MONTREAL, QUEBEC , today reported its financial results for the

third quarter and nine months ended April 30, 2008.

FINANCIAL RESULTS

Solely for the convenience of the reader, selected financial

results expressed in Canadian dollars on the financial statements,

have been translated into U.S. dollars at the April 30, 2008

month-end rate C$1.00 equals US$ 0.9928. This translation should

not be construed as an application of the recommendations relating

to the accounting for foreign currency translation, but rather as

supplemental information for the reader.

Results for the Quarter

Sales for the three-month period ended April 30, 2008 totaled

$712,997 (US$707,860) compared to $551,768 in the third quarter of

fiscal 2007, representing an increase of 29%.

Net profit for the third quarter of fiscal 2008 was $259,269

(US$257,400) or $0.01 per share, compared to a net loss of $815,603

or ($0.04) per share for the same period in fiscal 2007.

In addition to sales gains, the Company's profit improvement can

be traced to significantly reduced operating costs, from $1,367,765

in the prior year to $453,752 in the current quarter, due to a cost

reduction program which included, among other things, the decision

to terminate the research and development activities related to its

arthritis and cancer programs.

"The results for the quarter were enhanced by the recent

industry crisis regarding heparin, leading to an increase in sales

of the Company's heparinase products useful in the identification

of heparin contaminants" said Paul Baehr, President and CEO.

The heparin contamination issue presents a unique opportunity

for the use of IBEX pure recombinant enzymes and as a result IBEX

has commenced development of an easy-to-use enzyme-based assay to

measure chondroitin contamination.

Results for the Nine Months

Sales for the nine-month period ended April 30, 2008 totaled

$1,816,800 (US$1,803,720) compared to $1,454,113 for the same

period in the prior year, representing an increase of 25%.

Net profit for the nine-months ended April 30, 2008 was $158,622

(US$157,480) or ($0.01) per share compared to a net loss of

$1,900,938 or ($0.08) per share for the same period in fiscal

2007.

A significant contributor to the year to date profit (versus the

net loss same period of the prior year) is a reduction of the

company's operating expenses from $3,567,237 to $1,655,261 due to

the previously mentioned cost reduction program.

Working Capital

The Company's working capital was $1,629,408 as at the end of

the quarter, in-line with the guidance provided at the time of the

restructuring announcement and up from $1,338,625 as at the end of

the prior quarter ending January 31, 2008 (and compared to

$1,403,321 as at July 31, 2007).

LOOKING FORWARD

IBEX has been successful in bringing its existing business to

profitability and is now turning its attention to growth

opportunities, including opportunities to maximize shareholders'

value through discussions with companies interested in the IBEX

infrastructure and its accumulated tax loss carry-forwards.

ABOUT IBEX

The Company markets a series of proprietary enzymes (heparinases

and chondroitinases) for research use, as well Heparinase I, which

is used in many leading hemostasis monitoring devices.

IBEX also markets a series of arthritis assays which are widely

used in pharmaceutical research. These assays are based on the

discovery of a number of specific molecular biomarkers associated

with collagen synthesis and degradation.

Safe Harbor Statement

All of the statements contained in this news release, other than

statements of fact that are independently verifiable at the date

hereof, are forward-looking statements. Such statements, based as

they are on the current expectations of management, inherently

involve numerous risks and uncertainties, known and unknown. Some

examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry,

changes in the regulatory environment in the jurisdictions in which

IBEX does business, stock market volatility, fluctuations in costs,

and changes to the competitive environment due to consolidation or

otherwise. Consequently, actual future results may differ

materially from the anticipated results expressed in the

forward-looking statements. IBEX disclaims any intention or

obligation to update these statements.

CONSOLIDATED BALANCE SHEETS

--------------------------------------------------------------------------

April 30, July 31,

unaudited 2008 2007

--------------------------------------------------------------------------

$ $

ASSETS

Current assets

Cash and cash equivalents 1,398,745 348,752

Marketable securities (note 3) - 1,099,673

Accounts receivable 345,138 500,509

Inventories 173,121 164,384

Prepaid expenses 133,065 135,014

--------------------------------------------------------------------------

Sub-total Current Assests 2,050,069 2,248,332

--------------------------------------------------------------------------

Property and equipment 255,919 303,271

--------------------------------------------------------------------------

TOTAL ASSETS 2,305,988 2,551,603

--------------------------------------------------------------------------

--------------------------------------------------------------------------

LIABILITIES

Current liabilities

Accounts payable and accrued liabilities 420,661 845,011

--------------------------------------------------------------------------

Sub-total Current Liabilities 420,661 845,011

--------------------------------------------------------------------------

TOTAL LIABILITIES 420,661 845,011

--------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Capital stock (note 4) 52,660,078 52,660,078

Contributed surplus (note 4) 399,975 375,151

Profit (Deficit) (51,174,727) (51,328,637)

