SANTA BARBARA, CA, April 25, 2012 /CNW/ - Underground Energy

Corporation ("Underground", "UGE" or the "Company") today announced

its financial results for the year ended December 31, 2011.

All amounts are in US dollars unless otherwise noted and these

results have been prepared in accordance with International

Financial Reporting Standards ("IFRS"). Recent Highlights

Highlights for the quarter ended December 31, 2011 include: --

Closing of a transaction which significantly increased the

Company's California acreage to 38,005 net acres through the

acquisition of 30,152 net acres, including two producing oil wells

with total production of approximately 65 bopd, a producing gas

well, a number of drill ready locations and multiple exploitation

and exploration prospects in the Santa Maria and San Joaquin

Basins. Total consideration was US$5.5 million, comprising $4.6

million in cash and $0.9 million in assumed liabilities; --

Purchasing and reprocessing existing seismic data as well as

acquiring more than 30 miles of new 2D swath seismic data over the

recently acquired Zaca Field Extension area; and -- Acquiring and

processing 10 miles of new 2D swath seismic data over the Asphaltea

prospect. Highlights subsequent to year-end include: -- Renewing

permits for two drill pads and six well locations at the Zaca

Extension Project; -- Entry into an agreement with Key Energy

Services to secure a drilling rig for the initial portion of the

Company's 2012 drilling program comprising a minimum of five wells

with an option for an additional five wells; -- Spudding and

drilling the Chamberlin 4-2 well, the initial well drilled by the

Company at its recently acquired 6,200 net acre Chamberlin lease in

the Zaca Field Extension Project ("Zaca") in Santa Barbara County,

California, to a total depth of 6,679 feet; -- Encouraging initial

results from the Chamberlin 4-2 well which encountered oil shows in

a number of sections and, in particular, penetrated more than 900

feet of continuous, strong oil shows in a section of Monterey

consistent with the most productive sections at the existing Zaca

field and elsewhere in the Santa Maria Basin; and -- Receipt of the

year-end reserve evaluation conducted by GLJ Petroleum Consultants

Ltd. ("GLJ") of Calgary, the Company's independent reserve

engineers, dated April 12, 2012 and evaluating the Company's

proved, probable, and possible reserves as at December 31, 2011 in

accordance with the Canadian standards and requirements of National

Instrument 51-101 - Standards of Disclosure for Oil and Gas

Activities. "In the fourth quarter we successfully completed a

transaction that allowed us to substantially increase our land

position in California and provided us with a number of near-term

development and exploration opportunities," said Michael Kobler,

President and CEO of Underground. "Immediately following the

closing of the transaction, we moved rapidly to shoot new seismic

at Zaca and to complete preparations for our 2012 drilling program,

culminating in the spudding of our first well in February 2012. We

also secured an independent third party reserve report as at

December 31, 2011 which validates the purchase price of the

assets acquired and provides a solid base from which we will grow

as our drilling and seismic programs continue. Through the early

part of 2012 our entire team has worked to aggressively advance our

exploration program and we will continue to implement our initial

five well drilling program through the balance of 2012 and to build

upon the encouraging results from our initial well (Chamberlin

4-2). These activities highlight our strategy to de-risk the

company by diversifying the asset base, from primarily exploration

prospects to also include lower risk drilling of offset development

wells." Financial Review As at As at December 31, 2011 December 31,

2010 Cash and cash equivalents 14,646,951 427,730 Property, plant

and equipment 5,138,369 39,688 Exploration and evaluation 5,377,653

443,497 assets Total assets 27,519,369 1,103,985 Long term

liabilities 99,012 - 12 months ended 12 months ended December 31,

2011 December 31, 2010 Net loss 10,164,978 1,917,560 Net loss per

share - basic & (0.08) (0.04) diluted Cash and Cash Equivalents

As a development stage company, Underground constantly consumes

cash for its operating activities and for its investing

activities. During the first half of the year shareholders

provided financial support by purchasing common stock and warrants

amounting to $6,529,880, net of issuance costs. During the

third quarter the Company closed a $25,499,300 brokered private

placement transaction ($23,364,124 after issuance costs). Business

Combination Effective October 1, 2011, the Company acquired working

interests ranging from 70% to 80% in projects comprising 30,151 net

acres of oil and gas leases in California. With this

acquisition, the company acquired three producing wells and

multiple exploitation and exploration prospects in the San Joaquin

and Santa Maria basins in California. As at the date of this

announcement, two of the three wells acquired are out of service.

