Regulus Resources Inc. ("Regulus" or the

"Company", TSX-V: REG, OTCQX: RGLSF) is pleased to

announce a US$15,000,000 (approx. C$20,460,153*) non-brokered

private placement (the “Private Placement”), by Nuton, a Rio Tinto

Venture (“Nuton”).

Highlights

- Regulus is completing a Private

Placement of US$15,000,000 (approx. C$20,460,153*) at a

subscription price of C$1.02 per common share

- Nuton will subscribe for 20,058,974

common shares (the “Nuton Subscription”)

- Upon closing, Nuton will own an

approximate 16.5% interest in Regulus

- Regulus and Nuton will jointly

undertake copper sulphide leach testing utilizing Nuton’s copper

sulphide leach technologies with samples from AntaKori

- The Nuton™ technologies have

the potential to process arsenic-bearing copper sulphides with less

impact on the environment and water resources than traditional

concentrator processing

- The Private Placement will put

Regulus in a very strong cash position

- Adding Rio Tinto as a strategic

partner will enhance Regulus’ ability to optimize the value of the

existing resources at AntaKori and explore various options with the

neighbouring Tantahuatay mine to optimize the combined

Tantahuatay-AntaKori copper gold sulphide deposit (TantaKori).

John Black, Chief Executive Officer of

Regulus, commented as follows:

“We are delighted to welcome Rio Tinto as a

strategic investor in the Company. The investment by Rio Tinto, one

of the largest miners in the world, is another strong endorsement

for the AntaKori project. Through Nuton, Rio Tinto has developed

sulphide leach processing technologies that could allow for the

processing of high arsenic ores without the need for additional

on-site treatment or paying heavy penalties to a smelter. Utilizing

the Nuton sulphide leach technologies could truly be a game-changer

for the AntaKori deposit. The Private Placement will significantly

bolster our financial position and enhance our ability to optimize

the value of the existing resources in the project area.”

Rio Tinto’s Chief Executive, Copper,

Bold Baatar, commented as follows:

“This agreement will allow us to evaluate the

potential to commercially deploy Rio Tinto’s innovative Nuton

technologies for copper leaching at Regulus’ AntaKori project. Our

Nuton technologies have the capacity to increase copper production

for Rio Tinto and our partners, with a lower carbon footprint and

leading environmental performance. Unlocking value from

high-arsenic copper sulphides is a particularly exciting prospect

for Nuton.”

In connection with the Nuton Subscription,

Regulus and Nuton will enter into a collaboration agreement wherein

Nuton will be granted certain investor rights, including allowing

Nuton to maintain its equity interest in Regulus if it maintains

said interest above 10%. Additionally, Nuton shall be allowed to

nominate a director to the board of directors of the Company. The

Company and Nuton have agreed to form a joint advisory committee to

share expertise, exploration concepts and discuss development

opportunities at AntaKori. The Company has granted exclusivity to

Nuton in the area of novel, patented or trade secret leaching

technologies, for a period of one year after the delivery of

metallurgical samples from AntaKori to Nuton for testing. For a

one-year period, Nuton has agreed to not sell any share of Regulus,

acquire greater than a 19.9% interest in the Company and vote its

common shares in favour of each director nominated by the

Company.

Closing of the Private Placement is expected to

occur in January 2023 and is subject to various conditions,

including approval of the TSX Venture Exchange. No finder’s fee or

commissions are payable in connection with the Private

Placement.

The securities referred to in this news release

have not been, nor will they be, registered under the United States

Securities Act of 1933, as amended, and may not be offered or sold

within the United States or to, or for the account or benefit of,

U.S. persons absent U.S. registration or an applicable exemption

from the U.S. registration requirements. This release does not

constitute an offer for sale of, nor a solicitation for offers to

buy, any securities in the United States. Any public offering of

securities in the United States must be made by means of a

prospectus containing detailed information about the issuer and its

management, as well as financial statements.

Webinar

For more context, please join CEO John Black in

a live event on December 22nd at 3 pm EST / 12 noon PST. Q&A

will follow the presentation. Click here to register:

https://my.6ix.com/RJhqsqDD.

