true

0001021917

S-1/A

62197

0001021917

2024-07-01

2024-09-30

0001021917

dei:BusinessContactMember

2024-07-01

2024-09-30

0001021917

2024-06-30

0001021917

2023-06-30

0001021917

us-gaap:NonrelatedPartyMember

2024-06-30

0001021917

us-gaap:NonrelatedPartyMember

2023-06-30

0001021917

us-gaap:RelatedPartyMember

2024-06-30

0001021917

us-gaap:RelatedPartyMember

2023-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

2024-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

2023-06-30

0001021917

2024-09-30

0001021917

us-gaap:NonrelatedPartyMember

2024-09-30

0001021917

us-gaap:RelatedPartyMember

2024-09-30

0001021917

2023-07-01

2024-06-30

0001021917

2022-07-01

2023-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

2023-07-01

2024-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

2022-07-01

2023-06-30

0001021917

2023-07-01

2023-09-30

0001021917

us-gaap:CommonStockMember

2022-06-30

0001021917

AWCA:CommonStockSubscribedMember

2022-06-30

0001021917

AWCA:SubscriptionReceivableMember

2022-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001021917

us-gaap:RetainedEarningsMember

2022-06-30

0001021917

2022-06-30

0001021917

us-gaap:CommonStockMember

2023-06-30

0001021917

AWCA:CommonStockSubscribedMember

2023-06-30

0001021917

AWCA:SubscriptionReceivableMember

2023-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001021917

us-gaap:RetainedEarningsMember

2023-06-30

0001021917

us-gaap:CommonStockMember

2024-06-29

0001021917

AWCA:CommonStockSubscribedMember

2024-06-29

0001021917

AWCA:SubscriptionReceivableMember

2024-06-29

0001021917

us-gaap:AdditionalPaidInCapitalMember

2024-06-29

0001021917

us-gaap:RetainedEarningsMember

2024-06-29

0001021917

2024-06-29

0001021917

us-gaap:CommonStockMember

2024-06-30

0001021917

AWCA:CommonStockSubscribedMember

2024-06-30

0001021917

AWCA:SubscriptionReceivableMember

2024-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001021917

us-gaap:RetainedEarningsMember

2024-06-30

0001021917

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001021917

AWCA:CommonStockSubscribedMember

2022-07-01

2023-06-30

0001021917

AWCA:SubscriptionReceivableMember

2022-07-01

2023-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0001021917

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0001021917

us-gaap:CommonStockMember

2023-07-01

2024-06-30

0001021917

AWCA:CommonStockSubscribedMember

2023-07-01

2024-06-30

0001021917

AWCA:SubscriptionReceivableMember

2023-07-01

2024-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2024-06-30

0001021917

us-gaap:RetainedEarningsMember

2023-07-01

2024-06-30

0001021917

us-gaap:CommonStockMember

srt:ScenarioPreviouslyReportedMember

2023-07-01

2024-06-30

0001021917

AWCA:CommonStockSubscribedMember

srt:ScenarioPreviouslyReportedMember

2023-07-01

2024-06-30

0001021917

AWCA:SubscriptionReceivableMember

srt:ScenarioPreviouslyReportedMember

2023-07-01

2024-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

srt:ScenarioPreviouslyReportedMember

2023-07-01

2024-06-30

0001021917

us-gaap:RetainedEarningsMember

srt:ScenarioPreviouslyReportedMember

2023-07-01

2024-06-30

0001021917

us-gaap:CommonStockMember

us-gaap:AccountingStandardsUpdate202006Member

2024-06-30

2024-06-30

0001021917

AWCA:CommonStockSubscribedMember

us-gaap:AccountingStandardsUpdate202006Member

2024-06-30

2024-06-30

0001021917

AWCA:SubscriptionReceivableMember

us-gaap:AccountingStandardsUpdate202006Member

2024-06-30

2024-06-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

us-gaap:AccountingStandardsUpdate202006Member

2024-06-30

2024-06-30

0001021917

us-gaap:RetainedEarningsMember

us-gaap:AccountingStandardsUpdate202006Member

2024-06-30

2024-06-30

0001021917

us-gaap:AccountingStandardsUpdate202006Member

2024-06-30

2024-06-30

0001021917

us-gaap:CommonStockMember

2024-07-01

2024-09-30

0001021917

AWCA:CommonStockSubscribedMember

2024-07-01

2024-09-30

0001021917

AWCA:SubscriptionReceivableMember

2024-07-01

2024-09-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2024-07-01

2024-09-30

0001021917

us-gaap:RetainedEarningsMember

2024-07-01

2024-09-30

0001021917

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001021917

AWCA:CommonStockSubscribedMember

2023-07-01

2023-09-30

0001021917

AWCA:SubscriptionReceivableMember

2023-07-01

2023-09-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001021917

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001021917

srt:ScenarioPreviouslyReportedMember

us-gaap:CommonStockMember

2024-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

AWCA:CommonStockSubscribedMember

2024-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

AWCA:SubscriptionReceivableMember

2024-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001021917

srt:ScenarioPreviouslyReportedMember

us-gaap:RetainedEarningsMember

2024-06-30

0001021917

us-gaap:CommonStockMember

2024-09-30

0001021917

AWCA:CommonStockSubscribedMember

2024-09-30

0001021917

AWCA:SubscriptionReceivableMember

2024-09-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0001021917

us-gaap:RetainedEarningsMember

2024-09-30

0001021917

us-gaap:CommonStockMember

2023-09-30

0001021917

AWCA:CommonStockSubscribedMember

2023-09-30

0001021917

AWCA:SubscriptionReceivableMember

2023-09-30

0001021917

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001021917

us-gaap:RetainedEarningsMember

2023-09-30

0001021917

2023-09-30

0001021917

srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember

2024-07-01

2024-07-01

0001021917

us-gaap:FurnitureAndFixturesMember

2024-06-30

0001021917

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001021917

us-gaap:ComputerEquipmentMember

srt:ScenarioPreviouslyReportedMember

2024-06-30

0001021917

us-gaap:ComputerEquipmentMember

srt:ScenarioPreviouslyReportedMember

2023-06-30

0001021917

us-gaap:ComputerEquipmentMember

2024-06-30

0001021917

us-gaap:MachineryAndEquipmentMember

2024-06-30

0001021917

us-gaap:MachineryAndEquipmentMember

2023-06-30

0001021917

us-gaap:SoftwareDevelopmentMember

2024-06-30

0001021917

us-gaap:SoftwareDevelopmentMember

2023-06-30

0001021917

AWCA:AssetsPropertyPlacedintoServiceMember

srt:ScenarioPreviouslyReportedMember

2024-06-30

0001021917

AWCA:AssetsPropertyPlacedintoServiceMember

srt:ScenarioPreviouslyReportedMember

2023-06-30

0001021917

AWCA:AssetsPropertyPlacedintoServiceMember

