Canadian Premium Sand Inc. (“

CPS”

or the “

Company”) (TSXV: CPS) is pleased to

announce that an updated Preliminary Feasibility Study and Mineral

Resource Report effective March 19, 2020 (the “

Updated

Technical Report”) has been completed for the Company’s

Wanipigow Sand Project (the “

Project”) by APEX

Geoscience Ltd. and John T. Boyd Company. The Updated Technical

Report incorporates the results of the previously announced capital

optimization review on February 4, 2020.

Driven by a significant reduction in estimated

capital and operating costs, the project will produce a pre-tax

internal rate of return (“IRR”) of 52.2% and a

pre-tax net present value using an 8% discount rate

(“NPV8”) of CAD $397.5 million. The revised

capital cost of CAD $124 million before contingency, including CAD

$8 million in expected short line rail infrastructure upgrades

north of Winnipeg, represents a dramatic improvement from the

previous estimated capital cost of CAD $204 million.

The table below highlights the key differences

in economic valuation between the previously announced Technical

Report on June 12, 2019 and the Updated Technical Report. Material

downward changes in the oil and gas commodity price forecasts

between June 2019 and February 2020 have been incorporated into the

Updated Technical Report.

|

|

March 2020 |

June 2019 |

Change |

Change (%) |

|

Capital cost (‘000s) (CAD, before contingency) Note 1 |

$123,800 |

$204,000 |

-$80,200 |

- 39.3% |

|

Average annual production rate (tonnes / year) |

1,250,000 |

1,360,000 |

-110,000 |

- 8.1% |

|

Year 1 of production |

2022 |

2020 |

+ 2 years |

- |

|

Grande Prairie Price Basis in 2022 (CAD / tonne, delivered in

rail-car) Note 2 |

$141 |

$152 |

- $11 |

- 7.2% |

|

Grande Prairie Price Basis for 2026 onwards (CAD / tonne, delivered

in rail-car) Note 2 |

$145 |

$157 |

- $12 |

- 7.6% |

|

5-yr Average Mine-Gate Operating Cash Cost (CAD / tonne) Note

3 |

$32.3 |

$51.7 |

- $19.4 |

- 37.5% |

|

Before-Tax NPV8 (‘000s CAD) |

$397,466 |

$316,400 |

+ $81,066 |

+ 25.6% |

|

Before-Tax IRR |

52.2% |

23.1% |

+ 29.1% |

+ 126% |

|

Capital Payback |

3.0 years |

5.3 years |

- 2.3 years |

- 43.4% |

|

After-Tax NPV8 (‘000s CAD) |

$290,746 |

$220,300 |

+ $70,446 |

+ 32.0% |

|

After-Tax IRR |

46.0% |

20.2% |

+ 25.8% |

+ 128% |

Note 1: CAD / USD conversion rate of 1.33 was used to estimate

the capital cost Note 2: Grande Prairie Price Basis is provided as

a reference point for the reader. Company sales plans include

multiple locations Note 3: In addition to plant operating costs,

royalties and reclamation levy, the Mine-Gate Operating Cash Cost

for March 2020 includes costs of barging across the lake and for

June 2019 includes costs of trucking to Winnipeg

Subject to permitting, final investment decision

and subsequent financing, the Project will be in production in

early 2022. The Company believes that by 2022 market conditions,

drilling activity and silica sand prices in Western Canada will

have stabilized at much improved levels over the current volatile

conditions.

In light of the current market volatility the

Company and JT Boyd have utilized independent Sproule and

Deloitte’s oil and gas commodity price forecasts from Q1 2020 to

establish a reasonable drilling forecast by basin and play in

Western Canada. The Company notes that establishing a reliable

third party forecast for oil and gas commodities and related

drilling activity with the recent oil price collapse is

challenging. As such, the Company has prepared a sensitivity

table to illustrate the financial effects on various future pricing

scenarios for the Company’s silica sand.

A summary of the sensitivity of the pre-tax NPV8 and IRR to a

change in revenue and operating costs is shown in the tables below.

The full sensitivity analyses can be found in the Updated Technical

Report.

Pre-Tax NPV8 Sensitivity (in ‘000s CAD) is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c6101368-eb47-440c-8499-43cede77988b

Pre-Tax IRR Sensitivity is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/df7ad1de-ab9d-4504-aaf4-fa44b2c13795

“With a successful conclusion of the capital

optimization review, closing of convertible debenture financing in

February 2020 and completion of the Updated Technical Report with

significantly improved economics we look forward to continuing to

engage with local stakeholders and regulatory groups and seek

financing to advance the project to a Final Investment Decision to

build the project and start production,” says Glenn Leroux,

President & CEO of CPS. “We continue to advance our sales

objectives in Western Canada, having made progress over the first

two months of this year. The COVID-19 pandemic and the recent

global oil-price collapse has dramatically impacted drilling and

completion activity in Western Canada. There will however be a

point of market stability in the future and management is doing

everything within our means to ensure the Company is well

positioned to benefit from that when it occurs.”

