Immunotec Announces 2014 First Quarter Results

28 March 2014 - 3:23AM

Marketwired Canada

Immunotec Inc. (TSX VENTURE:IMM), a Canadian based company and a leader in the

wellness industry (the "Company") today released its first quarter results for

the three-month period ended 31 January 2014.

"We are pleased with first quarter results and the collaborative efforts to

produce them" said Mr. Charles L. Orr, Immunotec's Chief Executive Officer.

FIRST QUARTER 2014 - FINANCIAL HIGHLIGHTS

-- Total Revenues for the three-month period reached $16.2M, an increase of

32.6% as compared to the same period in the previous year.

-- Network sales for the three-month period reached $14.8M, an increase of

31.9% as compared to the same period in the previous year. We recorded

growth in Network sales revenue of 48.6% in Mexico and 21.3% in the US,

after adjustment for the impact of foreign exchange fluctuations.

-- Margin before expenses as a percentage of revenues decreased during the

three-month period ended 31 January 2014 to 26.4% as compared to 32.1%

in the same period in the previous year. This decrease is primarily a

result of increases in sales incentives during the three-month period.

-- Selected expenses,(1)defined as administrative, marketing and selling,

and quality and development expenses amounted to $3.5M in the three-

month period and measured favourably as a percentage of total revenues

by improving to 21.8% as compared to 25.3% in the same period in the

previous year.

-- Adjusted EBITDA,(1)amounted to $0.8M or 4.7% of total revenues in the

three-month period, compared to $0.8M or 6.8% of total revenues in the

same period in the previous year, primarily due to $0.4M in costs

related to our Annual Convention in Mexico, whereas there were no

equivalent charges in the same period in the previous year.

-- Net profit of $0.8M for the three-month period, compared $0.5M in the

same period in the previous year.

(1) Refer to the non-GAAP measures section.

During the three-month period ended 31 January 2014, network sales were $14.8M

as compared to $11.2M for the same period in the previous year, an increase of

$3.6M or 31.9%. This increase was driven primarily by our Mexican operations, as

well as from growth in our western US operations.

Other revenue, which includes revenues of products sold to licensees (export

sales), freight and shipping and educational material purchased by our network

of independent consultants, increased to $1.4M compared to $1.0M in the previous

year, an increase of $0.4M or 40.9%, which is primarily attributable to

improvements in export sales.

Sales incentives paid to our Network is the Company's most significant expense

and consists of commissions, performance bonuses and other promotional

incentives provided to qualifying independent consultants. During the

three-month period ended 31 January 2014, sales incentives amounted to $8.0M or

54.0% of total Network sales compared to $5.4M or 48.1% of total Network sales

in the same period in the previous year. The most significant element of the

increase in the percentage of sales incentives during the three months ended 31

January 2014 is the costs in the amount of $0.4M related to the Company's Annual

Convention, which were not present in the same period in the previous year.

Selected expenses(1) in the three-month period ended 31 January 2014 amounted to

$3.5M or 21.8% of revenues, as compared to $3.1M or 25.3% or revenues for the

same period in the previous year. This result shows that the growth in revenues

during the three-month period ended 31 January 2014 was achieved without a

commensurate growth in these expenses, reflective of a continued disciplined

approach to these expenses.

For the three-month period ended 31 January 2014 adjusted EBITDA(1)was $0.8M or

4.7% of revenues, versus $0.8M or 6.8% for the same period in the previous year.

This was impacted by $0.4M in costs related to our Annual Convention in Mexico

whereas there were no equivalent costs in the same period in the previous year.

The various components of Adjusted EBITDA were relatively stable during the

three-month period except for a an additional $0.1M in income taxes and $0.4M in

net finance income, primarily the result of net foreign exchange impacts during

the current period.

Net profit for the three-month period ended 31 January 2014 totalled $0.8M, as

compared to net profit of $0.5M for the same period in the previous year. This

period-over-period improvement is primarily the result of revenue growth in

Mexico.

About Immunotec Inc.

Immunotec Inc. is dedicated to making a positive difference in people's

lifestyle every day by offering research-driven nutritional products through its

network of Independent Consultants worldwide. Immunotec's strength comes from

its culture that emphasizes teamwork and entrepreneurial leadership by

employees, consultants and research collaborators.

Headquartered with manufacturing facilities near Montreal, Canada, Immunotec's

independent consultants generate nearly $55.0M in annual revenues. Please visit

us at www.immunotec.com for additional information.

