Dear Nova Leap Health Corp. (“Nova Leap” or the “Company”)

Shareholders:

All amounts are in United States dollars unless

otherwise specified.

Nova Leap is a story of entrepreneurship born

from the experience of one of my close family members with dementia

requiring home care. The positive impact my family saw from home

care led to the creation of the Company in 2016. At that time, I

believed that we could provide families impacted by dementia with a

level of service that would have a meaningful impact on their lives

and that the demand for our services would grow over time due to an

aging demographic. I am reminded every day of why this industry is

so important to families and the challenge in meeting the

generational demand that will exist for decades to come.

Today, Nova Leap is a very different company

than it was in 2016, when we started with a mere CAD$500,000, but

one very much with a continued focus on providing exceptional

in-home care to families. As we move through the early stages of

2024, I would like to recognize the significant contribution from

our team for the results achieved during 2023. Nova Leap is in

excellent financial condition and is actively seeking M&A

opportunities.

From my perspective, the highlights from 2023

are as follows:

- We established Nova Leap as a cash

flow positive company;

- We paid off all long-term bank debt

during the year, ahead of schedule, positioning the Company to

re-engage its acquisition program;

- We achieved record annual

consolidated Adjusted EBITDA of $1.477 million (CAD$2.0 million),

which was more than the three previous years combined and a 124%

increase over 2022 results;

- In my 2022 year end comments, I

specifically addressed the changes we had made in the U.S.

operating segment. We delivered on these changes with a 73% year

over year increase in U.S. segment Adjusted EBITDA;

- We ended the year with record

Adjusted EBITDA of $571K (CAD$778K) in Q4, the Company’s third

straight quarter of record Adjusted EBITDA;

- Nova Leap’s accounts receivable

collection rate of 99.7% remained exceptional and consistent with

the prior years range of 99.7% - 99.9% between 2020 and 2022;

and

- Insider ownership grew. During the

fourth quarter, insiders continued to acquire shares in the open

market bringing insider ownership to 40.61%. Insider ownership was

38.9% at the end of 2022 and 36.2% at the end of 2021.

In summary, 2023 was a year in which the

leadership team at Nova Leap demonstrated its ability to execute on

operations and to put the Company in excellent financial position

for the next phase of growth.

Allocation of capital plans for 2024:

Management has three primary objectives

pertaining to allocating capital for 2024 as follows:

- Investing in current home care

operations – Our objective is to increase revenues and hours of

service at existing home care locations by hiring experienced sales

personnel that can bring in new business to complement existing

operational teams. More on this below.

- Acquisitions – Nova Leap has

created borrowing capacity with the repayment of all long-term bank

debt. Management plans to leverage some of this capacity for

M&A opportunities in addition to cash generated from

operations, where appropriate.

- Promissory note repayment –

Management intends to repay the approximately $117,000 of

promissory notes remaining from previous acquisitions on

schedule.

Financial objectives:

For the past year, Management has been working

towards an internal objective of sustaining quarterly consolidated

Adjusted EBITDA for existing operations of $450,000. The average of

the past three quarters is just above that mark.

Management has a new objective of achieving

quarterly consolidated Adjusted EBITDA of $750,000 as a next level

which would represent annualized Adjusted EBITDA of $3 million

(CAD$4 million). We are working to achieve this through our

allocation of capital strategy of investing further in current

operations to build on the success of last year and by making

acquisitions. We don’t expect an immediate jump as it will take

some time for our capital allocation decisions to take shape but I

think it is important for shareholders to understand where our

focus lies and what Management is trying to achieve.

Where we have been challenged:

Simply put, our largest challenge in 2023 was

revenue growth. We saw significant achievements in major financial

categories such as gross margin percentage, Adjusted EBITDA, cash

flows, operating income and debt reduction but revenues fell below

expectations. It is a focus in 2024.