In the three months to December 31, 2011, the working interests

contributed revenue of $0.2 million and losses of $0.9 million. The

Company has moved to rationalize and improve the operations

acquired. Identifiable assets acquired and liabilities assumed:

Property, plant and equipment $ 3,482,661 Exploration and

Evaluation assets 1,952,656 Joint venturers' share of pipeline

liability 372,766 Pipeline liability assumed (1,263,185)

Decommissioning liability assumed (99,012) Other 178,198 Total cash

consideration $ 4,624,084 No goodwill was identified in this

transaction, as the cash amount paid is the same as the sum of the

identifiable assets and liabilities. Property Plant and Equipment

Property Plant and Equipment ("PP&E") assets increased by

approximately $5,099,000 during the year. The net increase in

PP&E assets was due primarily to acquisitions of oil leases

with production in the California Monterey shale of $3,483,000;

geological and geophysical work and lease acquisitions at the Zaca

Extension project of $1,258,000, annual lease payments and other

items that totaled $53,000 and corporate asset additions of

$422,000, offset by depletion and depreciation totaling $117,000.

Exploration and Evaluation Assets Exploration and Evaluation

("E&E") assets increased by approximately $4,934,000 during the

year. The net increase in E&E assets was due primarily to

oil and gas lease acquisitions in California of $1,953,000;

geological and geophysical work at various California projects of

$1,880,000, of which $1,540,000 was invested in Asphaltea seismic

acquisition and analysis; other oil and gas lease acquisitions and

expenditures totaling $1,244,000; and annual lease payments and

other items that totaled $355,000. This spending, totaling

$5,432,000, was offset by impairment provisions of $496,000 and a

disposition of $2,000 for a net increase of $4,934,000. Net Loss

TwelveMonths EndedDecember 31 2011 2010 Oil and natural gas revenue

197,738 - Other income 47,925 - 245,663 - Production and operating

expense 468,458 - Exploration and evaluation expense 1,562,019

1,006,233 Administrative expense 7,526,197 913,773 Other expense

738,334 - Operating loss 10,004,345 1,920,006 Net finance expense

(income) 991 (2,446) Loss before loss of equity accounted

10,050,336 1,917,560 investments Loss of equity accounted

investments 114,642 - Loss and comprehensive loss for the year

10,164,978 1,917,560 Net Loss increased by $8,247,400 compared to

last year due to the acquisition of a public listing on the TSXV

and due to the build-out of the Company as it developed its oil and

gas prospects and increased its land acquisition activities,

including: -- Oil and natural gas revenue and production and

operating expense increased by $197,738 and $468,458, respectively,

due to the acquisition of three producing wells that were included

in the oil and gas lease acquisition that closed during the fourth

quarter of 2011; -- Exploration and evaluation expense increased by

$556,000 compared to last year primarily due to $496,000 in

impairments of various properties: $204,000 relates to the costs

incurred on the Mustang Flats seismic option prospect in Nevada,

the rights to which the Company quit claimed early in 2012 after

completion of seismic evaluation, $2,000 relates to money expended

in 2011 on an unsuccessful attempt to recomplete a gas well

acquired with the large purchase of leases in the fourth quarter,

$250,000 relates to the Chu Chua mineral property acquired as part

of the merger during the third quarter, and $40,000 with respect to

the NW Casmalia property during the second quarter of 2011. Other

factors in the increase, totaling $60,000, are due to the increased

level of exploration and evaluation activities - being software and

general office expenses; -- Administrative expense increased by

$6,612,000 compared to last year primarily due to the $2,867,000

cost of acquiring a listing on TSXV; $440,000 increased

professional fees related to the merger with Shenul and becoming a

TSXV listed company; $1,700,000 increased personnel cost due to the

addition of a fulltime executive team and support staff; $379,000

increase in legal, audit and other professional fees apart from the

merger with Shenul; $328,000 increased directors' compensation; and

$405,000 increased office, insurance and miscellaneous expenses;

