Oceanic Iron Ore Corp. (TSX VENTURE:FEO)(OTCQX:FEOVF) ("Oceanic", the "Company")

is pleased to announce that it has received the results of a Pre-Feasibility

Study ("PFS") prepared by Micon International Limited ("Micon") in respect of

the Company's 100% owned Hopes Advance project. The PFS was completed using the

NI 43-101 Mineral Resource estimate reported in the Company's news release of

April 2, 2012 which the PFS has converted to a mineral reserve within engineered

pit designs.

HIGHLIGHTS:

The PFS Delivers Positive Economic Results:

-- Optimal production case delivers robust economics

-- Base case pre-tax NPV of $5.6 billion, pre-tax unlevered IRR of

20.5% and levered IRR (60% debt finance) of 23.2% at a price of $100

/ tonne FOB for a 66.5% Fe concentrate;

-- Life of mine operating cost of approximately $30/tonne;

-- Initial production of 10 million tonnes of concentrate per annum

commencing in 2017;

-- Expansion to production of 20 million tonnes per annum in 2027

funded through operating cash flows, to coincide with availability

of hydroelectric power;

-- Life of mine 31 years;

-- $2.85 billion initial capital cost inclusive of $0.93 billion

indirect costs and contingency;

-- Scheduled expansion capital cost of $1.61 billion 2025 - 2026,

including $0.49 billion indirect costs and contingencies;

-- Sustaining capital of $0.77 billion over life of mine.

(i)CAD $1.00 = USD $1.00

Additional Attributes of the Project:

-- Project implementation and development schedule independent of third

party infrastructure

-- Construction and operations to commence utilizing self-generated

power;

-- Intention to connect to the Hydro Quebec grid in 2025 to support

expansion (as reported in the Company's press release of September

5, 2012).

-- Projected lowest quartile operating cost per tonne resulting from "no

rail" advantage, simple metallurgy and low waste / ore strip ratio (0.57

: 1 in years 1 to 15 of production, 1.17 : 1 over life of mine).

-- Pilot plant metallurgical testwork confirms product quality suitable for

pellet or sinter feed

-- 66.5% Fe grade concentrate with low deleterious elements and silica

content less than or equal to 4.5%

-- High weight and Fe recoveries using a simple flow sheet

-- Construction of a marine facility in Hopes Advance Bay at Pointe

Breakwater as proposed in the Company's Marine Facility and Shipping

Logistics Study prepared by AMEC International in September 2011.

Steven Dean, Chairman and CEO noted: "Since the acquisition of the Ungava

properties in November 2010, we have fast-tracked the development of the Hopes

Advance project through to the feasibility stage with the delivery today of a

very robust pre-feasibility study. The study presents a construction schedule

that enables the commencement of commercial production of iron ore in 2017 with

the development components, in particular the construction of key

infrastructure, under our control. Operating and capital costs have been refined

based on the higher level of engineering and analysis typical of a

pre-feasibility study when compared to a preliminary economic assessment. The

results of the pre-feasibility study continue to validate the project's position

as a future lower quartile operating cost producer, which in turn underpins the

project's resilient economics. These economics together with the high quality

metallurgical characteristics of the Hopes Advance deposit, help to define the

Hopes Advance project as one of the premier large scale iron development

projects globally."

Alan Gorman, COO added: "We are pleased with the quality and attention to detail

that our consultants Micon, Met-Chem, Golder, and AMEC, have applied in

generating the Hopes Advance pre-feasibility study. The attributes associated

with extraction, particularly our favorable strip ratio, and the simple process

required for concentration validated through our pilot plant testwork, as well

as no rail requirement, support that we will be a low cost producer. The capital

and operating cost assumptions are reasonable and we are confident that with an

appropriate level of engineering and planning, the project can be delivered on

schedule and on budget.

The project's location adjacent to an identified port site is a key competitive

advantage and my past involvement with northern projects, both in Nunavik and on

Baffin Island, together with the conclusions reached by AMEC in their Shipping

and Marine Logistics Study, lead me to conclude that shipping from our location

is viable. Recognizing that we have undertaken significant upfront work in

respect of metallurgy and that our mine plan and schedule are solid, we expect

minimal variations to our production scenario, which will be further optimized,

as we advance to completion of our Feasibility Study."