--------------------------------------------------------------------------

TOTAL SHAREHOLDER'S EQUITY 1,885,327 1,706,592

--------------------------------------------------------------------------

--------------------------------------------------------------------------

TOTAL LIABILITIES & SHAREHOLDER'S EQUITY 2,305,988 2,551,603

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF DEFICIT

--------------------------------------------------------------------------

For the nine months ended April 30 (unaudited) 2008 2007

--------------------------------------------------------------------------

$ $

Balance - Beginning of period (51,328,637) (43,918,975)

Transition adjustment on adoption of financial

instrument standard (note 2) (4,711) -

--------------------------------------------------------------------------

Restated balance - Beginning of period (51,333,348) (43,918,975)

Net profit (Net loss) year to date 158,622 (7,409,662)

--------------------------------------------------------------------------

Balance - End of period (51,174,727) (51,328,637)

--------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF EARNING (LOSS)

Three months ended Nine months ended

April 30th April 30th

--------------------------------------------------------------------------

(unaudited) 2008 2007 2008 2007

--------------------------------------------------------------------------

$ $ $ $

Revenue 712,997 551,768 1,816,800 1,454,113

--------------------------------------------------------------------------

Operating expenses

Cost of good solds (200,821) (228,527) (735,318) (643,542)

Net research and

development expenditure

(note 7) 39,427 (372,938) 39,427 (986,805)

Selling, general and

administrative expenses (265,704) (723,584) (926,200) (1,925,728)

Amortization of property

and equipment (15,763) (33,497) (49,677) (100,409)

Amortization of

identifiable intangible

assets - (809) - (2,427)

Other interest and bank

charges (3,266) (8,435) (7,703) (24,266)

Foreign exchange loss

(note 6) (15,749) (48,872) (22,646) (27,785)

Investment income 8,124 48,897 36,857 143,725

--------------------------------------------------------------------------

Total operating expenses (453,752) (1,367,765) (1,665,261) (3,567,237)

--------------------------------------------------------------------------

259,245 (815,997) 151,540 (2,113,124)

Current Income taxes (24) (394) (7,082) (212,186)

--------------------------------------------------------------------------

Net profit (loss) 259,269 (815,603) 158,622 (1,900,938)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Net profit (loss) per

share

Basic and diluted $0.01 $(0.04) $0.01 $(0.08)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CONSOLIDATED CASH FLOW STATEMENTS

Three months ended Nine months ended

April 30th April 30th

--------------------------------------------------------------------------

(unaudited) 2008 2007 2008 2007

--------------------------------------------------------------------------

$ $ $ $

Cash flows provided by

(used in):

Operating activities

Net profit (loss) for the

period 259,269 (815,603) 158,622 (1,900,938)

Items not affecting cash -

Amortization of property and

equipment 15,763 42,270 49,678 126,726

Amortization of identifiable

intangible assets - 71,308 - 213,922

Stock-based compensation

costs 17,150 4,520 24,824 21,040

Accretion of interest on

balance of payments - 4,550 - 13,650

--------------------------------------------------------------------------

Cash flow relating to

operating activities 292,182 (692,955) 233,124 (1,525,600)

--------------------------------------------------------------------------

Net changes in non-cash

working capital items -

Decrease in accounts

receivable 26,770 52,917 155,371 109,845

Decrease (increase) in

inventories (58,963) 22,595 (8,737) 63,790

(Increase) decrease in

prepaid expenses (45,903) (48,174) 1,949 (19,932)

(Decrease) increase in

accounts payable and

accrued liabilities 119,689 358,827 (429,061) 56,117

--------------------------------------------------------------------------

Net changes in non-cash

working capital balances

relating to operations 41,593 386,165 (280,478) 209,820

--------------------------------------------------------------------------

Cash flow relating to

operating activities 333,775 (306,790) (47,354)(1,315,780)

--------------------------------------------------------------------------

Investing activities

Additions to marketable

securities - (2,001,239) - (5,640,573)

Proceeds on disposal of

marketable securities - 4,290,850 1,099,673 9,315,062

Additions to property and

equipment (1,400) (550) (2,326) (8,573)

Increase in other assets - (360,371) - (1,000,000)

--------------------------------------------------------------------------

Cash flow relating to

financing activities (1,400) 1,928,690 1,097,347 2,665,916

--------------------------------------------------------------------------

Increase in cash and cash

equivalents during the year 332,375 1,621,900 1,049,993 1,350,136

Cash and cash equivalents -

Beginning of period 1,066,370 544,688 348,752 816,452

--------------------------------------------------------------------------

Cash and cash equivalents -

End of period 1,398,745 2,166,588 1,398,745 2,166,588

--------------------------------------------------------------------------

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release

Contacts: IBEX Technologies Inc. Paul Baehr President & CEO

514-344-4004 ext 147 www.ibex.ca

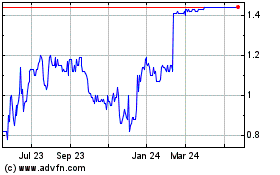

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

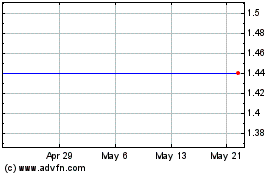

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2023 to Dec 2024