2024-06-30

0001021917

AWCA:PropertyPlacedintoServiceMember

2024-09-30

0001021917

AWCA:PropertyPlacedintoServiceMember

2024-06-30

0001021917

us-gaap:BuildingImprovementsMember

2024-09-30

0001021917

us-gaap:BuildingImprovementsMember

2024-06-30

0001021917

us-gaap:FurnitureAndFixturesMember

2024-09-30

0001021917

us-gaap:ComputerEquipmentMember

2024-09-30

0001021917

us-gaap:SoftwareDevelopmentMember

2024-09-30

0001021917

AWCA:AssetsPropertyPlacedintoServiceMember

2024-09-30

0001021917

AWCA:HarthorneCapitalIncMember

2024-06-30

0001021917

AWCA:HarthorneCapitalIncMember

2023-06-30

0001021917

us-gaap:RelatedPartyMember

2022-07-01

2023-06-30

0001021917

us-gaap:RelatedPartyMember

2024-06-26

0001021917

AWCA:HarthorneCapitalIncMember

2024-09-30

0001021917

2022-06-30

2022-06-30

0001021917

AWCA:TwoUnsecuredDemandPromissoryNoteMember

2022-06-30

0001021917

AWCA:FirstPromissoryNoteMember

2022-06-30

0001021917

AWCA:SecondPromissoryNoteMember

2022-06-30

0001021917

2024-06-26

0001021917

2024-06-26

2024-06-26

0001021917

2024-06-30

2024-06-30

0001021917

srt:DirectorMember

2023-07-01

2024-06-30

0001021917

us-gaap:CommonStockMember

us-gaap:PrivatePlacementMember

2022-07-01

2023-06-30

0001021917

us-gaap:CommonStockMember

us-gaap:PrivatePlacementMember

2023-06-30

0001021917

us-gaap:CommonStockMember

AWCA:SubscriptionAgreementsMember

us-gaap:PrivatePlacementMember

2023-06-30

0001021917

us-gaap:CommonStockMember

AWCA:SubscriptionAgreementsMember

2022-07-01

2023-06-30

0001021917

us-gaap:CommonStockMember

AWCA:ExecutiveOfficersAndDirectorsMember

2022-07-01

2023-06-30

0001021917

us-gaap:CommonStockMember

srt:OfficerMember

2024-06-26

2024-06-26

0001021917

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2024-06-30

0001021917

us-gaap:GeneralAndAdministrativeExpenseMember

2022-07-01

2023-06-30

0001021917

AWCA:TwentyTwentyTwoOmnibusPerformanceAwardPlanMember

2022-02-28

0001021917

2023-02-13

2023-02-13

0001021917

us-gaap:CommonStockMember

AWCA:SubscriptionAgreementsMember

us-gaap:PrivatePlacementMember

2024-09-30

0001021917

AWCA:TwentyTwentyTwoOmnibusPerformanceAwardPlanMember

us-gaap:CommonStockMember

2022-02-28

0001021917

us-gaap:SubsequentEventMember

2024-09-01

2024-09-01

0001021917

us-gaap:SubsequentEventMember

AWCA:LeaseOneMember

2024-09-01

2024-09-01

0001021917

us-gaap:SubsequentEventMember

AWCA:LeaseOneMember

2024-09-01

0001021917

us-gaap:SubsequentEventMember

AWCA:LeaseTwoMember

2024-09-01

2024-09-01

0001021917

us-gaap:SubsequentEventMember

AWCA:LeaseTwoMember

2024-09-01

0001021917

us-gaap:SubsequentEventMember

2024-09-27

0001021917

us-gaap:SubsequentEventMember

2024-09-27

2024-09-27

0001021917

us-gaap:SubsequentEventMember

2024-09-01

2024-09-30

0001021917

AWCA:ChairmanAndCoChiefExecutiveOfficerMember

2024-07-01

2024-09-30

0001021917

AWCA:ChairmanAndCoChiefExecutiveOfficerMember

us-gaap:SubsequentEventMember

2024-11-15

2024-11-15

0001021917

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2022-06-30

2022-06-30

0001021917

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2022-08-08

2022-08-08

0001021917

us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember

2022-08-08

0001021917

srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember

2024-06-30

0001021917

srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember

2023-07-01

2024-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As

filed with the U.S. Securities and Exchange Commission on January 31, 2025

Registration

No. 333-275922

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 2 to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Awaysis

Capital, Inc.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

000-21477 |

|

27-0514566 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

3400

Lakeside Drive, Suite 100

Miramar,

Florida 33027

(855)

795-3311

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Andrew

Trumbach, President & Chief Financial Officer

Awaysis

Capital, Inc.

3400

Lakeside Drive, Suite 100

Miramar,

Florida 33027

(855) 795-3311

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

to:

Stephen

E. Fox, Esq.

Dominick

P. Ragno, Esq.

Ruskin

Moscou Faltischek, P.C.

1425

RXR Plaza, East Tower, 15th Floor

Uniondale,

New York 11556

(516)

663-6600

(516)

663-6601 (Facsimile)

|

|

Ross

Carmel, Esq.

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas

31st Floor

New York, New York 10036

(212) 930-9700

(212) 930-9725 (Facsimile) |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes

effective

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

|

Emerging

growth company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Act or until the registration statement shall become effective on such date as the Commission,

acting pursuant to said Section 8(a), may determine.

The

information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

JANUARY 31, 2025 |

AWAYSIS

CAPITAL, INC.

2,857,142

Shares of Common Stock

This prospectus relates to a firm commitment

public offering of 2,857,142 shares of common stock, par value $0.01 per share (“Common Stock”), of

Awaysis Capital, Inc. (the “Company”), at an assumed offering price per share of $3.50. We currently estimate that the initial offering price will be

between $3.00 and $4.00 per share of Common Stock. The actual public offering price per share will be determined

between us and the underwriter at the time of pricing and may be at a discount to the current market price. Therefore, the assumed

public offering price used throughout this prospectus may not be indicative of the final offering price.

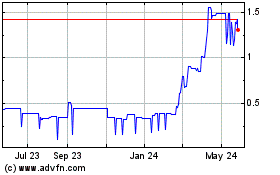

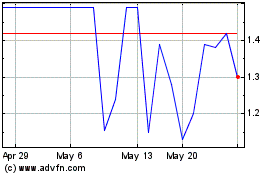

Our Common Stock is currently quoted as Pink Current

Information on the OTCMarkets platform, under the symbol “AWCA.” On January 30, 2025, the

last reported closing bid price for our Common Stock was $0.4999.

We

intend to apply to list our Common Stock under the proposed symbol “AWCA”, on NYSE American. No assurance can be given that

our application will be approved by NYSE American, and we will not consummate this offering unless our Common Stock is approved for listing

on NYSE American or another national securities exchange. If our Common Stock is approved for listing on NYSE American, trading of our

Common Stock will cease on the OTCPink.