Next Steps

-- Pot Grate Pelletizing test work Q4 2012

-- Strategic Partnering and Project Financing 2012 - 2013

-- Fast track completion of the Feasibility Study 2012 - 2013, including a

final shipping logistics study

-- Complete environmental impact assessment and permitting 2013 - 2014

-- Negotiate Stakeholder Impact and Benefits Agreement 2013 - 2014

-- Construction 2014 - 2016

-- Concentrate Shipments 2017 - 2047

Pre-Feasibility Study

The Company engaged a team of specialized consultants, led by Micon

International Limited ("Micon") and Met-Chem Canada Inc. ("Met-Chem") to produce

the PFS. Micon performed the mine design and pit optimization and compiled the

economic results for the project. Met-Chem performed the process flow sheet

design and equipment selection based on the results of the Company's

metallurgical and pilot plant test work performed by SGS Mineral Services

Lakefield ("SGS"). In addition, Met-Chem completed the site infrastructure

design. Port marine infrastructure design was completed by AMEC International

(September 2011). Golder Associates Ltd. carried out studies for tailings

disposal and waste rock.

The base case in the PFS for the Hopes Advance project assumes initial

production of 10 million tonnes of concentrate per annum commencing in 2017

utilizing self generated power, expanding to production of 20 million tonnes of

concentrate per annum using hydroelectric power from 2027, following connection

to the grid in 2025 and construction to support the expansion in 2025 and 2026.

The PFS has been based on the Mineral Resource prepared by Eddy Canova, P.Geo.,

OGQ reported in a Company news release on April 2, 2012 and filed on SEDAR on

May 17, 2012.

The open pit reserves, summarized below, are based on a 25% Fe cut off grade.

The reserves shown below are calculated based on industry standard pit

optimization techniques guiding detailed pit designs including ramps and surface

constraints. The mineral reserve is contained within the mineral resource. The

effective date of the mineral reserve estimate is September 19, 2012.

Table 1 - NI 43-101 In-Pit Mineral Reserve Estimate Hopes Advance Bay (25%

Fe Cut-off)

----------------------------------------------------------------------------

Wt.

Recov. Concentrate

Category Tonnes Fe (%) (%) Tonnes

----------------------------------------------------------------------------

Proven Reserves 763,276,000 32.3% 37.4% 285,428,000

----------------------------------------------------------------------------

Probable Reserves 595,990,000 32.1% 37.1% 221,246,000

----------------------------------------------------------------------------

Proven & Probable Reserves 1,359,266,000 32.2% 37.3% 506,675,000

----------------------------------------------------------------------------

There are no known legal, political, environmental or other risks that could

materially affect the potential development of the mineral reserve.

The PFS mine schedule and economic analysis does not include inferred resources

of approximately 72.7 million tonnes of 32.8% Fe. Mineral resources that are not

mineral reserves do not have demonstrated economic viability.

Pre-Feasibility Metrics

The table below lists the key PFS metrics. The analysis is based on the

assumption that production begins in 2017.

Table 2 - PFS Results

----------------------------------------------------------------------------

Variable Results

----------------------------------------------------------------------------

Price assumption - FOB $100 / tonne

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net Present Value (8%) (pre-tax/post-tax) $5.6 billion $3.2 billion

----------------------------------------------------------------------------

Pre-tax IRR (unlevered / levered) 20.5% 23.2%

----------------------------------------------------------------------------

Post-tax IRR (unlevered / levered) 16.8% 19.2%

----------------------------------------------------------------------------

Post-tax Payback 5 years

----------------------------------------------------------------------------

Mine Life 31 years

----------------------------------------------------------------------------

10 Million Tonne Initial Capital Costs $2.85 billion

----------------------------------------------------------------------------

20 Million Tonne Expansion Capital Costs $1.61 billion

----------------------------------------------------------------------------

Sustaining Capital Expenditure (LOM) $0.77 billion

----------------------------------------------------------------------------

Life of Mine Operating Cost per tonne $30.18/tonne

----------------------------------------------------------------------------

Strip Ratio Years 1 - 15 0.57

----------------------------------------------------------------------------

Strip Ratio Life of Mine 1.17

----------------------------------------------------------------------------

As noted above, the PFS assumes a concentrate selling price of $100/tonne FOB

and also takes into consideration the 2% royalty payable to the vendors of the

project. The PFS assumes that the Company exercises its right to purchase half

of this royalty for $3 million in 2017, the first year of commercial production.

