Avidbank Holdings, Inc. (“the Company”) (OTCBB: AVBH), sole

owner of Avidbank (“the Bank”), an independent full-service

commercial bank serving businesses and consumers in Northern

California, announced net income of $923,000 for the second quarter

of 2013 compared to $653,000 during the same period in 2012.

2nd Quarter 2013 Financial Highlights

- Net income was $1,437,000 for the first

six months of 2013, compared to $1,424,000 for the first six months

of 2012

- Diluted earnings per common share were

$0.47 for the first six months of 2013, compared to $0.48 for the

first six months of 2012

- Net income was $923,000 for the second

quarter of 2013. Excluding gains from the sale of investment

securities net income from core operations was $528,000 for the

quarter.

- Diluted earnings per common share were

$0.30 for the quarter, compared to $0.22 for the second quarter of

2012

- Total assets grew annually by 11% to

$433 million

- Total loans outstanding grew by 4% to

$248 million

- Total deposits grew by 8% to $377

million

- The Company continues to be well

capitalized with a Tier 1 Leverage Ratio of 12.7% and a Total Risk

Based Capital Ratio of 17.2%

Mark D. Mordell, Chairman and Chief Executive Officer, stated,

“We are pleased that net income for the second quarter of 2013

increased by 41% compared to the second quarter of 2012 as gains

from investment security sales more than offset an increase in

expenses from expanding our business development and loan

generation capacity. The Bank’s loans, deposits and total assets

all showed growth over the second quarter of the previous year.

Loan growth was 4% in spite of some large construction loan

payoffs. Our loan production offices in San Jose and Redwood City

are starting to gain traction in the marketplace and our capacity

for generating earning assets is continually improving. All of our

capital ratios have dramatically improved with the $16 million

capital raise we recently completed and announced in June.”

For the three months ended June 30, 2013, net interest income

before provision for loan losses was $3.8 million, an increase of

more than $91,000 or 2% compared to the second quarter of 2012. The

growth in net interest income was the result of growth in loans

outstanding. Average earning assets were $402 million in the second

quarter of 2013, a 14% increase over the second quarter of the

prior year. Net interest margin was 3.82% for the second quarter,

compared to 4.34% for the second quarter of 2012. No loan loss

provision was made in the second quarter of 2013 while a $100,000

loan loss provision was made in the second quarter of 2012.

For the first six months of 2013 net interest income before

provision was $7.7 million, a $0.3 million increase over the prior

year. The growth in net interest income was the result of growth in

earning assets partially offset by a decrease in net interest

margin. Average earning assets grew by $59 million or 17% over

2012. Net interest margin decreased from 4.41% in 2012 to 3.88% in

2013, primarily as a result of a drop in loan yields partially

offset by a decrease in the Bank’s cost of funds. No provision for

loan losses has been recorded to date in 2013, while a $100,000

loan loss provision was recognized in the first half of 2012. We

have experienced net recoveries of $285,000 for the first half of

2013 compared to net charge-offs of $14,000 for the first six

months of 2012. Non-accrual loans totaled $699,000 on June 30, 2013

compared to $975,000 for the end of the previous year. “Our high

underwriting standards continue to serve us well as we prepare for

growth in the second half of the year,” stated Mr. Mordell.

Non-interest expense grew by $433,000 in the second quarter of

2013 to $3.1 million compared to $2.6 million for the second

quarter of 2012. This growth is due to investments in loan

production personnel and facilities as we continue to expand our

footprint and grow our loan portfolio.

Non-interest expense grew by $990,000 for the first six months

of 2013 to $6.2 million compared to $5.2 million for the first six

months of 2012. This growth is due to the previously mentioned

investments in loan production personnel and facilities.

Non-interest income was $840,000 in the second quarter of 2013,

an increase of $727,000 or 644% over the second quarter of 2012.

Non-interest income in the second quarter of 2013 reflected

$681,000 of gains from investment securities sales.

For the first six months of 2013, non-interest income, excluding

gains on sales of securities was $284,000, an increase of more than

$64,000 or 29% over the comparable period in 2012.

About Avidbank

Avidbank Holdings, Inc., headquartered in Palo Alto, California

offers innovative financial solutions and services. We specialize

in the following markets: commercial & industrial, corporate

finance, asset-based lending, real estate construction and

commercial real estate lending, and real estate bridge financing.

Avidbank advances the success of our clients by providing them with

financial opportunities and serving them as we wish to be served –

with mutual effort, ingenuity and trust – creating long-term

banking relationships.

Forward-Looking Statement:

This news release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on current

expectations, estimates and projections about Avidbank’s business

based, in part, on assumptions made by management. These statements

are not guarantees of future performance and involve risks,

uncertainties and assumptions that are difficult to predict.

Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in such forward-looking statements

due to numerous factors, including those described above and the

following: Avidbank’s timely implementation of new products and

services, technological changes, changes in consumer spending and

savings habits and other risks discussed from time to time in

Avidbank’s reports and filings with banking regulatory agencies. In

addition, such statements could be affected by general industry and

market conditions and growth rates, and general domestic and

international economic conditions. Such forward-looking statements

speak only as of the date on which they are made, and Avidbank does

not undertake any obligation to update any forward-looking

statement to reflect events or circumstances after the date of this

release.

