Filed Pursuant to Rule 253(g)(1)

File No. 024-11621

OFFERING CIRCULAR

Black Bird Biotech, Inc.

100,000,000 Shares of Common Stock

This Post-Qualification Offering Circular Amendment No. 1 (the “PQA”) amends the Offering Circular of Black Bird Biotech, Inc., dated September 9, 2021, as qualified on September 9, 2021, and as may be amended and supplemented from time to time, to add additional shares of common stock (the “Offered Shares”) to be offered pursuant to the Offering Circular. This PQA relates to the offer and sale of up to an additional 50,000,000 Offered Shares, for a revised maximum of 100,000,000 Offered Shares.

By this Offering Circular, Black Bird Biotech, Inc., a Nevada corporation, is offering for sale a maximum of 100,000,000 shares of its common stock (the “Offered Shares”), at a fixed price of $0.015 per share, pursuant to Tier 2 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). A minimum purchase of $1,000 of the Offered Shares is required in this offering. This offering is being conducted on a best-efforts basis, which means that there is no minimum number of Offered Shares that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds from this offering will become immediately available to us and may be used as they are accepted. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments.

This offering was qualified by the SEC on September 9, 2021; this offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

|

Title of

Securities Offered

|

|

Number

of Shares

|

|

|

Price to Public

|

|

|

Commissions (1)

|

|

|

Proceeds to Company (2)

|

|

|

Common Stock

|

|

|

100,000,000

|

|

|

$

|

0.015

|

|

|

$

|

-0-

|

|

|

$

|

1,500,000

|

|

|

|

(1)

|

We may offer the Offered Shares through registered broker-dealers and we may pay finders. However, information as to any such broker-dealer or finder shall be disclosed in an amendment to this Offering Circular.

|

|

|

(2)

|

Does not account for the payment of expenses of this offering estimated at $12,500. See “Plan of Distribution.”

|

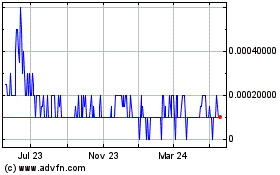

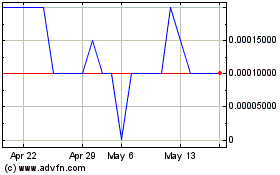

Our common stock is quoted in the over-the-counter under the symbol “BBBT” in the OTC Pink marketplace of OTC Link. On September 23, 2021, the closing price of our common stock was $0.02 per share.

Investing in the Offered Shares is speculative and involves substantial risks. You should purchase such securities only if you can afford a complete loss of your investment. See Risk Factors, beginning on page 5, for a discussion of certain risks that you should consider before purchasing any of the Offered Shares.

THE SEC DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC. HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in Offered Shares.

No sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State Law Exemption and Offerings to ‘Qualified Purchasers’” (page 12). Before making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular follows the disclosure format of Form S-1, pursuant to the General Instructions of Part II(a)(1)(ii) of Form 1-A.

The date of this Post-Qualification Offering Circular Amendment No. 1 is September 24, 2021.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of our company; and various other matters (including contingent liabilities and obligations and changes in accounting policies, standards and interpretations). These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words anticipates, believes, continue, could, estimates, expects, intends, may, might, plans, possible, potential, predicts, projects, seeks, should, will, would and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below in the Risk Factors section. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

OFFERING CIRCULAR SUMMARY

The following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular carefully, including the Risk Factors section and the consolidated financial statements and the notes thereto. Unless otherwise indicated, the terms “we”, “us” and “our” refer and relate to Black Bird Biotech, Inc., a Nevada corporation, including its wholly-owned subsidiaries, Black Bird Potentials Inc., a Wyoming corporation (“BB Potentials”), Big Sky American Dist., LLC, a Montana limited liability company (“Big Sky American”), and Black Bird Hemp Manager, LLC, a Montana limited liability company.

Our Company

We were incorporated in the State of Nevada in 2006 under the name “Cyprium Resources Inc.”, which was changed in August 2009 to “Digital Development Partners, Inc.” Our corporate name was changed to “Black Bird Biotech, Inc.,” effective June 14, 2021. Through 2014, our company was involved, first, in the mining industry and, then, in the communications industry. From 2015 until the January 2020 acquisition of Black Bird Potentials Inc., a Wyoming corporation (BB Potentials), our company was a “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934. Our Board of Directors has adopted the business plan of BB Potentials and our ongoing operations now include those of BB Potentials.

We are the exclusive worldwide manufacturer and distributor for MiteXstreamTM, an EPA-certified plant-based biopesticide effective in the eradication of mites and similar pests, including spider mites, a pest that destroys crops, especially cannabis, hops, coffee and house plants, as well as molds and mildew. (See “Business—MiteXstream”).

We also manufacture and sell, under our Grizzly Creek NaturalsTM brand name, CBD products, including CBD Oils, gummies and pet treats, and CBD-infused personal care products, as well as hand sanitizer gel and spray products. In addition, BB Potentials is a licensed grower of industrial hemp under the Montana Hemp Pilot Program. (See “Business—Grizzly Creek Naturals”).

Offering Summary

|

Securities Offered

|

|

The Offered Shares, 100,000,000 shares of common stock, are being offered by our company.

|

|

Offering Price Per Share

|

|

$0.015 per Offered Share.

|

|

Shares Outstanding

Before This Offering

|

|

224,197,495 shares of common stock issued and outstanding as of the date of this Offering Circular.

|

|

Shares Outstanding

After This Offering

|

|

294,697,495 shares of common stock issued and outstanding, assuming a maximum offering hereunder. As of the date of this PQA, a total of 29,500,000 of the Offered Shares have been sold hereunder.

|

|

Minimum Number of Shares

to Be Sold in This Offering

|

|

None

|

|

Investor Suitability Standards

|

|

The Offered Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include: (a) “accredited investors” under Rule 501(a) of Regulation D and (b) all other investors so long as their investment in the Offered Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons).

|

|

Market for our Common Stock

|

|

Our common stock is quoted in the over-the-counter market under the symbol “BBBT” in the OTC Pink marketplace of OTC Link.

|

|

Termination of this Offering

|

|

This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. (See “Plan of Distribution”).

|

|

Use of Proceeds

|

|

We will apply the proceeds of this offering for the purchase of inventories, product testing expenses, sales and marketing expenses, payment of certain indebtedness, general and administrative expenses and working capital. (See “Use of Proceeds”).

|

|

Risk Factors

|

|

An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares.

|

|

Corporate Information

|

|

Our principal executive offices are located at 3505 Yucca Drive Suite 104, Flower Mound, Texas 75022; our telephone number is (833) 223-4204; our corporate website is located at www.blackbirdbiotech.com. No information found on our company’s website is part of this Offering Circular.

|

Continuing Reporting Requirements Under Regulation A

We are required to file periodic and other reports with the SEC, pursuant to the requirements of Section 13(a) of the Securities Exchange Act of 1934. Our continuing reporting obligations under Regulation A are deemed to be satisfied, as long as we comply with sour Section 13(a) reporting requirements. As a Tier 2 issuer under Regulation A, we will be required to file with the SEC a Form 1-Z (Exit Report Under Regulation A) upon the termination of this offering.

