Golden Tag Resources Ltd. (“

Golden Tag” or the

“

Company”) (TSX.V: GOG) is pleased to announce

that it has closed the first tranche (the “

First

Tranche”) of its previously announced non-brokered private

placement (the “

Offering”) of subscription

receipts (each a “

Subscription Receipt”). The

gross proceeds received under the First Tranche combined with those

to be received pursuant to subscription commitments secured by the

Company will result in aggregate gross proceeds of $5.7 million.

This Offering is being completed in connection

with the previously announced acquisition (the

“Transaction”) of the La Parrilla Silver Mine

Complex in Durango State, Mexico (“La Parrilla”)

(as more fully described in the press release dated December 7,

2022 available at www.SEDAR.com).

Subscription Receipts

The Subscription Receipts were issued pursuant

to the terms of a subscription receipt agreement (the

“Subscription Receipt Agreement”) entered into

between Marrelli Trust Company Limited and the Company. The Escrow

Release Conditions (as defined below) are set forth in the

Subscription Receipt Agreement and provide that if the Escrow

Release Conditions are not satisfied on or before the Release

Deadline (as defined below), then the Subscription Receipts shall

be cancelled and the subscription receipt agent shall distribute

the escrowed funds to the holders of the Subscription Receipts,

together with their pro rata share of interest earned thereon.

The gross proceeds from the sale of the

Subscription Receipts, less any finders’ fees and expenses payable

on closing of the First Tranche, are being held in escrow pending

satisfaction or waiver of certain conditions, including all

conditions to the closing of the Transaction (the “Escrow

Release Conditions”). Upon satisfaction or waiver (as

applicable) of the Escrow Release Conditions on or prior to 5:00

p.m. (Toronto time) on August 15, 2023, or such later date as may

be determined in accordance with the Subscription Receipt Agreement

(the “Release Deadline”) each Subscription Receipt

will be exchanged for one Unit (subject to adjustment in certain

events). The Transaction remains subject to a number of conditions,

including, but not limited to: (i) the approval of the Company’s

shareholders as a result of the Transaction creating a new control

person; (ii) the receipt of all necessary consents, approvals and

authorizations (including approval of the TSX Venture Exchange (the

“TSXV”) and the Mexican Antitrust Commission) for

the Transaction; (iii) the completion of the Offering for gross

proceeds of CAD$9.0 million; and (iv) other conditions which are

customary for a transaction of this type.

Each Unit consists of one common share of the

Company (a “Common Share”) and one-half of one

Common Share purchase warrant (each whole warrant, a

“Warrant”). Each whole Warrant shall be

exercisable to acquire one Common Share at a price of C$0.34 per

Common Share for a period of 36 months from the date of the

exchange of the Subscription Receipts.

Other Information Regarding the

Offering

The Company intends to use the net proceeds of

the Offering to fund drilling and exploration programs at La

Parrilla, holding costs, technical work for restart, transaction

costs and for working capital and general corporate purposes.

The Subscription Receipts were offered by way of

private placement pursuant to exemptions from prospectus

requirements under applicable securities laws. The securities

issued and issuable pursuant to the Offering will be subject to a

four month and one-day hold period from the date of closing.

In connection with the First Tranche, the

Corporation, agreed to pay certain eligible arm’s length parties

(each a “Finder”): (1) up to 7% cash fees; and (2)

issue upon satisfaction of the Escrow Release Conditions, up to 7%

finder’s warrants entitling the holder to acquire one Common Share

at a price of C$0.20 for a period of 24 months.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, or applicable

state securities laws, and may not be offered or sold to persons in

the United States absent registration or an exemption from such

registration requirements. This press release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful.

About Golden Tag Resources

Golden Tag Resources Ltd. is a Toronto based

mineral resource exploration company. The Company holds a 100%

interest, subject to a 2% NSR, in the San Diego Project, in

Durango, Mexico. The San Diego property is among the largest

undeveloped silver assets in Mexico and is located within the

prolific Velardeña Mining District. Velardeña hosts several mines

having produced silver, zinc, lead and gold for over 100 years. For

more information regarding the San Diego property please visit our

website at www.goldentag.ca.

For additional information, please

contact: Greg McKenzie, President & CEO Ph:

416-504-2024 greg.mckenzie@goldentag.ca

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this news

release.

