Rio2 Limited (“

Rio2” or the “Company”) (TSXV: RIO;

OTCQX: RIOFF; BVL: RIO) today announces the Feasibility Study

(

“FS”) for its 100% owned Fenix Gold Project

(

“Fenix Gold” or the

“Project”)

located in the Maricunga Mineral Belt of the Atacama Region, Chile.

The FS, authored by international mining consultants Mining Plus,

includes updated Mineral Resource and Mineral Reserve estimates

(see Appendix), a run of mine heap leach (ROM) operational plan,

and updated capital and operating cost estimates.

The deposit is interpreted as an intrusion

related, low sulfidation, quartz-sulphide mineralization of deep

epithermal type, lately remobilized by supergene processes

facilitated by the permeable fine-grained matrix of the

phreatomagmatic breccias. Gold mineralization is hosted

mainly by the tuffs, breccias, and the dacitic subvolcanic

intrusions from the Phreatomagmatic Unit and, in less extent, by

andesites and dacitic domes of the same unit. The high-grade gold

is commonly associated with low-temperature black banded quartz

veins (BBV) which occur in sheeted veins, stockworks, in subangular

fragments in phreatomagmatic breccias, and in hydrothermal

injections of silica-magnetite. Extensive metallurgical test work

supported by geo-metallurgical studies have shown that the oxide

mineralization is amenable to cyanidation via ROM heap

leaching.

All amounts in this news release are in US

dollars unless otherwise indicated.

FS HIGHLIGHTS

- 1.77 million gold ounces (“oz”) of

Proven and probable Mineral Reserves grading 0.48 grams per tonne

(“g/t”) constrained within a $1,650/oz Au gold price pit

shell.

High-grade

to leach pad – 81.2 million tonnes grading 0.55 g/t

Au Low-grade

to stockpile – 33.5 million tonnes grading 0.31 g/t Au

- $353.2 million after-tax life of

mine (“LOM”) cumulative cash flow (unlevered)

- $1,237 / oz Au average LOM all-in

sustaining costs (“AISC”) – as defined by World Gold Council

guidelines

- Life of Mine (LOM) strip ratio –

0.85:1

- Average gold recovery from ROM heap

leaching – 75%

- 1.32 million oz Au LOM gold

production (17 years)

- 91,000 oz average annual gold

production during initial 12 years

- 54,000 oz average annual gold

production during final 5 years (4 years 2 months)

- $210.3 million after-tax net

present value discounted at 5% (“NPV5”)

- 28.5% after-tax internal rate of

return (“IRR”)

- After-tax payback after start of

production - 2.8 years.

- A previously announced gold stream

with Wheaton Precious Metals International Ltd. is included in the

FS financial estimation.

- Initial capital costs of $117

million with LOM sustaining capital costs of $88 million, which

includes adequate contingency at feasibility level.

- Construction timeline of

approximately 14 months from receipt of relevant permits and

contractor mobilization

Initial capex estimates exclude pre-construction

activities completed to date which include construction of a

565-person camp, water loading infrastructure in Copiapó, the

purchase of long-lead items such as electrical switchgear,

electrical transformers, pumps, prefabricated components of the

adsorption/desorption process plant, and preliminary earthworks.

This pre-construction capex totaled approximately $29 million.

Robust project economics have been confirmed

reflecting a low capital intensity, long life conventional open pit

mining and ROM heap leach operation, with moderate operating costs

and high rate of return as noted in the FS highlights.

Project after-tax net present value

(“NPV5”) (5% discount rate) is $210.3 million with

an after-tax internal rate of return (“IRR”) of

28.5% at a gold price of $1,750 per ounce, and $304.2 million and

37.2% at a gold price of $1,900 per ounce.