We

are currently a “controlled company” under the corporate governance rules of the NYSE American. As of the date of this

prospectus, Michael Singh, our Chairman and Co-CEO, and Dr. Trumbach, our Co-CEO and CFO, and Harthorne Capital, Inc., an entity

controlled by them, collectively beneficially owns approximately 93% of our outstanding shares of Common Stock. Upon completion of

this offering, such parties, collectively, will hold approximately 92.1% of our Common Stock, which will constitute a

majority of the voting power of our stockholders. As a result, we will continue to be a “controlled company”. We have

elected to rely on certain of these exemptions and as a result, we are not required to have: (i) a Board of Directors consisting of

a majority of independent directors, (ii) a compensation committee consisting entirely of independent directors, and (ii) a

nominating/corporate governance committee that is composed entirely of independent directors. We may also rely on the other

exemptions so long as we qualify as a “controlled company.”

You

should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities. These securities

involve a high degree of risk. See “Risk Factors” contained in this prospectus beginning on page 7.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

We

have retained D. Boral Capital to act as the sole underwriter (the “Underwriter”) in connection with this Offering. See “Underwriting”

in this prospectus for more information regarding the underwriting arrangements.

| | |

Per Share | | |

Total | |

| Price to the public | |

$ | 3.500 | | |

$ | 10,000,000 | |

| Underwriting discounts and commissions (1) | |

$ | 0.245 | | |

$ | 700,000 | |

| Proceeds to us, before expenses (2) | |

$ | 3.255 | | |

$ | 9,300,000 | |

| (1) | We

have agreed to pay the Underwriter a discount equal to 7% of the gross proceeds of the Offering.

See “Underwriting” beginning on page 52 for additional information regarding

the Underwriter’s compensation. |

| | |

| (2) | Excludes

fees and expenses payable to the Underwriter and other expenses of this Offering (including

a non-accountable expense allowance equal to 1% of the gross proceeds from this Offering

payable to the Underwriter). |

We

have granted to the Underwriter a 45-day option, exercisable one or more times in whole or in part, to purchase up to an additional 428,571

shares of Common Stock at the public offering price per share and, less the underwriting discounts and commissions, to cover over-allotments,

if any.

The

Underwriter is offering the securities for sale on a firm commitment basis. The Underwriter expects to deliver the securities to purchasers

on or about [●], 2025.

Sole

Book Running Manager

Prospectus

dated , 2025

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

Unless

the context otherwise requires or indicates, all references to “we”, “us”, “our”, “ourselves”,

“the Company,” and “Awaysis” refer to Awaysis Capital, Inc. a Delaware corporation, formerly known as JV Group,

Inc. and its consolidated subsidiaries. References to our “Common Stock” refer to the common stock, par value $0.01 per

share, of Awaysis Capital, Inc.

Through and including [●],

2025 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating

in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus

when acting as an underwriter and with respect to an unsold allotment or subscription.

You should rely only on the

information contained in this prospectus or in any free writing prospectus we or the underwriters may authorize to be delivered or made

available to you. Neither we nor the underwriters have authorized

anyone to provide you with different information. We and the underwriters take no responsibility for and can provide

no assurance as to the reliability of any information that others may give you. If anyone provides you with different or inconsistent

information, you should not rely on it.

The information in this

prospectus is accurate only as of the date

of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our Common Stock. You should

not assume that the information appearing in this prospectus any post-effective amendment, and any applicable prospectus supplement

to this prospectus is accurate as of any date other than their respective dates. Our business, financial condition,

operating results and prospects may have changed since that date.

The

registration statement we filed with the Securities and Exchange Commission (“SEC”), of which this prospectus forms a part,

includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus, any post-effective

amendment, and any applicable prospectus supplement and the related exhibits filed with the SEC before making your investment decision.

The registration statement and the exhibits can be obtained from the SEC, as indicated under the section entitled “Where You

Can Find More Information”.

Certain

amounts, percentages and other figures presented in this prospectus have been subject to rounding adjustments. Accordingly, figures shown

as totals, dollars or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede

them.

We

are offering to sell, and seeking offers to buy, shares of Common Stock only in jurisdictions where offers and sales are permitted.

For

investors outside of the United States: No action is being taken in any jurisdiction outside of the United States that

would permit a public offering of the shares of our Common Stock or possession or distribution of this prospectus in any

such jurisdiction. Persons outside of the United States who come into possession of this prospectus must inform themselves

about, and observe any restrictions relating to, the offering of the shares of Common Stock and the distribution of this

prospectus outside of the United States.

TRADEMARKS

This

prospectus contains references to our trademarks, trade names and service marks. Solely for convenience, trademarks, trade names and

service marks referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to

indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable

licensor to these trademarks, trade names and service marks. Other trademarks, trade names and service marks appearing in this prospectus

(or documents we have incorporated by reference) are the property of their respective holders. We do not intend our use or display of

other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by,

any other companies.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. Forward-looking statements convey management’s expectations as to the future of

Awaysis, and are based on management’s beliefs, expectations, assumptions and such plans, estimates, projections and other information

available to management at the time Awaysis makes such statements. Forward-looking statements may be identified by terminology

such as the words “outlook,” “believe,” “expect,” “potential,” “goal,” “continues,”

“may,” “will,” “should,” “could,”, “would”, “seeks,” “approximately,”

“projects,” predicts,” “intends,” “plans,” “estimates,” “anticipates”

“future,” “guidance,” “target,” or the negative version of these words or other comparable words,

although not all forward-looking statements may contain such words. The forward-looking statements contained in this prospectus may include

statements related to Awaysis’ revenues, earnings, taxes, cash flow and related financial and operating measures, and expectations

with respect to future operating, financial and business performance, and other anticipated future events and expectations that are not

historical facts.

Awaysis

cautions you that its forward-looking statements involve known and unknown risks, uncertainties and other factors, including those

that are beyond Awaysis’ control, which may cause the actual results, performance or achievements to be materially different from

the future results. Factors that could cause Awaysis’ actual results to differ materially from those contemplated by its forward-looking

statements include:

| ● | Risks

that

there may be significant costs and expenses associated with liabilities related to the development

of its business that were either unknown or are greater than those anticipated at the time

of the acquisition of its assets; |

| ● | Risks

that

Awaysis may not be successful in integrating new properties into all aspects of our business

and operations or that the integration will take longer than anticipated; |

| ● | The

operational

risks as a result of acquiring undeveloped or underdeveloped assets and real estate and integration

of those assets into our business; risks related to disruption of management’s attention

from Awaysis’ ongoing business operations due to its efforts to identify, acquire,

develop and manage new resort properties into Awaysis; |

| ● | Any

adverse

effect of an acquired asset on Awaysis’ reputation, relationships, operating results

and business generally; |

| ● | Any

lingering impact of the COVID-19 pandemic on Awaysis’ business, operating results,