$324,000 increased travel and accommodation expenditures related to

exploring financing alternatives; $153,000 in investor relations

fees and related charges and an increase of $48,000 in depreciation

of corporate PP&E. Those increases were partially offset by a

$32,000 warrant liability mark-to-market adjustment; and -- Other

expense increased by $738,000 and represents the Company's

provision for all of the net billings to its joint interest

partners since the acquisition of leases early in the fourth

quarter ($428,000) and the joint interest partners' share of future

payments under a pipeline financing arrangement ($310,000). Outlook

The Company is focussed on the drilling program currently underway

at its Zaca Extension Project, where its initial well (Chamberlin

4-2) encountered 900 feet of continuous strong oil shows in a new

fault block (the "Chamberlin East Block"). The Company's

second well (Chamberlin 3-2) is directly targeting the newly

discovered Chamberlin East Block and the Company will look to

production test and then produce oil from this new block.

Thereafter, the Company will look to add further production at Zaca

as it continues to implement its 2012 drilling program. At the same

time, it will continue to process and acquire additional seismic at

Zaca and its other core assets. To view the Company's Year End 2011

Consolidated Financial Statements, related Notes to the

Consolidated Financial Statements, Management's Discussion and

Analysis and Annual Information Form, please see the Company's

annual filings which will be available on www.sedar.com. About

Underground Energy Corporation Underground Energy is focused on

identifying, acquiring rights to, exploring for, developing and

producing oil reserves from shale formations in North America using

the latest exploration and recovery techniques and

technologies. Underground focuses on identifying and

acquiring sizable land positions and prospects in historically

prolific but under-explored shale formations as well as in emerging

shale plays that, in both instances, hold large volumes of

prospective resources. Underground currently holds hydrocarbon

rights on approximately 69,291 net acres of highly prospective

lands in California and Nevada with an initial focus on the

Monterey shale in California. Underground is listed on the TSX

Venture Exchange under the ticker symbol "UGE". For more

information on Underground, including a copy of the Company's

latest corporate presentation, please visit www.ugenergy.com.

Underground's regulatory filings are available under the Company's

profile at www.sedar.com. Cautionary Statements Statements in this

press release contain forward-looking statements and

forward-looking information within the meaning of applicable

securities law (collectively, "forward-looking information").

Forward-looking information is frequently characterized by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate" and other similar words, or statements

that certain events or conditions "may" or "will" occur. In

particular, forward-looking information in this press release

includes, without limitation, statements with respect to the

Company's continuation of its 5 well drilling program and the

Company's growth strategy and anticipated activities under the

heading "Outlook" above. Although the Company believes that the

expectations and assumptions reflected in the forward-looking

information are reasonable, there can be no assurance that such

expectations or assumptions will prove to be correct. In

particular, assumptions have been made that: (i) Underground will

be able to obtain equipment, qualified staff and regulatory

approvals in a timely manner to carry out its planned exploration

and development activities; (ii) Underground will have sufficient

financial resources with which to conduct its planned capital

expenditures; and (iii) the current regulatory and tax regime will

remain substantially unchanged. Readers are cautioned that

assumptions used in the preparation of forward-looking information

may prove to be incorrect. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors (many of which are beyond the control of Underground) that

