false

0000867028

0000867028

2024-04-02

2024-04-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 2, 2024

FOMO

WORLDWIDE, INC.

(Exact

name of Registrant as specified in its Charter)

| wyoming |

|

001-13126 |

|

87-3971203 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

108

Scharberry Lane #2, Mars, PA 16046

(Address

of principal executive offices)

(630)

708-0750

(Registrant’s

Telephone Number)

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4© under the Exchange Act (17 CFR 240.13©(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

IGOT |

|

OTC

Pink Current |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

FOMO

WORLDWIDE, INC. is referred to herein as “FOMO”, “we”, “us”, or the “Company”.

Item

1.01 Entry into a Material Definitive Agreement.

On

April 1, 2024, we entered into a definitive agreement to acquire the North American assets and operations of EcoChem Alternative Fuels

LLC (https://www.hpcdfuel.com/), an Ohio-based provider of advanced filtration systems and services that generate high performance carbon

fuels including diesel, gasoline, biofuel, and jet fuel. The terms of the transaction include consideration of five million restricted

Series B Preferred shares convertible into 50,000,000 common shares, an earn-out based on technology and revenue milestones for an additional

five million restricted Series B Preferred shares over three years, ten million stock options to be issued to existing staff and new

hires at strike prices and vesting schedules to be determined in the future, and a $1.5 million two-year convertible note (@ $0.05/common

share) with $250,000 cash amortization in six months from closing and $250,000 cash amortization in twelve months from closing. $125,000

cash is due on closing, which is scheduled for April 16, 2024. We intend to form a wholly owned acquisition subsidiary which will incorporate

the purchased assets and operate the business under “2050 Fuel” and/or “Fuel Drop”. The definitive agreement

is included herein as Exhibit 10.1.

Item

9.01. Exhibits

| |

(10) |

Exhibits.

The following exhibit is filed with this Current Report on Form 8-K: |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

FOMO

WORLDWIDE, INC. |

| |

|

| Date:

April 2, 2024 |

By: |

/s/

Vikram Grover |

| |

|

Vikram

Grover |

| |

|

Chief

Executive Officer |

Exhibit

10.1

| State of Ohio |

Rev. 133EE24 |

BUSINESS

PURCHASE AGREEMENT

This

Business Purchase Agreement (this “Agreement”) is entered into as of the 1st day of April, 2024 (the “Effective

Date”) by and between ECOCHEM ALTERNATIVE FUELS LLC (the “Seller”) and FOMO WORLDWIDE, INC. (the “Buyer”).

WHEREAS,

the Seller owns and operates a business known as EcoChem Alternative Fuels LLC, an Ohio limited liability company located at 4621 Lyman

Dr., Hilliard, OH 43026 that engages in the business of: transportation and provision of high performance clean carbon fuels created

from super filtration, application of magnetic fields, and proprietary fuel additives thereby improving MPG, extending engine life, and

reducing emissions and NOX. (the “Business”); and FOMO WORLDWIDE, INC., a Wyoming corporation located at 108 Scharberry Lane

#2, Mars, PA 16046 (OTC: IGOT).

WHEREAS,

the parties intend that the Seller shall sell to the Buyer the Business for the price, terms and conditions described below, and pursuant

to the attachments and exhibits, if any, annexed to this main document.

NOW

THEREFORE, for the reasons set forth, and in consideration of the mutual covenants and promises of the parties hereto, and intending

to be legally bound, the Seller and the Buyer agree as follows:

1.

Sale of North America Assets. On the terms and subject to the conditions set forth in this Agreement, the Seller agrees to sell,

assign, transfer, convey and deliver to the Buyer, and the Buyer agrees to purchase and acquire from the Seller all rights, title and

interests of the Seller’s North American Assets and Operations, including the assets described in Exhibit A attached hereto.

Buyer

agrees to form a NEWCO or use an existing subsidiary of FOMO with a name change to transfer the North American assets of Seller. Buyer

also agrees that NEWCO or subsidiary will provide employment contracts to Joshua F. Koch and John S. Bolus for a period of 5 years. Terms

to be negotiated.

2.