RISK FACTORS

An investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular before purchasing any of the Offered Shares. The occurrence of any of the following risks might cause you to lose a significant part of your investment. The risks and uncertainties discussed below are not the only ones we face, but do represent those risks and uncertainties that we believe are most significant to our business, operating results, prospects and financial condition. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements.

Risks Related to Our Company

We have a limited operating history, which may make it difficult for investors to predict future performance based on current operations. We have a limited operating history upon which investors may base an evaluation of our potential future performance. In particular, we have not proven that we can manufacture and sell our MiteXstream biopesticide product in a manner that enables us to be profitable and meet customer requirements, raise sufficient capital in the public and/or private markets or respond effectively to competitive pressures. As a result, there can be no assurance that we will be able to develop or maintain consistent revenue sources, or that our operations will be profitable and/or generate positive cash flows.

Any forecasts we make about our operations may prove to be inaccurate. We must, among other things, determine appropriate risks, rewards, and level of investment in our product lines, respond to economic and market variables outside of our control, respond to competitive developments and continue to attract, retain, and motivate qualified employees. There can be no assurance that we will be successful in meeting these challenges and addressing such risks and the failure to do so could have a materially adverse effect on our business, results of operations, and financial condition. Our prospects must be considered in light of the risks, expenses, and difficulties frequently encountered by companies in the early stage of development. As a result of these risks, challenges, and uncertainties, the value of your investment could be significantly reduced or completely lost.

The report of our independent auditors indicates uncertainty concerning our ability to continue as a going concern and this may impair our ability to raise capital to fund our business. In its opinion on our financial statements for the year ended December 31, 2020, our independent auditors raised substantial doubt about our ability to continue as a going concern. We cannot assure you that this will not impair our ability to raise capital on attractive terms. Additionally, we cannot assure you that we will ever achieve significant revenues and therefore remain a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

There is doubt about our ability to develop as a viable business, and it is expected that we will need additional funding. Our current efforts are focused on developing sales of: (a) our MiteXstream biopesticide product; and (b) our Grizzly Creek Naturals CBD and other products. In addition, and assuming the availability of capital, of which there is not assurance, our parallel long-term efforts are focused on the establishment of a hemp processing facility under our Black Bird American Hemp division. To date, we have derived a modest level of revenues. We must obtain capital, in order to exploit the business potential our products, in general, and, in particular, MiteXstream. There can be no assurance that any one of our business activities will prove to be successful.

It is possible that the novel Coronavirus pandemic could cause long-lasting stock market volatility and weakness, as well as long-lasting recessionary effects on the United States and/or global economies. Should the negative economic impact caused by the novel Coronavirus pandemic result in long-term economic weakness in the United States and/or globally, our ability to establish our business would be severely negatively impacted. It is possible that our company would not be able to sustain during any such long-term economic weakness.

We have incurred significant losses in prior periods, and losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows. We have incurred significant losses in prior periods. For the six months ended June 30, 2021, we incurred a net loss of $474,047 (unaudited) and, as of that date, we had an accumulated deficit of $1,283,928 (unaudited). For the year ended December 31, 2020, we incurred a net loss of $690,158 and, as of that date, we had an accumulated deficit of $839,669. Any losses in the future could cause the quoted price of our common stock to decline or have a material adverse effect on our financial condition, our ability to pay our debts as they become due, and on our cash flows.

If we fail to secure the required additional financing on acceptable terms and in a timely manner, our ability to implement our business plan will be compromised and we may be unable to sustain our operations. We have limited capital resources and operations. To date, our operations have been funded extensively from the proceeds of equity sales and, to a lesser extent, debt financings. We will require substantial additional capital in the near future to accomplish our business objectives. We may be unable to obtain additional financing on terms acceptable to us, or at all.

Even if we obtain financing for our near-term operations, we expect that we will require additional capital thereafter. Our capital needs will depend on numerous factors including: (a) our profitability; (b) the release of competitive products and services by our competition; (c) the level of our investment in research and development; and (d) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership held by our existing shareholders will be reduced and our shareholders may experience significant dilution. In addition, new securities may contain rights, preferences, or privileges that are senior to those of our common stock. If we raise additional capital by incurring debt, this will result in increased interest expense. If we raise additional funds through the issuance of securities, market fluctuations in the price of our shares of common stock could limit our ability to obtain equity financing.

We cannot give any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us. If we are unable to raise capital when needed, our business, financial condition, and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue our operations.

We may be unable to obtain sufficient capital to pursue our growth strategy. We do not possess sufficient financial resources to implement our complete business plan, including the commercial exploitation of MiteXstream. We are currently seeking available sources of capital. There is no assurance that we will obtain needed capital, nor is there any assurance that our business will be able to generate revenues that are sufficient to sustain our operations. We are not able to offer assurance that we will be able to obtain needed sources of financing to satisfy our working capital needs.

We do not have a successful operating history. We are without a history of successful business operations, which makes a purchase of Offered Shares speculative in nature. Because of this lack of operating history, it is difficult to forecast our future operating results. Additionally, our operations are subject to risks inherent in the establishment of a new business, including, among other factors, efficiently deploying our capital, developing and implementing our marketing campaigns and strategies and developing awareness and acceptance of our products.

There are risks and uncertainties encountered by early-stage companies. As an early-stage company, we are unable to offer assurance that we will be able to overcome the lack of recognition for the MiteXstream and Grizzly Creek Naturals brand names and, later, the Black Bird American Hemp brand name, and our lack of capital.

