Signature Resources Ltd. (TSXV: SGU, OTCQB: SGGTF, FSE 3S3)

("Signature" or the "Company") is pleased to announce, subject to

the approval of the TSX Venture Exchange, a non-brokered private

placement of flow-through units (the ”FT Units”) and

non-flow-through units (the “NFT Units”) for gross proceeds of up

to C$3,500,000 (the “Offering”).

Commodity Discovery Fund

(“CDF”) out of the Netherlands has agreed to lead participation in

the financing. This new interest from CDF was further bolstered by

additional support from existing shareholders including funds

Managed by Sprott Asset Management LP and Crescat Capital.

Each FT Unit is being offered at a price of

C$0.165 and will be comprised of one common share of the Company

and one-half non flow-through common share purchase warrant (a “FT

Warrant”) with an exercise price of C$0.25 per FT Warrant.

Concurrently, NFT Units will be offered at a price of $0.16 per NFT

Unit consisting of one common share and one-half common share

purchase warrant (a “NFT Warrant”) with an exercise price of C$0.22

per NFT Warrant. Both the FT Warrants and the NFT Warrants expire

two-years following the closing date of the Offering.

The net proceeds from the Offering will be used

for general corporate purposes but primarily used to expand

the current exploration efforts focused on the Lingman Lake Gold

Project (the “Project”). The Company now controls approximately 90%

of the Lingman Lake greenstone belt in Northwestern Ontario,

Canada.

|

“The Commodity Discovery Fund is a Dutch-based fund that seeks

investment opportunities in new discoveries with a tier 1

potential, where early positions in undervalued companies are taken

that are most likely to get taken over by producing companies

seeking to replenish their reserves. The Signature project provides

for precisely this outlook, in a known mining region hosting

deposits with an interesting geological signature and

mineralization. We feel the Signature Resources management team

will be able to draw on its vast experience in order to advance the

projects in order to create value for investors.” |

Commodity Discovery Fund CEO Willem Middelkoop

|

“We are incredibly pleased to welcome Commodity Discovery Fund as

our newest cornerstone investor. We aim to further bolster their

performance track record of generating significant returns through

an expanded drill campaign at the Lingman Lake Gold Project. Just

as important, we greatly appreciate the additional support from

existing shareholders. Long lead time items have been secured with

a focus on positioning, de-risking, and executing an expanded

exploration program to deliver value to shareholders.” |

Robert Vallis – President, CEO, and Director

Project UpdatesSignature is

pleased to announce that it has secured a second Signature-owned

diamond drill rig, continuing the expansion and de-risking of

drilling capabilities. Signature is securing an expanded drill crew

and has initiated securing the required camp optimizations to

enable an upscaled targeted 10,000 metre diamond drill program

commencing late August. Work has commenced on previously announced

geophysical programs to optimize local and regional targeting.

Normin Engineering continues to work on converting the existing

dataset at the Project in preparation for completing our maiden NI

43-101 compliant resource estimate in 2022.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall it constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale is unlawful.

These securities have not been, and will not be, registered under

the United States Securities Act of 1933, as amended, or any state

securities laws, and may not be offered or sold in the United

States or to U.S. persons unless registered or exempt

therefrom.

About Signature The Lingman

Lake gold property consists of 1,434 staked claims, four free hold

full patented claims and 14 mineral rights patented claims totaling

approximately 27,448 hectares. The property hosts an historical

estimate of 234,684 oz of gold* (1,063,904 tonnes grading 6.86 g/t

with 2.73 gpt cut-off) and includes what has historically been

referred to as the Lingman Lake Gold Mine, an underground

substructure consisting of a 126.5-meter shaft, and 3-levels at

46-meters, 84-meters and 122-meters depths.

*This historical resource estimate is based on

prior data and reports obtained and prepared by previous operators,

and information provided by governmental authorities. A Qualified

Person has not done sufficient work to verify the classification of

the mineral resource estimates in accordance with current CIM

categories. The Company is not treating the historical estimate as

a current NI 43-101 mineral resource estimate. Establishing a

current mineral resource estimate on the Lingman Lake deposit will

require further evaluation, which the Company and its consultants

intend to complete in due course. Additional information regarding

historical resource estimates is available in the technical report

entitled, "Technical Report on the Lingman Lake Gold Property"

dated January 31, 2020, prepared by John M. Siriunas, P.Eng. and

Walter Hanych, P.Geo., available on the Company's SEDAR profile at

www.sedar.com.To find out more about Signature Resources Limited,

visit our website at www.signatureresources.ca, or contact:

Jonathan HeldChief Financial Officer

416-270-9566

Cautionary Notes

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This news release contains forward-looking

statements which are not statements of historical fact.

Forward-looking statements include estimates and statements that

describe the Company’s future plans, objectives or goals, including

words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “believes”, “anticipates”, “expects”,

“estimates”, “may”, “could”, “would”, “will”, or “plan”. Since

forward-looking statements are based on assumptions and address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Although these statements are

based on information currently available to the Company, the

Company provides no assurance that actual results will meet

management’s expectations. Risks, uncertainties and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Forward looking information in this news release

includes, but is not limited to, the Company’s objectives, goals or

future plans, statements, exploration results, potential

mineralization, the estimation of mineral resources, exploration

and mine development plans, timing of the commencement of

operations and estimates of market conditions and risks associated

with infectious diseases, including COVID-19. Factors that could

cause actual results to differ materially from such forward-looking

information include, but are not limited to completion of the IP,

LIDAR and VLF surveys, changes in general economic and financial

market conditions, failure to identify mineral resources, failure

to convert estimated mineral resources to reserves, the inability

to complete a feasibility study which recommends a production

decision, the preliminary nature of metallurgical test results,

delays in obtaining or failures to obtain required governmental,

environmental or other project approvals, political risks,

inability to fulfill the duty to accommodate First Nations and

other indigenous peoples, uncertainties relating to the

availability and costs of financing needed in the future, changes

in equity markets, inflation, changes in exchange rates,

fluctuations in commodity prices, delays in the development of

projects, capital and operating costs varying significantly from

estimates and the other risks involved in the mineral exploration

and development industry, and those risks set out in the Company’s

public documents filed on SEDAR. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

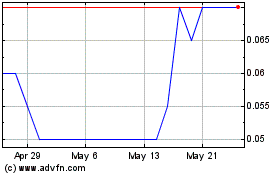

Signature Resources (TSXV:SGU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Signature Resources (TSXV:SGU)

Historical Stock Chart

From Dec 2023 to Dec 2024