Excluded Assets. Notwithstanding anything to the contrary in this Agreement, the Seller will not sell, assign, transfer, convey or

deliver to the Buyer the international assets outside of North America and operations (i.e., “rest of world”) and its intellectual

property listed in Exhibit B attached hereto. Seller shall grant to buyer a first right of refusal to acquire the international licensing

rights (rest of world) in whole or in part. Seller agrees to give buyer an Independent agent agreement which will allow buyer to earn

commissions on international opportunities.

3.

Assumed Liabilities. Unless otherwise specified herein, the Buyer agrees to assume and be responsible for the liabilities listed

on Exhibit C attached hereto.

4.

Excluded Liabilities. Notwithstanding anything to the contrary in this Agreement, the Buyer will not assume or be liable for any

liabilities related to any excluded assets, in addition to the liabilities listed on Exhibit D attached hereto.

5.

Purchase Price. Buyer will pay to the Seller for the purchase of the North American assets business payable by issuing five million

(5,000,000) Series B Preferred shares of the Buyer convertible into fifty million (50,000,000) common shares of the Buyer, a $1.5 million

dollar ($1,500,000,) 10% two-year convertible note ($0.05) per common share of Buyer subject to certain terms and conditions for conversion

and redemption) to be secured by the assets of an acquisition subsidiary of the Buyer, and the creation of a stock option plan of up

to ten million (10,000,000) securities to be awarded to current and new employees of the Buyer’s acquisition subsidiary which will

hold the purchased assets and operations.

The

5 million shares of Preferred stock shall have an anti-dilution clause for a period of 18 months or when Seller hits their first milestone,

whichever comes first. The closing document will need a “Put Option” given to the Seller to bring Sellers shares back to

the same % ownership based on the original five (5) million Series B Preferred shares granted as part of the purchase.

Sellers

$1.5 million convertible note (@ $0.05 per common share) shall be payable over a two (2) year period. The first payment shall be made

at the end of month 6, which shall be a $250,000 payment in cash. The second payment shall occur in month 12, which shall be $250,000.

The balance of the loan ($1,000,000) shall be payable in month 24 with any accrued interest.

| 6.

|

Additionally,

Buyer will issue additional Series B Preferred shares to Seller upon Seller’s acquired business assets and operations in North

America achieving certain earn-out milestones (up to 5,000,000 total additional Series B Preferred shares). The 1st earnout

milestone is worth 2 million shares of Series B preferred stock. The remainder three earnout milestones listed below are given at

one (1) million additional Series B shares

|

| |

1 |

Confirmation

of successful completion of the carbon credit accreditation process by an independent third-party auditor or EPA certified lab test

concluding the reduction of greenhouse gas emissions |

| |

2 |

Achievement

of $10 million of annualized quarterly revenues derived from sale of clean fuel technology products and services developed and sold

by an EAF acquisition subsidiary to be formed by FOMC by year-end 2025, |

| |

3 |

Achievement

of $23 million of annualized quarterly revenues derived from sale of clean fuel technology products and services developed and sold

by an EAF acquisition subsidiary to be formed by FOMC by year-end 2026, |

| |

4 |

Achievement

of $52 million of annualized quarterly revenues derived from sale of clean fuel technology products and services developed and sold

by an EAF acquisition subsidiary to be formed by FOMC by year-end 2027. |

Revenue

milestones will begin once the entity is funded.. The revenue milestones will be prorated to the additional stock the Seller can earn.

Meaning, if the revenue milestone is $10 million dollars and Seller is able to achieve 80%, then Seller would earn 80% of the 1 million

additional Series B Preferred shares.

7.

Allocation of Purchase Price. The Purchase Price shall be allocated in accordance with the Internal Revenue Code §1060 as agreed

upon by the parties within thirty (30) days of the closing date.

8.

Closing Date. The sale and transfer of assets and the closing under this Agreement shall take place on April 15, 2024 (the “Closing”).

At that time Seller shall deliver possession of the tangible property and all assets included in the sale to the Buyer and all other

instruments and documents necessary to transfer the Business and assets to Buyer. Seller shall at that time execute and deliver all papers

and instruments suitable for filing and/or which are necessary to transfer ownership of the trade name to Buyer, and Seller shall thereafter

cease to use said name in any manner or purpose. When that delivery is made to Buyer and when Seller receives the balance due on the

Purchase Price, the sale by Seller to Buyer shall be completed and effective, and Buyer shall have ownership and possession of the Business

and the assets.

9.