could cause actual events or results to differ materially from

those anticipated in the forward-looking information. Some of

the risks and other factors could cause results to differ

materially from those expressed in the forward-looking information

include, but are not limited to: general economic conditions in

Canada, the United States and globally, the risks associated with

the oil and gas industry, commodity prices and exchange rate

changes. Industry related risks could include, but are not

limited to: operational risks in exploration, development and

production; delays or changes in plans; competition for and/or

inability to retain drilling rigs and other services; competition

for, among other things, capital, acquisitions of reserves,

undeveloped lands, skilled personnel and supplies; risks associated

to the uncertainty of reserve estimates; governmental regulation of

the oil and gas industry, including environmental regulation;

geological, technical, drilling and processing problems and

other difficulties in producing reserves; the uncertainty of

estimates and projections of production, costs and expenses;

unanticipated operating events or performance which can reduce

production or cause production to be shut in or delayed; incorrect

assessments of the value of acquisitions; the need to obtain

required approvals from regulatory authorities; stock market

volatility; volatility in market prices for oil and natural

gas; liabilities inherent in oil and natural gas operations; access

to capital; and other factors. Readers are cautioned that

this list of risk factors should not be construed as

exhaustive. The forward-looking information contained in this

news release is expressly qualified by this cautionary

statement. Underground does not undertake any obligation to

update or revise any forward-looking statements to conform such

information to actual results or to changes in our expectations

except as otherwise required by applicable securities

legislation. Readers are cautioned not to place undue

reliance on forward-looking information. Neither the TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

UNDERGROUND ENERGYCORPORATION Consolidated Balance Sheets (in US

dollars) December 31, December 31, January 1, 2011 2010 2010 Assets

Cash and cash $ 14,646,951 $ 427,730 $ 309,267 equivalents

Restricted cash 1,077,260 - - Accounts receivable 302,422 4,818 -

Prepaid expenses and 653,370 19,243 9,016 deposits Loans receivable

167,970 - - Total current 16,847,973 451,791 318,283 assets

Investments 155,374 169,009 135,000 Property, plant and 5,138,369

39,688 50,763 equipment Exploration and 5,377,653 443,497 224,100

evaluation assets Total non-current 10,671,396 652,194 409,863

assets Total assets $ 27,519,369 $ 1,103,985 $ 728,146 Liabilities

Accounts payable and accrued $ 3,144,624 $ 561,214 $ 85,118

liabilities Warrant liability 448,000 - - Total current 3,592,624

561,214 85,118 liabilities Decommissioning obligations 99,012 - -

provision Total liabilities 3,691,636 561,214 85,118 Equity Share

capital 37,590,330 5,028,198 3,403,315 Share-based payment

1,324,286 433,625 241,205 reserve Deficit (15,086,883) (4,919,052)