We may not be successful in establishing our business model. We are unable to offer assurance that we will be successful in bringing our products to market and earning a profit from such efforts. Should we fail to implement successfully our business plan, you can expect to lose your entire investment in the Offered Shares.

We may never earn a profit. Because we lack a successful operating history, we are unable to offer assurance that we will ever earn a profit from our operations.

If we are unable to manage future expansion effectively, our business may be adversely impacted. In the future, we may experience rapid growth in our business, which could place a significant strain on our operations, in general, and our internal controls and other managerial, operating and financial resources, in particular. If we are unable to manage future expansion effectively, our business would be harmed. There is, of course, no assurance that we will enjoy rapid development in our business.

We currently depend on the efforts of our executive officers’ serving without current compensation; the loss of these officers could disrupt our operations and adversely affect the development of our business. Our success in establishing our business operations will depend, primarily, on the continued service of our President, Fabian G. Deneault, and our Vice President, Eric Newlan. We have not yet entered into employment agreements with Messrs. Deneault and Newlan, although we expect to do so in the near future. (See “Executive Compensation”). However, the loss of service of either of such persons, for any reason, could seriously impair our ability to execute our business plan, which could have a materially adverse effect on our business and future results of operations. We have not purchased any key-man life insurance.

If we are unable to recruit and retain key personnel, our business may be harmed. If we are unable to attract and retain key personnel, our business may be harmed. Our failure to enable the effective transfer of knowledge and facilitate smooth transitions with regard to our key employees could adversely affect our long-term strategic planning and execution.

Our business plan is not based on independent market studies. We have not commissioned any independent market studies concerning the market for MiteXstream, any of our Grizzly Creek Naturals CBD and other products or for our planned other industrial hemp products. Rather, our plans for implementing our business strategy and achieving profitability are based on the experience, judgment and assumptions of our executive officers. If these assumptions prove to be incorrect, we may not be successful in establishing our business.

Our Board of Directors may change our policies without shareholder approval. Our policies, including any policies with respect to investments, leverage, financing, growth, debt and capitalization, will be determined by our Board of Directors or officers to whom our Board of Directors delegate such authority. Our Board of Directors will also establish the amount of any dividends or other distributions that we may pay to our shareholders. Our Board of Directors or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any time without shareholder vote. Accordingly, our shareholders will not be entitled to approve changes in our policies, which policy changes may have a material adverse effect on our financial condition and results of operations.

Risks Related to Our Business

We may not be able to compete effectively in our intended markets. None of our products enjoys name recognition and many of our competitors possess substantially greater resources, financial and otherwise, than does our company. There is no assurance that we will be able to establish our business and compete successfully in this environment.

We may suffer sluggish or negative sales growth as a result of the novel Coronavirus pandemic. It is possible that the negative economic impact caused by the novel Coronavirus pandemic will result in long-term economic weakness in the United States and/or globally and our ability to establish our business would be severely negatively impacted. It is possible that our company would not be able to survive as a going business during any such long-term economic weakness.

Introduction of new products by competitors could harm our competitive position and results of operations. The respective markets for our products – MiteXstream, our Grizzly Creek Naturals CBD and other products and planned Black Bird American Hemp products – are characterized by severe competition, evolving industry standards, evolving business and distribution models, price cutting, with resulting downward pressure on gross margins, and price sensitivity on the part of customers. In particular, with respect to our CBD products, we face the risk that there exist minimal barriers to the entry of competitors into the market segment.

Our future success will depend on our ability to gain product name recognition and customer loyalty, as well as our being able to anticipate and respond to emerging standards and other unforeseen changes. If we fail to satisfy such standards of operation, our operating results could suffer. Further, intra-industry consolidations may result in stronger competitors and may, therefore, also harm our future results of operations.

If we fail to maintain a positive reputation with consumers concerning our products, we may not be able to develop loyalty to our products, and our operating results may be adversely affected. We believe a positive reputation with customers to be highly important in developing loyalty to our products. To the extent our products are perceived as low quality or otherwise not compelling to potential customers, our ability to establish and maintain a positive reputation and product loyalty may be adversely impacted.

We are subject to payment processing risk. A portion of purchases of our products are made online by customers using credit/debit cards. For the foreseeable future, we intend to rely on third parties to process payment. Acceptance and processing of these payment methods are subject to certain rules and regulations and require payment of interchange and other fees. To the extent there are disruptions in our payment processing systems, our revenue, operating expenses and results of operation could be adversely impacted.

Laws and regulations affecting the regulated industrial hemp industry are in a constant state of flux, which could negatively affect our business, and we cannot predict the impact that future regulations may have on us. Local, state and federal industrial hemp laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs associated with compliance or alter our business. In addition, violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our business operations. In addition, it is likely that regulations may be enacted in the future that will be directly applicable to our CBD business. We are unable to predict the nature of any future laws, regulations, interpretations or applications, nor are we able to determine the effect any such additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on our CBD business.

FDA regulation of industrial hemp and industrial-hemp-derived CBD could negatively affect the industrial hemp industry, which could adversely affect our financial condition. While the 2018 Farm Bill recently legalized industrial hemp, the U.S. Food and Drug Administration (FDA) intends to regulate it under the Food, Drug and Cosmetics Act of 1938. Additionally, the FDA is in the process of issuing rules and regulations, including CGMPs (certified good manufacturing practices) related to the licensing of growth, cultivation, harvesting and processing of industrial hemp. Companies may need to perform clinical trials to verify efficacy and safety, which could prove costly and delay production and profits. It appears likely the FDA will require that facilities where hemp is grown be registered and comply with certain federally prescribed regulations which have not yet been released. In the event that some or all of these regulations are imposed, we are unable to predict what the impact would be on the industrial hemp industry, what costs, requirements and possible prohibitions may be enforced. If we are unable to comply with the regulations and or registration as may be prescribed by the FDA, we may be unable to continue to operate our business in its current form or at all, to the extreme detriment to our financial operating results and condition.

Because we manufacture and sell CBD products, it is possible that, in the future, we may have difficulty accessing the service of banks. While industrial hemp cultivation was legalized by the 2018 Farm Bill, the FDA is choosing to regulate certain hemp products, including CBD. It is possible that the circumstances surrounding the FDA’s handling of CBD-related issues could cause us to have difficulty securing services from banks, in the future.