Representations and Warranties of Seller. Seller represents and warrants that:

(a)

Seller is duly qualified and organized, and is validly existing and in good standing, under the laws of its state of formation.

(b)

Seller has the requisite power and authority to enter into and perform under this Agreement.

(c)

Seller is the owner of and has good and marketable title to the property involved in this sale, free of all restrictions on transfer

or assignment and all encumbrances except for those that are set forth in this Agreement.

(d)

Seller is not required to acquire any consents, approvals or authorizations by any governmental authority to execute, deliver and perform

its obligations under this Agreement.

(e)

The execution and delivery of this Agreement by Seller will not conflict with or result in a violation of or default under any material

agreements to which Seller is a party or create a lien upon the Business.

(f)

Seller has not otherwise contracted to sell, pledge, or mortgage all or part of the Business.

(g)

Seller has all necessary licenses and permits required to operate the Business.

(h)

Seller has complied with all applicable federal, state, and local statutes, laws, and regulations affecting Seller’s properties

or the operation of Seller’s business, and Seller has received no notice of a violation or citation same from any governmental

agencies.

(i)

Seller has presented to Buyer true, complete, and correct information and documents regarding the Business, and none of the information

contains an untrue statement of material fact or omits to state a material fact.

(j)

Seller has paid all taxes, federal, state and local.

(k)

Seller has in full force and effect a general liability and casualty insurance policy in such amounts as are carried by similar companies.

10.

Representations and Warranties of Buyer. Buyer represents and warrants that:

| a.

|

Buyer

is duly qualified and organized, and is validly existing and in good standing, under the laws of its state of formation. |

| |

|

| b.

|

Buyer

is not required to acquire any consents, approvals or authorizations by any governmental authority to execute, deliver and perform

its obligations under this Agreement. |

| |

|

| c.

|

Buyer

has the requisite power and authority to enter into and perform under this Agreement. |

| |

|

| d.

|

The

execution and delivery of this Agreement by Buyer will not conflict with or result in a violation of or default under any material

agreements to which Buyer is a party. |

| |

|

| e. |

Buyer

represents it has the ability to raise Six million ($6,000,000) dollars in 18 months. Said $6 million can be raised in tranches. |

| |

|

| f.

|

Buyer

agrees to provide Seller $125,000 at closing for working capital. |

| |

|

| g.

|

If

Buyer is able to raise the funds for the EPA testing and certification (included in the $6 million raise), EcoChem shall issue Fifteen

(15%) percent in equity to Buyer. |

| |

|

| h.

|

Buyer

understands that Seller is making no other representations or warranties other than as provided in this Agreement. |

11.

Covenants. Between the signing of this Agreement and the date of the Closing:

a.

Buyer shall have the right at any reasonable time prior to the Closing, at Buyer’s expense, to inspect or have

inspected by a certified public accountant or other financial expert, the books and records of the Business.

b.

Seller will operate the Business in the usual and ordinary manner and will not enter into any contract except as may be required in the

regular course of business.

c.

Seller shall not remove or cause to be removed any inventory of the Business except upon sale in the ordinary course of business or in

the event of return to a supplier for credit.

d.

Seller will pay all taxes, federal, state and local.

e.

Seller will not do anything to cause a violation or breach of any contracts relating to the Business.

f.

Seller will pay and will not increase the salary or commissions of any employee, agent, or representative of the business.

12.

Covenant Not to Compete.

a.

Seller shall not engage in a business similar to that involved in this transaction in any capacity, directly or indirectly, either as

a principal, agent, manager, owner, partner, employee, officer, director, or stockholder of any company or corporation, or engage in

or become interested financially or otherwise in any business, trade, or occupation similar to or in competition with the business sold

hereunder, within North America (i.e., Canada, Mexico, United States), for a 3 year period from the date of closing or so long as Buyer

or his successors carry on a like business, whichever first occurs. The parties agree that this provision is an essential part of this

Agreement and is material to the sale and purchase of Seller’s business. For purposes of this Agreement, “business similar

to that involved in this transaction” includes within its scope any of the following: high performance fuel production/refining

or similar in North America.

b.

The parties agree that Buyer shall have the right to assign this restrictive covenant in the event that Buyer sells the business, and

Seller agrees to remain obligated by the covenant to any subsequent purchases from Buyer.

c.