A strategic development plan has focused on the

shortest possible timeline to production along with an optimally

configured mine plan, yielding a lower initial capex and higher

grades being mined in the initial production years at a low

stripping ratio. Ore mining is scheduled at a rate of 20,000 tonnes

per day (“tpd”) with water for the Project being trucked from

Copiapó (158 km). To maximize cash-flow, high-grade ore will be

placed on the leach pad during the initial 12 years of production

and low-grade ore will be stockpiled for leaching in the subsequent

5 years of production giving a total mine life of 17 years. Average

annual gold production during the first 12 years is estimated to be

91,000 oz and 54,000 oz in years 13 – 17, the final years the

stockpiled ore is processed.

Estimated Mineral Resources for Fenix Gold

(including Mineral Reserves) which remain open at depth and along

strike, are 4.76 million oz of gold in the measured and indicated

category and 0.96 million oz of gold in the inferred category

constrained within a $1,800/oz gold price pit shell. This large,

mineralized resource coupled with the potential for Mineral

Resources growth through further drilling, provides an excellent

opportunity to increase annual production and extend the mine life

of the Fenix Gold Mine.

Rio2 is planning a two-stage development

strategy for the Fenix Gold Mine, with this FS representing the

first stage of production. Conceptually, the second stage will

incorporate the expansion of ore mining from 20,000 tonnes per day

to 80,000 – 100,000 tonnes per day with industrial water and/or

desalinated water being transported to the site via a pipeline and

project power being sourced from the nearby grid with estimated

annual gold production rising to more than 250,000 oz. A study into

the expansion of the mine will be launched during the construction

of the first stage described in the FS to determine the most

optimal water sourcing option, the related opex and capex, and the

timing of the proposed mine expansion.

EIA (ENVIRONMENTAL IMPACT ASSESSMENT) APPROVAL

PROCESS

On June 22, 2022, the Technical Committee, made

up of the SEA (Environmental Evaluation Service), two OAECAS (

State Administration Agencies with Environmental Competences),

CONADI and CONAF (The National Corporation for Indigenous

Development and National Forest Corporation, respectively), and the

SEREMI (Regional Representative of the relevant Ministry) of the

Environment, met and issued the Consolidated Evaluation Report

(ICE-Informe Consolidado de Evaluación) recommending a rejection of

the Project’s EIA. It should be noted that prior to the Technical

Committee decision, 16 OAECAS had declared in writing their

agreement with the contents of the Fenix Gold EIA.

On July 5, 2022, the Atacama Regional

Evaluation Commission voted not to approve the Environmental Impact

Assessment (“EIA”) of the Fenix Gold Project indicating that while

the Project complied with all the guides and environmental

regulations, there was insufficient information supplied to rule

out negative impacts to three species: Guanacos, Vicuñas, and

Chinchillas.

On August 31, 2022, Fenix Gold decided to

exercise its right to file an administrative appeal before the

Committee of Ministers, as the EIA study was completed in

accordance with the Chilean Environmental Assessment Service (SEA)

Guidelines. The Committee of Ministers is comprised of the

Ministers of Environment (Chairman), Health, Economy, Agriculture,

and Energy and Mining. The national director of the SEA is the

secretary of the Committee. The Committee of Ministers is currently

evaluating the Project with a decision expected in 2023. To

date, the company has not received confirmation from the Chilean

authorities as to when the appeal will be heard.

NEXT STEPS AND TIMELINES

The Company will be progressing the following

short-term activities in the lead-up to the commencement of

construction at the Fenix Gold Project which is targeted for late

2023 pending a positive outcome in the committee of ministers

expected in 2023:

- Conclusion of the financing package

for the construction of the Project;

- Mobilization of key contractors

like STRACON (civils and mining) & HLC (process plant);

- Conclusion of the regional

permitting required for construction; and

- Restart construction plan.

In respect to the proposed stage two expansion

of the mine, the company will:

- Continue to investigate the best

water and power options for the project and select the most optimal

solutions for the future of the Project; and

- Initiate a study for the Fenix Gold

stage two expansion based on the water solution identified.

Management’s principal focus will be achieving

the Project’s construction timeline and budget objectives to

produce doré as set out in the 14-month project execution plan

detailed in the FS.