Notes* Based on CAD/USD

exchange rate on December 21, 2022

Qualified Person

The scientific and technical data contained in

this news release pertaining to the AntaKori project has been

reviewed and approved by Dr. Kevin B. Heather, Regulus' Chief

Geological Officer, FAusIMM, who serves as Regulus' qualified

person (QP) under the definition of National Instrument 43-101.

ON BEHALF OF THE REGULUS BOARD (signed) “John

Black” John BlackCEO and DirectorPhone: +1 (604) 685-6800Email:

info@regulusresources.com

For further information, please contact:

Regulus Resources Inc.Ben CherringtonPhone: +1

1 347 394 2728Email: ben.cherrington@regulusresources.com

About Regulus Resources Inc. and the

AntaKori Project

Regulus is an international mineral exploration

company run by an experienced technical and management team. The

principal project held by Regulus is the AntaKori

copper-gold-silver project in northern Peru. The AntaKori project

currently hosts a resource with indicated mineral resources of 250

million tonnes with a grade of 0.48 % Cu, 0.29 g/t Au and 7.5 g/t

Ag and inferred mineral resources of 267 million tonnes with a

grade of 0.41 % Cu, 0.26 g/t Au, and 7.8 g/t Ag (independent

technical report prepared by AMEC Foster Wheeler (Peru) S.A., a

Wood company, titled AntaKori Project, Cajamarca Province, Peru, NI

43-101 Technical Report, dated February 22, 2019 - see news release

dated March 1, 2019). Mineralization remains open in most

directions.

For further information on Regulus, please

consult our website at www.regulusresources.com.

About Nuton

Nuton is an innovative new venture that aims to

help grow Rio Tinto’s copper business. At the core of Nuton is a

portfolio of proprietary copper leach-related technologies and

capability – a product of almost 30 years of research and

development. Nuton technologies offer the potential to economically

unlock copper sulphide resources, copper bearing waste and

tailings, and achieve higher copper recoveries on oxide and

transitional material, allowing for a significantly increased

copper production. One of the key differentiators of Nuton is the

potential to deliver leading environmental performance, including

more efficient water usage, lower carbon emissions, and the ability

to reclaim mine sites by reprocessing mine waste.

Forward Looking Information

Certain statements regarding Regulus, including

management's assessment of future plans and operations, may

constitute forward-looking statements under applicable securities

laws and necessarily involve known and unknown risks and

uncertainties, most of which are beyond Regulus' control. Often,

but not always, forward-looking statements or information can be

identified by the use of words such as "plans", "expects" or "does

not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate" or

"believes" or variations of such words and phrases or statements

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved.

Specifically, and without limitation, all

statements included in this press release that address activities,

events or developments that Regulus expects or anticipates will or

may occur in the future, including the expected use of proceeds of

the Private Placement, receipt of exchange approvals, the proposed

exploration and development of the AntaKori project described

herein, and management's assessment of future plans and operations

and statements with respect to the completion of the anticipated

exploration and development programs, may constitute

forward-looking statements under applicable securities laws and

necessarily involve known and unknown risks and uncertainties, most

of which are beyond Regulus' control. These risks may cause actual

financial and operating results, performance, levels of activity

and achievements to differ materially from those expressed in, or

implied by, such forward-looking statements. Although Regulus

believes that the expectations represented in such forward-looking

statements are reasonable, there can be no assurance that such

expectations will prove to be correct. The forward-looking

statements contained in this press release are made as of the date

hereof and Aldebaran does not undertake any obligation to publicly

update or revise any forward-looking statements or information,

whether as a result of new information, future events or otherwise,

unless so required by applicable securities law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

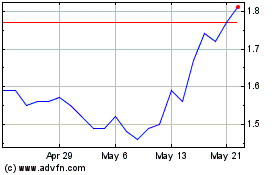

Regulus Resources (TSXV:REG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Regulus Resources (TSXV:REG)

Historical Stock Chart

From Dec 2023 to Dec 2024