrogen to design a CTI based radio frequency (“RF”)

heating system for their hydrogen production technology, which is

based on a methane pyrolysis reaction. The goal of this project is

for Aurora to have a highly scalable, low-cost method of producing

hydrogen relative to competitors, enabled by CTI. Acceleware will

continue to develop a CTI that is specifically suited to hydrogen

production to ensure that the opportunity for the CTI to become

part of the hydrogen economy is maximized.

The Company has also commenced work on a

technology development project involving RF heating utilizing CTI

technology for agriculture and food drying applications. The

intended outcome of the project is to demonstrate the ability of

CTI to economically decarbonize agricultural drying at a commercial

scale. According to DataIntelo, the global market for agricultural

industrial dryers was valued at over $11 billion USD per year in

2017.

Acceleware also began project work within the

mining sector as announced by our client, International Minerals

Innovation Institute, on May 17, 2023. The intention of the project

is to validate the potential to use radio frequency energy from the

CTI to dry potash ore and other mineral commodities.

Mr. Clark said “We have been talking about the

potential for CTI to economically decarbonize multiple

heavy-emitting industrial heating processes for several years.

Having validated the capabilities of the CTI at our Pilot we are

ready to expand the use of the CTI to other heavy emitting

applications. We believe this diversification can lead to

meaningful emissions reductions as well as growth opportunities for

the CTI platform. Cost effective electrification of industrial heat

at very large scale is urgently needed if we are to meet global GHG

emission reduction goals, and Acceleware believes the CTI is a

technology that can make a significant impact on this front.”

Details of the Private

Placement

Pursuant to the Private Placement, each Unit

will consist of (i) one common share in the capital of the Company

(a “Common Share”); and (ii) one Common Share purchase warrant (a

“Warrant”). Each Warrant will entitle the holder thereof to acquire

one (1) Common Share of Acceleware at $0.30 for a period of

24-months from the date of issuance of the Warrant. In the event

that the Common Shares trade at a closing price at or greater than

$0.69 per Common Share for a period of thirty (30) consecutive

trading days, Acceleware may accelerate the expiry date of the

Warrants by giving notice to the holders thereof, and in such case,

the Warrants will expire on the 30th day after the date on which

such notice is given by Acceleware.

Acceleware expects the Private Placement to

close on or about June 27, 2023 (the “Closing Date”).

Acceleware intends to use the net proceeds of

the Private Placement to fund a portion of the Pilot workover, to

fund research and development related to new CTI industrial heating

applications including those mentioned above, and for general

corporate purposes.

Completion of the Private Placement is subject

to certain conditions including, but not limited to, the receipt of

all necessary regulatory approvals including the approval of the

TSX Venture Exchange (the “TSXV”). The TSXV has not approved the

Unit Price and this remains subject to change. Purchasers of the

Units will be subject to a four months plus one day hold period in

accordance with securities legislation.

Acceleware expects certain insiders to

participate in the Private Placement, which will make the Private

Placement a related party transaction within the meaning of

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). Acceleware intends

to rely on the exemptions from the formal valuation and minority

approval requirements of MI 61-101.

About Acceleware

Acceleware (www.acceleware.com) is an innovator

of clean-tech decarbonization technologies comprised of two

business units: Radio Frequency Heating Technology and Seismic

Imaging Software.

Acceleware is piloting RF XL, its patented

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy

production that can quickly bend the emissions curve downward. With

clean electricity, Acceleware’s RF XL technology could

eliminate greenhouse gas (GHG) emissions associated with heavy oil

and oil sands production. RF XL uses no water, requires

no solvent, has a small physical footprint, can be redeployed from

site to site, and can be applied to a multitude of reservoir types.

Acceleware is also actively developing partnerships for RF heating

of other industrial applications using the Company’s proprietary

CTI.

Acceleware and Saa Dene Group

(co-founded by Jim Boucher) have created

Acceleware | Kisâstwêw to raise the

profile, adoption, and value of Acceleware technologies. The

shared vision of the partnership is to improve the

environmental and economic performance of

the energy sector by supporting ideals that are

important to Indigenous peoples, including respect for land, water,

and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol “AXE”.

Disclaimers

This news release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking statements”) within the meaning of the applicable

Canadian securities legislation. All statements, other than

statements of historical fact, are forward-looking statements and

are based on expectations, estimates and projections as at the date

of this release. Any statement that involves discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, “anticipates”, “plans”,

“continues”, “budget”, “scheduled”, “forecasts”, “estimates”,

“believes” or “intends” or variations or negatives of such words

and phrases or stating that certain actions, events or results

“may” or “could”, “would”, “might”, “shall” or “will” be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking statements.

In this news release, forward-looking statements

relate to, among other things, statements relating to the benefits

of RF XL, future operation of the Pilot, prospective performance of

the Company, the status and advancement upgrades and repairs, the

anticipated development, application and market potential of CTI,

the receipt of regulatory approvals for the Private Placement

(including TSXV approvals) and the timing thereof, statutory hold

periods, the terms and conditions of the Private Placement, the

Closing Date for the Private Placement, the anticipated use of

proceeds from the Private Placement and the participation of

related parties in the Private Placement. Various assumptions or

factors are typically applied in drawing conclusions or making the

forecasts or projections set out in forward-looking information.

Those assumptions and factors are based on information currently

available to the Company. The material facts and assumptions

include obtaining approval of the TSXV of the proposed Private

Placement, the availability of certain prospectus exemptions in

respect of the Private Placement and the intended use of proceeds

remaining in the best interests of the Company. Actual results may

vary from the forward-looking information in this news release due

to certain material risk factors. The Company cautions the reader

that the above list of risk factors is not exhaustive and

additional risk factors risk factors are described in detail in

Acceleware’s continuous disclosure documents, which are filed on

SEDAR at www.sedar.com. The forward-looking information contained

in this release is made as of the date hereof and the Company is

not obligated to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws. Due to the risks,

uncertainties and assumptions contained herein, investors should

not place undue reliance on forward-looking information. The

foregoing statements expressly qualify any forward-looking

information contained herein.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

release.

For further information:Geoff Clark, CEOTel: +1

(403) 249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10th Avenue SECalgary, AB,

T2G 0W3 CanadaTel: +1 (403) 249-9099www.acceleware.com

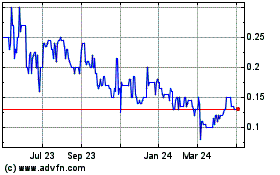

Acceleware (TSXV:AXE)

Historical Stock Chart

From Dec 2024 to Jan 2025

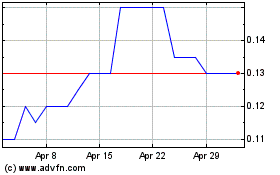

Acceleware (TSXV:AXE)

Historical Stock Chart

From Jan 2024 to Jan 2025