Cathedra Bitcoin Inc. (TSX-V: CBIT; OTCQX: CBTTF)

(“Cathedra”), a Bitcoin company that develops and operates

world-class bitcoin mining infrastructure, and Great American

Mining (“GAM”) (together, the “Companies”), a bitcoin

mining company that provides a solution for oil and gas companies

to reduce flaring and increase oil production, today announce the

Companies have amended their original partnership agreement to

provide for the conclusion of the business relationship by

September 15, 2022 (the “Conclusion Date”).

In 2021, the Companies entered into a business relationship (the

“Original Relationship”) under which Cathedra purchased 12

bitcoin mining containers from GAM and outfitted them with its own

bitcoin mining machines. GAM designed and produced the containers,

installed the mining machines therein, and deployed the containers

on a site in North Dakota (the “Site”) throughout the course

of 2021, where they have been operating using flared gas as a power

source. Under the Original Relationship, Cathedra has paid to

purchase the gas and lease the generators and has remitted a

portion of the mined bitcoin to GAM in the form of a revenue

share.

Due to severe winter weather conditions that resulted in up to

four feet of snow accumulation in multiple storms, the Cathedra and

GAM bitcoin mining operation saw its performance impaired

throughout the month of April, operating at an average of 45% of

expected hash rate during the month. Current hash rate levels and

operating conditions have now returned to normal.

Additionally, the Companies were recently notified by their

generator provider that the generator lease rate would be

increasing by over 50%. In light of this higher cost and the

adverse effect it will have on mining economics at the Site, the

Companies have mutually agreed to work toward a conclusion of the

business relationship and have entered into an amended agreement

that governs the terms of the wind-up (the “Amendment”).

Under the Amendment, Cathedra has agreed to collect its bitcoin

mining machines from the Site on or before the Conclusion Date.

Cathedra intends to redeploy these machines in its own mobile

bitcoin mining containers, the production of which Cathedra began

in March, on an off-grid site with more beneficial economic

characteristics.

Pursuant to the Amendment, GAM will purchase the 12 containers

back from Cathedra for approximately US$935,750, or net book value,

on or before the Conclusion Date. GAM intends to outfit these

containers with its own mining machines and redeploy them on

another site of its choosing.

The Companies have also agreed to modify the terms of the

revenue share for the remaining months of the business

relationship. Under the Amendment, GAM will receive a flat share of

25% of bitcoin mined each month.

“GAM has been a first-class partner for Cathedra in this stage

of our company’s growth. We appreciate GAM’s excellent work

building and outfitting our containers, deploying them in North

Dakota, and maintaining them on our behalf. We look forward to

installing our machines at a low-cost site upon the conclusion of

the business relationship. We wish the GAM team the very best in

their future endeavors,” remarked AJ Scalia, CEO of Cathedra

Bitcoin.

“Cathedra has been a great partner for us as we have scaled the

company over the past year from approximately 1 megawatt to over 20

megawatts of deployed hash rate on the oil fields of North Dakota.

We would like to thank Cathedra and their management team for the

partnership to date, and wish them the best of luck,” commented

Todd Garland, Founder and CEO of Great American Mining.

About Cathedra Bitcoin

Cathedra Bitcoin Inc. (TSX-V: CBIT; OTCQX: CBTTF) is a Bitcoin

company that develops and operates world-class bitcoin mining

infrastructure.

Cathedra believes sound money and abundant energy are the

fundamental ingredients to human progress and is committed to

advancing both by working closely with the energy sector to secure

the Bitcoin network. Today, Cathedra owns 187 PH/s across various

sites around the United States and expects to deploy an additional

538 PH/s in 2022. Upon the full deployment of its purchased

machines, Cathedra’s hash rate is expected to total 725 PH/s. The

Company is focused on expanding its portfolio of hash rate through

a diversified approach to site selection and operations, utilizing

multiple energy sources across various jurisdictions.

For more information about Cathedra, visit cathedra.com or

follow Company news on Twitter at @CathedraBitcoin or on Telegram

at @CathedraBitcoin.

About Great American Mining

Great American Mining provides a solution for oil and gas

companies to reduce flaring and increase oil production. GAM has

deployed over 20 megawatts of Bitcoin hash rate across on the oil

fields of North Dakota and manufactures proprietary mobile bitcoin

mining data centers. Great American Mining believes in a future

where all hash rate will become mobile and is on a mission to build

the world's largest fleet of mobile hash rate.

For more information about Great American Mining, please visit

gam.ai and follow GAM on Twitter at @GAMdotAI and LinkedIn.

Cautionary Statement

Trading in the securities of the Company should be considered

highly speculative. No stock exchange, securities commission or

other regulatory authority has approved or disapproved the

information contained herein.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains certain “forward-looking information”

within the meaning of applicable Canadian securities laws that are

based on expectations, estimates and projections as at the date of

this news release. The information in this release about future

plans and objectives of the Company, are forward-looking

information. Other forward-looking information includes but is not

limited to information concerning: the expected deployment of an

additional miners, the intentions and future actions of senior

management, the intentions, plans and future actions of the

Company, as well as the Company’ ability to successfully mine

digital currency; revenue increasing as currently anticipated; the

ability to profitably liquidate current and future digital currency

inventory; volatility of network difficulty and, digital currency

prices and the resulting significant negative impact on the

Company’s operations; the construction and operation of expanded

blockchain infrastructure as currently planned; and the regulatory

environment of cryptocurrency in applicable jurisdictions.

Any statements that involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives,

assumptions, future events or performance (often but not always

using phrases such as “expects”, or “does not expect”, “is

expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could”, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on reasonable

assumptions and estimates of management of the Company at the time

it was made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others: the ability of the Company to achieve its corporate

objectives or otherwise advance the progress of the Company; risks

related to the international operations; the Company's inability to

obtain any necessary permits, consents or authorizations required

for its activities; an inability to predict and counteract the

effects of COVID-19 on the business of the Company, including but

not limited to the effects of COVID-19 on capital market

conditions, restriction on labor and international travel and

supply chains; general market and industry conditions; and those

risks set out in the Company’s public documents filed on SEDAR. The

Company has also assumed that no significant events occur outside

of the Company’s normal course of business. Although the Company

has attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such statements will prove to be accurate as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

undertakes no obligation to revise or update any forward-looking

information other than as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220503005627/en/

Cathedra Bitcoin Media and Investor Relations Inquiries

Sean Ty Chief Financial Officer ir@cathedra.com

Cathedra Bitcoin (TSXV:CBIT)

Historical Stock Chart

From Oct 2024 to Nov 2024

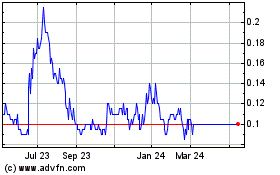

Cathedra Bitcoin (TSXV:CBIT)

Historical Stock Chart

From Nov 2023 to Nov 2024