About the Wanipigow Sand Resource and

Reserve Estimates

Since June 2019, the Project’s land position has

changed due to the Government of Manitoba’s Infrastructure

Department’s decision that the Province maintain a single Quarry

Lease for municipal aggregate use. This single lease area may

potentially be made available for silica sand extraction once the

surficial aggregate is depleted however there is no firm assurance

of that outcome. The subsurface sand underlying the Manitoba

Infrastructure lease was originally considered as a CPS pending

lease application in June 2019 and was included in the previous

resource and reserve estimations. In the Updated Technical Report,

the sand resource underlying this lease has been removed from the

resource and reserve estimations. The Updated Technical Report

supersedes and replaces the June 2019 report and resource

estimates.

The Updated Technical Report prepared in accordance with

National Instrument 43-101 (“NI 43-101”) predicts

total resources of 35.5 million tonnes of Measured Resource, 6.8

million tonnes of Indicated Resource and 94.7 million tonnes of

Inferred Resource. Mineral resources are not mineral reserves and

do not have demonstrated economic viability. The estimations were

completed using the same methods as in June 2019 including a lower

cutoff of mesh-sizes that are greater than or equal to 20-mesh and

less than or equal to 140-mesh fraction and in-situ compacted bulk

densities of between 1.88 and 1.91 g/cm3 to convert the volumes to

tonnages.

Furthermore, the Updated Technical Report

indicates a total Proven and Probable Reserve of 24.1 million

tonnes, upon which the published economics, mine-life and business

plan are based. The Mineral Reserves estimated for the Project are

subject to the types of risks common to most silica sand quarry

operations that exist in Canada. Uncertainty that may materially

impact mineral reserve estimation include but are not limited to:

site-specific mining and geological conditions, management and

personnel capabilities, availability of funding to properly operate

and capitalize the operation, variations in cost elements and

market conditions, developing and operating the mine in an

efficient manner, unforeseen changes in legislation and new

industry developments.

About Canadian Premium Sand

Inc.

The Company is an exploration stage company

which is developing its Wanipigow Sand Resource in Manitoba and

developing a sales channel into Western Canada Sedimentary Basin to

support the basis for a commercial operation at Wanipigow, when

achieved. The Company is a reporting issuer in Ontario, Alberta and

British Columbia. Its shares trade on the TSX Venture Exchange

under the symbol "CPS".

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Technical Disclosure

The technical information in this press release has been

reviewed and approved by Roy Eccles, P. Geol. of APEX Geoscience

Ltd. and Michael Wick P. Eng. of John T. Boyd Company, each of whom

is independent of CPS and a “qualified person” under NI 43-101. The

Updated Technical Report, effectively dated March 19, 2020 was

prepared by Roy Eccles, P. Geol. of APEX Geoscience Ltd. and Robert

Farmer P. Eng. of John T. Boyd Company, each of whom is independent

of CPS and a “qualified person” under NI 43-101 and provides the

details of the Project including the quality assurance program and

quality control measures applied and key assumptions, parameters

and methods used to estimate the Mineral Resources and Reserves and

is available for review under the Company's profile on SEDAR at

www.sedar.com.

Cautionary Note Regarding Mineral

Reserves and Mineral Resources

The terms "Mineral Reserve", "Proven Mineral

Reserve" and "Probable Mineral Reserve" used in this press release

are Canadian mining terms as defined in accordance with NI 43-101

under the guidelines set out in the Canadian Institute of Mining,

Metallurgy and Petroleum (the "CIM") Standards on

Mineral Resources and Mineral Reserves, as may be amended from time

to time by the CIM. The terms "Mineral Resource", "Measured Mineral

Resource", "Indicated Mineral Resource", "Inferred Mineral

Resource" used in this press release are Canadian mining terms as

defined in accordance with NI 43-101 under the guidelines set out

in the CIM Standards. Mineral Resources which are not Mineral

Reserves do not have demonstrated economic viability.

For a detailed discussion of the Company's

resource and reserve estimates and related matters see the

Company's Updated Technical Report filed under the Company's

profile on SEDAR at www.sedar.com.

Forward Looking Information

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and the

Company’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“estimates”, “forecasts”, “intends”, “anticipates”, “believes”,

“plans”, “seeks”, “projects” or variations of such words and

phrases, or state that certain actions, events or results “may” or

“will” be taken, occur or be achieved. Such forward-looking

statements reflect the Company's beliefs, estimates and opinions

regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and the Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change. Forward-looking statements are

necessarily based upon a number of estimates and assumptions made

by the Company that are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Forward-looking statements are not guarantees of

future performance. In particular, this press release contains

forward-looking statements pertaining, but not limited, to:

estimates with respect to the revised capital costs for the Project

and related future production rates and IRR and NPV8 estimates;

future improvement in commodity prices and the anticipation of

market stabilization and improvement and the ability to be

well-positioned to take advantage of changing conditions; the

impact of COVID-19 on the Company’s business; the timing of

production from the Project and changes in lease characterizations

and the benefits to be derived therefrom; the ability to achieve

meaningful capital cost reductions on the basis outlined in this

press release and improve the investment opportunity and related

economics of the Project; projections about future improvements in

market conditions and silica sand pricing; future development

plans; industry activity levels; industry conditions pertaining to

the silica sand industry; the ability of and manner by which the

Company expects to meet its capital needs and additional financing

and final investment decision for building of the Project; and the

Company's objectives, strategies and competitive strengths.