Analysis of the economics has been undertaken on both a pre-tax and post-tax

basis and IRR is presented on both an unlevered and levered basis. In respect of

the leveraged case, the key assumptions are as follows:

-- Initial capital 60% debt financed;

-- Annual interest rate of 8%;

-- Upfront financing fee of 3%;

-- 7 year term post commencement of commercial production;

-- Expansion capital is assumed funded through operating cashflow.

Figure 1 highlights the sensitivity of pre and post tax NPV to the FOB

concentrate selling price:

To view Figure 1 - NPV (Unlevered) Sensitivity to FOB Ungava Bay Iron Ore Price,

visit: http://media3.marketwire.com/docs/feo919-F1.pdf.

Capital Costs

Construction Capital Costs are set out below:

Table 3 - Capital Costs

----------------------------------------------------------------------------

Initial Capex Expansion Capex

2014 to 2016 2025/2026

Capital Description ($000) ($000)

----------------------------------------------------------------------------

Mine Equipment 92,658 61,231

----------------------------------------------------------------------------

Mine Development 66,203 2,918

----------------------------------------------------------------------------

Crusher 29,674 30,355

----------------------------------------------------------------------------

Concentrator 481,514 492,643

----------------------------------------------------------------------------

Pipeline 56,740 83,787

----------------------------------------------------------------------------

Port Filtering and Drying 325,654 267,401

----------------------------------------------------------------------------

Port and Marine Infrastructure 288,000 84,000

----------------------------------------------------------------------------

Power 377,892 26,775

----------------------------------------------------------------------------

Site Infrastructure 81,591 25,675

----------------------------------------------------------------------------

Site Roads 33,583 -

----------------------------------------------------------------------------

Camp and Offices 29,575 7,175

----------------------------------------------------------------------------

Airstrip Upgrade 11,824 -

----------------------------------------------------------------------------

Fresh Water Supply 10,469 3,621

----------------------------------------------------------------------------

Sewage 4,554 1,574

----------------------------------------------------------------------------

Tailings and Hazardous Waste Disposal 23,577 30,122

----------------------------------------------------------------------------

Communications 2,305 -

----------------------------------------------------------------------------

Mobile Equipment 9,983 -

----------------------------------------------------------------------------

Indirect Costs 499,962 249,378

----------------------------------------------------------------------------

Contingency and Closure Bond 427,899 241,135

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total Construction Capital $2,853,657 $1,607,790

----------------------------------------------------------------------------

The estimated initial capital cost required to support the initial phase of

production of 10 million tonnes of concentrate amounts to approximately $2.85

billion. This compares to a cost of approximately $2.4 billion outlined in

"Scenario 1" of the Company's preliminary economic assessment (PEA) published in

November 2011. Significant components of the increase in capital cost include

the addition of concentrate drying and concentrate storage infrastructure and

equipment which had not been accounted for in the PEA, in addition to increased

indirect costs.

Cost reductions between the PEA and PFS have been realized in the mining and

mineral processing components of the capital expenditures, reflecting the

attributes associated with extraction, in particular the strip ratio and a

simplified process required for concentration. In addition, cost reductions have

been realized in respect of power infrastructure, where the estimated initial

capital cost of self-generation is below the PEA estimate of capital cost

required for the development of an electrical transmission line (the PEA base

case assumed that electrical power would be available at the time of project

construction).

The PFS assumes that once the Company moves to the use of hydroelectric grid

power in year 9 of the project, the expansion capital required in respect of

power is limited given the fact that the transmission line is assumed financed

by Hydro Quebec and amortized through the power rate charged to the Company by

Hydro Quebec.

Operating Costs

A summary of the estimated operating costs is set out below:

Table 4 - Operating Costs (excluding royalty)

----------------------------------------------------------------------------

Years Years Years

2017 - 2024 2025 - 2026 2027 - 2047

--------------------------------------------

(10 MM T/YR &

Self (10 MM T/Y & (Post

Generated Hydroelectric Expansion - Life of Mine

Category Power) Power) 20 MM T/YR) Average

----------------------------------------------------------------------------

Mining

($/tonne all

material) $1.57 $1.59 $1.23 $1.27

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Mining

($/tonne product) $5.46 $6.30 $7.78 $7.37

----------------------------------------------------------------------------

Concentrator

($/tonne product) $20.87 $18.35 $17.45 $18.02

----------------------------------------------------------------------------

Port

($/tonne product) $2.13 $2.13 $1.45 $1.58

----------------------------------------------------------------------------

Site Services

($/tonne product) $3.33 $2.77 $2.04 $2.27

----------------------------------------------------------------------------

G&A (Site only)