If our trademarks and other proprietary rights are not adequately protected to prevent use or appropriation by competitors, the value of our brands may be diminished, and our business adversely affected. We rely, and expect to continue to rely, on a combination of confidentiality and license agreements with employees, consultants and third parties with whom we have relationships, as well as trademark protection laws, to protect our proprietary rights. If the protection of our intellectual property rights is inadequate to prevent use or misappropriation by third parties, the value of our brands, including MiteXstream, Grizzly Creek Naturals and Black Bird American Hemp, may be diminished, and the perception of our products may become confused in the marketplace. In such circumstance, our business could be adversely affected.

Our operating results can be expected to be seasonal. With respect to MiteXstream, sales can be expected to be seasonal in nature, with greater sales volumes occurring during the warmer months of the growing season. However, because our business is only in its nascent stage, we are unable to predict how our operating results will be affected by such seasonality.

Pests, disease, severe weather, natural disasters and other conditions could result in substantial losses to our planned industrial hemp crops and weaken our financial condition. Pests, crop disease, severe weather conditions, such as floods, droughts and windstorms, and natural disasters could adversely affect our ability to produce our planned industrial hemp crops. Should any such adverse event occur, it can be expected that we would lose our investment in the affected industrial hemp crops.

We could be subject to product liability claims. The sale of MiteXstream biopesticide and Grizzly Creek Naturals CBD and other products involves, and will involve, the risk of injury to customers and others. There can be no assurance that the use or consumption of any of one of our products will not cause a health-related illness or that it will not be subject to claims or lawsuits relating to such matters. We intend to purchase product liability insurance during September 2021. Any claims or liabilities might not be covered by our insurance, once obtained. Thus, there is no assurance that we would not incur claims or liabilities for which we are not insured or that exceed the amount of our insurance coverage, resulting in cash outlays that could, if significant enough in nature, materially and adversely affect our results of operations and financial condition.

Environmental and other regulation could adversely impact our planned industrial hemp farming business, by increasing production costs. Because our planned industrial hemp farming business can be expected to use fertilizers, pesticides and other agricultural products, we will be subject to regulations relating to their use and disposal. A decision by a regulatory agency to restrict significantly the use of such products that have traditionally been used in the production of hemp could have an adverse impact on us. In addition, if a regulatory agency were to determine our company not to be in compliance with a regulation in that agency’s jurisdiction, this could result in substantial penalties.

Risks Related to Our Organization and Structure

Our holding company structure makes us dependent on our subsidiaries for our cash flow and could serve to subordinate the rights of our shareholders to the rights of creditors of our subsidiaries, in the event of an insolvency or liquidation of any such subsidiary. Our company acts as a holding company and, accordingly, substantially all of our operations are conducted through our subsidiaries. Such subsidiaries will be separate and distinct legal entities. As a result, substantially all of our cash flow will depend upon the earnings of our subsidiaries. In addition, we will depend on the distribution of earnings, loans or other payments by our subsidiaries. No subsidiary will have any obligation to provide our company with funds for our payment obligations. If there is an insolvency, liquidation or other reorganization of any of our subsidiaries, our shareholders will have no right to proceed against their assets. Creditors of those subsidiaries will be entitled to payment in full from the sale or other disposal of the assets of those subsidiaries before our company, as a shareholder, would be entitled to receive any distribution from that sale or disposal.

Risks Related to a Purchase of the Offered Shares

We may seek capital that may result in shareholder dilution or that may have rights senior to those of our common stock, including the Offered Shares. From time to time, we may seek to obtain additional capital, either through equity, equity-linked or debt securities. The decision to obtain additional capital will depend on, among other factors, our business plans, operating performance and condition of the capital markets. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to the rights of our common stock, which could negatively affect the market price of our common stock or cause our shareholders to experience dilution.

We do not intend to pay dividends on our common stock. We intend to retain earnings, if any, to provide funds for the implementation of our business strategy. We do not intend to declare or pay any dividends in the foreseeable future. Therefore, there can be no assurance that holders of our common stock will receive cash, stock or other dividends on their shares of our common stock, until we have funds which our Board of Directors determines can be allocated to dividends.

Our common stock is a “Penny Stock,” which may impair trading liquidity. Disclosure requirements pertaining to penny stocks may reduce the level of trading activity in the market for our common stock and investors may find it difficult to sell their shares. Trades of our common stock will be subject to Rule 15g-9 of the SEC, which rule imposes certain requirements on broker-dealers who sell securities subject to the rule to persons other than established customers and accredited investors. For transactions covered by the rule, broker-dealers must make a special suitability determination for purchasers of the securities and receive the purchaser’s written agreement to the transaction prior to sale. The SEC also has rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

It is possible that our common stock will continue to be thinly traded and its market price highly volatile. Our common stock is quoted in the over-the-counter market under the symbol “BBBT” in the OTC Pink marketplace of OTC Link. For over the past five years, our common stock has traded sporadically and has been extremely limited in nature. A limited market is characterized by a relatively limited number of shares in the public float, relatively low trading volume and a small number of brokerage firms acting as market makers. The market for low-priced securities is generally less liquid and more volatile than securities traded on national stock markets. Wide fluctuations in market prices are not uncommon. No assurance can be given that the market for our common stock will become robust or less volatile.

The price of our common stock may be subject to wide fluctuations in response to factors such as the following, some of which are beyond our control:

|

|

·

|

quarterly variations in our operating results;

|

|

|

·

|

operating results that vary from the expectations of investors;

|

|

|

·

|

changes in expectations as to our future financial performance, including financial estimates by investors;

|

|

|

·

|

reaction to our periodic filings, or presentations by executives at investor and industry conferences;

|

|

|

·

|

changes in our capital structure;

|

|

|

·

|

changes in market valuations of other pesticide companies;

|

|

|

·

|

announcements of innovations or new products by us or our competitors;

|

|

|

·

|

announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

·

|

lack of success in the expansion of our business operations;

|

|

|

·

|

announcements by third parties of significant claims or proceedings against our company or adverse developments in pending proceedings;

|

|

|

·

|

additions or departures of key personnel;

|

|

|

·

|

asset impairment;

|

|

|

·

|

temporary or permanent inability to offer products or services; and

|

|

|

·

|

rumors or public speculation about any of the above factors.

|

Future sales of our common stock, or the perception in the public markets that these sales may occur, could reduce the market price of our common stock. Our current shareholders, including our management, hold shares of our restricted common stock, and are able to sell their shares in the market. In general, our officers and directors and 10% shareholders, as affiliates, under Rule 144 may not sell more than one percent of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. The availability for sale of substantial amounts of our common stock under Rule 144 or otherwise could reduce prevailing market prices for our common stock.