By their nature, forward-looking statements

involve numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to differ materially

from those anticipated by the Company and described in the

forward-looking statements.

With respect to the forward-looking statements

contained in this press release, assumptions have been made

regarding, among other things: the ability to obtain the necessary

stakeholder, regulatory and environmental approval to advance the

development of the Wanipigow Sand Project; the ability to secure

3rd party sales into Western Canada; the ability to enter into

definitive documentation with Hi-Crush, the ability to continue to

consult with, and address feedback received from interested stake

holders including the Hollow Water First Nation and surrounding

communities; environmental risks and regulations; future global

economic and financial conditions; future commodity prices;

operating, capital and sustaining costs; that the regulatory

environment in which the Company operates will be maintained in the

manner currently anticipated by the Company; future exchange and

interest rates; geological and engineering estimates in respect of

the Company's silica sand quantities; the recoverability of the

Company’s silica sand and its quality; the accuracy and veracity of

information and projections sourced from third parties respecting,

among other things, future industry conditions and product demand;

demand for horizontal drilling and hydraulic fracturing and the

maintenance of current techniques and procedures, particularly with

respect to the use of silica sand; the Company's ability to obtain

qualified staff and equipment in a timely and cost-efficient

manner; the regulatory framework governing royalties, taxes and

environmental matters in the jurisdictions in which the Company

conducts its business and any other jurisdictions in which the

Company may conduct its business in the future; future capital

expenditures to be made by the Company; future sources of funding

for the Company's capital program; the Company's future debt

levels; the impact of competition on the Company; and the Company's

ability to obtain financing on acceptable terms.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; effects of fluctuations in the

price of proppants; risks related to indebtedness and liquidity,

including the Company's capital requirements; risks related to

interest rate fluctuations and foreign exchange rate fluctuations;

changes in general economic, financial, market and business

conditions in the markets in which the Company operates; the

effects and impacts of the coronavirus disease (COVID-19) pandemic;

changes in the technologies used to drill for and produce oil and

natural gas; the Company's ability to obtain, maintain and renew

required permits, licenses and approvals from regulatory

authorities; the stringent requirements of and potential changes to

applicable legislation, regulations and standards; the ability of

the Company to comply with unexpected costs of government

regulations; liabilities resulting from the Company's operations;

the results of litigation or regulatory proceedings that may be

brought against the Company; uninsured and underinsured losses;

risks related to the transportation of the Company's products,

including potential rail line interruptions or a reduction in rail

car availability; the geographic and customer concentration of the

Company; the ability of the Company to retain and attract qualified

management and staff in the markets in which the Company operates;

labour disputes and work stoppages and risks related to employee

health and safety; general risks associated with the oil and

natural gas industry, loss of markets, consumer and business

spending and borrowing trends; limited, unfavourable, or a lack of

access to capital markets; uncertainties inherent in estimating

quantities of mineral resources; sand processing problems; and the

use and suitability of the Company's accounting estimates and

judgments.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in its

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will materialize or prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. The forward-looking statements contained in this

press release are expressly qualified by this cautionary statement.

Readers should not place undue reliance on forward-looking

statements. These statements speak only as of the date of this

press release. Except as may be required by law, the Company

expressly disclaims any intention or obligation to revise or update

any forward-looking statements or information whether as a result

of new information, future events or otherwise.

Any financial outlook and future-oriented

financial information contained in this press release regarding

prospective financial performance, financial position, IRR or cash

flows is based on assumptions about future events, including

economic conditions and proposed courses of action based on

management’s assessment of the relevant information that is

currently available. Projected operational information contains

forward-looking information and is based on a number of material

assumptions and factors, as are set out above. These projections

may also be considered to contain future oriented financial

information or a financial outlook. The actual results of the

Company's operations for any period will likely vary from the

amounts set forth in these projections and such variations may be

material. Actual results will vary from projected results. Readers

are cautioned that any such financial outlook and future-oriented

financial information contained herein should not be used for

purposes other than those for which it is disclosed herein.

CONTACT

INFORMATION:

Canadian Premium Sand

Inc. Glenn Leroux President and Chief Executive

Officer 587.350.5772glenn.leroux@cpsmail.com

Investor

RelationsIR@cpsmail.com

www.canadianpremiumsand.com

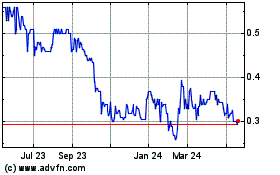

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

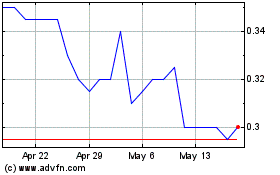

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025