Gowest Gold Ltd. (“

Gowest” or the

“

Company”) (TSX VENTURE: GWA) announced today

that, pursuant to its previously announced non-brokered private

placement (the “

Private Placement”) (see news

release dated December 8, 2019), it has completed an initial

closing of the Private Placement pursuant to which it raised

aggregate gross proceeds of $2,043,049. Specifically, the Company

has issued 5,000,000 units of the Company (the

“

Units”), at a price of $0.20 per Unit, for gross

proceeds of $1,000,000 and 4,741,130 flow-through units (the

“

FT Units”), at a price of $0.22 per FT Unit, for

gross proceeds of $1,043,049.

Each Unit comprises one common share and

one-half (1/2) of one common share purchase warrant (each whole

common share purchase warrant, a “Warrant”), with

each Warrant being exercisable to acquire one common share of the

Company at a price of $0.30 for a period of 24 months following the

closing date of the Private Placement.

Each FT Unit comprises one common share and

one-half (1/2) of one Warrant issued on a flow-through basis, with

each Warrant being exercisable to acquire one common share of the

Company at a price of $0.30 for a period of 24 months following the

closing date of the Private Placement. The common shares underlying

the Warrants will not be issued as flow-through shares.

It is anticipated that one or more additional

closings of the Private Placement will be completed in early

2020.

The proceeds of the Private Placement will be

used by the Company for the continued development of its 100% owned

Bradshaw Gold Deposit and for working capital purposes. The

proceeds derived from the sale of the FT Units will be used for

“Canadian exploration expenses” (within the meaning of the Income

Tax Act [Canada]) in connection with the mineral exploration

programs of the Company.

Subscriptions by insiders of the Company

accounted for approximately $1,490,000 of the gross proceeds of the

Private Placement. Participation by insiders under the Private

Placement is exempt from the valuation and minority shareholder

approval requirements of Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”) by virtue of the exemptions

contained in Sections 5.5(b) and 5.7(1)(b) of MI 61-101.

In connection with the closing of the private

placement, the Company paid finders’ fees of $22,274 in cash.

All of the securities issuable in connection

with the Private Placement will be subject to a hold period

expiring four months and one day after date of issuance.

The securities offered have not been registered

under the United States Securities Act of 1933, as amended, and may

not be offered or sold in the United States or to, or for the

account or benefit of, U.S. persons absent registration or an

applicable exemption from registration requirements. This release

does not constitute an offer for sale of securities in the United

States.

Shares for Debt

The Company also announced that it intends to

settle up to an aggregate of $545,000 of indebtedness (the

“Debt Settlement”) through the issuance of common

shares of the Company. Pursuant to the proposed Debt Settlement,

the Company will issue (i) 1,725,000 common shares, at a deemed

price of $0.20 per share, to non-management directors of the

Company, in satisfaction of director fees owing and outstanding to

such individuals as of October 31, 2019, and (ii) 1,000,000 common

shares, at a deemed price of $0.20 per share, to a consultant of

the Company in satisfaction of consulting fees owing and

outstanding to such consultant. The Company has elected to settle

the indebtedness through the issuance of common shares to preserve

cash and improve the Company’s balance sheet.

The Debt Settlement is subject to the approval

of the TSX Venture Exchange. All of the securities issuable in

connection with the Debt Settlement will be subject to a hold

period expiring four months and one day after date of issuance

Participation by insiders under the Debt

Settlement is exempt from the valuation and minority shareholder

approval requirements of MI 61-101 by virtue of the exemptions

contained in Sections 5.5(b) and 5.7(1)(b) of MI 61-101.

About Gowest

Gowest is a Canadian gold exploration and

development company focused on the delineation and development of

its 100% owned Bradshaw Gold Deposit (Bradshaw), on the Frankfield

Property, part of the Company’s North Timmins Gold Project (NTGP).

Gowest is exploring additional gold targets on its

+100‐square‐kilometre NTGP land package and continues to evaluate

the area, which is part of the prolific Timmins, Ontario gold camp.

Currently, Bradshaw contains a National Instrument 43‐101 Indicated

Resource estimated at 2.1 million tonnes (“t”) grading 6.19 grams

per tonne gold (g/t Au) containing 422 thousand ounces (oz) Au and

an Inferred Resource of 3.6 million t grading 6.47 g/t Au

containing 755 thousand oz Au. Further, based on the

Pre‐Feasibility Study produced by Stantec Mining and announced on

June 9, 2015, Bradshaw contains Mineral Reserves (Mineral Resources

are inclusive of Mineral Reserves) in the probable category, using

a 3 g/t Au cut‐off and utilizing a gold price of US$1,200 / oz,

totaling 1.8 million t grading 4.82 g/t Au for 277 thousand oz

Au.

Forward-Looking Statements

This news release may contain certain “forward

looking statements.” Forward-looking statements involve known and

unknown risks, uncertainties, assumptions and other factors that

may cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Any forward-looking statement speaks

only as of the date of this news release and, except as may be

required by applicable securities laws, the Company disclaims any

intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

| For further information please

contact: |

| |

|

| Greg RomainPresident & CEOTel: (416) 363-1210Email:

info@gowestgold.com |

Greg TaylorInvestor RelationsTel: 416 605-5120Email:

gregt@gowestgold.com |

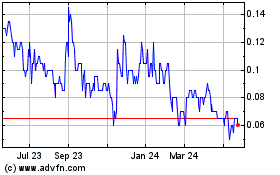

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Dec 2024 to Jan 2025

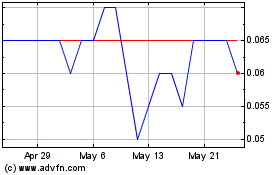

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Jan 2024 to Jan 2025