and financial condition, or on global economic conditions; |

| ● | Awaysis’

ability to meet its liquidity needs; risks related to Awaysis’ indebtedness, especially

in light of the significant amount of indebtedness we expect to incur to complete various

identified properties for our resort portfolio; |

| |

● |

Risks related to Awaysis’ indebtedness, especially

in light of the significant amount of indebtedness we expect to incur to complete the acquisition and development of hospitality

and resort properties; |

| ● | Inherent

business

risks, market trends and competition within the resort and hospitality industries; |

| ● | Compliance

with

and changes to United States, Belize and global laws and regulations, including those related

to anti-corruption and privacy; |

| ● | Risks

related

to Awaysis’ planned acquisitions, joint ventures, and other partnerships; |

| ● | Awaysis’

dependence on third-party development activities; the performance of Awaysis’ information

technology systems and its ability to maintain data security; |

| ● | Regulatory

proceedings

or litigation; adequacy of our workforce to meet Awaysis’ business and operation needs;

|

| ● | Awaysis’

ability to attract and retain key executives and employees with skills and capacity to meet

our needs; and |

| ● | Natural

disasters

or adverse geo-political conditions. Any one or more of the foregoing factors could adversely

impact Awaysis’ operations, revenue, operating profits and margins, financial condition

or credit rating. |

For

additional information regarding factors that could cause Awaysis’ actual results to differ materially from those expressed or

implied in the forward-looking statements in this prospectus, please see the risk factors discussed under “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” elsewhere in

this prospectus, and in our other filings with the Securities and Exchange Commission. There may be other risks and uncertainties

that we are unable to predict at this time or we currently do not expect to have a material adverse effect on our business. Except for

Awaysis’ ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to

publicly update or review any forward-looking statement, whether as a result of new information, future developments, changes in management’s

expectations, or otherwise.

CAUTIONARY

NOTE REGARDING INDUSTRY DATA

Unless

otherwise indicated, information contained in this prospectus concerning our company, our business, the services we provide and intend

to provide, our industry and our general expectations concerning our industry are based on management’s estimates. Such estimates

are derived from publicly available information released by third party sources, as well as data from our internal research, and reflect

assumptions made by us based on such data and our knowledge of the industry, which we believe to be reasonable. We have not sought

the consent of the sources to refer to their reports appearing or incorporated by reference in this prospectus.

PROSPECTUS

SUMMARY

This

summary highlights some information contained elsewhere in this prospectus, and it may not contain all of the information important to

making an investment decision. Therefore, a potential investor should read the following summary together with the more detailed information

regarding the Company and the Common Stock being sold in this offering, including, in particular, the “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this

prospectus.

The

Company

We

are a real estate management and hospitality company focused on acquisition, redevelopment, sales, and managing rentals of residential

vacation home communities in desirable travel destinations. We seek to create value through the targeting and acquisition, development,

and up-cycling, rebranding, and repositioning of currently undervalued operating and shovel ready residential/resort communities in global

travel destinations, with the intention to relaunch these assets under the “Awaysis” brand with the goals of creating a network

of residential and resort enclave communities that will optimize both sales and rental revenues, providing attractive returns to owners

and exceptional vacation experiences to travelers.

Increased global trends

towards “work from home” opportunities have

impacted both residency and travel. We believe that more people are seeking comfortable and convenient places to travel, visit, and

live for extended durations. We seek to capitalize on these trends by transforming residential resort properties in desirable

locations into convenient enclaves that facilitate this type of travel or residency. We define an enclave as a gated community that

has all the amenities that will allow a person to live, work and play without having to leave the community.

At

least initially, we are seeking to develop resorts that have not been completed nor have a prior operational history. As

such we intend to purchase the real estate and finish the development, then we would sell the finished units to individual buyers

and put them in a rental pool that we would manage.

We

seek to own, grow and manage a stable, cash generating, diversified portfolio of single-family and luxury resort/residence properties

in the Caribbean, Europe, South America, and the United States.

We

are a licensed real estate corporation in the State of Florida and maintain compliance with the Florida Real Estate Commission, the entity

that regulates companies providing real estate services such as rentals, management, and sales. Additionally, our business is subject

to federal, state, local and foreign laws, rules, and regulations that may vary depending on the geographical location and classification

of our individual properties. Hospitality operations are also subject to compliance with the U.S. Americans with Disabilities Act and

other laws and regulations relating to accessibility, and to laws, regulations and standards in other areas such as zoning and land use,

licensing, permitting and registrations, safety, environmental and other property condition matters, staffing and employee training,

and cleanliness/sanitation protocols.

Our

business strategy entails targeting and identifying undervalued assets in emerging markets located in proximity to high demand

travel destinations. We intend to focus these efforts on shovel-ready properties and/or other assets that we believe can be used to

optimize sales and rental revenues. To that effect, on June

30, 2022, we closed on the acquisition of certain real estate assets in San Pedro, Belize (the “Awaysis Casamora

Assets”), pursuant to a series of Agreements of Purchase and Sale, all dated April 15, 2022. The total

consideration paid by us for the properties subject to the agreements was at the appraisal value of $11.4 million (excluding

transaction costs and fees) and was settled in a combination of a Purchase Money Mortgage of $2.6 million at 0% interest rate,

payable on demand, a Purchase Money Mortgage of $280,000 at 0% interest rate that was paid on August 8, 2022 and 56.8 million shares

of the Company’s Common Stock based on a per share price equal to the market price on the date of appraisal of $0.150. As the

first acquisition by the Company in Belize and an important milestone, the Company is rebranding the Awaysis Casamora Assets, so it is easily identifiable as an Awaysis Property and fit perfectly with its strategy of

creating a countrywide network of Awaysis residential enclave communities in the country.

Recent

Developments

Line

of Credit

Between

November 15, 2024 and December 20, 2024, the Company borrowed an aggregate of $3,000,000, evidenced by a Secured Promissory Note,

dated December 1, 2024, under a planned committed line of credit with BOS Investment Inc. to borrow up to an aggregate of

$5,000,000. BOS is an affiliate of Michael Singh, the Company’s Chairman and Co-CEO. The Company used a portion of the

proceeds from the loan for the acquisition of an additional operating property in Belize from Chial Mountain Ltd., another affiliate

of Mr. Singh, and expects to use additional proceeds for other targeted acquisitions, and to further develop the

Company’s Awaysis Casamora Assets.

Interest on the note portion

of the loan is 3.5% per annum (subject to late payment penalties), and the principal and interest on the note shall be paid as follows:

| |

1. | $110,000, originally on or before December 20,

2024, which the parties have agreed shall be deferred until on or before February 15, 2025; |

| |

| |

| |

2. | $2,500,000 on or before February 15, 2025; and |

| |

| |

| |

3. | The balance of the principal and interest to be paid on or before

June 1, 2025. |

The note is secured by a

first priority lien on substantially all of the assets of the Company and contains customary events of default, which entitle BOS, among

other things, to accelerate the due date of the unpaid principal and accrued and unpaid interest of the note. Additional definitive documentation

regarding the line of credit has not yet been negotiated or entered into. However, the Company expects the note will be rolled into the

definitive documents relating to the full line of credit once finalized and executed.