TSX Venture Exchange Inc. has in no way passed

upon the merits of the Transaction and has neither approved nor

disapproved the contents of this press release.

Cautionary Note Regarding Forward

Looking Statements:

Certain statements in this news release are

forward-looking and involve a number of risks and uncertainties.

Such forward-looking statements are within the meaning of the

phrase ‘forward-looking information’ in the Canadian Securities

Administrators’ National Instrument 51-102 – Continuous Disclosure

Obligations. Forward-looking statements are not comprised of

historical facts. Forward-looking statements include estimates and

statements that describe the Company’s future plans, objectives or

goals, including words to the effect that the Company or management

expects a stated condition or result to occur. Forward-looking

statements may be identified by such terms as “believes”,

“anticipates”, “expects”, “estimates”, “may”, “could”, “would”,

“will”, or “plan”. Since forward-looking statements are based on

assumptions and address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Although

these statements are based on information currently available to

the Company, the Company provides no assurance that actual results

will meet management’s expectations. Risks, uncertainties and other

factors involved with forward-looking information could cause

actual events, results, performance, prospects and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward-looking information in this

news release includes, but is not limited to, the completion of

Transaction and the Offering on the terms described herein (or if

at all), the ability to obtain requisite corporate and regulatory

approvals, including, but not limited to, the approval from the

TSXV for the Transaction and the Offering, the completion of

subscription of subscription commitments under the Offering, the

Company’s use of the net proceeds of the Offering, and the payment

of a finders’ fee in connection with the Offering.

In making the forward-looking statements

included in this news release, the Company has applied several

material assumptions, including that the Company´s financial

condition and development plans do not change because of unforeseen

events, that future metal prices and the demand and market outlook

for metals will remain stable or improve, management’s ability to

execute its business strategy, the receipt of all necessary

approvals, the satisfaction of all closing conditions of the

Transaction, the closing of the Offering, and no unexpected or

adverse regulatory changes with respect to La Parrilla.

Forward-looking statements and information are subject to various

known and unknown risks and uncertainties, many of which are beyond

the ability of the Company to control or predict, that may cause

the Company´s actual results, performance or achievements to be

materially different from those expressed or implied thereby, and

are developed based on assumptions about such risks, uncertainties

and other factors set out herein, including, but not limited to,

the risk that the Company is not able to complete the Transaction

or the Offering on the terms anticipated by the Company (or at

all), the risk that the Company is unable to obtain requisite

corporate and regulatory approvals, including but not limited to

the approval of the TSXV, the Mexican government, and shareholder

approval, the risk that the assumptions referred to above prove not

to be valid or reliable, market conditions and volatility and

global economic conditions including increased volatility and

potentially negative capital raising conditions resulting from the

continued or escalation of the COVID-19 pandemic, risk of delay

and/or cessation in planned work or changes in the Company´s

financial condition and development plans; risks associated with

the interpretation of data (including in respect of third party

mineralized material) regarding the geology, grade and continuity

of mineral deposits, the uncertainty of the geology, grade and

continuity of mineral deposits and the risk of unexpected

variations in mineral resources, grade and/or recovery rates; risks

related to gold, silver and other commodity price fluctuations;

employee relations; relationships with and claims by local

communities and indigenous populations; availability and increasing

costs associated with mining inputs and labour, the speculative

nature of mineral exploration and development, including the risks

of obtaining necessary licenses and permits and the presence of

laws and regulations that may impose restrictions on mining; risks

relating to environmental regulation and liability; the possibility

that results will not be consistent with the Company´s

expectations.

Such forward-looking information represents

management´s best judgment based on information currently

available. No forward-looking statement can be guaranteed, and

actual future results may vary materially. Accordingly, readers are

advised not to place undue reliance on forward-looking statements

or information.

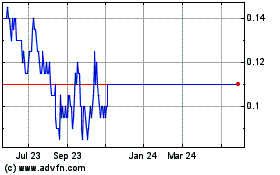

Golden Tag Resources (TSXV:GOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

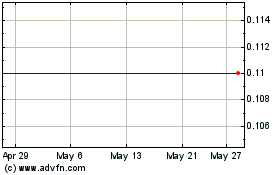

Golden Tag Resources (TSXV:GOG)

Historical Stock Chart

From Nov 2023 to Nov 2024