On an individual basis, our home care agencies

would all be considered small businesses. At the local level, hours

of service are driven by a recurring revenue model where caregivers

are generally scheduled to assist clients on the same schedule each

week for as long as they require care. These small businesses are

greatly impacted by either obtaining or losing clients requiring

high hours of service. As an example, if a business was doing $2

million in revenue in a year and lost a 24 hour client, revenue

would drop by approximately 15% (assuming remaining hours held

constant). We experienced that in 2023 along with other agencies

where revenue grew for the same reason, including one of our

agencies whose revenue grew by 54%.

A lot of new business is generated by local

reputation, word of mouth, families of past clients, and recurring

referral sources. As we examined our collection of agencies, we

found that the natural attrition of clients was being offset by

agencies that had successful sales personnel that were able to

market our services to a broader base of referral sources than

those agencies without a sales role. As a result, we have allocated

capital to the hiring of sales personnel in some of our larger

markets. We anticipate that these new hires will have a positive

impact on our results over time.

What we offer other home care business

owners:

Home care agency owners regularly engage with us

for two reasons:

- Succession planning/retirement;

and/or

- Seeking a strategic partner for

growth.

The acquisitions that we have made in the past

have been driven by owner succession, meaning that the founder of

the home care agency we acquired was seeking an exit for retirement

purposes and wanted a suitable home for their staff. I believe

owners have chosen Nova Leap so many times to purchase their

businesses because 1) we value people and want to welcome the team

at the acquired agency to their new home with Nova Leap 2) we

acquire these agencies with a view to holding them and supporting

them in perpetuity further respecting the exiting owner’s legacy

and 3) we have a fair and reasonable approach which allows us to

agree on deal terms and structures in an efficient manner.

We are also willing to partner with home care

agency owners that are not quite ready to exit the business

entirely but would rather have a strategic partner to assist with

growing the business for some period of time prior to a full exit.

These types of situations are always of interest to us because

partnering with great people usually leads to a lot of success.

Shareholders and Shareholder Communications:

I have generally sought out, and we have

attracted, shareholders that share my view that significant value

creation transpires over a long period of time. Our two largest

shareholders, of which I am one, own 30% of the stock. Another 10%

is collectively owned by members of the Board and our CFO.

Meaningful blocks are held by entrepreneurs who have built

companies from the ground up with sustained success, founders,

directors or past directors of publicly traded companies that are

or have been successful with value creating roll-up strategies,

similar to the strategy pursued by Nova Leap, senior capital

markets executives with practical counsel and a couple of micro-cap

funds with a long term horizon. I find these types of shareholders

valuable because they have experience they can share that is

directly applicable to our situation. All have been supportive. I

hope that we will attract more of these types of quality investors

over time.

Throughout our history, we have been intentional

in avoiding “hot money” and have done our best to recognize

contributions from existing shareholders by issuing equity at a

premium to market in certain cases, demonstrating our commitment

with insider led offerings, along with reducing the risk of warrant

stripping by mostly not issuing them since our early days.

We do not spend a lot of money on shareholder

communications. We do not provide earnings guidance or hold

quarterly conference calls. I do provide quarterly commentary with

the release of results, present at select capital market events and

hold CEO interviews with some third parties that are uploaded to

YouTube. We believe capital is best spent in growing the Company

and that we will continue to attract quality shareholders based on

Company performance.

We do not have any institutional ownership that

I am aware of and I don’t think we will for some time. I recall two

conversations that I had which may be instructive. The first was in

2019 before the pandemic when we were setting record results each

quarter. I met with an investment fund manager in New York, one

that generally takes concentrated positions over time. His view was

that, while we were making a lot of progress, we would be an

interesting opportunity at $5 million of EBITDA, particularly given

the potential for significant compounding at those levels.

The other meeting was in Toronto near the

beginning of 2023, post-pandemic. It was relayed to me that the

institutional investors that had been previously seeking alpha down

to the sub-CAD$100 million market cap companies had moved back up

to the CAD$250 million market cap area. The message being that it

would take longer to get institutional capital and lots of hard

work.