Acquisition of Chial Mountain

On December 31, 2024, Awaysis

Belize Ltd., a Belize corporation and wholly-owned subsidiary of the Company, or Awaysis Belize, acquired all of the stock and substantially

all of the assets of Chial Mountain Ltd., a Belize corporation, or Chial Mountain, pursuant to the terms and conditions of an Agreement

of Purchase and Sale, dated December 31, 2024 and effective December 20, 2024, between Chial Mountain and Awaysis Belize.

Pursuant to the terms of

the Asset Purchase Agreement, Awaysis Belize acquired all outstanding shares of Chial Mountain and concurrently acquired substantially

all of the assets of Chial Mountain on an “as is, where is” basis, including, but not limited to: (i) all tangible and intangible

property of Chial Mountain; and (ii) certain real property located in the Cayo District of Belize, aggregating over 63 acres (the “Chial

Reserve Assets”). The Chial Reserve Assets include approximately 35 villas consisting of an estimated 59,000 square feet that are

expected to be further developed and renovated by the Company as an “Awaysis” branded residential enclave community.

The aggregate estimated

purchase price of the Chial Reserve Assets is $5,500,000, subject to potential adjustments, consisting of: (i) $2,400,000 in cash; (ii)

a $1,500,000 secured promissory note, dated December 21, 2024, between the Company and Michael Singh, which bears no interest and has

a maturity date on the earlier of February 15, 2025, or the up-listing of the Company to the NYSE American; and (iii) a $1,600,000 senior

convertible promissory note, dated December 20, 2024, between the Company and Michael Singh, which bears interest at a rate of 3.5% per

annum and has a maturity date of June 30, 2025.

The notes are secured by

first priority liens on substantially all of the assets of the Company and contain customary events of default, which entitle Mr. Singh,

among other things, to accelerate the due date of the unpaid principal and accrued and unpaid interest to the extent applicable.

The senior convertible promissory

note is convertible at the option of Mr. Singh into shares of the Company’s Common Stock at a conversion price equal to the closing

price of the Company’s Common Stock on the trading day immediately prior to Mr. Singh’s delivery of a notice of conversion,

as set forth therein.

On

January 30, 2025, Chial Mountain assigned an Agreement, dated December 5, 2024 to Awaysis Belize, granting Awaysis Belize the right

until May 28, 2025 to purchase an aggregate of approximately 157 acres of property in the Cayo District of Belize, adjacent to the

Chial Reserve Assets for an aggregate purchase price of approximately $408,000.

Reverse

Stock Split

In

September of 2024, our Board of Directors and holders of a majority of our outstanding voting securities, approved a reverse split

of up to 1-for-20 of our issued and outstanding shares of Common Stock (the “Reverse Split”) and authorized our Co-CEOs,

in their sole discretion, to determine the final ratio and effect the Reverse Split any time before the one year anniversary of the

approval date. We do not yet have an effective date for the Reverse Split and we have not yet determined the exact split ratio, but expect the Reverse Split to take effect in the

second half of our fiscal year ending June 30, 2025.

We

intend to effect the Reverse Split immediately prior to and contingent

upon the completion of this offering, pursuant to which each up to 20 shares of our Common Stock held of record by the holder thereof

will be reclassified into one share of our Common Stock. No fractional shares will be issued. Unless otherwise indicated, the number of our shares of Common

Stock in this prospectus have not been adjusted to reflect the Reverse Split.

Controlled

Company

As

of the date of this prospectus, approximately 93% of our outstanding shares of Common Stock are collectively beneficially owned by

Michael Singh, our Chairman and Co-CEO, and Dr. Trumbach, our Co-CEO and CFO, and Harthorne Capital, Inc., an entity controlled by

them, and therefore we currently meet the definition of a “controlled company” under the corporate governance standards

for the NYSE American. Upon the closing of this offering, such parties will own approximately 92.1% of the voting power of our

outstanding Common Stock.

As

long as such parties collectively own at least 50% of the voting power of our Company, we will be a “controlled company”

as defined under the NYSE American. Under that definition, we are permitted to rely on certain exemptions from corporate governance rules,

including:

| ● | an

exemption from the rule that a majority of our Board must be independent directors; |

| ● | an

exemption from the rule that the compensation of our chief executive officer must be determined

or recommended solely by independent directors; and |

| ● | an

exemption from the rule that our director nominees must be selected or recommended solely

by independent directors. |

We

have elected to rely on certain of these exemptions and as a result, we are not required to have: (i) a Board of Directors consisting

of a majority of independent directors, (ii) a compensation committee consisting entirely of independent directors, and (ii) a nominating/corporate

governance committee that is composed entirely of independent directors. We may also rely on the other exemptions so long as we qualify

as a “controlled company.” As a result, you will not have the same protection afforded to shareholders of companies that

are subject to these corporate governance requirements.

Risk

Factor Summary

A

purchase of any of our securities involves a high degree of risk. Investors should consider carefully the following information about

these risks, together with the other information contained in this prospectus, including the section titled “Risk Factors”

before the purchase of any of our shares of Common Stock. If any of the following risks actually occur, the business, financial condition

or results of operations of the Company would likely suffer, the market price of the Common Stock would likely decline, and investors

could lose all or a portion of their investment. The Company has listed the following risk factors which it believes to be those material

to an investment decision in this offering.

Our

business is subject to a number of risks of which you should be aware before making an investment decision. These risks include, but

are not limited to, the following:

Risks

Relating to our Business and Finances

| |

● | We

are a development stage company with a limited operating history and have not yet achieved

profitability, making it difficult for you to evaluate our business and your investment. |

| |

| |

| |

● | We

have only recently established any material and recurring revenues or operations, and there

can be no assurance that we will realize our plans on our projected timetable (or at all)

in order to reach sustainable or profitable operations. |

| |

| |

| |

● | We

have incurred net losses of $7,093,476 and $4,295,446 for the fiscal years ended June 30,

2024 and June 30, 2023, respectively, $694,074 for the fiscal quarter ended September 30,

2024, and we anticipate that we will continue to incur significant losses for the foreseeable

future, and even if we were to generate material and recurring revenue, we may never achieve or maintain profitability.

