UPDATE: Michelin 3Q Revenue Rose 24%; Sees 2010 Tire Sales +12%

27 October 2010 - 4:57AM

Dow Jones News

French tire maker Cie Generale des Etablissements Michelin

(ML.FR) Tuesday reported a 24% year-on-year increase in its

third-quarter revenue, to EUR4.65 billion, driven by a rebound in

demand for tires worldwide that pushed the company's volume sales

up by 14% compared to the corresponding period of 2009.

The third-quarter revenue figure was well above an average

estimate of EUR4.38 billion among a group of 11 analysts surveyed

by the company.

Michelin said it now expects its volume sales will increase by

around 12% this year from 2009. Michelin's previous sales guidance

has been for volume sales to grow by more than 10%. The company

reaffirmed its target of generating positive free cash flow this

year and an operating margin of close to 9% despite an expected

negative impact of between EUR600 million and EUR650 million from

rising raw material costs. It said it will continue its "reactive"

policy of passing on higher input costs to its customers.

Price increases during the period more than offset rising raw

materials costs, but the product mix deteriorated because sales of

original-equipment tires to car manufacturers rose at a faster pace

than sales of replacement tires that offer higher margins.

The world's second-largest tire maker after Japan's Bridgestone

Corp (5108.TO) said its revenue for the first nine months of this

year was 19% above those of the same 2009 period at EUR13 billion.

Michelin said it had also benefited from a positive foreign

currency impact of EUR338 million in the third quarter and of

EUR537 million in the first nine months thanks to favorably

fluctuations of the U.S., Canadian and Australian dollars, the

Brazilian real and the Mexican peso against the euro.

Last week, Bridgestone said it expects a 21% increase in annual

revenue by 2012, with operating profit set to rise by 8% over the

period.

Michelin said revenue of its car and light commercial vehicle

segment rose by 20% year-on-year in the three months to Sept. 30,

while revenue from truck tires was up 27% and that of its specialty

tires was 33% above that of a year earlier. It noted that the

recovery of global tire markets has been more rapid than was

expected at the beginning of this year.

The steep rise in demand for tires from car makers partly

reflected the very low levels registered in the third quarter of

2009 as automobile manufacturers cut back production to a build-up

of inventories.

Original-equipment sales in the U.S. market fell 22% in the

first nine months, while those in Europe were down 9%. By contrast,

original-equipment sales surged 37% in Asia as manufacturers

located in China and the rest of Asia ramped up their production,

and were up 23% in South America. Replacement tire sales declined

3% in the U.S. in the first nine months, but were up 4% in Europe,

by 30% in Asia and by 13% in South America.

Earlier this month, Michelin raised EUR1.22 billion through a

rights issue to help finance an ambitious capital spending program

to add production capacity in the fast-growing markets of Asia and

Brazil. the plan calls for the company to add capacity of 150,000

tons, equivalent to more than one new production plant every

year.

Michelin is a heavy consumer of natural rubber, and Dominique

Senard, one of Michelin's three managing partners, told an

analysts' meeting that the price of rubber, which reached record

levels this week, is "incredibly high, and probably abnormally

high."

"We're not surprised by high raw materials," he said, adding:

"We could imagine that it remains at that level for next year."

Senard said that Michelin considers a 5% average annual increase in

raw material prices to be "standard."

Michelin's head of finance operations, Marc Henry, said that the

volume of rubber being sold today "is less than in 2007, so that

explains some of the abnormality of this pricing level."

-By David Pearson, Dow Jones Newswires; +33 1 4017 1740;

david.pearson@dowjones.com

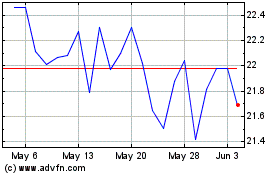

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

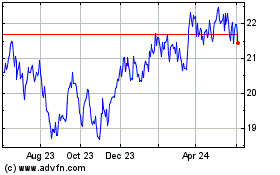

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Jan 2024 to Jan 2025