CoTec Holdings Corp. (TSXV: CTH; OTCQB: CTHCF) (“CoTec”) and Mkango

Resources Ltd. (AIM/TSX-V: MKA) (“Mkango”) are pleased to announce

that CoTec and Maginito Limited ("Maginito") have entered into a

binding letter agreement pursuant to which they have agreed a 50:50

joint venture (the “Joint Venture”) in relation to the United

States roll-out of HyProMag’s rare earth magnet recycling

technology. HyProMag’s technology will be sublicenced to the new

Joint Venture company, HyProMag US, on formation.

HyProMag is 100 per cent owned by Maginito

Limited (“Maginito”), which is owned on a 90:10 basis by Mkango and

CoTec. HyProMag is commercialising rare earth magnet recycling

using Hydrogen Processing of Magnet Scrap (HPMS) technology in the

UK, Germany and United States, with first production expected in

the UK in 2023 and in Germany in 2024. Revenue from the US Joint

Venture is targeted for 2025/2026.

The Joint Venture will initially be focused on

completing a scoping study and a bankable feasibility study

(“Feasibility Study”) for the deployment of three HPMS vessels

utilizing the HyProMag technology and one magnet manufacturing

facility in the US (combined the “US Project”). The Feasibility

Study is expected to be completed in 2024. Following completion of

the Feasibility Study, CoTec and Mkango would make a joint decision

on whether the Joint Venture will proceed with the construction of

the US Project.

CoTec will fund the initial operations of the

Joint Venture, including the costs of the Feasibility Study. If the

Joint Venture proceeds with the construction of the US Project,

CoTec will also be responsible for funding all the development

costs of the US Project, with a total expected funding of £30

million to £50 million during the first three years post completion

of the Feasibility Study, subject to results of the Feasibility

Study. All funding provided by CoTec would be in the form of

shareholder loans. CoTec and Mkango also expect that the Joint

Venture will seek US government funding for the US Project.

The parties have agreed that certain long lead

items could be pre-ordered to expedite, subject to approval, the

development of the US Project. A comprehensive joint venture

agreement dealing with all other commercial aspects of the US

Project, consistent with the terms of the existing cooperation

agreement between CoTec and Mkango, will be agreed by the parties

in parallel with the completion of the Feasibility Study.

Julian Treger, CoTec CEO commented; “This is a

major step forward for CoTec and Mkango/Maginito and we are looking

forward to working with the Mkango and HyProMag teams on this very

exciting, proven and much needed technology in the US targeting the

long-term supply of low cost, sustainable recycled rare earth

magnets.

“The US presents a significant opportunity for

the HyProMag technology and the technical skills of Mkango and

HyProMag combined with CoTec’s commercial strength could

potentially provide shareholders with a unique and robust value

proposition in the rare earth industry in the right jurisdiction at

the right time.”

“We look forward to working and collaborating

with local, state and federal stakeholders targeting the completion

of the feasibility study."

Will Dawes, Mkango CEO commented; “We see a very

significant opportunity in the US market and look forward to

working with CoTec and HyProMag as we move into the next phase of

growth.”

“Less than 5 per cent of rare earth magnets are

currently recycled from end-of-life products. Increasing recycling

rates via HyProMag’s HPMS technology solution to unlock this new

potential source of rare earths, thereby avoiding waste to landfill

and significantly reducing the carbon footprint, can make a major

contribution to creating more sustainable and robust rare earth

supply chains across multiple jurisdications.”

HPMS technology was developed at the University

of Birmingham, underpinned by approximately US$100 million of

research and development funding, and has major competitive

advantages versus other rare magnet recycling technologies, which

are largely focused on chemical processes but do not solve the

challenges of liberating magnets from end-of-life scrap streams –

HPMS provides the solution. HyProMag’s company presentation can be

viewed via the following link: HyProMag Corporate Presentation

Maginito

Maginito is a UK based Company owned 90 per cent

by Mkango and 10 per cent by CoTec. It is focused on developing

green technology opportunities in the rare earths supply chain,

encompassing neodymium (NdFeB) magnet recycling as well as

innovative rare earth alloy, magnet, and separation

technologies.

Maginito holds a 100 per cent interest in

HyProMag and a 90 per cent direct and indirect interest (assuming

conversion of Maginito’s recently announced convertible loan) in

HyProMag GmbH, focused on short loop rare earth magnet recycling in

the UK and Germany, and a 100 per cent interest in Mkango Rare

Earths UK Ltd (“Mkango UK”), a company focused on long loop rare

earth magnet recycling in the UK via a chemical route.

About Mkango Resources

Ltd.

Mkango's corporate strategy is to develop new

sustainable primary and secondary sources of neodymium,

praseodymium, dysprosium and terbium to supply accelerating demand

from electric vehicles, wind turbines and other clean technologies.

This integrated Mine, Refine, Recycle strategy differentiates

Mkango from its peers, uniquely positioning the Company in the rare

earths sector. Mkango is listed on the AIM and the TSX-V.

Mkango is developing its flagship Songwe Hill

rare earths project (“Songwe”) in Malawi with a Definitive

Feasibility Study completed in July 2022 and an Environmental,

Social and Health Impact Assessment approved by the Government of

Malawi in January 2023.

