ITT Tech Campuses Up for Sale in School's Bankruptcy

07 October 2016 - 9:40AM

Dow Jones News

Parking spaces, and lots of them—that is the pitch from A&G

Realty, the firm hired to sell campuses abandoned when ITT

Technical Institute shut down abruptly last month.

Thirty major parcels of owned real estate across the country

were thrown on the market when the for-profit school operator

closed its doors. Many have nearly double the amount of parking

spaces found in most office parks, said Emilio Amendola, the

A&G executive leading the sale.

That is an invitation to operators of call centers, which, like

schools, need more parking slots than the average office park, he

said. Community colleges and other schools have made inquiries

already, and ITT Tech is being marketed for office and industrial

uses as well, Mr. Amendola said.

ITT Tech's parent, ITT Educational Services, is liquidating in a

chapter 7 bankruptcy. But don't look for fire sale prices, he

said.

"We're being given the time to market these in an appropriate

fashion. We're not giving them away; we're selling them," he

said.

ITT designed and built smart, adaptable buildings, useful to

schools, offices or industrial businesses, according to the broker.

It also has some surprising sources of cash to fund a prolonged

sale process, lawyers said at a bankruptcy court hearing. ITT

Tech's pension plans were over-funded by millions, for example.

Company leaders denied accusations that students were improperly

lured into enrolling and taxpayers duped into supporting

institutions that couldn't deliver the good jobs they promised. ITT

Tech leaders blame unfair treatment at the hands of the Department

of Education, which cut off its access to taxpayer-backed loans,

for a closure that set 40,000 students adrift for the fall

semester, released 8,000 employees and stoked political and legal

debates about for-profit education.

In the hard-cash world of bankruptcy, trustee Deborah Caruso is

charged with exploiting all sources of value in an effort to

appease creditors. Real estate could be a major source of cash for

creditors. Early estimates laid out in bankruptcy-court papers are

that the real estate could bring as much as $100 million.

Experts say the prices ITT Tech's campuses will bring depends on

factors including location.

Two or three years ago, finding buyers for big suburban office

or school campuses was a challenge, said Keith DeCoster, director

of U.S. real estate analytics for commercial real estate advisory

firm Savills Studley. Investors including foreign real-estate

investment trusts and institutions were focusing on urban assets,

chasing the long-term trend of millennials and retirees moving to

the cities and employers following them.

That is still true in many areas, said Suzanne Mulvee, director

of research at CoStar Group's property division. ITT Tech was a

creature of the suburbs, with a large concentration in California,

Texas and Florida, according to an analysis of leased and owned

locations performed by CoStar.

Over the last 18 months, however, suburban properties have made

a comeback in some markets, particularly in the sunbelt states, Mr.

DeCoster said. Call centers and customer support centers are

possible tenants.

So are churches, which like big parking lots, and companies that

offer speedy delivery, such as Amazon, which are attracted to

property in the convenient "last mile" outside major cities, said

Steven Bandolik, managing director of real estate services for

Deloitte LLP.

Perhaps most importantly for ITT Tech and its creditors, the

campuses are going up for sale in a market where there is money

available for deals, Mr. Bandolik said. "There's a lot of capital

looking for transactions," he said.

(END) Dow Jones Newswires

October 06, 2016 18:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

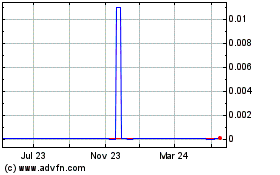

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

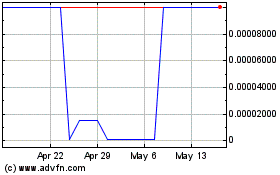

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Mar 2024 to Mar 2025