($/tonne product) $1.38 $1.38 $0.85 $0.95

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total Operating

Cost /

tonne product

(excluding

royalty) $33.17 $30.93 $29.57 $30.18

----------------------------------------------------------------------------

The low operating costs are a function of a number of factors including:

-- No rail component given the project's proximity to the identified port

site at Pointe Breakwater;

-- A very low strip ratio, averaging 0.57:1 waste to ore in the first 15

years of production and 1.17:1 over the life of mine;

-- Straightforward metallurgy and high Fe recoveries, reflected in the

simple flowsheet and low operating costs.

Overall, operating costs have increased relative to the PEA reflecting the net

effect of higher electricity costs associated with self-generated power and

additional costs for concentrate drying, offset by cost reductions in mining and

other process costs.

Before the increase in power costs, total costs per tonne decreased by

approximately $1.40/tonne in comparison to the PEA estimate.

In particular, in regards to power, the PEA assumed that Hydro Quebec would

offer an L rate of $0.045 per kilowatt hour to the project. Subsequent

discussions with Hydro Quebec confirmed that it would not be consistent with

current government policy to offer the Company the L rate. In terms of

concentrate drying, the PEA did not include operating costs (or capital costs)

for concentrate drying in order to reduce concentrate moisture content to 2% to

accommodate concentrate handling during the winter months. The PFS includes

estimates with regard to such additional costs.

The chart below sets out a sensitivity of the pre-tax NPV based on a factor of

the base fuel price delivered to site for power generation of $0.652/Litre for

No. 6 Oil. Diesel fuel for equipment operation has been assumed at $0.75/ Litre.

To view Figure 2 - Pre-tax NPV Sensitivity to Base Fuel Price, visit:

http://media3.marketwire.com/docs/feo919-F2.pdf.

Conceptual Layout

A conceptual diagram outlining the project layout is set out below. As

illustrated, the deposits are optimally located within approximately 26 km from

the planned port site at Pointe Breakwater (discussed in more detail below) such

that a pipeline will run from the concentrator, expected to be placed in

proximity to all deposits, to the port. The Company has produced a 3D animated

simulation of the project which can be accessed via its website

www.oceanicironore.com and which provides a visual interpretation of the

project.

The Company's power plant is planned to be located at the port site. The Company

expects hydroelectric power from one of the existing operational power

reservoirs near Ungava Bay is anticipated to be available by 2025.

To view Figure 3 - Hopes Advance Conceptual Layout, visit:

http://media3.marketwire.com/docs/feo919-F3.pdf.

Metallurgical Pilot Plant Program

Background

In September 2011, the Company took the decision to accelerate its metallurgical

test work program in order to continue the fast-track development of the Hopes

Advance project. This included the completion of a comprehensive metallurgical

bench scale testing program earlier this year by SGS.

In addition to the bench scale work, SGS has undertaken a pilot plant testwork

program to determine a flow sheet for the recovery of hematite and magnetite.

The pilot plant test work was also used to determine the appropriate size of

equipment for the flow sheet as well as the optimum grinding equipment and power

requirements.

Bulk Samples and Composites

During the 2011 field season, the Company collected bulk samples to support the

bench scale test work and the pilot plant.

The 180.1 tonne Castle Mountain bulk sample was collected from the same three

trenches that provided samples for historic metallurgical work conducted in the

late 1950s. A 95.1 tonne sample was composited and blended from the Castle

Mountain bulk sample for the pilot plant test.

Bench Scale Testing

Bench scale work was conducted on a sample of the Castle Mountain bulk sample

and included head mineralogy, bench-scale grindability testing, bench-scale

gravity and low intensity magnetic separation (LIMS) testing. A full suite of

grindability testing was conducted on the sample. The sample was classified as

soft to very soft in terms of rod and ball milling (RWI and BWI) and very soft

in terms of autogenous milling (AWI). This bench work complements the Mozley

Table and Davis Tube test work conducted on drill core composites earlier this

year at SGS.

Pilot Plant Testing

The initial flowsheet for the pilot plant test was designed based on historic

metallurgical work with modifications indicated by the results of bench scale

Mozley Table and Davis Tube tests conducted on drill core composites from Hopes

Advance earlier this year (noted above).