In parallel, Mkango and Grupa Azoty PULAWY,

Poland's leading chemical have agreed to work together towards

development of a rare earth separation plant at Pulawy in Poland

(the “Pulawy Separation Plant”) to process the purified mixed rare

earth carbonate produced at Songwe Hill.

Mkango also has an extensive exploration

portfolio in Malawi, including the Mchinji rutile exploration

project, the Thambani uranium-tantalum-niobium-zircon project and

Chimimbe nickel-cobalt project.

For more information, please visit www.mkango.ca

About CoTec Holdings Corp.

CoTec is a publicly traded investment issuer

listed on the Toronto Venture Stock Exchange (“TSX- V”) and the

OTCQB and trades under the symbol CTH and CTHCF respectively. The

Company is an environment, social, and governance (“ESG”)-focused

company investing in innovative technologies that have the

potential to fundamentally change the way metals and minerals can

be extracted and processed for the purpose of applying those

technologies to undervalued operating assets and recycling

opportunities, as the Company transitions into a mid-tier mineral

resource producer.

CoTec is committed to supporting the transition

to a lower carbon future for the extraction industry, a sector on

the cusp of a green revolution as it embraces technology and

innovation. The Company has made four investments to date and is

actively pursuing operating opportunities where current technology

investments could be deployed.

For more information, please

visit www.cotec.ca.

Market Abuse Regulation (MAR)

Disclosure

The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 ('MAR') which has been incorporated into UK law

by the European Union (Withdrawal) Act 2018. Upon the publication

of this announcement via Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

statements (within the meaning of that term under applicable

securities laws) with respect to Mkango and CoTec. Generally,

forward looking statements can be identified by the use of words

such as “plans”, “expects” or “is expected to”, “scheduled”,

“estimates” “intends”, “anticipates”, “believes”, or variations of

such words and phrases, or statements that certain actions, events

or results “can”, “may”, “could”, “would”, “should”, “might” or

“will”, occur or be achieved, or the negative connotations thereof.

Readers are cautioned not to place undue reliance on

forward-looking statements, as there can be no assurance that the

plans, intentions or expectations upon which they are based will

occur. By their nature, forward-looking statements involve numerous

assumptions, known and unknown risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and other forward-looking

statements will not occur, which may cause actual performance and

results in future periods to differ materially from any estimates

or projections of future performance or results expressed or

implied by such forward-looking statements. Such factors and risks

include, without limiting the foregoing, the availability of (or

delays in obtaining) financing to develop Songwe Hill, the Tyseley

Recycling Plant, the HyProMag GmbH Recycling Plant, the Mkango UK

Pilot Plant, the Pulawy Separation Plant, governmental action and

other market effects on global demand and pricing for the metals

and associated downstream products for which Mkango is exploring,

researching and developing, geological, technical and regulatory

matters relating to the development of Songwe Hill, the ability to

scale the HPMS and chemical recycling technologies to commercial

scale, competitors having greater financial capability and

effective competing technologies in the recycling and separation

business of Maginito and Mkango, availability of scrap supplies for

Maginito’s recycling activities, government regulation (including

the impact of environmental and other regulations) on and the

economics in relation to recycling and the development of the

Tyseley Recycling Plant, the HyProMag GmbH Recycling Plant, the

Mkango UK Pilot Plant, the Pulawy Separation Plant and future

investments in the United States pursuant to the proposed

cooperation agreement between Maginito and CoTec, the outcome and

timing of the completion of the feasibility studies, cost overruns,

complexities in building and operating the plants, and the positive

results of feasibility studies on the various proposed aspects of

Mkango’s, Maginito’s and CoTec’s activities. The forward-looking

statements contained in this news release are made as of the date

of this news release. Except as required by law, the Company and

CoTec disclaim any intention and assume no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law. Additionally, the Company and CoTec undertake no

obligation to comment on the expectations of, or statements made

by, third parties in respect of the matters discussed above.

For further information on Mkango,

please contact:

Mkango Resources Limited

|

William DawesChief Executive Officerwill@mkango.caCanada: +1 403

444 5979www.mkango.ca@MkangoResources |

Alexander LemonPresidentalex@mkango.ca |

|

|

|

SP Angel Corporate Finance

LLPNominated Adviser and Joint BrokerJeff Keating, Kasia

BrzozowskaUK: +44 20 3470 0470

Alternative Resource

CapitalJoint BrokerAlex Wood, Keith DowsingUK: +44 20 7186

9004/5

Tavistock CommunicationsPR/IR

AdviserJos Simson, Cath DrummondUK: +44 (0) 20 7920

3150mkango@tavistock.co.uk

For further information on CoTec, please

contract:

CoTec Holdings Corp.Braam

JonkerChief Financial Officerbraam.jonker@cotec.caCanada: +1 604

992-5600

The TSX Venture Exchange has neither

approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any equity or other

securities of the Company in the United States. The securities of

the Company will not be registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities Act") and

may not be offered or sold within the United States to, or for the

account or benefit of, U.S. persons except in certain transactions

exempt from the registration requirements of the U.S. Securities

Act.

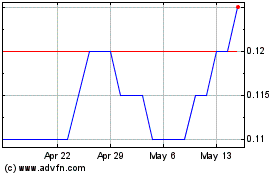

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mkango Resources (TSXV:MKA)

Historical Stock Chart

From Jan 2024 to Jan 2025