Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the second quarter ended June 30,

2012.

“Farmers & Merchants reported solid financial results for

the second quarter, maintaining strong operational performance and

continuing to grow the Bank’s deposit base,” said Henry Walker,

president of Farmers & Merchants Bank of Long Beach. “The

Bank’s strength reflects our conservative lending practices and

disciplined approach to managing investments.”

Income Statement

For the 2012 second quarter, interest income decreased to $42.9

million from $45.5 million in the prior-year comparable period.

Interest income for the first half of 2012 was $89.2 million,

compared with $90.7 million reported for the first half of

2011.

Interest expense for the 2012 second quarter declined to $1.8

million from $2.5 million in the second quarter of 2011, primarily

related to the prolonged low interest rate environment. Interest

expense for the first half of 2012 declined to $3.6 million from

$5.1 million reported for the first half of 2011.

Net interest income for the 2012 second quarter declined to

$41.1 million from $42.9 million for the second quarter of 2011,

and was virtually unchanged at $85.5 million for the first half of

2012, compared with the six months ended June 30, 2011.

The Bank did not have a provision for loan losses in the second

quarter or first half of 2012, primarily because of generally more

stable economic conditions. The provision for loan losses was $6.1

million for the second quarter of 2011 and $6.8 million for the

first half of 2011. The Bank’s allowance for loan losses as a

percentage of loans outstanding was 2.80% at June 30, 2012, in line

with 2.80% at December 31, 2011.

Non-interest income was $3.4 million for the 2012 second

quarter, the same as that for the second quarter a year ago.

Non-interest income was $8.6 million for the first half of 2012,

compared with $6.6 million for the first half of 2011.

Non-interest expense for the 2012 second quarter was $19.9

million, compared with $18.5 million for the same period last year.

Non-interest expense for the first half of 2012 was $41.8 million,

compared with $39.8 million for the first half of 2011.

Farmers & Merchants’ net interest margin was 3.73% for the

2012 second quarter, compared with 4.24% last year.

The Bank’s net income for the 2012 second quarter rose 19.0% to

$16.7 million, or $127.87 per diluted share, from $14.0 million, or

$107.21 per diluted share, for the 2011 second quarter. Net income

for the first half of 2012 advanced to $35.3 million, or $269.35

per diluted share, from $29.4 million, or $224.39 per diluted share

for the first six months of 2011.

Balance Sheet

At June 30, 2012, net loans decreased to $1.99 billion from

$2.03 billion at December 31, 2011. The Bank’s deposits grew to

$3.48 billion at the end of the 2012 second quarter, from $3.39

billion at December 31, 2011. Non-interest bearing deposits

represented 37.7% of total deposits at June 30, 2012, versus 37.2%

of total deposits at December 31, 2011. Total assets increased to

$4.78 billion at the close of the 2012 second quarter from $4.66

billion at December 31, 2011.

At June 30, 2012, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 28.90%, a Tier 1 risk-based capital

ratio of 27.64%, and a Tier 1 leverage ratio of 14.47%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“Deposits grew at a steady clip during the first half of 2012,

as we continued to maintain a strong balance sheet,” said Daniel

Walker, chief executive officer and chairman of the board. “With

capital ratios well above regulatory minimums, the Bank enters the

second half of the year in a position of strength and

stability.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 21 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG BEACH

Income Statements (Unaudited) (In Thousands)

Three Months Ended June

30, Six Months Ended June 30, 2012 2011

2012 2011 Interest income: Loans

$ 27,945 $ 28,436 $ 59,355 $ 57,835 Securities held to maturity

11,911 13,014 23,544 25,434 Securities available for sale 2,776

3,961 5,791 7,341 Deposits with banks 252 50

471 111 Total interest income 42,884

45,461 89,161 90,721

Interest

expense: Deposits 1,513 2,106 3,079 4,239 Securities

sold under agreement to repurchase 280 433

549 868 Total interest expense 1,793

2,539 3,628 5,107 Net interest

income 41,091 42,922 85,533 85,614

Provision for loan

losses - 6,050 - 6,750

Net int. income after provision for loan losses

41,091 36,872 85,533 78,864

Non-interest income: Service charges on deposit

accounts 1,153 1,182 2,352 2,352 Merchant bankcard fees 481 290 902

555 Escrow fees 264 272 429 477 Other 1,530

1,605 4,915 3,255 Total non-interest income

3,427 3,350 8,598 6,639

Non-interest expense: Salaries and employee benefits

11,803 10,349 23,564 21,038 FDIC and other insurance expense 1,609

703 3,179 1,820 Occupancy expense 1,358 1,405 2,736 2,663 Equipment

expense 1,379 1,416 2,716 2,732 Other real estate owned expense,net

(758 ) 550 538 2,043 Amortization of investments in low-income

communities 1,830 451 4,031 902 Legal and professional fees 581 862

1,045 1,613 Marketing and promotional expense 547 1,100 1,233 1,905

Other 1,509 1,673 2,747 5,050

Total non-interest expense 19,858

18,509 41,789 39,766 Income before income tax

expense 24,660 21,713 52,342 45,737

Income tax

expense 7,918 7,676 17,077

16,359

Net income $ 16,742

$ 14,037 $ 35,265 $

29,378 Basic and diluted earnings per common share $

127.87 $ 107.21 $ 269.35 $ 224.39

FARMERS & MERCHANTS BANK OF LONG

BEACH Balance Sheets (Unaudited) (In Thousands)

June 30, 2012 Dec. 31, 2011 Assets

Cash and due from banks: Noninterest-bearing balances $

55,720 $ 57,394 Interest-bearing balances 245,722 278,525

Investment securities 2,308,810 2,113,130 Gross loans 2,044,716

2,087,388 Less allowance for loan losses (57,155 ) (58,463 ) Less

unamortized deferred loan fees, net (450 ) (418 ) Net loans

1,987,111 2,028,507 Other real estate owned 21,248

23,036 Investments in low-income communities 39,535 43,566 Bank

premises and equipment 59,751 55,155 Accrued interest receivable

16,940 16,464 Deferred tax asset 29,117 28,583 Other assets 15,909

14,985

Total assets $

4,779,863 $ 4,659,345

Liabilities and stockholders' equity

Liabilities: Deposits: Demand, non-interest bearing $

1,314,325 $ 1,263,162 Demand, interest bearing 307,950 300,984

Savings and money market savings 964,329 909,794 Time deposits

897,608 919,538 Total deposits 3,484,212

3,393,478 Securities sold under agreements to repurchase

559,007 555,992 Other liabilities 37,289 39,659

Total liabilities 4,080,508

3,989,129 Stockholders' Equity:

Common Stock, par value $20;

authorized

250,000 shares; issued and outstanding 130,928 shares 2,619 2,619

Surplus 12,044 12,044 Retained earnings 676,474 646,708 Other

comprehensive income 8,218 8,845

Total

stockholders' equity 699,355 670,216

Total liabilities and stockholders' equity

$ 4,779,863 $ 4,659,345

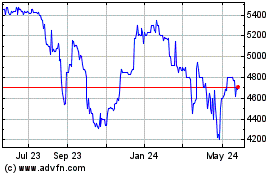

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Feb 2025 to Mar 2025

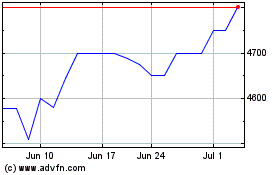

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Mar 2024 to Mar 2025