We had an accumulated deficit of $13,300,442 as of September 30, 2024. |

| |

| |

| |

● | We

are dependent on management. Failure to retain and recruit, or failure to manage succession

of, key personnel could have an adverse impact on our future performance. |

| |

| |

| |

● | Failure

to properly estimate the risks, time and cost involved in a project or delays in completion

may lead to cost overruns and affect our financial conditions and any profitability. |

| |

| |

| |

● | We

are subject to significant accounts payable and other current liabilities. |

| |

| |

| |

● | The

expansion of our operations can have a significant impact on our profitability. |

| |

| |

| |

● | Our

financial success is dependent on general economic conditions. |

| |

| |

| |

● | Our

operating results are subject to significant fluctuations based on seasonality and other

factors. |

Risks

Relating to our Properties

| |

● | Our

success will partially depend upon the acquisition and re-development of hospitality properties

in varying stages of development, and we may be unable to consummate acquisitions on advantageous

terms, the acquired properties may not perform as expected, or we may be unable to efficiently

integrate assets into our existing operations. |

| |

| |

| |

● | Investors

are reliant on management’s assessment, selection, and development of appropriate properties. |

| |

| |

| |

● | Our

profitability may be impacted by delays in the selection, acquisition, and re-development

of properties. |

| |

| |

| |

● | Our

business is affected by macroeconomic conditions, including rising inflation, interest rates

and supply chain constraints. |

| |

| |

| |

● | Supply

chain disruptions could create unexpected renovation or maintenance costs or delays and/or

could impact our development projects, any of which could adversely impact our results of

operations. |

| |

| |

| |

● | We

may be unable to sell a property if or when we decide to do so, including as a result of

uncertain market conditions, which could adversely affect our ability to respond to market

conditions. |

| |

| |

| |

● | We

may not succeed in creating a portfolio enclave strategy. |

| |

| |

| |

● | Our

properties may be subject to liabilities or other problems. |

| |

| |

| |

● | The

failure to successfully execute and integrate properties that support our planned business

model could adversely affect our growth rate and consequently our revenues and results of

operations. |

| |

| |

| |

● | There

are significant risks associated with “value-add” and properties in need of re-positioning. |

| |

| |

| |

● | Uninsured

losses relating to real property may adversely affect our performance. |

| |

| |

| |

● | Competition

for real property to grow our business may increase costs and reduce returns. |

| |

| |

| |

● | Environmental

regulations and issues, certain of which we may have no control over, may potentially impose

liability and adversely impact our business. |

| |

| |

| |

● | Real

estate may develop harmful mold, which could lead to liability for adverse health effects

and costs of remediating the problem. |

| |

| |

| |

● | Terrorist

attacks or other acts of violence or war may adversely affect our industry, operations, and

profitability. |

| |

| |

| |

● | Our

international operations subject us to additional costs and risks, which could adversely

affect our business, financial condition, and results of operations. |

| |

| |

| |

● | We

will be subject to risks related to the geographic locations of the properties we develop

and manage. |

| |

| |

| |

● | We

are subject to significant government regulations, which could adversely affect our business,

financial condition, and results of operations. |

| |

| |

| |

● | Weather

events, natural disasters and other events beyond our control could adversely affect our

business. |

| |

| |

| |

● | There

may be several conflicts of interest that arise as we implement our business plan. |

| |

| |

| |

● | Our

quarterly results may fluctuate significantly based on seasonality and other factors. |

Risks

Related to Being a Public Company

| |

● | We

will incur increased costs as a result of operating as a public company listed on NYSE American,

and our management will devote substantial and increased time to comply with our public company

responsibilities and corporate governance practices. |

| |

| |

| |

● | Our

management team has limited experience managing a public company and no experience managing

a public company listed on a national securities exchange. |

| |

| |

| |

● | We

have been unable to maintain effective disclosure controls and procedures, which could result

in our stock price and investor confidence being materially and adversely affected. |

Risks

Relating to our Common Stock

| |

● | There

is a limited trading market for our Common Stock, which could make it difficult for you to

liquidate an investment in our Common Stock, in a timely manner. |

| |

| |

| |

● | The

market price and trading volume of our Common Stock may be volatile, which may adversely

affect its market price. |

| |

| |

| |

● | If

you purchase our Common Stock in this offering, you will incur immediate and substantial

dilution in the book value of your shares. |

| |

| |

| |

● | Your

interest in us may be diluted if we issue additional shares of Common Stock. |

| |

| |

| |

● | Sales

of a substantial number of shares of our Common Stock by our existing stockholders in the

public market could cause our stock price to fall. |

| |

| |

| |

● | We

have broad discretion in the use of the net proceeds from this offering and may not use them

effectively. |

| |

| |

| |

● | The

sale of our Common Stock may cause its market price to drop significantly, regardless of

the Company’s performance. |

| |

| |

| |

● | We

may not be able to satisfy listing requirements of the NYSE American or obtain or maintain

a listing of our Common Stock on the NYSE American. |

| |

| |

| |

● | Our

Common Stock is subject to the “penny stock” rules of the SEC, which makes transactions

in our stock cumbersome and may reduce the value of an investment in our stock. |

| |

| |

| |

● | We

are a “controlled company” within the meaning of the NYSE American listing standards

and, as a result, qualify for, and intend to rely on, exemptions from certain corporate governance

requirements which would not provide you the same protections afforded to stockholders of

companies that are subject to such requirements. |

| |

| |

| |

● | Certain

of our executive officers and directors, through their direct and indirect ownership of Common Stock, can substantially influence the outcome of matters requiring shareholder approval

and may prevent you and other stockholders from influencing significant corporate decisions,

which could result in conflicts of interest that could cause the Company’s stock price

to decline. |

| |

| |

| |

● | Anti-takeover

provisions in the Company’s charter and bylaws under Delaware law may prevent or frustrate

attempts by stockholders to change the board of directors or current management and could

make a third-party acquisition of the Company difficult. |

| |

| |

| |

● | Investments

in our Common Stock may provide you with limited rights, and we do not expect to pay cash

dividends in the short term. |

| |

| |

| |

● | We qualify as a smaller reporting company

within the meaning of the Securities Act, and we take advantage of certain exemptions

from disclosure requirements available to smaller reporting

companies, this could make our securities less attractive to investors and may make it more

difficult to compare our performance with other public companies. |

Corporate

Information

We

have historically existed as a publicly quoted shell company. In February 2022, our Board of Directors determined to pursue a business

strategy of acquiring, developing, and managing residential vacation home communities in desirable travel destinations. On May 18, 2022,

we changed our name from JV Group, Inc. to Awaysis Capital, Inc. In connection with this name change, we changed our ticker symbol from

“ASZP” to “AWCA” and effective May 25, 2022, we began trading on the OTC Market under our new symbol.

Our

principal executive offices are located at 3400 Lakeside Drive, Miramar, Florida 33027. Our main telephone number is (855) 795-3311.

Our website is www.awaysisgroup.com. The information contained on, or that can be accessed through, our website is not incorporated

by reference and is not a part of this prospectus.