Avidbank Holdings, Inc. Balance Sheet ($000, except

per share amounts) Unaudited Audited Unaudited

Assets

6/30/13

12/31/12

6/30/12

Cash and due from banks $ 13,718 $ 21,493 $ 11,870 Fed funds sold

115,575 85,510 57,171

Total cash and cash equivalents 129,293 107,003 69,041

Investment securities - available for sale 50,541 55,343 74,114

Loans, net of deferred loan fees 247,964 247,269 237,341

Allowance for loan losses (4,764 ) (4,480 )

(4,462 ) Loans, net of allowance for loan losses 243,200 242,789

232,879 Premises and equipment, net 1,269 1,291 708 Accrued

interest receivable & other assets 8,212

9,296 11,222 Total assets $ 432,515 $

415,721 $ 387,965

Liabilities

Non-interest-bearing demand deposits $ 115,115 $ 105,518 $ 109,522

Interest bearing transaction accounts 16,177 17,293 14,549 Money

market and savings accounts 186,885 185,664 158,042 Time deposits

58,901 66,520 67,083

Total deposits 377,078 374,994 349,195 Other liabilities

2,332 2,864 3,019 Total

liabilities 379,410 377,858 352,215

Shareholders'

equity

Preferred stock 5,974 5,952 5,929 Common stock 44,579 29,556 29,448

Retained earnings 2,436 1,171 23 Accumulated other comprehensive

income 116 1,184 350

Total shareholders' equity 53,105 37,863 35,750 Total

liabilities and shareholders' equity $ 432,515 $ 415,721

$ 387,965 Tier 1 leverage ratio 12.66 %

8.88 % 9.72 % Tier 1 risk-based capital ratio 15.92 % 10.78 % 10.84

% Total risk-based capital ratio 17.17 % 12.03 % 12.09 % Book value

per common share $ 11.03 $ 12.20 $ 11.41 Total shares outstanding

4,274,014 2,614,655 2,613,655

Avidbank Holdings,

Inc. Condensed Statements of Operations

(Unaudited) ($000, except per share

amounts)

Quarter Ended Year to Date

6/30/13

6/30/12

6/30/13

6/30/12

Interest and fees on loans $ 3,661 $ 3,692

$

7,383

$ 7,347 Interest on investment securities 399 528 803 1,056 Other

interest income 57 17 111

37 Total interest income 4,117 4,237 8,297 8,440

Interest expense 289 500 607

1,002 Net interest income 3,828 3,736 7,690

7,438 Provision for loan losses - 100

- 100

Net interest income after provision for

loan losses

3,828 3,636 7,690 7,338 Service charges, fees and other

income 159 113 284 220 Gain on sale of investment securities

681 - 681 - Total

non-interest income 840 113 965 220 Compensation and benefit

expenses 1,802 1,559 3,640 3,052 Occupancy and equipment expenses

441 296 1,413 1,088 Other operating expenses 829

785 1,116 1,038 Total

non-interest expense 3,072 2,639 6,168 5,178 Income before

income taxes 1,596 1,110 2,487 2,380 Provision for income taxes

673 457 1,050 956

Net income $ 923 $ 653

$

1,437

$ 1,424 Preferred dividends & warrant

amortization 84 84 168

168

Net income applicable to common

shareholders

$ 839 $ 569

$

1,269

$ 1,256 Basic earnings per share $ 0.31

$ 0.22

$

0.47

$ 0.48 Diluted earnings per share $ 0.30 $ 0.22

$

0.47

$ 0.48 Average shares outstanding 2,733,948 2,612,127

2,675,349 2,607,977 Average fully diluted shares 2,773,900

2,623,127 2,715,301 2,618,977 Annualized returns: Return on

average assets 0.88 % 0.70 % 0.69 % 0.79 % Return on average common

equity 9.87 % 8.81 % 8.25 % 9.73 % Net interest margin 3.82

% 4.34 % 3.88 % 4.41 % Cost of funds 0.31 % 0.62 % 0.33 % 0.63 %

Efficiency ratio 66 % 69 % 71 % 68 %

Avidbank Holdings, Inc.Steve Leen, 650-843-2204Executive Vice

President and Chief Financial

Officersleen@avidbank.comavidbank.com

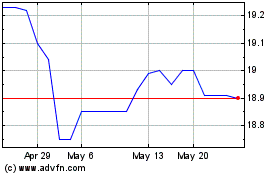

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Jan 2025 to Feb 2025

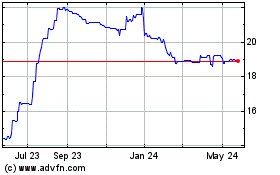

Avidbank (PK) (USOTC:AVBH)

Historical Stock Chart

From Feb 2024 to Feb 2025