Noble Provides Additional Details regarding Letter of Intent with Canna-Saver, LLC

10 June 2014 - 8:11AM

Access Wire

Toronto, Ontario / ACCESSWIRE / June 9, 2014 /

Noble Mineral Exploration Inc. (the

"Company", "Noble" or "NOB") (TSX-V:NOB,

FRANKFURT:NB7, OTC.PK:NLPXF) is pleased to provide terms of the

non-binding letter of intent (the "Letter of Intent") it signed with

Canna-Saver, LLC ("Canna-Saver"). The Letter of

Intent provides that Noble's wholly owned subsidiary

("Noble Subsidiary") would acquire a 50%

interest in Canna-Saver under terms that are summarized below, with

a right to acquire the remaining 50% interest upon completion of

certain conditions. The material terms of the transaction

contemplated in the letter of intent are as follows.

-As outlined in the Letter of

Intent, while there is no guarantee it is Noble's intention

that Noble Subsidiary would become a

separate public company with a listing on a

Canadian and a US stock exchange or

marketplace.

-Noble would distribute to its

existing shareholders a unit of Noble

Subsidiary that would be comprised of one share

and 1/4 of a warrant, with each full warrant being exercisable at

$0.20 into a share of Noble Subsidiary.

These units would be distributed pro rata to the shareholders of

Noble at a ratio that, based on Noble's current capitalization, is

expected to give rise to approximately 1 unit of Noble

Subsidiary distributed for every 6 shares of

Noble currently outstanding. The shares of Noble Subsidiary

distributed in the manner would represent approximately 36% of the

outstanding shares of Noble Subsidiary after the completion of the

financing described below and Noble's acquisition of 50% of

Canna-Saver.

-Noble Subsidiary will acquire

from the principals or members of Canna-Saver a 50% interest in

Canna-Saver by issuing a number of shares of Noble Subsidiary

corresponding to approximately 57% of the outstanding shares of

Noble Subsidiary after completion of the unit distribution to

Noble's shareholders described above and completion of the

financing described below.

-Subject to compliance with

TSX.Venture Exchange policies and any required approval of the TSX

Venture Exchange, Noble and/or its principals or other investors

would subscribe for at least $750,000 in Noble

Subsidiary through the purchase of at least 5,000,000 units at a

price of $0.15 per unit, with each unit comprised of 1 share of

Noble Subsidiary and 1/4 warrant of Noble Subsidiary and each full

warrant being exercisable at $0.20. This financing

would provide working capital to Noble Subsidiary for the

development and expansion of Canna-Saver's business. Assuming

5,000,000 shares of Noble Subsidiary were distributed in this

financing, these shares would represent approximately 7% o the

outstanding shares of Noble Subsidiary after the completion of the

unit distribution to Noble's shareholders and the acquisition of a

50% interest in Canna-Saver, both as described above.

-If all of the Noble

Subsidiary warrants issued as part of the units of Noble Subsidiary

issued and distributed to Noble's shareholders and in the minimum

$750,000 financing are exercised, Noble Subsidiary would then have

the right to acquire any portion or all of the 50% of Canna-Saver

not initially acquired. The Letter of Intent provides that the

remaining 50% of Canna-Saver can be acquired through the issuance

of additional shares of Noble Subsidiary. Assuming Noble Subsidiary

acquired all of the remaining 50% ownership of Canna-Saver that it

did not initially acquire, the members or principals of Canna-Saver

would receive a number of shares of Noble Subsidiary corresponding

to approximately 16.5% of the outstanding shares of Noble

Subsidiary at that time. As a result, upon all outstanding warrants

of Noble Subsidiary having been exercised and Noble's purchasing

the remaining 50% of Canna-Saver, the outstanding shares of

Noble Subsidiary would be held as follows:

approximately 27% by the shareholders of Noble, approximately 5% by

the investors in the $750,000 financing completed by Noble

Subsidiary and approximately 68% by the members or principals of

Canna-Saver.

Having now executed the Letter

of Intent with Canna-Saver, Noble will now work to complete its due

diligence of Canna-Saver, to negotiate and enter into definitive

agreements for the transactions outlined in the Letter of Intent,

to otherwise to embark upon the steps outlined in the Letter of

Intent and to obtain all required regulatory and stock exchange

approvals. For the time being, the Letter of Intent remains

non-binding and may or may not result in definitive agreements or

regulatory approval being reached.

Canna-Saver is a start-up,

with operations of its website, www.canna-saver.com, having

commenced in April 2013. To date, it has not earned substantial

revenues. Through its website and other means, Canna-Saver offers

coupons and deals catered to the marijuana demographic that has

emerged as a result of marijuana decriminalization and legalization

in certain parts of the US and elsewhere. Canna-Saver is based in

Denver, Colorado, and recently won a Cannabis Industry business

award for invention of the year. It has been hailed as the "Groupon

of Marijuana" on CNN's Outfront, highlighted on Fox News and in

High Times Magazine. Canna-Saver now intends to expand into the

California and Washington State markets and will be actively

seeking additional acquisitions in this space.

Canna-Saver also entered into

an agreement with Tommy Chong, a well known comedian, movie star,

and long time advocate for marijuana use. The agreement calls for

Tommy Chong to act as the key spokesperson for the Canna-Saver.com

web platform and to perform other duties to increase brand

awareness for Canna-Saver.

Regarding Noble's current

operations, Noble advises that it will continue to focus its

attention on the vast mineral potential of its Project 81 - Block A

land holdings in the Timmins-Cochrane district, and its Holdsworth

Gold Oxide Sand project in the Wawa district. Both projects are

located in Northern Ontario, and Noble will continue to work to

advance the exploration of this property though initiatives that

Noble hopes will include joint venture arrangements with senior

exploration and mining partners.

About Noble Mineral Exploration Inc.

Noble Mineral Exploration Inc.

is a Canadian based junior exploration company holding in excess of

72,000 hectares of mineral rights in the Timmins Cochrane areas of

Northern Ontario. The Company also holds a portfolio of diversified

exploration projects at various stages of exploration Gold in the

Wawa area of Northern Ontario, and Uranium in Northern

Saskatchewan.

More detailed information is

available on the website at www.noblemineralexploration.com

Cautionary

Statement

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

The

foregoing information may contain forward-looking statements

relating to the future performance of Noble Mineral Exploration

Inc. Forward-looking statements, specifically those concerning

future performance, are subject to certain risks and uncertainties,

and actual results may differ materially from the Company's plans

and expectations. These plans, expectations, risks and

uncertainties are detailed herein and from time to

time in the filings made by the Company with the TSX Venture

Exchange and securities regulators. Noble Mineral Exploration Inc.

does not assume any obligation to update or revise its

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts:

Noble Mineral

Exploration Inc.

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

eMail: info@noblemineralexploration.com

Investor Relations

Phone: 416-214-2250

eMail: ir@noblemineralexploration.com

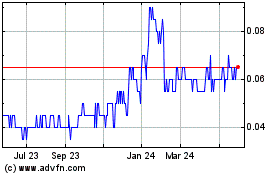

Noble Mineral Exploration (TSXV:NOB)

Historical Stock Chart

From Dec 2024 to Jan 2025

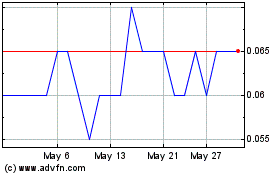

Noble Mineral Exploration (TSXV:NOB)

Historical Stock Chart

From Jan 2024 to Jan 2025