As of the date of this Offering Circular, there is a total of 78,450,482 shares of our common stock reserved for issuance upon conversion of the currently convertible portions of convertible debt instruments and pursuant to agreements. All such shares constitute an overhang on the market for our common stock and, if and when issued, will be issued without transfer restrictions, pursuant to certain exemptions from registration, and could reduce prevailing market prices for our common stock. Also, in the future, we may also issue securities in connection with our obtaining needed capital or an acquisition transaction. The amount of shares of our common stock issued in connection with any such transaction could constitute a material portion of our then-outstanding shares of common stock.

Future issuances of debt securities and equity securities could negatively affect the market price of shares of our common stock and, in the case of equity securities, may be dilutive to existing shareholders. In the future, we may issue debt or equity securities or incur other financial obligations, including stock dividends. Upon liquidation, it is possible that holders of our debt securities and other loans and preferred stock would receive a distribution of our available assets before common shareholders. We are not required to offer any such additional debt or equity securities to existing shareholders on a preemptive basis. Therefore, additional common stock issuances, directly or through convertible or exchangeable securities, warrants or options, would dilute the holdings of our existing common shareholders and such issuances, or the perception of such issuances, could reduce the market price of shares of our common stock.

As an issuer of penny stock, the protection provided by the federal securities laws relating to forward-looking statements does not apply to us. Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection, in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

DILUTION

Dilution in net tangible book value per share to purchasers of our common stock in this offering represents the difference between the amount per share paid by purchasers of the Offered Shares in this offering and the pro forma as adjusted net tangible book value per share immediately after completion of this offering. In this offering, dilution is attributable primarily to our relatively low net tangible book value per share.

If you purchase Offered Shares in this offering, your investment will be diluted to the extent of the difference between your purchase price per Offered Share and the net pro forma as adjusted tangible book value per share of our common stock after this offering. Our net tangible book value as of June 30, 2021, was $172,787 (unaudited), or $0.00 per share.

The tables below illustrate the dilution to purchasers of Offered Shares in this offering, on a pro forma basis, assuming 100%, 75%, 50% and 25% of the Offered Shares are sold.

|

Assuming the Sale of 100% of the Offered Shares

|

|

|

|

|

|

|

|

Offering price per share

|

|

$

|

0.015

|

|

|

Net tangible book value per share as of June 30, 2021

|

|

$

|

0.00

|

|

|

Increase in net tangible book value per share after giving effect to this offering

|

|

$

|

0.0015

|

|

|

Pro forma net tangible book value per share as of June 30, 2021

|

|

$

|

0.0015

|

|

|

Dilution in net tangible book value per share to purchasers of Offered Shares in this offering

|

|

$

|

0.0085

|

|

|

|

|

|

|

|

|

Assuming the Sale of 75% of the Offered Shares

|

|

|

|

|

|

|

|

Offering price per share

|

|

$

|

0.015

|

|

|

Net tangible book value per share as of June 30, 2021

|

|

$

|

0.00

|

|

|

Increase in net tangible book value per share after giving effect to this offering

|

|

$

|

0.0019

|

|

|

Pro forma net tangible book value per share as of June 30, 2021

|

|

$

|

0.0019

|

|

|

Dilution in net tangible book value per share to purchasers of Offered Shares in this offering

|

|

$

|

0.0081

|

|

|

|

|

|

|

|

|

Assuming the Sale of 50% of the Offered Shares

|

|

|

|

|

|

|

|

Offering price per share

|

|

$

|

0.015

|

|

|

Net tangible book value per share as of June 30, 2021

|

|

$

|

0.00

|

|

|

Increase in net tangible book value per share after giving effect to this offering

|

|

$

|

0.0024

|

|

|

Pro forma net tangible book value per share as of June 30, 2021

|

|

$

|

0.0024

|

|

|

Dilution in net tangible book value per share to purchasers of Offered Shares in this offering

|

|

$

|

0.0076

|

|

|

|

|

|

|

|

|

Assuming the Sale of 25% of the Offered Shares

|

|

|

|

|

|

|

|

Offering price per share

|

|

$

|

0.015

|

|

|

Net tangible book value per share as of June 30, 2021

|

|

$

|

0.00

|

|

|

Increase in net tangible book value per share after giving effect to this offering

|

|

$

|

0.0028

|

|

|

Pro forma net tangible book value per share as of June 30, 2021

|

|

$

|

0.0028

|

|

|

Dilution in net tangible book value per share to purchasers of Offered Shares in this offering

|

|

$

|

0.0072

|

|

USE OF PROCEEDS

The table below sets forth the estimated proceeds we would derive from this offering, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares and assuming the payment of no sales commissions or finder’s fees. There is, of course, no guaranty that we will be successful in selling any of the Offered Shares in this offering.

|

|

|

Assumed Percentage of Offered Shares Sold in This Offering

|

|

|

|

|

|

25%

|

|

|

|

50%

|

|

|

|

75%

|

|

|

|

100%

|

|

|

Offered Shares sold

|

|

|

25,000,000

|

|

|

|

50,000,000

|

|

|

|

75,000,000

|

|

|

|

100,000,000

|

|

|

Gross proceeds

|

|

$

|

375,000

|

|

|

$

|

750,000

|

|

|

$

|

1,125,000

|

|

|

$

|

1,500,000

|

|

|

Offering expenses

|

|

|

12,500

|

|

|

|

12,500

|

|

|

|

12,500

|

|

|

|

12,500

|

|

|

Net proceeds

|

|

$

|

362,500

|

|

|

$

|

737,500

|

|

|

$

|

1,112,500

|

|

|

$

|

1,487,500

|

|

The table below sets forth the manner in which we intend to apply the net proceeds derived by us in this offering, assuming the sale of 25%, 50%, 75% and 100% of the Offered Shares. All amounts set forth below are estimates.