The pilot plant test work concluded that an optimized flowsheet composed of

single-stage semi autogeneous milling (SAG), followed by rougher, cleaner, and

recleaner spirals was optimal. The rougher spiral tails were sent to a LIMS

Cobber for recovery of the remaining magnetite. The Cobber concentrate (12.9% of

the feed) is then sent to a regrind mill for further liberation of the

magnetite. The liberated magnetite is then sent to the two-stage cleaning LIMS

to produce an iron rich magnetite concentrate of 70.0% Fe.

The Castle Mountain composite, with a Head Fe of 34.2% and a magnetite content

of 11.8% (Table 5) responded well to the optimized pilot plant flowsheet. With a

target grind of 300 microns the gravity circuit produced concentrate with a SiO2

content of 4.8%. Not only did the gravity circuit recover hematite, it recovered

46.7% of the magnetite (Table 6). The LIMS circuit with a target grind of 37

microns (minus 400 mesh) produced concentrate with a SiO2 content of 3.0%. The

LIMS circuit recovered another 49.8% of the magnetite. The optimized circuit

produced a combined concentrate with 4.5% SiO2 with a weight recovery of 37.6%

and an iron recovery of 73.1%.

To view Figure 4 - Optimized Flowsheet, visit:

http://media3.marketwire.com/docs/feo919-F4.pdf.

Figure 4 above sets out the optimized flowsheet. A description of the process is

set out below:

A. Crushed ore is fed into a SAG mill (no ball mill required at this

stage), where the ore is ground to minus 50 mesh (300 microns);

B. Ground ore is passed through a series of spirals to recover hematite,

coarse magnetite, and aggregates of hematite and magnetite. A gravity

concentrate (gc) is recovered;

C. Tailings (rougher tails) from the spirals are sent to a magnetic cobber

(low intensity magnetic cobber) where particles containing magnetite are

separated from particles that do not contain magnetite;

D. Only 12.9% by weight of ore requires fine grinding for magnetic

separation processing;

E. Residual magnetite containing particles are ground to minus 400 mesh (37

microns);

F. Ground magnetic material is passed through LIMS to recover the remaining

magnetite. The magnetite concentrate (mc) is combined with the gravity

concentrate (gc) to form the final concentrate (fc). By recovering the

magnetite after gravity separation the amount of material that has to be

finely ground is significantly reduced.

Table 5 - Analysis of Head for Optimized Castle Mountain Pilot Plant Test

----------------------------------------

Composite Fe% Satmagan%

----------------------------------------

Castle Mountain 34.2 11.8

----------------------------------------

Table 6 - Optimized Pilot Plant product quality and recovery

----------------------------------------------------------------------------

Composite / Streams Mass K80 Grade % Distribution (%)

Dist. % microns Fe SiO2 Fe Satmagan

----------------------------------------------------------------------------

Castle Mountain

-----------------------------

Recleaner Spiral Concentrate 31.5 144 65.9 4.8 60.6 46.7

Secondary LIMS Cleaner Con. 6.1 33 70.0 3.0 12.5 49.8

Combined Concentrate 37.6 66.6 4.5 73.1 96.5

----------------------------------------------------------------------------

The results of the pilot plant test work on the composite suggest that Castle

Mountain iron ore:

-- Is soft;

-- Can be processed with a simple flow sheet;

-- Produces a concentrate with low SiO2 and low deleterious elements;

-- Produces concentrate with approximately 37.6% weight recovery and

approximately 73.1% iron recovery, with 96.5% magnetite content recovery

(Satmagan) (see Table 6 above).

The other zones at Hopes Advance can be expected to respond well to a similar

flowsheet given the similarity in response to bench scale testing by Mozley

Table and Davis tube as indicated by the results shown in Table 7.

Table 7 - Summary of overall concentrate grade from Mozley Table and Davis Tube

bench tests

----------------------------------------------------------------------------

Deposit Overall Concentrate Grade Overall Recovery

Fe SiO2 Al2O3 Sat MnO Wt Fe SiO2 Sat

% % % % % % % % %

----------------------------------------------------------------------------

Castle Mountain 65.87 4.42 0.02 30.84 0.33 39.34 78.60 4.34 73.97

Iron Valley 65.97 4.64 0.04 25.48 0.33 40.49 80.58 4.76 62.92

Bay Zone 66.96 4.46 0.03 59.15 0.28 40.08 81.01 4.38 81.06

West Zone 66.20 4.31 0.03 42.55 0.58 40.19 76.93 4.49 73.11

----------------------------------------------------------------------------

Next Steps

The complete report in respect of the PFS, including further details on mine

reserves and schedule layouts, drawings and the results of metallurgical test

work and pilot plant will be filed on SEDAR and on the Company's website within

45 days of this news release.

