Toronto Stocks Edge Higher; Corus Entertainment Slides on 2Q Loss, Revenue Decline

14 April 2023 - 3:05AM

Dow Jones News

By Adriano Marchese

Stocks in Toronto advanced in midday trading on Thursday, with

most sectors seeing gains. Materials and healthcare led the

advance, while industrials, staples and utilities paced the

declines.

Canada's S&P/TSX Composite Index was up 0.27% at 20509.91

and the blue-chip S&P/TSX 60 rose 0.21% to 1233.83.

Corus Entertainment Inc. shares were down 3% at 1.63 Canadian

dollars ($1.21) after reporting a loss for the second quarter of

fiscal 2023. The Toronto-based, mass media company saw its revenue

drop as a decline in advertising dollars weighed on performance.

Corus also cut its dividend in favor of paying down debt.

Other market movers:

Teck Resources Ltd. shares rose 1.5% to C$58.66 after the

company said it will look to speed up the separation of its

steelmaking business, as the Swiss-based commodities company

Glencore PLC continues its bid to take over the company.

Foraco International S.A.'s shares gained after the company it

secured a 111 million Australian-dollar ($74.3 million) contract to

provide metals and mining giant Rio Tinto with water drilling

services in Australia. The shares were up 3.7% to C$1.95.

GreenPower Motor Co. climbed 18% to C$3.55 after they received a

$15 million order for their electric school buses from the state of

West Virginia.

Hudbay Minerals Inc. said it struck a roughly $439 million deal

to buy Copper Mountain Mining Corp., creating one of Canada's

largest copper miners with output of about 150,000 metric tons a

year from operations in North and South America. Shares of Hudbay

were up 2.9% to C$7.20 while Copper Mountain shares soared over 20%

to C$2.72.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

April 13, 2023 12:50 ET (16:50 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

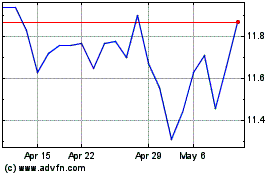

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

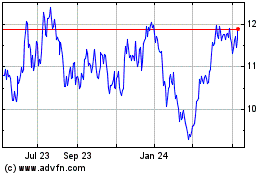

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Nov 2023 to Nov 2024