Listing

on a National Stock Exchange

We

intend to apply to list our Common Stock under the proposed symbol “AWCA” on the NYSE American. No assurance can be given

that our application will be approved by NYSE American, and we will not consummate this offering unless our Common Stock is approved

for listing on NYSE American or another national securities exchange.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. Accordingly, we may provide

less public disclosure than larger public companies, including the inclusion of only two years of audited consolidated financial statements

and only two years of management’s discussion and analysis of financial condition and results of operations disclosure and the

inclusion of reduced disclosure about our executive compensation arrangements. As a smaller reporting company, we are also exempt from

compliance with the auditor attestation requirements pursuant to the Sarbanes-Oxley Act. As a result, the information that we provide

to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our Common Stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float

or a public float (based on our Common Stock) that is less than $700 million, annual revenues of $100 million or more during the most

recently completed fiscal year.

The Offering

Issuer

|

|

Awaysis

Capital, Inc. |

| Securities Offered: |

|

2,857,142 shares of

Common Stock (or 3,285,713 shares of Common Stock if the underwriter’s option to subscribe for additional shares is exercised

in full), at a public offering price of $3.50 per share. |

| |

|

|

| Shares of Common Stock Outstanding Before the

Offering: |

|

384,031,524 shares of

Common Stock (as of January 30, 2025) |

| |

|

|

| Shares of Common Stock Outstanding After the

Offering: |

|

386,888,666 shares of

Common Stock (or 387,317,237 shares of Common Stock if the underwriter’s option to subscribe for additional shares is

exercised in full), after giving effect to the reverse stock split, based on our issued and outstanding shares of Common Stock as of

January 30, 2025. Does not include the conversion of any options or other warrants, or any convertible debentures or other

indebtedness that may be outstanding or issuable. |

| |

|

|

| Over-Allotment Option: |

|

We have granted to the

underwriters a 45-day option to purchase from us up to an additional 15% of the shares of Common Stock sold in the offering in any

combination thereof, solely to cover over-allotments, if any, at the public offering price per share of Common Stock, less the underwriting

discounts. |

| |

|

|

Use

of Proceeds:

|

|

We intend to use the

proceeds from this offering for development costs and expenditures related to the implementation our business plan to acquire, develop,

operate and manage a range of hospitality properties, pay off a portion of our outstanding indebtedness, and for general corporate

purposes and working capital. See “Use of Proceeds” on page 20 for more information. |

| |

|

|

| Trading Symbol: |

|

Our

Common Stock is currently quoted as Pink Current Information on the OTCMarkets platform, under the symbol “AWCA.”

We intend to apply to list our Common Stock under the proposed symbol “AWCA” on the NYSE American. We believe that

upon completion of the offering, we will meet the standards for listing on NYSE American. The closing of this offering is contingent

upon the successful listing of our Common Stock on NYSE American.

|

Risk

Factors:

|

|

See

“Risk Factors” beginning on page 7 of this prospectus for a discussion of factors that you should carefully

consider before deciding to invest in our Common Stock.

|

| Lock-up: |

|

In connection with this

offering, we, our directors, and officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell,

pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of 180 days after

the date of this prospectus. See “Underwriting—Lock-Up Agreements.” |

The

number of shares of Common Stock to be outstanding immediately after this offering is based on 384,031,524 shares of Common Stock outstanding

on January 30, 2025, and which excludes:

| ● | 19,775,931

shares of our Common Stock that are available for future issuance under our 2022 Omnibus

Performance Award Plan; |

| | | |

| ● | 22,500,000

shares of Common Stock issuable upon exercise of outstanding non-plan options |

| | | |

| ● | 3,666,666

shares of our Common Stock underlying a Convertible Promissory Note which may be converted

from time to time in the discretion of Harthorne, executed by the Company and Harthorne on

August 2, 2024, or any additional shares upon conversion of accrued and unpaid interest under

the note; and |

| | | |

| | ● | An indeterminate number of shares of Common Stock underlying a Convertible

Promissory Note, which may be converted at the discretion of Michael Singh, executed by the Company and

Michael Singh on December 31, 2024, upon conversion of $1,600,000 of principal and any accrued and unpaid

interest under the note, at a conversion price equal to the closing price of the Company’s Common Stock on the trading day immediately preceding Mr. Singh’s delivery of a notice of conversion. |

RISK

FACTORS

A

purchase of any of our securities involves a high degree of risk. Investors should consider carefully the following information about

these risks, together with the other information contained in this prospectus before the purchase of any of our shares of Common Stock.

If any of the following risks actually occur, the business, financial condition or results of operations of the Company would likely

suffer, the market price of the Common Stock would likely decline, and investors could lose all or a portion of their investment.

The Company has listed the following risk factors which it believes to be those material to an investment decision in this offering.

Risks Relating to our Business and Finances

We

are a development stage company with a limited operating history and have not yet achieved profitability, making it difficult

for you to evaluate our business and your investment.

Our

operations are subject to all of the risks inherent in the establishment of a new business enterprise, including but not limited to the

absence of an operating history, lack of fully-developed or commercialized properties, insufficient capital, limited assets, expected

substantial and continual losses for the foreseeable future, limited experience in dealing with regulatory issues, lack of marketing

experience, need to rely on third parties for the development and commercialization of our proposed properties, a competitive environment

characterized by well-established and well-capitalized competitors and reliance on key personnel.

We

may not be successful in carrying out our business objectives. The revenue and income potential of our business and operations are unproven

as the lack of operating history makes it difficult to evaluate the future prospects of our business. There is nothing at this time on

which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably.

We have incurred net losses since our inception. Accordingly, we have no track record of successful business activities, strategic

decision-making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we

will be successful in our business. There is a substantial risk that we will not be successful in fully implementing our business plan,

or if initially successful, in thereafter generating material operating revenues or in achieving profitable operations.

We

have only recently established

any material and recurring revenues or operations, and there can be no assurance that we will realize our plans on our projected timetable

(or at all) in order to reach sustainable or profitable operations.

Investors

are subject to all the risks incident to the creation and development of a new business and each investor should be prepared to withstand

a complete loss of his, her or its investment. Furthermore, the accompanying financial statements have been prepared assuming that we

will continue as a going concern. We have not emerged from the development stage and may be unable to raise further equity. Additionally,

we have only recently commenced generated material and recurring revenues, have sustained losses and have accumulated a significant

deficit since our inception. As of September 30, 2024, we had cash of approximately $234,000 and total current liabilities

of approximately $5,000,000.

Even

if we successfully develop and market our business plan, we may not generate sufficient or sustainable revenue to achieve or sustain

profitability, which could cause us to cease operations and cause you to lose all of your investment. Because we are subject to these

risks, you may have a difficult time evaluating our business and your investment in our Company.

We have incurred net losses to date, we anticipate

that we will continue to incur significant losses for the foreseeable future, and even if we were to generate material and recurring

revenue, we may never achieve or maintain profitability.