Alex Black, Executive Chairman of Rio2, stated,

“As everyone can imagine, the past twelve months have been

particularly frustrating for the Company’s management team as it

has wound down pre-construction activities in Chile and directed

its efforts to deal with the administrative appeal to overturn the

Chilean authority’s disapproval of the Fenix Gold EIA. The team has

done a great job managing financial resources during this extremely

difficult time whilst conducting many productive meetings with

various ministries. We are hopeful that our collective efforts with

our advisors and legal counsel will result in a positive outcome at

the appeal hearing in the near term.”

Andrew Cox, President & CEO of Rio2 also

stated, “I am very proud of the way our management team has handled

the challenge of dealing with the administrative appeal over the

past twelve months and feel confident that the Company has covered

all bases with its advisors and legal counsel to achieve a positive

outcome. With the completion of the stage one feasibility study, we

are now ready to finalize the financing package to fund the capex

required and our technical team is ready to advance permitting and

construction of the mine subject to the receipt of approval of the

Fenix Gold EIA. Once the Fenix Gold Project achieves commercial

production it will be the only gold oxide heap leach gold mine in

operation in Chile and represents a significant investment in the

gold mining business in Chile by a junior mining company of

approximately $205 million of initial and sustaining capital and

will generate employment for at least 1,200 people during the

construction phase and 550 people during its initial 12 years of

operations.”

RIO2 2022 ESG REPORT

Rio2 also announces the publication of its 2022

ESG Report. This report represents a comprehensive review of the

Company’s Environmental, Social, and Governance factors related to

Rio2’s development activities at its Fenix Gold Project in Chile

for the year 2022.

Rio2 is committed to the principles of

responsible mining and best practices in corporate governance.

The complete report is available at:

https://onyen.com/published/RIO_2022_Annual_677.html

TECHNICAL INFORMATION

The scientific and technical content of this

news release has been reviewed, approved, and verified by Ian

Dreyer, B.App.Sc. MAIG, a consultant to Rio2 Limited, who is a QP

under NI 43-101.

The Feasibility Study (FS) Report has been

completed in accordance with NI 43-101, Canadian Institute of

Mining, Metallurgy and Petroleum (CIM) standards, and best

practices.

The qualified persons involved in the

preparation of the FS summarized in this press release, and the

related technical report, have followed industry accepted practices

for verifying that the data used in the study is suitable for the

purposes used. The independent Qualified Persons for the FS, Erick

Ponce (FAusIMM), Manager Open Pit South America of Mining Plus;

Andres Beluzan, Chartered Professional, Mining Engineering and a

registered member in good standing of the Chilean Mining

Commission, REG# 215; Denys Parra, (Member SME) of ANDDES; and

Anthony Maycock, (P.Eng.) of HLC, have prepared the scientific and

technical information on the FS and reviewed the information that

is summarized in this press release.

The NI 43-101 technical report, supporting the

results of the FS included in this release, is in the process of

being finalized and is expected to be filed under Rio2's profile on

SEDAR+ within 45 days. For readers to fully understand the

information in this news release they should read the FS technical

report in its entirety when it is available on SEDAR+, including

all qualifications, assumptions, exclusions, and risks that relate

to the study. The technical report is intended to be read as a

whole and sections should not be read or relied upon out of

context.

ABOUT RIO2 LIMITED

Rio2 is a mining company with a focus on

development and mining operations with a team that has proven

technical skills as well as successful capital markets track

record. Rio2 is focused on taking its Fenix Gold Project in Chile

to production in the shortest possible timeframe based on a staged

development strategy. Rio2 and its wholly owned subsidiary, Fenix

Gold Limitada, are companies with the highest environmental

standards and responsibility with the firm conviction that it is

possible to develop mining projects that respect the three axes

(Social, Environment, Economics) of sustainable development. As

related companies, we reaffirm our commitment to apply

environmental standards beyond those that are mandated by

regulators, seeking to protect and preserve the environment of the

territories that we operate in.

