Global Brokerage, Inc. (NASDAQ:GLBR) (“Global Brokerage”),

announced today a series of steps to achieve stability, reduce

costs, and equip Global Brokerage for the future, including entry

into a restructuring support agreement and expected delisting from

Nasdaq Global Market, transferring to Nasdaq Capital Market and

certain changes to its board of directors and officers.

Restructuring Support Agreement and Prepackaged Plan of

Reorganization

Recently, Global Brokerage and its affiliate, Global Brokerage

Holdings, LLC (“Global Brokerage Holdings”), have been engaged in a

series of highly productive negotiations with an ad hoc group (the

“Ad Hoc Group”) of holders of more than 68.5% of Global Brokerage’s

2.25% Convertible Notes due 2018 (the “Current Notes”). These

negotiations, aimed at restructuring the terms of the Current

Notes, have also included participation from FXCM Group, LLC (“FXCM

Group” or “FXCM”) and Leucadia National Corporation and LUK-FX

Holdings, LLC (together, “Leucadia”).

Global Brokerage is very pleased to announce that, as a result

of those negotiations, Global Brokerage, Global Brokerage Holdings,

FXCM Group, Leucadia and the Ad Hoc Group have entered into a

restructuring support agreement (the “RSA”) to restructure the

obligations of Global Brokerage and Global Brokerage Holdings

pursuant to a prepackaged plan of reorganization (the “Plan”) to be

filed under Chapter 11 of the United States Bankruptcy Code. The

overall purpose of the Plan is to enable Global Brokerage to extend

the maturity on its current debt obligations for five years and

restructure its current operations to reduce current expenses.

FXCM Group is not involved with the Chapter 11 filing.

FXCM’s customers and customer funds will not be impacted by

the RSA and the Plan. Similarly, FXCM’s banking and trading

counterparties, service providers, and other business relationships

will not be impacted. FXCM Group, a leading retail FX and CFD

broker will continue to operate normally.

Generally, the Plan provides that:

- Current Notes will be exchanged for an equal amount of a new

series of senior secured notes (the “New Secured Notes”) due five

years from Global Brokerage’s emergence from Chapter 11 protection.

The New Secured Notes will be guaranteed by Global Brokerage

Holdings and accrue cash interest at a rate of 7% with a payment in

kind toggle option. The indenture governing the New Secured

Notes will not include a convertible feature, but will include

certain covenants, including covenants which, subject to certain

exceptions, limit the ability of Global Brokerage and Global

Brokerage Holdings to incur additional indebtedness, engage in

certain asset sales, make certain types of restricted payments,

engage in transactions with affiliates and create liens on assets.

The New Secured Notes are not liabilities of FXCM Group and

only have recourse to the assets of Global Brokerage and Global

Brokerage Holdings.

- The credit agreement among Global Brokerage Holdings and FXCM

Group, as borrowers, and Leucadia, as lender (the “Credit

Agreement”), will be amended to provide a twelve-month extension.

- The rights of holders of Global Brokerage common stock will be

unimpaired.

- The operating agreements of Global Brokerage Holdings and FXCM

Group will be amended to provide certain covenants that will, among

other things, permit certain excess cash generated by FXCM Group

and its affiliates to be distributed to Global Brokerage Holdings

and, thus, Global Brokerage.

- The 2016 Incentive Bonus Plan for Founders and Executives,

which had provided a long-term incentive program for the founders

of Global Brokerage, was terminated on November 8, 2017.

- The waterfall for distributions from FXCM Group will be

allocated as follows:

| |

|

|

|

|

Amounts due under

Credit Agreement: |

100% Leucadia |

| |

Next $350 million: |

50% Leucadia / 50%

Global Brokerage Holdings

|

| |

Next $600 million: |

90% Leucadia / 10%

Global Brokerage Holdings |

| |

All aggregate amounts

thereafter: |

60% Leucadia / 40%

Global Brokerage Holdings |

| |

|

|

- Mutual releases will be effectuated among the members of the Ad

Hoc Group, Leucadia, Global Brokerage, Global Brokerage Holdings

and FXCM Group.

- All administrative expense claims, priority tax claims, and

priority claims, as well as all undisputed trade obligations, of

Global Brokerage will be paid in full.

Upon receipt of the requisite votes to accept the Plan, which

requires the consent of more than two-thirds in terms of value of

the voting holders of Current Notes and 50% in number of those

noteholders who vote, Global Brokerage plans to file a Chapter 11

case to consummate the Plan. The bankruptcy case is expected to

take no longer than sixty days.

FXCM Group is not involved with the Chapter 11 filing. The

RSA and the Plan were designed not to impact – and should have no

impact on – FXCM Group’s business or operations.

Nasdaq Delisting and Transfer

As previously announced, on May 2, 2017 the Nasdaq Stock Market

(“Nasdaq”) notified Global Brokerage that the market value of its

publicly held shares does not meet the requirement for continued

listing under the Nasdaq Global Market’s listing standards. On

November 6, 2017, Global Brokerage was notified that Nasdaq would

remove Global Brokerage from The NASDAQ Global Market.