(3,001,492) Total equity 23,827,733 542,771 643,028 Commitments and

contingencies Subsequent events Total equity and $ 27,519,369 $

1,103,985 $ 728,146 liabilities UNDERGROUND ENERGY CORPORATION

Consolidated Statements of Comprehensive Loss (in US dollars) Year

Ended December 31 2011 2010 Revenues Oil and natural gas revenue $

197,738 $ - Other income 47,925 - 245,663 - Expenses Production and

operating 468,458 - Exploration and evaluation 1,562,019 1,006,233

Administrative 7,526,197 913,773 Other expenses 738,334 -

10,295,008 1,920,006 Operating Loss 10,049,345 1,920,006 Finance

income 26,408 2,446 Finance expense 27,399 - Net finance expense

(income) 991 (2,446) Loss Before Loss of Equity Accounted

10,050,336 1,917,560 Investments Share of loss of equity accounted

114,642 - investments Loss and comprehensive loss for the year $

10,164,978 $ 1,917,560 Loss per share: Basic and diluted $ (0.08) $

(0.04) . UNDERGROUND ENERGY CORPORATION Consolidated Statements of

Changes in Equity (in US dollars) Number Share- of based ordinary

Share payment Total shares capital reserve Deficit equity Balance

at January 1, 45,075,496 $ 3,403,315 $ 241,205 $ (3,001,492) $

643,028 2010 Issue of ordinary 11,258,840 1,624,883 - - 1,624,883

shares Share-based - - 192,420 - 192,420 payments Loss for - - -

(1,917,560 (1,917,560) the year Balance at December 56,334,336 $

5,028,198 $ 433,625 $ (4,919,052) $ 542,771 31, 2010 Number of

shares has been adjusted to reflect the reverse takeover Number

Share- of based ordinary Share payment Total shares capital reserve

Deficit equity Balance at December $ $ $ $ 31, 2010 56,334,336

5,028,198 433,625 (4,919,052) 542,771 Issue of ordinary shares

134,440,376 32,177,450 - - 32,177,450 Share issuance costs, net of

tax of $nil - (2,283,446) - - (2,283,446) Options exercised

1,477,667 54,528 (10,500) - 44,028 Shenul Capital Inc. shares

outstanding brought forward upon merger 9,900,000 - - - - Net

assets of Shenul Capital Inc. acquired upon merger - 2,613,600

42,667 - 2,656,267 Share-based payments - - 858,494 - 858,494

Non-cash dividends paid - - - (2,853) (2,853) Loss for the year - -

- (10,164,978) (10,164,978) Balance at December $ $ $ $ 31, 2011

202,152,379 37,590,330 1,324,286 (15,086,883) 23,827,733 Number of

shares has been adjusted to reflect the reverse takeover

UNDERGROUND ENERGY CORPORATION Consolidated Statements of Cash

Flows (in US dollars) Year Ended December 31 2011 2010 Cash

flowsfrom operating activities: Loss for the year $ (10,164,978) $

(1,917,560) Adjustments for: Share of loss of equity accounted

114,642 - investments Depletion, depreciation and 116,735 21,881

amortization Impairment losses on exploration and 496,082 -

evaluation assets Joint venturers' share of pipeline 372,766 -

obligation Gain on sale of exploration and (47,925) - evaluation

assets Non-cash TSX-V listing expense 2,867,096 - Share-based

compensation 773,619 192,420 Warrant liability, mark-to-market

(32,000) - adjustment Net finance expenses (income) 991 (2,446)

Foreign exchange (8,730) 1,064 Interest paid (18,668) - Change in

non-cash working capital, 414,829 461,051 operating activities Net

cash used in operatingactivities (5,115,541) (1,243,590) Cash

flowsfrom investing activities: Additions to property, plant and

(1,732,755) (10,806) equipment Additions to exploration and

(3,101,868) (219,397) evaluation assets Acquisition of oil and gas

leases (4,624,084) - Proceeds from sale of exploration and 50,000 -

evaluation assets Investment in Careaga Sand and (2,853) - Asphalt

Company Investment in restricted cash (1,077,260) - Interest income

received 26,407 1,382 Increase in investments (101,007) (34,009)

Cash acquired from Shenul 2,817 - Net cash used in

investingactivities (10,560,603) (262,830) Cash flows from

financing activities: Proceeds from issue of share capital

32,134,783 1,627,000 Share issuance costs (2,283,446) (2,117)

Proceeds upon exercise of options 44,028 - Net cash from financing

activities 29,895,365 1,624,883 Change in cash and cash equivalents

14,219,221 118,463 Cash and cash equivalents beginning of 427,730

309,267 year Cash and cash equivalents end of year $ 14,646,951 $

427,730 Underground Energy Corporation CONTACT: Peter

BallacheyChief Financial OfficerUnderground Energy CorporationTel:

805-845-4700 x 17Simon ClarkeVice President, Corporate

DevelopmentUnderground Energy CorporationTel: 604-551-9665

Copyright

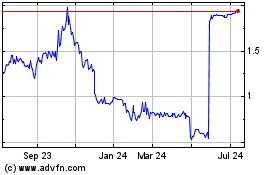

UGE (TSXV:UGE)

Historical Stock Chart

From Dec 2024 to Jan 2025

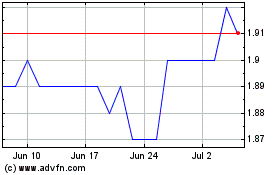

UGE (TSXV:UGE)

Historical Stock Chart

From Jan 2024 to Jan 2025