December 15, 2020 -- InvestorsHub NewsWire -- via MarketWatch

With the end of the year fast approaching, investors are jockeying

new positions. Some part with winners and others sell their losers.

In fact, the adage that "for every sale, there is a buyer" couldn't

be more true than in the stock market, where both ecstasy and

misery can split emotions in a single trade. But, these actions

often create opportunities.

Three stocks that may be positioned to fill the role of

"opportunity taken" are micro-cap companies World Series of Golf

(OTC: WSGF),

StrikeForce Technologies (OTC: SFOR),

and Exxe Group, Inc. (OTC: AXXA).

Each earned massive attention last week.

In fact, coming off of last week's impressive gains, these three

stocks are sitting atop bullish lists, and a slew of investors

believe they are each poised to extend their gains.

And, while these companies may offer potentially exponential

gains in the coming days or weeks, set a trading strategy and stick

with it. No stocks go straight up. However, with that said,

momentum trading can be a trader's best friend. And these three

have it.

World Series of Golf Surges On Analyst Coverage

World Series of Golf (WSGF)

stock rallied sharply last week. The shares hit a high of $0.093,

and volume exceeded 139 million shares on Friday alone. That

compares to its price of $0.011 on Monday and an average volume of

roughly 2.5 million shares exchanging hands per day.

The rally started after a Goldman Small Cap Research report set

a 12-month price target of $0.20 for the stock. Compared to its

closing price on Friday, that target represents a more than 566%

gain in value. Some blogs suggest the shares can go much higher.

News on Thursday and Friday helps to support that sentiment.

On Thursday, WSGF announced that its subsidiary, Vaycaychella,

is experiencing a robust response to recent marketing efforts

targeting entrepreneurs looking to acquire and operate short-term

vacation property rentals. Management is optimistic that the

initial response rates support the company's projection to reach

$100 million in revenue during the first twelve months following

the launch of its peer-to-peer (P2P) application that will fully

automate the connection of short-term vacation property buyers with

investors.

Then, on Friday, WSGF announced a capital transaction that will

reduce balance sheet debt by $1.25 million in a deal expected to be

completed by the end of the month. Other changes are happening, as

well.

WSGF is in the process of making a corporate name change in

conjunction with its new Vaycaychella business focus. That

subsidiary provides short-term financing alternatives for vacation

rental properties that may be excluded from conventional financing

channels. Vaycaychella's mission is ambitious, to say the least.

However, the market is enormous, and the company is managed by a

team with both vision and an ability to deliver results.

At its core, WSGF believes they have designed a better way to

empower entrepreneurs to get into the short-term vacation property

rental business by utilizing sharing technology apps similar to

Airbnb, Booking.com, and Vrbo.

Investors believe in the vision as well. The combination of news

sent shares higher by more than 300% for the week on exceptionally

high volume.

StrikeForce Technologies Set To Launch Cutting Edge Conferencing

Technology

StrikeForce Technologies, Inc. (OTC

PINK: SFOR) shares soared last week after announcing that its

SafeVchat secure video conferencing platform will go live on

December 18, 2020. In addition to launching the service, the

company said it has secured distribution partners in six countries

that are already set up and ready to sell. Those deals could lead

to robust revenue streams in the near term.

Mark L. Kay, CEO of StrikeForce, said,

"We have never been as excited about launching a new

product as we are right now... the stars have definitely lined up

for us like never before. The reason why I can say that is because

of the following three reasons, we will be launching the industry's

most secure video conferencing platform, the video conferencing

industry is now forecast to hit $50+ billion by the end of 2025

(according to Global Market Insights), and Continuation Capital is

funding us with others approximately up to $2,500,000 for product

marketing for SafeVchat and to retire convertible debt."

Shares closed the week higher by an extraordinary 5253% on the

news, with more than one billion shares trading hands on the week.

The stock closed on Friday just off its high for the week, leading

investors to expect a continuation into Monday. Additional news

early in the week could certainly add more fuel to its phenomenal

run. Be careful, though.

As noted, the stock is higher by more than 5253% in a single

week. A pullback may be healthy before the stock continues to move

higher as its products develop. An overbought condition could also

send prices lower ahead of a next leg higher.

Exxe Group, Inc. Under The Radar

An under-the-radar stock that is gaining in popularity is Exxe

Group (AXXA).

Shares are trading at roughly $0.011, and the average volume stands

at approximately seven million shares exchanged daily. Exxe is an

exciting story, and it's under-the-radar profile may be short-lived

after posting record revenues in its most recent quarter.

Last month, AXXA reported that it generated $8.2 million in

gross revenues during its fiscal second quarter of 2021. That

revenue surpassed the $7.7 million record set in its previous

quarter and showed sequential growth of 5% quarter-over-quarter.

Compared to the same period last year, second-quarter revenue

increased 211% from $2,619,576, and produced net income of

$1,249,894 against a $(831,911) loss in the comparable period.

Also impressive for a micro-cap company is that total assets on

the balance sheet at the end of its second-quarter were

$206,022,467, a 32% increase from the $152,958,973 in the same

period last year. Assets of that magnitude are impressive by any

measure. And, with the stock trading at a penny a share, investors

are starting to take notice.

Clearly, the trends are higher. AXXA's $15.8M revenues in the

first half of its fiscal 2021 grew 216% compared to the same period

last year. Revenues came from AXXA's agribusiness segment as a

result of rising commodity prices. Agribusiness was Exxe's single

largest revenue contributor, followed by Real Estate.

Looking ahead, AXXA noted that its UK-based 1Myle currency

exchange is set to go live. The company estimates that 1Myle can

generate $15 million in revenues during the first twelve months of

operation from bitcoin exchange trading activities.

The sum of the parts creates a compelling thesis for investment

consideration. Strong revenues, a substantial asset base, and plans

in motion to accelerate revenue growth in the coming weeks and

quarters may show Exxe to be significantly undervalued at current

levels.

Investors are taking notice, and sent the stock 11% higher on

Friday.

Micro-Cap Stocking Stuffers

Heading into the back half of the month, the companies profiled

above have put together well thought out plans to sustain their

upward trends. Remember, no stock goes straight up, so expect

pullbacks that can be healthy to long-term appreciation. However,

the measure of risk/reward is favorable based on each company's

ability to transform its intrinsic value into shareholder

value.

Also, with each stock earning a sizable amount of attention over

the weekend, expect some erratic moves in either direction. But,

after the rush subsides, the fundamentals should replace emotion

and allow these companies to earn an appropriate valuation... with

the consensus calling for sustained appreciation.

Media Contact

Company Name: Soulstring Media Group

Contact Person: Kenny Soulstring

Email: Send

Email

City: Miami Beach

State: Florida

Country: United States

Website: https://www.soulstringmedia.com

Source: https://www.marketwatch.com/press-release/three-red-hot-micro-caps-that-can-make-this-holiday-season-cheerful-wsgf-sfor-and-axxa-2020-12-15

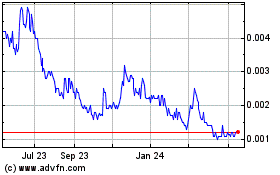

Exxe (PK) (USOTC:AXXA)

Historical Stock Chart

From Dec 2024 to Jan 2025

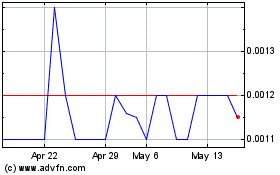

Exxe (PK) (USOTC:AXXA)

Historical Stock Chart

From Jan 2024 to Jan 2025