The Company files its consolidated financial statements, its management and

discussion analysis report, its press releases and such other required documents

on the SEDAR database at www.sedar.com and on the Company's website at

www.immunotec.com. The common shares of the Company are listed on the TSX

Venture Exchange under the ticker symbol IMM. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or accuracy of this

release.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained in

this news release are forward looking and are subject to numerous risks and

uncertainties, known and unknown. For information identifying known risks and

uncertainties and other important factors that could cause actual results to

differ materially from those anticipated in the forward-looking statements,

please refer to the heading Risks and Uncertainties in Immunotec's most recent

Management's Discussion and Analysis, which can be found at www.sedar.com.

Consequently, actual results may differ materially from the anticipated results

expressed in these forward-looking statements.

Selected Financial Information

The following tables summarize selected financial information from the unaudited

interim Consolidated Statements of Income and the unaudited interim Consolidated

Statements of Financial Position regarding the Company's results of operations

and financial position.

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Selected Financial Information

For the three-month periods ended 31 January

('000s of C$, except for share and per share data) 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues 16,156 12,179

Cost of goods sold 2,922 1,988

Sales incentives - Network 7,980 5,382

Other variable costs 988 904

----------------------------------------------------------------------------

Margin before expenses 4,266 3,905

Expenses 3,694 3,302

----------------------------------------------------------------------------

Operating income 572 603

Net finance income (467) (68)

Income taxes 280 143

----------------------------------------------------------------------------

Net profit 759 528

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total comprehensive income 625 437

Net profit per common share:

Basic and diluted 0.01 0.01

Weighted average number of common shares

oustanding during the period

Basic 69,126,082 69,845,360

Diluted 69,130,254 69,845,360

----------------------------------------------------------------------------

----------------------------------------------------------------------------

As at 31 January 31 October

(000's of C$) 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash 4,313 4,706

Total assets 24,217 23,495

Long-term liabilities (including current portions) 2,253 2,021

Equity 13,683 13,071

----------------------------------------------------------------------------

----------------------------------------------------------------------------

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Geographic distribution of revenues

For the three-month periods ended 31 January

('000s of C$) 2014 2013 Growth

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Mexico 8,379 5,277 58.8%

United States 3,983 3,094 28.7%

Canada 3,147 3,442 -8.6%

Other countries 647 366 76.8%

----------------------------------------------------------------------------

16,156 12,179 32.7%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Geographic distribution in key markets

presented in local currency: Growth

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Mexico ('000s of Mexican Pesos) 102,678 68,446 50.0%

United States ('000s of US$) 3,725 3,116 19.5%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Selected expenses as a percentage (%) of total revenue

For the three-month periods ended 31 January

('000s of C$) 2014 % 2013 %

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues 16,156 100.0% 12,179 100.0%

Selected expenses

Administrative 1,852 11.5% 1,611 13.2%

Marketing and selling 1,433 8.9% 1,239 10.2%

Quality and development costs 220 1.4% 227 1.9%

----------------------------------------------------------------------------

3,505 21.7% 3,077 25.3%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

---------------------------------------------------------------------------

---------------------------------------------------------------------------

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Calculation of adjusted EBITDA

For the three-month periods ended 31 January

('000s of C$) 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net profit 759 528

Add (deduct):

Depreciation and amortization 174 221

Net finance income (467) (68)

Other expenses 17 4

Income tax recovery 280 143

----------------------------------------------------------------------------

Adjusted EBITDA 763 828

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Percentage of revenues 4.7% 6.8%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Adjusted EBITDA and Selected Expenses are a non-GAAP measures providing

additional information on the commercial performance of regular operations.

Adjusted EBITDA corresponds to EBITDA as defined Earnings before Interest Taxes

Depreciation and Amortization less elements that management considers outside of

the normal activities of the Company. Selected Expenses correspond to general

administration charges and fixed overhead charges in the normal activities of

the Company. For more information please refer to the non-GAAP measures section

of the most recent Management Discussion and Analysis filed on www.sedar.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Patrick Montpetit CPA, CA, CF,

Vice-President and Chief Financial Officer,

Immunotec Inc.

(450) 510-4527

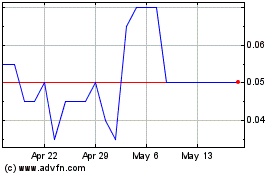

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Dec 2023 to Dec 2024