|

|

|

Use of Proceeds for Assumed Percentage of Offered Shares Sold in This Offering

|

|

|

|

|

|

25%

|

|

|

|

50%

|

|

|

|

75%

|

|

|

|

100%

|

|

|

Product Manufacturing

|

|

$

|

100,000

|

|

|

$

|

125,000

|

|

|

$

|

150,000

|

|

|

$

|

150,000

|

|

|

Purchase of Inventories

|

|

|

10,000

|

|

|

|

30,000

|

|

|

|

50,000

|

|

|

|

50,000

|

|

|

Repayment of Indebtedness

|

|

|

0

|

|

|

|

158,125

|

(1)

|

|

|

409,075

|

(2)

|

|

|

969,325

|

(3)

|

|

New Product Development

|

|

|

0

|

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

15,000

|

|

|

Product Testing

|

|

|

0

|

|

|

|

5,000

|

|

|

|

10,000

|

|

|

|

10,000

|

|

|

Sales and Marketing

|

|

|

135,000

|

|

|

|

135,000

|

|

|

|

1355,000

|

|

|

|

225,000

|

|

|

General & Administrative Expenses

|

|

|

62,500

|

|

|

|

222,500

|

|

|

|

222,500

|

|

|

|

112,250

|

|

|

Working Capital

|

|

|

55,000

|

|

|

|

119,375

|

|

|

|

125,925

|

|

|

|

45,925

|

|

|

Total Net Proceeds

|

|

$

|

362,500

|

|

|

$

|

737,500

|

|

|

$

|

1,112,500

|

|

|

$

|

1,487,500

|

|

|

(1)

|

The indebtedness to be repaid with such proceeds (with an estimated payment amount) includes: (a) SE Holdings, LLC ($75,625) – the proceeds from this loan were applied to the acquisition of distribution assets; and (b) Power Up #4 ($82,500) – the proceeds from this loan were applied to operating expenses and for working capital.

|

|

(2)

|

The indebtedness to be repaid with such proceeds (with an estimated payment amount) includes: (a) Tri-Bridge Ventures LLC ($30,000) – the proceeds from this loan were applied to operating expenses; (b) SE Holdings, LLC ($75,625) – the proceeds from this loan were applied to the acquisition of distribution assets; (c) Power Up #4 ($82,500) – the proceeds from this loan were applied to operating expenses and for working capital; and (d) FirstFire Global Opportunities funds LLC ($200,000) – the proceeds from this loan were applied to operating expenses and for working capital.

|

|

(3)

|

The indebtedness to be repaid with such proceeds (with an estimated payment amount) includes: (a) Tri-Bridge Ventures LLC ($30,000) – the proceeds from this loan were applied to operating expenses; (b) SE Holdings, LLC ($75,625) – the proceeds from this loan were applied to the acquisition of distribution assets; (c) Power Up #3 ($110,250) – the proceeds from this loan were applied to operating expenses and for working capital; (d) Power Up #4 ($82,500) – the proceeds from this loan were applied to operating expenses and for working capital; (e) FirstFire Global Opportunities funds LLC ($200,000) – the proceeds from this loan were applied to operating expenses and for working capital; and (f) Tiger Trout Capital Puerto Rico LLC ($450,000) - the proceeds from this loan were applied to operating expenses and for working capital.

|

We reserve the right to change the foregoing use of proceeds, should our management believe it to be in the best interest of our company. The allocations of the proceeds of this offering presented above constitute the current estimates of our management and are based on our current plans, assumptions made with respect to the industries in which we currently or, in the future, expect to operate, general economic conditions and our future revenue and expenditure estimates.

Investors are cautioned that expenditures may vary substantially from the estimates presented above. Investors must rely on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds of this offering for other purposes.

In the event we do not obtain the entire offering amount hereunder, we may attempt to obtain additional funds through private offerings of our securities or by borrowing funds. Currently, we do not have any committed sources of financing.

PLAN OF DISTRIBUTION

In General

Our company is offering a maximum of 100,000,000 Offered Shares on a best-efforts basis, at a fixed price of $0.015 per Offered Share; any funds derived from this offering will be immediately available to us for our use. There will be no refunds. This offering will terminate at the earliest of (a) the date on which the maximum offering has been sold, (b) the date which is one year from this offering being qualified by the SEC or (c) the date on which this offering is earlier terminated by us, in our sole discretion.

There is no minimum number of Offered Shares that we are required to sell in this offering. All funds derived by us from this offering will be immediately available for use by us, in accordance with the uses set forth in the Use of Proceeds section of this Offering Circular. No funds will be placed in an escrow account during the offering period and no funds will be returned, once an investor’s subscription agreement has been accepted by us.

We intend to sell the Offered Shares in this offering through the efforts of our President, Fabian G. Deneault. Mr. Deneault will not receive any compensation for offering or selling the Offered Shares. We believe that Mr. Deneault is exempt from registration as a broker-dealer under the provisions of Rule 3a4-1 promulgated under the Securities Exchange Act of 1934 (the Exchange Act). In particular, Mr. Deneault:

|

|

·

|

is not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Securities Act; and

|

|

|

|

|

|

|

·

|

is not to be compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

|

|

|

|

|

|

|

·

|

is not an associated person of a broker or dealer; and

|

|

|

|

|

|

|

·

|

meets the conditions of the following:

|

|

|

·

|

primarily performs, and will perform at the end of this offering, substantial duties for us or on our behalf otherwise than in connection with transactions in securities; and

|

|

|

|

|

|

|

·

|

was not a broker or dealer, or an associated person of a broker or dealer, within the preceding 12 months; and

|

|

|

|

|

|

|

·

|

did not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraphs (a)(4)(i) or (iii) of Rule 3a4-1 under the Exchange Act.

|

As of the date of this Offering Circular, we have not entered into any agreements with selling agents for the sale of the Offered Shares. However, we reserve the right to engage FINRA-member broker-dealers. In the event we engage FINRA-member broker-dealers, we expect to pay sales commissions of up to 7.0% of the gross offering proceeds from their sales of the Offered Shares. In connection with our appointment of a selling broker-dealer, we intend to enter into a standard selling agent agreement with the broker-dealer pursuant to which the broker-dealer would act as our non-exclusive sales agent in consideration of our payment of commissions of up to 7% on the sale of Offered Shares effected by the broker-dealer.

Procedures for Subscribing

If you are interested in subscribing for Offered Shares in this offering, please go to www.blackbirdbiotech.com and electronically receive and review the information set forth on such website.

Thereafter, should you decide to subscribe for Offered Shares, you are required to follow the procedures described therein, which are:

|

|

·

|

Electronically execute and deliver to us a subscription agreement; and

|

|

|

|

|

|

|

·

|

Deliver funds directly by check or by wire or electronic funds transfer via ACH to our specified bank account.

|

Right to Reject Subscriptions

After we receive your complete, executed subscription agreement and the funds required under the subscription agreement have been transferred to us, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions

Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Offered Shares subscribed. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

This Offering Circular will be furnished to prospective investors upon their request via electronic PDF format and will be available

for viewing and download 24 hours per day, 7 days per week on our website at www.blackbirdbiotech.com, as well as on the SEC’s website, www.sec.gov.