In the coming months, the Company will be focused on continuing to fast-track

the development of the project, including:

-- Strategic Partnering and offtake agreements

-- Pot Grate Pelletizing test work

-- Completing a Feasibility Study

-- Completing the environmental impact assessment and permitting

-- Negotiate Stakeholder Impact and Benefits Agreement

Eddy Canova, P. Geo. (Q403), the Exploration Manager for the Company and a

Qualified Person as defined by NI 43-101, has reviewed and is responsible for

the technical information contained in this news release.

Conference Call Details

Conference Call Date: September 19, 2012

Start Time: 10:30am PST / 1:30pm EST

Call in Number: 1 (800) 659-3814

Participants are asked to dial in 10-15 minutes in advance of the

commencement of the conference call.

OCEANIC IRON ORE CORP. (www.oceanicironore.com)

On behalf of the Board of Directors

Steven Dean, Chairman and Chief Executive Officer

This news release includes certain "Forward-Looking Statements" as that term is

used in applicable securities law. All statements included herein, other than

statements of historical fact, including, without limitation, statements

regarding potential mineralization and resources, exploration results, and

future plans and objectives of Oceanic Iron Ore Corp. ("Oceanic", or the

"Company"), are forward-looking statements that involve various risks and

uncertainties. In certain cases, forward-looking statements can be identified by

the use of words such as "plans", "expects" or "does not expect", "scheduled",

"believes", or variations of such words and phrases or statements that certain

actions, events or results "potentially", "may", "could", "would", "might" or

"will" be taken, occur or be achieved. There can be no assurance that such

statements will prove to be accurate, and actual results could differ materially

from those expressed or implied by such statements. Forward-looking statements

are based on certain assumptions that management believes are reasonable at the

time they are made.

In making the forward-looking statements in this presentation, the Company has

applied several material assumptions, including, but not limited to, the

assumption that: (1) there being no significant disruptions affecting

operations, whether due to labour/supply disruptions, damage to equipment or

otherwise; (2) permitting, development, expansion and power supply proceeding on

a basis consistent with the Company's current expectations; (3) certain price

assumptions for iron ore; (4) prices for availability of natural gas, fuel oil,

electricity, parts and equipment and other key supplies remaining consistent

with current levels; (5) the accuracy of current mineral resource estimates on

the Company's property; and (6) labour and material costs increasing on a basis

consistent with the Company's current expectations. Important factors that could

cause actual results to differ materially from the Company's expectations are

disclosed under the heading "Risks and Uncertainties" in the Company's MD&A

filed August 29, 2012 (a copy of which is publicly available on SEDAR at

www.sedar.com under the Company's profile) and elsewhere in documents filed from

time to time, including MD&A, with the TSX Venture Exchange and other regulatory

authorities. Such factors include, among others, risks related to the ability of

the Company to obtain necessary financing and adequate insurance; the economy

generally; fluctuations in the currency markets; fluctuations in the spot and

forward price of iron ore or certain other commodities (e.g., diesel fuel and

electricity); changes in interest rates; disruption to the credit markets and

delays in obtaining financing; the possibility of cost overruns or unanticipated

expenses; employee relations. Accordingly, readers are advised not to place

undue reliance on Forward-Looking Statements. Except as required under

applicable securities legislation, the Company undertakes no obligation to

publicly update or revise Forward-Looking Statements, whether as a result of new

information, future events or otherwise.

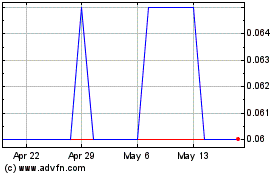

Oceanic Iron Ore (TSXV:FEO)

Historical Stock Chart

From Jun 2024 to Jul 2024

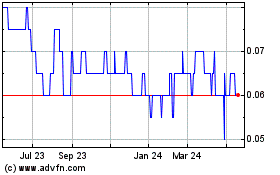

Oceanic Iron Ore (TSXV:FEO)

Historical Stock Chart

From Jul 2023 to Jul 2024