Prosper Gold Corp. Closes First Tranche of Private Placement

23 November 2023 - 8:15AM

Prosper Gold Corp. ("

Prosper Gold" or the

"

Company") (TSXV:PGX) announces that it has closed

the first tranche (the “

First Tranche”) of a

non-brokered private placement of (i) units (each, a

“

Unit”) and (ii) common shares of the Company that

qualify as “flow through shares” for purposes of the Income Tax Act

(Canada) (the “

Financing”).

The First Tranche consisted of (i) 2,520,000

Units at a price of $0.10 per Unit and (ii) 3,400,000 FT Shares at

a price of $0.15 per FT Share, for gross proceeds to the Company of

$762,000. Each Unit consists of one common share of the Company

(each, a “Common Share”) and one common share

purchase warrant (each, a “Warrant”). Each Warrant

entitles the holder to acquire one Common Share at an exercise

price of $0.20 (the “Warrant Exercise Price”) for

a period of 36 months following the closing date.

The Company paid an aggregate of $12,100 in cash

and issued an aggregate of 84,750 common share purchase warrants

(each, a "Broker Warrant") to

finders in connection with the closing of the First Tranche. Each

Broker Warrant is non-transferable and exercisable for one Common

Share for a period of 36 months following closing at the Exercise

Price.

The Company expects to close the second tranche

of the Financing during the week of November 27, 2023, for

aggregate gross proceeds under the Financing of up to

$1,000,000.

Prosper Gold expects to use the net proceeds

from the Financing to fund exploration activities at the Company’s

Golden Sidewalk Project and for working capital and general

corporate purposes.

The Financing involves related parties (as such

term is defined under Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI

61-101”)) and therefore constitutes a related party

transaction under MI 61-101. This transaction is exempt from the

formal valuation and minority shareholder approval requirements of

MI 61-101 pursuant to sections 5.5(a) and 5.7(a) of MI 61-101, as

the fair market value of the securities to be distributed and the

consideration to be received for the securities under the Financing

does not exceed 25% of the Company's market capitalization.

All securities issued pursuant to the Financing

will be subject to a four month and one day hold period in

accordance with applicable securities laws. The securities

described herein have not been, and will not be, registered under

the United States Securities Act of 1933, as amended, and were not

permitted to be offered or sold within the United States absent

registration or an applicable exemption from the registration

requirements of such Act.

For a detailed overview of Prosper Gold please

visit www.ProsperGoldCorp.com

ON BEHALF OF THE BOARD OF

DIRECTORS

Per: “Peter Bernier”Peter BernierPresident &

CEO

For further information, please contact:

Peter BernierPresident & CEOProsper Gold

Corp.Cell: (250) 316-6644Email: Pete@ProsperGoldCorp.com

Unless otherwise specified, all dollar amounts

used herein refer to the law currency of Canada.

Certain information in this news release

constitutes forward-looking statements under applicable securities

law. Any statements that are contained in this news release that

are not statements of historical fact may be deemed to be

forward-looking statements. Forward-looking statements are often

identified by terms such as “may”, “should”, “anticipate”,

“expect”, “intend” and similar expressions. Forward-looking

statements in this news release include, but are not limited to,

statements with respect to the use of proceeds from the Financing,

the timing of the close of the second tranche and the exercise of

the Warrants and Broker Warrants. Forward-looking statements

necessarily involve known and unknown risks, including, without

limitation, the Company’s ability to implement its business

strategies; risks associated with mineral exploration and

production; risks associated with general economic conditions;

adverse industry events; marketing and transportation costs; loss

of markets; volatility of commodity prices; inability to access

sufficient capital from internal and external sources, and/or

inability to access sufficient capital on favourable terms;

industry and government regulation; changes in legislation, income

tax and regulatory matters; competition; currency and interest rate

fluctuations; and other risks. Readers are cautioned that the

foregoing list is not exhaustive.

Readers are further cautioned not to place undue

reliance on forward-looking statements as there can be no assurance

that the plans, intentions or expectations upon which they are

placed will occur. Such information, although considered reasonable

by management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

The forward-looking statements contained in this

news release represent the expectations of the Company as of the

date of this news release, and, accordingly, are subject to change

after such date. The Company does not undertake any obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

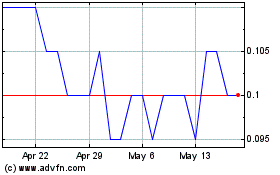

Prosper Gold (TSXV:PGX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Prosper Gold (TSXV:PGX)

Historical Stock Chart

From Dec 2023 to Dec 2024