We

had net losses of $7,093,476 and $4,295,446 for

the fiscal years ended June 30, 2024 and 2023, respectively, and net losses of $694,074 and $3,531,828 for the three

months ended September 30, 2024 and 2023, respectively. We expect to incur significant losses for the foreseeable future as we continue

to implement our business plan and acquire, develop and operate a range of hospitality properties. In the future, acquisition and development

of such additional properties, together with anticipated general and administrative expenses, will likely result in the Company incurring

further significant losses. We had an accumulated deficit as of September 30, 2024 of $13,300,442.

To

become profitable, we must successfully implement our proposed business plan and strategies, either alone in on conjunction with possible

collaborators. We may never have any significant recurring revenues or become profitable.

We

are dependent on management. Failure to retain and recruit, or failure to manage succession of, key personnel could have an adverse

impact on our future performance.

Our

business is and will continue to be significantly dependent on our management team, including Michael Singh and Andrew Trumbach, our

Co-CEOs. Our success depends upon the continued service of these directors and officers. The loss of any member of our management

team could have a materially adverse effect on our business, financial condition and results of operations.

Our

ability to attract, engage, develop and retain qualified and experienced employees at all levels, including in executive and other key

strategic positions, is essential for us to meet our objectives. Competition among potential employers might result in increased salaries,

benefits or other employee-related costs, or in our failure to recruit and retain employees which could have a materially adverse impact

on our business operations, financial condition and results of operations.

Additionally,

any failure to adequately plan for and manage succession of key management roles or the failure of key employees to successfully transition

into new roles could have a material adverse effect on our business and results of operations. While we have employment arrangements

with certain key executives, these do not guarantee the services of these executives will continue to be available to us.

Failure

to properly estimate the risks, time and cost involved in a project or delays in completion may lead to cost overruns and affect our

financial conditions and any profitability.

When

determining the price to construct and develop its projects, we generally adopt a cost-plus pricing model after taking into account factors

including, the nature, scale, complexity and location of the relevant project, as well as the estimated material, labor and equipment

cost. As such, whether we are able to achieve our target profitability in any project is significantly dependent on our ability to accurately

estimate and control these costs. The actual time taken and cost involved in implementing the construction and development of our project

may be adversely affected by a number of factors, such as shortage or cost escalation of materials and labor, adverse weather conditions,

accidents, and any other unforeseen problems and circumstances. As of the aforesaid factors may give rise to delays in completion of

works or cost overruns, which in turn result in a lower profit margin or even a loss for a project, thereby materially and adversely

affecting our financial condition, profitability or liquidity.

We

are subject to significant accounts payable and other current liabilities.

We

have accounts payable and accrued liabilities of approximately $5.0 million as of September 30, 2024. We also incur indebtedness from

time to time to fund operations, such as our recent $1.1 million loan from certain of our affiliates. Our operations are not currently

able to generate sufficient cash flows to meet our payable and other liabilities, which could reduce our financial flexibility, increase

interest expenses, and adversely impact our operations. We have not historically generated sufficient cash flow from operations to enable

us to repay indebtedness and to fund other liquidity needs. Such indebtedness could affect our operations in several ways, including

the following:

| ● | a

significant portion of our cash flows could be required to be used to service such indebtedness. |

| ● | a

high level of indebtedness could increase our vulnerability to general adverse economic and

industry conditions. |

| ● | any

covenants contained in the agreements governing such outstanding indebtedness could limit

our ability to borrow additional funds, dispose of assets, pay dividends and make certain

payments. |

| ● | a

high level of indebtedness may place us at a competitive disadvantage compared to our competitors

that are less leveraged and, therefore, our competitors may be able to take advantage of

opportunities that our indebtedness may prevent us from pursuing. |

| ● | debt

covenants may affect our flexibility in planning for, and reacting to, changes in the economy

and in our industry, if any; and |

| ● | any

ability to convert or exchange such indebtedness for equity in the

Company can cause substantial dilution to existing stockholders of the Company. |

The

expansion of our operations can have a significant impact on our profitability.

We

intend on expanding our business through the acquisition, development, and maintenance of real estate assets. Any expansion of operations

that we may undertake will entail risks, such actions may involve specific operational activities which may negatively impact our profitability.

Consequently, investors must assume the risk that (i) such expansion may ultimately involve expenditures of funds beyond the resources

available to us at that time, and (ii) management of such expanded operations may divert management’s attention and resources away

from our existing operations, all of which may have a material adverse effect on our present and prospective business activities.

Our

financial success is dependent on general economic conditions.

Our

financial success may be sensitive to adverse changes in general economic conditions in the United States, Belize and any other jurisdiction

in which our assets are located, such as recession, inflation, unemployment, geopolitical situations, and interest rates. Such changing

conditions could reduce demand in the marketplace for our hospitality and resort services. We have no control over these changes.

Our

operating results are subject to significant fluctuation based on seasonality and other factors.

Our

operating results may fluctuate significantly from period to period as a result of a variety of factors, including purchasing patterns

of customers, competitive pricing, debt service and principal reduction payments, and general economic conditions. Additionally, we

expect to experience seasonality in the rental segment of our business, with stronger revenue generation during traditional vacation

periods for those expected locations. Our business of selling units may be moderately cyclical as the demand for vacation units for sale

is affected by the availability and cost of financing for purchasers, as well as general economic conditions and the relative health

of the travel industry. Our operating results may vary on a quarterly basis, and may fluctuate significantly in the future. Other factors

may affect our operating results, some of which are beyond the control of management. Accordingly, we believe that quarter- to-quarter

comparisons of our operating results may not necessarily be meaningful, and investors should not place undue reliance on the results

of any particular quarter as an indication of our future performance.

Risks

Relating to our Properties

Our

success will partially depend upon acquiring and redevelopment of hospitality properties in varying stages of development,

and we may be unable to consummate acquisitions on advantageous terms, the acquired properties may not perform as expected, or we

may be unable to efficiently develop or integrate assets into our existing operations.

We

intend to acquire hospitality properties in varying stages of development which we would then re-develop, operate, maintain, rent and/or manage. The acquisition of such properties entails various risks, including the risks that they may not

perform as expected, that we may be unable to integrate assets quickly and efficiently into our existing operations and that the cost

estimates for the development of a property may prove inaccurate.

Investors

are reliant on management’s assessment, selection, and development of appropriate properties.

Our

ability to achieve our current objectives is dependent upon the performance of our management team in the quality and timeliness of our

acquisition and development of hospitality properties. Subject to requirements of applicable law, our stockholders are not

expected to have an opportunity to evaluate the terms of transactions or other economic or financial data concerning any

particular property we may acquire and re-develop. Investors must rely entirely on the decisions of the management team and the oversight

of our principals.

Our

profitability may be impacted by delays in the selection, acquisition and development of properties.

We

may encounter delays in the selection, acquisition and development of properties that could adversely affect our profitability. We may

experience delays in identifying properties that satisfy ideal purchase parameters.

Our