China Works to Look Open to Foreign Business as G-20 Summit Nears

26 November 2018 - 11:44PM

Dow Jones News

By Chao Deng

BEIJING--In its latest move to show it's open for foreign

businesses ahead of a summit with President Trump and other Western

leaders, China paved a way for German insurer Allianz SE.

With a meeting of the Group of 20 major economies opening

Friday, the monthslong trade battle with the U.S. and rising

criticism of China's trade practices from Europe are putting

pressure on Chinese President Xi Jinping.

In recent weeks, Chinese regulators permitted American Express

Co. to set up card-clearing services and blessed United

Technologies Corp.'s $23 billion takeover of airplane-parts maker

Rockwell Collins Inc. The insurance and banking regulator said

Sunday that it received Allianz's request to establish what the

regulator said would be the country's first wholly foreign-owned

insurance holding company. Allianz said the approval will allow it

to expand investment in China.

An insurance holding company signals broad access to China's

insurance market, compared with a wholly owned entity in either

life insurance or property and casualty insurance. Hong Kong-based

AIA Group, which spun out of AIG, is the only foreign company

operating without a local partner in China's life-insurance market,

and is limited to operating in only some cities.

Wider access has been long promised by China and long sought by

foreigners--often over decades of negotiation--but Beijing's

announcements over the past year of further openings in financial

services and autos have been shrugged off by the U.S.

"China is trying to show the world it is opening up, but whether

the world will believe that with this move is another question,"

said Jonas Short, head of the Beijing office at securities firm

Everbright Sun Hung Kai Co.

Much of the attention at the G-20 summit in Buenos Aires will be

on President Xi's meeting with President Trump, expected to cover

ways to ease trade tensions that have battered world markets and

threaten the global economy.

Responding to President Trump's criticisms of China's trade

surplus and policies--notable on technology transfers--Mr. Xi has

presented China as an upholder of the global trading order and

emphasized a commitment to liberalize the Chinese markets.

In allowing a German entrant to be the first to move toward a

wholly foreign-owned insurance holding company, Beijing may be

trying to improve its credibility in Europe as a counterweight to

the U.S., say some China watchers. President Xi's economic point

man, Vice Premier Liu He, is in Germany for a China-Europe forum

before traveling to the G-20.

MetLife Inc. and Chubb Ltd., global companies with U.S. roots,

have shown interest in expanding their China businesses. Each has a

joint venture there, MetLife with state-owned Shanghai Alliance

Investment Ltd. and Chubb with Huatai Insurance Group.

A MetLife spokeswoman said the company wants to sell more

insurance products in China, but declined to say whether it would

like to increase its stake in its life-insurance business, or set

up a wholly owned holding company. Chubb didn't respond to request

for comment.

For foreign insurers, a wholly owned holding company is a step

toward consolidating units offering various types of

insurance--potentially including wholly owned life insurance units.

AIA Group's wholly owned life insurer is an early 1990s legacy of

Hank Greenberg, then chief of AIG, who used his close ties to

Premier Zhu Rongji and other senior Chinese leaders to secure

special treatment.

Insurers with foreign ownership accounted for less than 6% of

China's $527 billion in premium income in 2017, according to

official data.

While foreigners may wholly own an entity in China's property

and casualty insurance sector, the cap is 50% in life insurance.

Last November, Beijing pledged to raise the cap to 51% in three

years and eliminate it entirely in five years.

The Allianz opening, while a step forward, falls short of the

full access to offer life insurance that foreign companies want,

some analysts and executives said. Separate approval will be needed

to increase its stake in its life-insurance unit, they noted.

Allianz owns 51% of a life-insurance joint venture with Citic

Trust--an exception to the 50% cap--and a 50% stake in a property

and casualty insurance venture with JD.com.

The latest measure merely signals Beijing's intent to allow a

foreign company to consolidate its China businesses, said Jacob

Parker, vice president of the U.S.-China Business Council, a

business association.

"The Chinese government wants to point to measurable progress in

market openings, but that argument would be much more persuasive if

it would have granted a majority stake to a foreign company in the

life-insurance sector," he said.

Allianz said it expects to establish the holding company in

Shanghai next year. An Allianz spokeswoman declined to comment on

whether Chinese authorities would allow it greater life-insurance

access.

Write to Chao Deng at Chao.Deng@wsj.com

(END) Dow Jones Newswires

November 26, 2018 07:29 ET (12:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

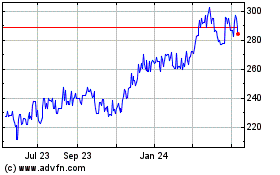

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

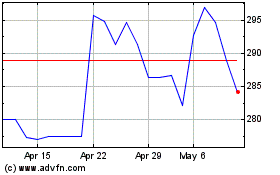

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024