Logica Ventures Corp. (“

Logica” or the

“

Company”) (TSXV:LOG.P) is pleased to provide an

update to its previously announced proposed acquisition (the

“

Proposed Transaction”) of all of the issued and

outstanding securities of Alpha Gold North Inc.

(“

AGN”). In connection with the Proposed

Transaction, Logica and AGN have engaged Echelon Capital Markets

(“

Echelon”) as lead agent and sole bookrunner,

along with a syndicate of agents including Red Cloud Securities

Inc. (and together with Echelon, the “

Agents”), to

conduct concurrent “best efforts” private placement offering of up

to $3 million.

The combined net proceeds of the Offering (as

defined below), after giving effect to the Proposed Transaction,

are expected to be used by the Resulting Issuer (as defined below)

for Canadian exploration expenses and for corporate and general

working capital purposes.

The Offering (as defined herein) will consist

of: (i) AGN subscription receipts (the “AGN Subscription

Receipts”) at a price of $0.18 per AGN Subscription

Receipt (the “AGN Offering”), which will be

automatically exchanged, for no additional consideration, into one

unit of AGN (each, a “Unit”), with each Unit

consisting of one common share in AGN (each an “AGN

Share”) and one common share purchase warrant (each, an

“AGN Warrant”), upon the satisfaction or waiver of

all conditions precedent to the Proposed Transaction and certain

other ancillary conditions customary for transactions of this

nature (collectively, the “Escrow Release

Conditions”); and (ii) Logica flow-through subscription

receipts (the “Logica Subscription Receipts” and

together with the AGN Subscription Receipts, the

“Subscription Receipts”) at a price of $0.20 per

Logica Subscription Receipt (the “Logica Offering”

and together with the AGN Offering, the

“Offerings”), which entitles the holder to receive

one flow-through unit of Logica (each, a “FT

Unit”), with each FT Unit consisting of one flow-through

common share in Logica (each, a “FT Share”) and

one-half of one common share purchase warrant (each whole warrant,

a “FT Warrant” and together with the AGN Warrants,

the “Warrants”), upon completion of the Proposed

Transaction. Each AGN Warrant shall entitle the holder thereof to

acquire one common share of AGN at an exercise price of $0.25, for

a period of 36 months following the closing date of the AGN

Offering. Each FT Warrant shall entitle the holder thereof to

acquire one common share of Logica (each, a “Logica

Share”) at an exercise price of $0.25, for a period of 36

months following the closing date of the Logica Offering.

The Resulting Issuer (as defined below) will

incur (or be deemed to incur) resource exploration expenses which

will constitute “Canadian exploration expenses” as defined in

subsection 66.1(6) of the Income Tax Act (Canada) (the “Tax

Act”) and “flow through mining expenditures” as defined in

subsection 127(9) of the Tax Act, in an amount equal to the amount

raised pursuant to the sale of Logica Subscription Receipts and the

Resulting Issuer will renounce the Canadian exploration expenses

(on a pro rata basis) to each subscriber with an effective date of

no later than December 31, 2022 in accordance with the Tax Act.

Each of the Offerings will be conducted pursuant

to the terms of one or more agency agreements to be entered into

among AGN, Logica and the Agents. AGN and Logica have each agreed

to pay the Agents a cash fee equal to 7.0% of the gross proceeds of

each of the respective Offerings and to issue that number of broker

warrants equal to 7.0% of the number of Subscription Receipts sold

under each of the respective Offerings (each a “Broker

Warrant”). Each Broker Warrant issued by AGN will be

exercisable to purchase one Unit for a period of three (3) years

from the closing date of the AGN Offering at an exercise price of

$0.18. Each Broker Warrant issued by Logica will be exercisable to

purchase one unit of Logica consisting of one Logica Share and

one-half of one common share purchase warrant (each whole warrant,

a “Logica Warrant”). Each Logica Warrant will be

exercisable to purchase one Logica Share at an exercise price of

$0.25 for a period of 36 months following the closing date of the

Logica Offering. The gross proceeds of the Offerings (less 50% of

the Agents’ fees and all of the Agents’ expenses) will be held in

escrow pending the satisfaction of the Escrow Release

Conditions.