An investor will become a shareholder of our company and the Offered Shares will be issued, as of the date of settlement. Settlement will not occur until an investor’s funds have cleared and we accept the investor as a shareholder.

By executing the subscription agreement and paying the total purchase price for the Offered Shares subscribed, each investor agrees to accept the terms of the subscription agreement and attests that the investor meets certain minimum financial standards. (See “State Qualification and Investor Suitability Standards” below).

An approved trustee must process and forward to us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of investments through IRAs, Keogh plans and 401(k) plans, we will send the confirmation and notice of our acceptance to the trustee.

Minimum Purchase Requirements

You must initially purchase at least $1,000 of the Offered Shares in this offering. If you have satisfied the minimum purchase requirement, any additional purchase must be in an amount of at least $250.

State Law Exemption and Offerings to “Qualified Purchasers”

The Offered Shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state “Blue Sky” law review, subject to certain state filing requirements and anti-fraud provisions, to the extent that the Offered Shares offered hereby are offered and sold only to “qualified purchasers”. “Qualified purchasers” include: (a) “accredited investors” under Rule 501(a) of Regulation D and (b) all other investors, so long as their investment in Offered Shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine, in our sole and absolute discretion, that such investor is not a “qualified purchaser” for purposes of Regulation A. We intend to offer and sell the Offered Shares to qualified purchasers in every state of the United States.

Issuance of Certificates

Upon settlement, that is, at such time as an investor’s funds have cleared and we have accepted an investor’s subscription agreement, we will issue a certificate or certificates representing such investor’s purchased Offered Shares.

Transferability of the Offered Shares

The Offered Shares will be generally freely transferable, subject to any restrictions imposed by applicable securities laws or regulations.

Advertising, Sales and Other Promotional Materials

In addition to this Offering Circular, subject to limitations imposed by applicable securities laws, we expect to use additional advertising, sales and other promotional materials in connection with this offering. These materials may include information relating to this offering, articles and publications concerning industries relevant to our business operations or public advertisements and audio-visual materials, in each case only as authorized by us. In addition, the sales material may contain certain quotes from various publications without obtaining the consent of the author or the publication for use of the quoted material in the sales material. Although these materials will not contain information in conflict with the information provided by this Offering Circular and will be prepared with a view to presenting a balanced discussion of risk and reward with respect to the Offered Shares, these materials will not give a complete understanding of our company, this offering or the Offered Shares and are not to be considered part of this Offering Circular. This offering is made only by means of this Offering Circular and prospective investors must read and rely on the information provided in this Offering Circular in connection with their decision to invest in the Offered Shares.

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 325,000,000 shares of common stock, $.001 par value per share. As of the date of this Offering Circular, there were 224,197,495 shares of our common stock issued and outstanding, held by 74 holders of record.

Common Stock

The holders of our common stock currently have (a) equal ratable rights to dividends from funds legally available therefor, when, as and if declared by our Board of Directors; (b) are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of our company; (c) do not have preemptive, subscriptive or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (d) are entitled to one non-cumulative vote per share on all matters on which shareholders may vote. Our Bylaws provide that, at all meetings of the shareholders for the election of directors, a plurality of the votes cast shall be sufficient to elect. On all other matters, except as otherwise required by Nevada law or our Articles of Incorporation, as amended, a majority of the votes cast at a meeting of the shareholders shall be necessary to authorize any corporate action to be taken by vote of the shareholders.

Non-cumulative Voting. Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event, the holders of the remaining shares will not be able to elect any of our directors. As of the date of this Offering Circular, our officers and directors own, directly or indirectly, a total of 103,010,322 shares, or approximately 53.74%, of our outstanding common stock, which ownership percentage would be reduced to approximately 42.62%, assuming all of the Offered Shares are sold in this offering, and, thereby, control all corporate matters relating to our company. (See “Risk Factors—Risks Related to a Purchase of the Offered Shares” and “Security Ownership of Certain Beneficial Owners and Management”).

Pre-emptive Rights. As of the date of this Offering Circular, no holder of any shares of our common stock has pre-emptive or preferential rights to acquire or subscribe for any unissued shares of any class of our capital stock not disclosed herein.

Dividend Policy. We have never declared or paid any dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Shareholder Meetings. Our bylaws provide that special meetings of shareholders may be called only by our Board of Directors, the chairman of the board, or our president, or as otherwise provided under Nevada law.

Transfer Agent. We have retained the services of Action Stock Transfer Corporation, 2469 E. Fort Union Boulevard, Suite 214, Salt Lake City, Utah 84121, as the transfer agent for our common stock. Action Stock Transfer’s website is located at: www.actionstocktransfer.com. No information found on Action Stock Transfer’s website is part of this Offering Circular.

Convertible Promissory Notes

As of the date of this Offering Circular, we have outstanding a total of four separate convertible promissory notes. The table below sets forth information with respect to such convertible promissory notes as of June 30, 2021.

|

Date of

Note Issuance

|

|

Principal Amount

at Issuance

|

|

|

Balance at

6/30/21

|

|

|

Accrued

Interest at

6/30/21

|

|

|

Maturity

Date

|

|

Conversion

Terms

|

|

Name of Noteholder

and Name of Person

with Investment Control

|

|

|

4/30/20

|

|

$

|

25,000

|

|

|

$

|

25,000

|

|

|

$

|

2,917

|

|

|

4/30/21

|

|

$0.001 per share

|

|

Tri-bridge Ventures LLC (John Forsythe III, Managing Manager)

|

|

|

2/3/21

|

|

$

|

121,000

|

|

|

$

|

121,000

|

|

|

$

|

0

|

|

|

2/3/22

|

|

Only upon event of default; conversion rate is the lowest closing bid price on either (1) delivery date of notice of default, (2) delivery date of notice of conversion or (3) 2/3/21.