Nasdaq has approved Global Brokerage to transfer its stock to

the NASDAQ Capital Market exchange, and the securities will begin

trading at the opening of business on November 13, 2017.

However, by the end of the 2017 calendar year, Global Brokerage

intends to initiate the steps to deregister its common stock under

the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) and terminate its duty to file periodic reports with the

Securities and Exchange Commission (the ”SEC”), such as quarterly

and annual reports. As a result of deregistration, Global

Brokerage expects its annual expenses to be reduced.

Board and Management Changes

In an effort to further minimize expenses as contemplated by the

restructuring, the Board of Directors of Global Brokerage (the

“Board”) has also decided to reduce its size. Effective as of

the Effective Date of the Plan, Messrs. David Sakhai and Eduard

Yusupov will resign from their positions as members of the

Board. The decisions by Messrs. Sakhai and Yusupov to resign

are not a result of any disagreement with Global Brokerage.

In addition, the following Executive Officers of Global

Brokerage will submit their resignation to the Board, effective as

of the Effective Date of the Plan, Margaret Deverell, Chief

Accounting Officer, Robert Lande, Chief Financial Officer, and

David S. Sassoon, General Counsel. The resignation of these

executives from Global Brokerage will allow each of them to focus

their priorities in these roles to FXCM Group.

This press release is for information purposes only and is not a

solicitation to accept or reject the proposed prepackaged plan of

reorganization referred to herein or an offer to sell or a

solicitation of an offer to buy the New Secured Notes or any

securities of Global Brokerage. The Plan will be distributed with a

Disclosure Statement to all holders of Global Brokerage’s Current

Notes. Global Brokerage, Global Brokerage Holdings, FXCM Group and

Leucadia, or their respective affiliates, recommend that all

holders of Current Notes should vote to accept the Plan.

Global Brokerage’s legal advisors are King & Spalding LLP,

and its financial advisors are Perella Weinberg Partners LP.

Additional information regarding Global Brokerage’s

restructuring can be found in the Current Report on Form 8-K to be

filed with the SEC on November 13, 2017.

Disclosure Regarding Forward-Looking

Statements

In addition to historical information, this earnings release may

contain “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, Section 21E of the Exchange Act

and/or the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements preceded by, followed

by, or including the words “believes,” “expects,” “anticipates,”

“plans,” “estimates,” “projects,” “forecasts,” or similar

expressions. Examples of forward-looking statements in this news

release are statements about the expected terms and timing of the

Plan, the expected SEC deregistration and the financial impact on

Global Brokerage, including reduced expenses, resulting from the

restructuring transactions. These forward-looking statements are

not historical facts and are based on current expectations,

estimates and projections about Global Brokerage’s industry,

business plans, management’s beliefs and certain assumptions made

by management, many of which, by their nature, are inherently

uncertain and beyond our control. Accordingly, readers are

cautioned that any such forward-looking statements are not

guarantees of future performance and are subject to certain risks,

uncertainties and assumptions that are difficult to predict

including, without limitation, risks associated with Global

Brokerage’s strategy to focus on its operations outside the United

States, risks associated with the events that took place in the

currency markets on January 15, 2015 and their impact on Global

Brokerage’s capital structure, risks associated with Global

Brokerage’s ability to recover all or a portion of any capital

losses, risks relating to the ability of Global Brokerage to

satisfy the terms and conditions of or make payments pursuant to

the terms of the finance agreements with Leucadia, as well as risks

associated with Global Brokerage’s obligations under its other

financing agreements, risks related to Global Brokerage’s

dependence on FX market makers, market conditions, risks associated

with the outcome of any potential litigation or regulatory

inquiries to which Global Brokerage may become subject, risks

associated with potential reputational damage to Global Brokerage

resulting from its sale of US customer accounts, and those other

risks described under “Risk Factors” in Global Brokerage’s Annual

Report on Form 10-K, Global Brokerage’s latest Quarterly Report on

Form 10-Q, and other reports or documents Global Brokerage files

with, or furnishes to, the SEC from time to time, which are

accessible on the SEC website at sec.gov. This information should

also be read in conjunction with Global Brokerage’s Consolidated

Financial Statements and the Notes thereto contained in Global

Brokerage’s Annual Report on Form 10-K, Global Brokerage’s latest

Quarterly Report on Form 10-Q, and in other reports or documents

that Global Brokerage files with, or furnishes to, the SEC from

time to time, which are accessible on the SEC website at

sec.gov.

About Global Brokerage, Inc.

Global Brokerage, Inc. (NASDAQ:GLBR) is a holding company with

an indirect effective ownership of FXCM Group, through its equity

interest in Global Brokerage Holdings, of between 7.5 – 37.3%

depending on the amount of distributions made by FXCM Group.

Investor Relations investorrelations@globalbrokerage.info

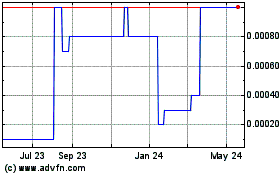

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

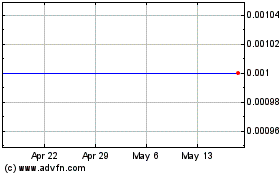

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Dec 2023 to Dec 2024