The closing of each of the Offerings will be

subject to, among other customary conditions, AGN entering into a

definitive agreement (the “Definitive Agreement”)

with Logica with respect to the Proposed Transaction, on terms and

conditions satisfactory to Echelon, acting reasonably.

On the satisfaction or waiver of all Escrow

Release Conditions the AGN Shares and will be exchanged for common

shares of the issuer (the “Resulting Issuer

Shares”) resulting from the Proposed Transaction (the

“Resulting Issuer”); and (ii) each of the AGN

Warrants will be exchanged for warrants (the “Resulting

Issuer Warrants”) of the Resulting Issuer, which exchanges

will be made subject to and in compliance with applicable

securities laws. The AGN Subscription Receipts will be subject to

an indefinite hold period, and the Logica Subscription Receipts

will be subject to a four-month statutory hold period. The

Resulting Issuer Shares and Resulting Issuer Warrants issued in

exchange for the AGN Shares and AGN Warrants pursuant to the

Proposed Transaction are expected to be free of any statutory hold

periods in Canada, other than in respect of control block sales (if

applicable).

For further information please contact:

Logica Ventures Corp. Munaf Ali

Directorir@logicaventures.com

Alpha Gold North Inc.Trumbull

FisherChief Executive OfficerTf@alphagoldnorth.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Completion of the Proposed Transaction is

subject to a number of conditions, including but not limited to,

TSXV acceptance and if applicable pursuant to TSXV Requirements,

majority of the minority shareholder approval. Where applicable,

the Proposed Transaction cannot close until the required

shareholder approval is obtained. There can be no assurance that

the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the Proposed

Transaction, any information released or received with respect to

the Proposed Transaction may not be accurate or complete and should

not be relied upon. Trading in the securities of a capital pool

company should be considered highly speculative.

The TSXV has in no way passed upon the merits of

the Proposed Transaction and has neither approved nor disapproved

the contents of this press release.

All information contained in this news release

with respect to the Company, AGN and the Resulting Issuer was

supplied by the parties, respectively, for inclusion herein.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

Notice Regarding Forward Looking

Statements

The information in this news release includes

certain information and statements about management's view of

future events, expectations, plans and prospects that constitute

forward looking statements, including statements relating to the

completion of the Proposed Transaction, the Offerings, the use of

proceeds of the Offerings and the proposed business of the

Resulting Issuer. These statements are based upon assumptions that

are subject to significant risks and uncertainties. Because of

these risks and uncertainties and as a result of a variety of

factors, the actual results, expectations, achievements or

performance may differ materially from those anticipated and

indicated by these forward looking statements. Any number of

factors could cause actual results to differ materially from these

forward-looking statements as well as future results. Although the

Company believes that the expectations reflected in forward looking

statements are reasonable, it can give no assurances that the

expectations of any forward looking statements will prove to be

correct. Except as required by law, the Company disclaims any

intention and assumes no obligation to update or revise any forward

looking statements to reflect actual results, whether as a result

of new information, future events, changes in assumptions, changes

in factors affecting such forward looking statements or

otherwise.

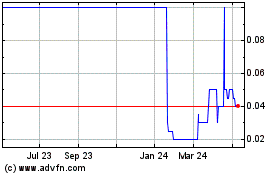

Logica Ventures (TSXV:LOG.P)

Historical Stock Chart

From Feb 2025 to Mar 2025

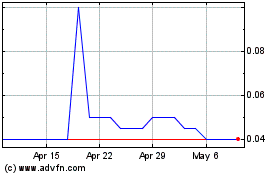

Logica Ventures (TSXV:LOG.P)

Historical Stock Chart

From Mar 2024 to Mar 2025