|

|

SE Holdings, LLC (Aryeh Goldstein, Manager)

|

|

|

2/17/20

|

|

$

|

43,500

|

|

|

$

|

43,500

|

|

|

$

|

0

|

|

|

2/17/22

|

|

anytime after 180 days; conversion rate: 61% of lowest trading price during 20 days prior to conversion

|

|

Power Up Lending Group Ltd. (Curt Kramer, CEO)

|

|

|

4/22/21

|

|

$

|

68,750

|

|

|

$

|

68,750

|

|

|

$

|

0

|

|

|

4/22/22

|

|

anytime after 180 days; conversion rate: 61% of lowest trading price during 20 days prior to conversion

|

|

Power Up Lending Group Ltd. (Curt Kramer, CEO)

|

|

|

8/17/21

|

|

$

|

78,750

|

|

|

$

|

78,750

|

|

|

$

|

0

|

|

|

8/17/22

|

|

anytime after 180 days; conversion rate: 61% of lowest trading price during 20 days prior to conversion

|

|

Power Up Lending Group Ltd. (Curt Kramer, CEO)

|

|

BUSINESS

Preliminary Statements Regarding the COVID-19 Pandemic

As of the date of this Offering Circular, there exist significant uncertainties regarding the current novel Coronavirus (COVID-19) pandemic, including the scope of health issues, the possible duration of the pandemic and the extent of local and worldwide social, political and economic disruption it may cause.

To date, the COVID-19 pandemic has had a discernable short-term negative impact on the ability of our company to obtain capital needed to accelerate the development of our business.

With respect to our business operations, while our product sales have increased since the initial impact of the COVID-19 pandemic due primarily to our recently introducing hand sanitizer gel and spray products, we believe the COVID-19 pandemic has had a discernable short-term negative impact on our product sales.

Overall, our company is not of a size that has required us to implement “company-wide” policies in response to the COVID-19 pandemic. Further, our product manufacturing operations have experienced no negative consequences attributable to the COVID-19 pandemic, inasmuch as these operations involve a limited number of persons. However, as the states continue to re-open their economies, the scope and nature of the impacts of COVID-19 on our company will evolve day-by-day, week-by-week.

The COVID-19 pandemic can be expect to continue to result in regional and local quarantines, labor stoppages and shortages, changes in consumer purchasing patterns, mandatory or elective shut-downs of retail locations, disruptions to supply chains, including the inability of our suppliers to deliver materials on a timely basis, or at all, severe market volatility, liquidity disruptions and overall economic instability. It can be further expected that the COVID-19 pandemic will continue to have unpredictably adverse impacts on our business, financial condition and results of operations. This situation is changing rapidly and additional impacts may arise of which we are not currently aware.

We intend to continue to assess the evolving impact of the COVID-19 pandemic, not only on our company, but on the operations of our customers, consumers and supply chains, and intend to make adjustments accordingly. However, the extent to which the COVID-19 pandemic may impact our business, financial condition and results of operations will depend on how the COVID-19 pandemic and its impact continues to impact the United States and, to a lesser extent, the rest of the world, all of which remains highly uncertain and cannot be predicted at this time.

In light of these uncertainties, for purposes of the discussion below, except where otherwise indicated, the descriptions of our business and our strategies, including regarding us, our business and the market generally, do not reflect the potential impact of the COVID-19 pandemic or our responses thereto.

Our Company After Acquiring Black Bird Potentials Inc.

With the January 2020 acquisition of Black Bird Potentials Inc., our company emerged from its long-standing status as a “shell company.” Our Board of Directors has adopted the business plan of Black Bird and our company’s ongoing operations now include those of Black Bird.

History of Our Company

We were incorporated in the State of Nevada in 2006 under the name “Cyprium Resources Inc.”, which was changed in August 2009 to “Digital Development Partners, Inc.” Our corporate name was changed to “Black Bird Biotech, Inc.,” effective June 14, 2021. Through 2014, our company was involved, first, in the mining industry and, then, in the communications industry. From 2015 until the January 2020 acquisition of Black Bird Potentials Inc., a Wyoming corporation (BB Potentials), our company was a “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934. Our Board of Directors has adopted the business plan of BB Potentials and our ongoing operations now include those of BB Potentials.

Business Overview

BB Potentials is the exclusive worldwide manufacturer and distributor of MiteXstream, an EPA-registered plant-based biopesticide effective in the eradication of mites and similar pests, including spider mites, a pest that destroys crops, especially cannabis, hops, coffee, and house plants, as well as molds and mildew. Also through BB Potentials, we manufacture and sell CBD products, including CBD Oils, gummies and pet treats, and CBD-infused personal care products, as well as hand sanitizer gel and spray products, under the Grizzly Creek Naturals brand name. In addition, BB Potentials is a licensed grower of industrial hemp under the Montana Hemp Pilot Program and has established “Black Bird American Hemp” as the brand name under which these efforts will be conducted.

Our corporate website is located at: www.blackbirdbiotech.com. No information found on our company’s website is part of this Offering Circular.

MiteXstream

Worldwide Exclusivity. Pursuant to a February 2021 Manufacturing, Sales and Distribution License Agreement (the “New MiteXstream Agreement”) with Touchstone Enviro Solutions, Inc. (“Touchstone”), a company owned by three of our directors, Fabian G. Deneault, L. A. Newlan, Jr. and Eric Newlan, BB Potentials possesses the exclusive rights, even as to Touchstone, to manufacture, sell and distribute MiteXstream, an EPA-registered biopesticide (EPA Reg. No. 95366-1). The exclusivity granted would be reduced to a status of non-exclusivity, should we fail to manufacture at least 2,500 gallons of concentrate in any year during the term of the New MiteXstream Agreement; provided, however, that such minimum required is deemed to have been satisfied through December 31, 2022. We are required to pay Touchstone a royalty of $10 per gallon of MiteXstream manufactured by us or by any sublicensee of ours. For no further consideration, we were granted the rights to use the “MiteXstream” trademark and the “Harnessing the Power of Water” trademark.

The New MiteXstream Agreement replaced a prior similar agreement with Touchstone (the “Original MiteXstream Agreement”) and served to expand Black Bird’s rights with respect to MiteXstream. The New MiteXstream Agreement contains the following important provisions as compared to the Original MiteXstream Agreement:

|

|

New MiteXstream Agreement

|

Original MiteXstream Agreement

|

|

Term

|

December 31, 2080

|

Initial terms of 10 years, with one 10-year renewal term

|

|

Territory

|

Worldwide Exclusive (1)

|

United States and Canada

|

|

Royalty

|

$10.00 per gallon manufactured

|

Effective royalty of an estimated $50 per gallon

|

|