Seller shall pay the sum of $1,000.00 to Buyer for each week in which or during which Seller may breach or violate the restrictive covenant

not to compete contained herein. Buyer’s receipt of such sums each week shall not be deemed a waiver or release of Buyer’s

rights to prevent further violations by seeking equitable relief in a court of law.

13.

Notices. All notices given under this Agreement must be in writing. A notice is effective upon receipt and shall be sent via one

of the following methods: delivery in person, overnight courier service, certified or registered mail, postage prepaid, return receipt

requested, addressed to the party to be notified at the address designated by either party upon reasonable notice to the other party.

14.

Amendment. This Agreement may be amended or modified only by a written agreement signed by both of the parties.

15.

Survival of Terms. All covenants, warranties, and representations herein shall survive this Agreement and the closing date.

16.

Binding Effect. This Agreement shall be binding upon and shall inure to the benefit of the parties and their successors and assigns.

Neither party may assign its rights or delegate its duties under this Agreement without the other party’s prior written consent,

said consent shall not be unreasonably withheld.

17.

Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of Ohio, without regard

to the principles of conflict of laws.

18.

Disputes. Any dispute arising from this Agreement shall be resolved through mediation. If the dispute cannot be resolved through

mediation, then the dispute will be resolved through binding arbitration conducted in accordance with the rules of the American Arbitration

Association.

19.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, and all

of which together shall constitute one and the same document.

20.

Headings. The section headings herein are for reference purposes only and shall not otherwise affect the meaning, construction or

interpretation of any provision in this Agreement.

21.

No Waiver. No Party shall be deemed to have waived any provision of this Agreement or the exercise of any rights held under this

Agreement unless such waiver is made expressly and in writing.

22.

Severability. If any provision of this Agreement is held to be invalid, illegal or unenforceable in whole or in part, the remaining

provisions shall not be affected and shall continue to be valid, legal and enforceable as though the invalid, illegal or unenforceable

part had not been included in this Agreement.

23.

Entire Agreement. This Agreement and the attachments and any associated documents represent the entire agreement between the parties,

and there are no representations, warranties, covenants or conditions, except those specified herein or in accompanying instruments or

documents.

24.

Miscellaneous. Audit to be completed as soon as possible but no later than within 71 days of closing. Buyer to prepare its own annual

report for 2023 and documents for an equity offering under Regulation A (JOBS Act) subject to market conditions. Buyer to work with its

investment bankers Maxim Group for an online roadshow and in person meetings/support.

IN

WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

|

|

EcoChem

Alternative Fuels LLC |

| Joshua

Koch |

|

Seller

Full Name |

| |

|

|

|

|

FOMO

WORLDWIDE, INC. |

| Vikram

Grover |

|

Buyer

Full Name |

EXHIBIT

A – ASSETS SOLD

100%

of EcoChem Alternative Fuels LLC assets and operations located in North America,

Perpetual

exclusive license to all intellectual property of EcoChem Alternative Fuels LLC and its affiliates and predecessors and successors in

interest developed by Joshua Koch or other,

Websites

and domain names,

Customer

lists,

Customer

contracts,

Business

relationships for accreditation and testing of high performance clean fuel.

Incorporated

by reference to excel files attached. The tab labeled “Service Equipment & Customers”.

EXHIBIT

B – ASSETS EXCLUDED

International

markets outside of North America (outside of Canada, Mexico, United States)

Intellectual

property and trade secrets (subject to license agreement in Exhibit A)

Incorporated

by reference to excel files attached.

EXHIBIT

C – LIABILITIES ASSUMED

Accounts

payable and vendor obligations critical to continuing operations in North America.

Incorporated

by reference to excel files attached.

EXHIBIT

D – LIABILITIES EXCLUDED

Incorporated

by reference to excel files attached. The tab labeled “EAF Shareholder & EIDL loans.

v3.24.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

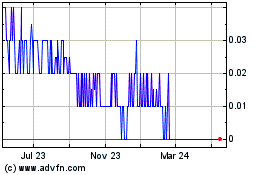

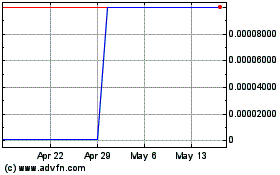

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Apr 2024 to May 2024

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From May 2023 to May 2024