I think those are important views as it relates

to Nova Leap as I think about achieving future milestones in terms

of levels. We made meaningful progress in 2023 with record Adjusted

EBITDA of $1.477 million. Internally, we are now working towards $3

million of Adjusted EBITDA as our next objective (see Financial

Objectives section above). I see that as the next level that we

need to sustain and one that we can achieve through organic growth

and M&A. If we can achieve that, I believe we will continue to

attract investors with the profile similar to our existing

shareholder base. After $3 million, I view the next level or

milestone to achieve as $5 million of Adjusted EBITDA. Will the

profile of our investor base change at this level? Time will tell.

Regardless, we’re up to the challenge and the hard work it will

take to get there.

Nova Leap as a public company:

Although Nova Leap is a public company,

Management makes decisions considering the long-term implications

to the Company. In this regard, we make decisions more in line with

a private enterprise without regard to how the impact of those

decisions may impact financial results from one quarter to the

next. In other words, we’re willing to allocate capital that may

have a shorter term negative impact on Adjusted EBITDA with an

expectation that it will create Adjusted EBITDA in a sustained

manner longer-term.

At the time of this writing, Nova Leap is a

TSX-V listed company with a CAD$17.6 million market cap ($12.9

million on the OTCQX). Hopefully, the summary of our results will

encourage investors to consider Nova Leap for investment purposes

as part of their own capital allocation strategy.

Thank you for your ongoing support.

Yours truly,

Chris Dobbin, CPA, ICD.DPresident & CEO

FORWARD LOOKING

INFORMATION:

Certain information in this press release may

contain forward-looking statements, such as statements regarding

future expansions and cost savings, and plans regarding future

acquisitions and business growth, including anticipated annualized

revenue or annualized recurring revenue run rate growth and

anticipated consolidated Adjusted EBITDA margins. This information

is based on current expectations and assumptions, including

assumptions described elsewhere in this release and those

concerning general economic and market conditions, availability of

working capital necessary for conducting Nova Leap’s operations,

availability of desirable acquisition targets and financing to fund

such acquisitions, and Nova Leap’s ability to integrate its

acquired businesses and maintain previously achieved service hour

and revenue levels, that are subject to significant risks and

uncertainties that are difficult to predict. Actual results might

differ materially from results suggested in any forward-looking

statements. Risks that could cause results to differ from those

stated in the forward-looking statements in this release include

the impact of the COVID-19 pandemic or any recurrence, including

staff and supply shortages, regulatory changes affecting the home

care industry or government programs utilized by the Company (such

as ERC), other unexpected increases in operating costs and

competition from other service providers. All forward-looking

statements, including any financial outlook or future-oriented

financial information, contained in this press release are made as

of the date of this release and included for the purpose of

providing information about management's current expectations and

plans relating to the future, and these statements may not be

appropriate for other purposes. The Company assumes no obligation

to update the forward-looking statements, or to update the reasons

why actual results could differ from those reflected in the

forward-looking statements unless and until required by securities

laws applicable to the Company. Additional information identifying

risks and uncertainties is contained in the Company's filings with

the Canadian securities regulators, which filings are available at

www.sedar.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information:

Chris Dobbin, CPA, ICD.D

Director, President and CEO

T: 902-401-9480

E: cdobbin@novaleaphealth.com

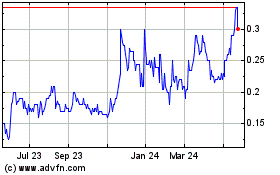

Nova Leap Health (TSXV:NLH)

Historical Stock Chart

From Nov 2024 to Dec 2024

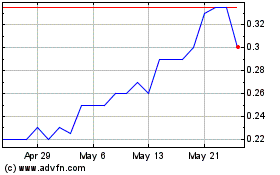

Nova Leap Health (TSXV:NLH)

Historical Stock Chart

From Dec 2023 to Dec 2024