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively

“forward-looking information”) within the meaning of applicable

securities laws relating to the FS including Rio2’s plans,

strategy, objectives, and other aspects of Rio2’s anticipated

future operations and financial, development and operating plans

and results. In addition, without limited the generality of the

foregoing, this news release contains forward-looking information

pertaining to the following: the timing of the filing of the

technical report relating to the FS, the financial results of the

FS including the NPV and IRR, estimated mineral resources and

reserves; timing of the commencement of construction at the Fenix

Gold Project and associated construction timeline; estimated

capital and operating costs, metal prices, mining and processing

rates, metal production and resulting financial results for the

Fenix Gold Project; the timing for the development of and

production from the Fenix Gold Project; annual production and mine

life; timing of environmental approval and permitting process and

outcomes; ongoing engineering works and studies; the potential to

secure water rights near to the Fenix Gold Project and the benefits

of holding such rights; and other matters ancillary or incidental

to the foregoing.

All statements included herein, other than

statements of historical fact, may be forward-looking information

and such information involves various risks and uncertainties.

Forward-looking information is often, but not always, identified by

the use of words such as “seek”, “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “predict”,

“potential”, “targeting”, “intend”, “could”, “might”, “should”,

“believe” and similar expressions. The forward-looking information

is based on certain key expectations and assumptions made by Rio2’s

management, including but not limited to: expectations concerning

prevailing commodity prices, exchange rates, interest rates,

applicable royalty rates and tax laws; capital efficiencies;

legislative and regulatory environment of Chile; future production

rates and estimates of capital and operating costs; estimates of

reserves and resources; anticipated timing and results of capital

expenditures; the sufficiency of capital expenditures in carrying

out planned activities; results of operations; performance; the

availability and cost of financing, labor and services; and Rio2’s

ability to access capital on satisfactory terms.

Rio2 believes the expectations reflected in

these forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements in this news release should not be

unduly relied upon. Assumptions used by Rio2 to develop

forward-looking statements include the following assumptions, (i)

the Fenix Gold Project will ultimately obtain all required

environmental and other permits, (ii) Rio2’s estimates of mineral

resources and mineral reserves will not change, (iii) Rio2 will be

able to secure the financing required to develop the Fenix Project.

A description of other assumptions used to develop such

forward-looking information and a description of risk factors that

may cause actual results to differ materially from forward-looking

information can be found in Rio2's disclosure documents on the

SEDAR website at www.sedar.com. Forward-looking statements included

in this news release are made as of the date of this news release

and such information should not be relied upon as representing its

views as of any date subsequent to the date of this news release.

Rio2 has attempted to identify important factors that could cause

actual results, performance or achievements to vary from those

current expectations or estimates expressed or implied by the

forward-looking information. However, there may be other factors

that cause results, performance or achievements not to be as

expected or estimated and that could cause actual results,

performance or achievements to differ materially from current

expectations. Rio2 disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as expressly

required by applicable securities legislation.

To learn more about Rio2 Limited, please visit:

www.rio2.com or Rio2's SEDAR+ profile at www.sedarplus.com.

ON BEHALF OF THE BOARD OF RIO2

LIMITED

Alex BlackExecutive ChairmanEmail:

alex.black@rio2.com Tel: +51 99279 4655

Kathryn JohnsonExecutive Vice President, CFO

& Corporate SecretaryEmail: kathryn.johnson@rio2.com Tel: +1

604 762 4720

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts the responsibility for the adequacy

or accuracy of this release.

A document accompanying this announcement

is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/50925156-6b0d-41cb-965b-22ea0cc8d516.

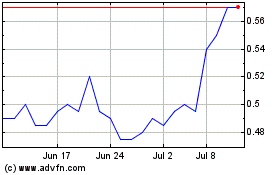

Rio2 (TSXV:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rio2 (TSXV:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024