Independence Gold Announces $2.2 Million Exploration Program for 3Ts Project, BC

01 March 2012 - 11:00PM

Marketwired Canada

Independence Gold Corp. (TSX VENTURE:IGO) ("Independence Gold" or "the Company")

is pleased to announce the 2012 exploration program for its 100% owned 3Ts

Project, located approximately 120 kilometres southwest of Vanderhoof. For

additional information please visit the Company's website www.ingold.ca.

The 2012 exploration program is budgeted at $2,200,000 and is scheduled to

commence on or about April 15, 2012. The program will consist of approximately

5,000 metres (m) of diamond drilling, prospecting, geological mapping,

geophysical surveying and trenching.

The Company will initially focus on drilling the Mint Vein and the Ted Vein

targets, with the objective to increase the Inferred Resource for the 3Ts

Project. These veins remain open at depth and along strike. Planned 2012 diamond

drill holes will also test for new mineralized veins. Well-mineralized vein

float boulders identified on the property indicate the potential to discover new

mineralized veins within the 3Ts Project area. These mineralized vein boulders

are described in the Company's National Instrument (NI) 43-101 technical report

filed on SEDAR December 23, 2011.

Mint Vein

A NI 43-101 compliant Inferred Resource estimate of 310,084 tonnes grading 5.24

grams per tonne ("g/t") gold and 63.2 g/t silver has been calculated for the

Mint Vein (see the Company's news release dated January 20, 2012). The first

diamond drill hole to test the Mint Vein below the cross-cutting microdiorite

sill was completed in 2011, and this vein intercept assayed 7.69 g/t gold and

84.2 g/t silver across 3.7 m (true width). The Mint Vein will be tested both

down-dip and along strike from this intercept during the 2012 drilling campaign,

with additional drill holes to test the presumed northern extension of the Mint

Vein structure.

Ted Vein

The best hole from previous drilling on the Ted Vein assayed 8.88 g/t gold and

393.6 g/t silver across 15.4 m (true width). A NI 43-101 compliant Inferred

Resource estimate of 1,813,573 tonnes grading 2.37 g/t gold and 124.4 g/t silver

has been calculated for the Ted Vein (see the Company's news release dated

January 20, 2012). The Ted Vein is open below a cross-cutting microdiorite sill,

where the best drill hole to date intersected 5.33 g/t gold and 50.6 g/t silver

across 14.0 m (true width). Planned 2012 diamond drilling will continue testing

the Ted Vein structure at depth, below the cross-cutting sill.

Further prospecting, geological mapping and trenching to search for additional

mineralized veins is planned for the 2012 field season. Existing ground magnetic

geophysical survey coverage will be extended northwards, into a largely

overburden-covered area within the north central part of the 3Ts Project area.

Ground magnetic surveying can provide information on geological features within

the underlying bedrock.

The total combined NI 43-101 compliant Inferred Resource for the known

mineralized vein structures at the 3Ts Project is 3,614,072 tonnes grading 3.39

g/t gold and 85.15 g/t silver for 394,383 contained ounces of gold and 9,894,835

contained ounces of silver, at a 1 g/t gold cutoff grade (see the Company's news

release dated January 20, 2012).

The 3Ts Project is comprised of twelve mineral claims covering approximately

4,272 hectares in the Nechako Plateau region of central British Columbia. The

3Ts Project covers an epithermal quartz-carbonate vein system within which more

than a dozen individual mineralized veins, ranging up to 650 m in strike length

and up to 20 m in true width, have been identified.

David Pawliuk, P.Geo., the Company's Qualified Person as defined by NI 43-101

for the 3Ts Project, has reviewed the technical information in this news

release.

A NI 43-101 compliant Technical Report on the 3Ts Project, supporting the

Company's announced Inferred Resource estimate from January 20, 2012 has been

filed on SEDAR and is now available on the Company's website.

The Company also wishes to announce the granting of incentive stock options to

certain directors, officers and employees to purchase up to 3,200,000 common

shares under the Company's Incentive Stock Option Plan. The options will be

granted for a period of five (5) years, commencing on March 1, 2012, exercisable

at a price of $0.35 per share.

INDEPENDENCE GOLD CORP.

Randy Turner, President

Independence Gold (TSXV:IGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

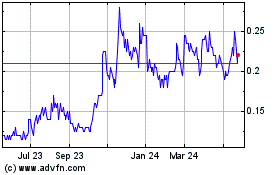

Independence Gold (TSXV:IGO)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Independence Gold Corp (TSX Venture Exchange): 0 recent articles

More Independence Gold Corp. News Articles