Sonoro GOLD Announces $500,000 Private Placement

27 November 2024 - 12:00AM

Sonoro Gold Corp. (TSXV: SGO | OTCQB: SMOFF | FRA: 23SP)

(“Sonoro” or the “Company”) announces a non-brokered private

placement offering (the "Offering") consisting of 5,555,556 units

(the “Units”) at a price of CAD $0.09 per Unit, for gross proceeds

of CAD $500,000.

Each Unit will be composed of one Sonoro common

share and one common share purchase warrant. Each warrant will

entitle the holder thereof to purchase one additional Sonoro common

share for a period of two years from the closing of the private

placement at an exercise price of CAD $0.14 per share.

The Company intends to pay finder’s fees, as

permitted under the policies of the TSX Venture Exchange, in

respect of Units placed with the assistance of registered

securities dealers.

All securities issued and issuable in connection

with the Offering will be subject to a 4-month plus one-day hold

period in Canada from the closing date. The Offering is subject to

TSX Venture Exchange acceptance.

The net proceeds from the Offering will be used

to fund the ongoing development of the Company’s Cerro Caliche gold

project in Sonora, Mexico as well as working capital.

About Sonoro Gold Corp.

Sonoro Gold Corp. is a publicly listed

exploration and development Company holding the development-stage

Cerro Caliche project and the exploration-stage San Marcial project

in Sonora State, Mexico. The Company has highly experienced

operational and management teams with proven track records for the

discovery and development of natural resource deposits.

Keep up-to-date on Sonoro developments and join

our online communities on X, Facebook, LinkedIn, Instagram and

YouTube.

On behalf of the Board of SONORO GOLD CORP.

Per: “Kenneth MacLeod”

Kenneth MacLeod

President & CEO

For further information, please

contact: Sonoro Gold Corp. - Tel: (604) 632-1764 Email:

info@sonorogold.com

Forward-Looking Statement Cautions:

This press release may contain "forward-looking

information" as defined in applicable Canadian securities

legislation. All statements other than statements of historical

fact, included in this release, including, without limitation,

statements regarding the Cerro Caliche project, and future plans

and objectives of the Company, constitute forward looking

information that involve various risks and uncertainties, including

statements regarding the amount of financing proposed to be raised,

intended use of the financing proceeds, sufficiency of fund to

complete certain project development steps, and outlook for the

results of the contemplated drilling program. Although the Company

believes that such statements are reasonable based on current

circumstances, it can give no assurance that such expectations will

prove to be correct. Forward-looking statements are statements that

are not historical facts; they are generally, but not always,

identified by the words "expects", "plans", "anticipates",

"believes", "intends", "estimates", "projects", "aims",

"potential", "goal", "objective", "prospective" and similar

expressions, or that events or conditions "will", "would", "may",

"can”, "could" or "should" occur, or are those statements, which,

by their nature, refer to future events. The Company cautions that

forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are

made and they involve a number of risks and uncertainties,

including the possibility of unfavorable exploration and test

results, the lack of sufficient future financing to carry out

exploration and development plans and unanticipated changes in the

legal, regulatory and permitting requirements for the Company’s

exploration programs. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law or the policies of the TSX Venture

Exchange. Readers are encouraged to review the Company’s complete

public disclosure record on SEDAR at www.sedar.com.

This press release does not constitute or

form a part of any offer or solicitation to purchase or subscribe

for securities in the United States. The securities referred to

herein have not been and will not be registered under the

Securities Act of 1933, as amended (the “Securities Act”), or with

any securities regulatory authority of any state or other

jurisdiction in the United States, and may not be offered or sold,

directly or indirectly, within the United States or to, or for the

account or benefit of, U.S. persons, as such term is defined in

Regulation S under the Securities Act (“Regulation S”), except

pursuant to an exemption from or in a transaction not subject to

the registration requirements of the Securities Act”

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this release.

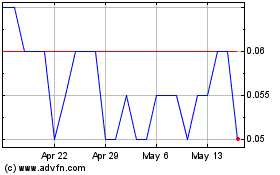

Sonoro Gold (TSXV:SGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sonoro Gold (TSXV:SGO)

Historical Stock Chart

From Feb 2024 to Feb 2025