NevGold Announces Closing of Second Tranche of Upsized C$2.35M Non-Brokered Private Placement Financing and Announces Shares-for-Debt Transaction

17 February 2024 - 7:13AM

NevGold Corp. (“

NevGold” or the

“

Company”) (

TSXV:NAU) (OTCQX:NAUFF)

(Frankfurt:5E50) is pleased to announce closing of a

second and final tranche of a non-brokered private placement

financing (see previous News Releases dated December 20, 2023 and

January 5, 2024) of 2,656,250 common shares of the Company (the

“Common Shares”) issued at a price of C$0.32 per Common Share for

gross proceeds of C$850k (the “Offering”). The Company increased

the total size of the Private Placement to $2.35 million gross

proceeds due to investor interest. A total of 7,343,750 Common

Shares were issued under the first and second tranches for $2.35

million gross proceeds.

NevGold CEO, Brandon Bonifacio,

comments: “It is positive to see further demand for our

no-warrant financing with strong participation from existing and

new shareholders. The financing proceeds will be directed to

high-potential opportunities at Nutmeg Mountain and other strategic

efforts in the adjacent Hercules Copper District in Washington

County, Idaho. We look forward to commencing field work which will

lead to a very active 1H-2024 for the Company. The NevGold platform

has made significant advances since our initial public listing in

June-2021, and we will continue to build on our oxide, heap-leach

gold resource base in the Western USA, while considering other

value-generating opportunities for shareholders.”

The Company intends to use the aggregate net

proceeds raised from the Offering for general working capital

purposes and advancing strategic efforts at the Nutmeg Mountain

Project and in the surrounding Washington County, Idaho

district.

NevGold paid a cash finder’s fee of C$25,920 and

issued 81,000 non-transferable finder’s warrants (the “Finder

Warrants”) to an arm’s length finder in connection with the second

closing tranche. Each Finder Warrant entitles the holder thereof to

acquire one Common Share at an exercise price of C$0.32 per share

until February 16, 2025.

All securities of the Company issued in

connection with the second tranche of the Offering are subject to a

hold period expiring on June 17, 2024 in accordance with applicable

securities laws. The Offering is subject to the final approval of

the TSX Venture Exchange (the “TSXV”).

Robert McKnight (the "Insider"), Executive VP

and Chief Financial Officer of the Company, has purchased an

aggregate of 93,750 Common Shares under the second tranche of the

Offering. The Insider participation in the Offering therefore

constitutes a "related-party transaction" within the meaning of

TSXV Policy 5.9 and Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special

Transactions ("MI 61-101"). The Company is relying on

exemptions from the formal valuation and minority security holder

approval requirements of the related-party rules set out in

sections 5.5(a) and 5.7(a) of MI 61-101 as the fair market value of

the Insiders participation does not exceed 25% of the market

capitalization of the Company. The Company did not file a material

change report more than 21 days before the closing of the second

tranche of the Offering as the details of the Offering and the

participation therein by each "related party" of the Company were

not settled until shortly prior to the closing of the second

tranche of the Offering, and the Company wished to close the

Offering on an expedited basis for sound business reasons. The

Company obtained approval by the board of directors of the Company

to the Offering. No materially contrary view or abstention was

expressed or made by any director of the Company in relation

thereto.

Shares for DebtAdditionally,

the Company is pleased to announce that it has entered into a debt

settlement agreement dated February 15, 2024 to settle outstanding

debt in the amount of C$135,000 (the “Debt”) owing to an

arm’s-length creditor by issuing to the creditor an aggregate of

421,875 Common Shares at a price of C$0.32 per Common Share (the

“Shares-for-Debt Transaction”). The NevGold Board of Directors has

determined that it is in the best interests of the Company to

settle the outstanding Debt by the issuance of Common Shares to

preserve the Company’s cash for ongoing operations.

Closing of the Shares-for-Debt Transaction is

subject to customary closing conditions, including the approval of

the TSXV. The Company intends to close the Shares-for-Debt

Transaction as soon as practicable. The Common Shares to be issued

pursuant to the Shares-for-Debt Transaction will be subject to a

hold period of four (4) months and one (1) day from the date of

issuance.

ON BEHALF OF THE BOARD

“Signed”

Brandon Bonifacio, President &

CEO

For further information, please contact Brandon

Bonifacio at bbonifacio@nev-gold.com, call 604-337-4997, or visit

our website at www.nev-gold.com.

About the CompanyNevGold is an

exploration and development company targeting large-scale mineral

systems in the proven districts of Nevada and Idaho. NevGold owns a

100% interest in the Limousine Butte and Cedar Wash gold projects

in Nevada, and the Nutmeg Mountain gold project in Idaho.

Please follow @NevGoldCorp on

Twitter, Facebook, LinkedIn, Instagram, and YouTube.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

statements that are based on the Company’s current expectations and

estimates. Forward-looking statements are frequently characterized

by words such as “plan”, “expect”, “project”, “intend”, “believe”,

“anticipate”, “estimate”, “suggest”, “indicate” and other similar

words or statements that certain events or conditions “may” or

“will” occur. Forward looking statements in this news release

include, but are not limited to, statements regarding regulatory

approval of the Offering, regulatory approval of the Shares for

Debt Transaction, exploration and development plans of the Company

and use of proceeds from the Offering. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that could cause actual events or results to differ

materially from estimated or anticipated events or results implied

or expressed in such forward-looking statements. Risks,

uncertainties, and other factors that could cause the Company’s

plans to change include risks related to regulatory approval of the

Offering, regulatory approval of the Shares for Debt Transaction,

changes in demand for and price of gold and other commodities and

currencies, and changes or disruptions in the securities markets

generally. Any forward-looking statement speaks only as of the date

on which it is made and, except as may be required by applicable

securities laws, the Company disclaims any intent or obligation to

update any forward-looking statement, whether as a result of new

information, future events or results or otherwise. Forward-looking

statements are not guarantees of future performance and accordingly

undue reliance should not be put on such statements due to the

inherent uncertainty therein.

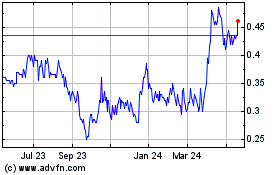

Nevgold (TSXV:NAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

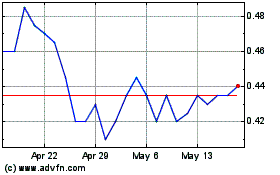

Nevgold (TSXV:NAU)

Historical Stock Chart

From Jan 2024 to Jan 2025