Important notes regarding participation in the meeting

Notice is given that the 2023 Annual General Meeting (AGM or meeting) of shareholders of ioneer Ltd (ABN 76 098 564 606) (the "Company")

("Shareholders") will be held both in person and virtually at 10.00AM (AEDT) on Friday, 3 November 2023.

This year the Company’s AGM will be held both in person and virtually. Shareholders are invited to attend and participate in the AGM at the Vibe Hotel North Sydney, 171 Pacific Highway, North Sydney NSW 2060 or

online at https://web.lumiagm.com/349221399 (Lumi Online Platform).

Even if you plan to attend the AGM online or in person, we encourage you to submit a directed proxy form ("Proxy Form") as early as possible. The personalised Proxy Form

physically posted to Shareholders should be completed and can be lodged online at www.votingonline.com.au/ioneeragm2023 (Voting Platform), by fax, by mail or in person (see Proxy Form for

lodgement options and further details). For your Proxy Form to be valid, completed Proxy Forms must be received no later than 48 hours before the commencement of the AGM, by 10.00AM (AEDT) on Wednesday, 1 November 2023.

Shareholders can submit questions before the meeting by emailing questions to enquiries@boardroomlimited.com.au by no later than 10.00AM (AEDT) on Friday, 27 October 2023 and can also ask questions during

the meeting, either online or in person.

In the event that it is necessary for the Company to give further updates, information will be provided on the Company’s website (https://www.ioneer.com/investors/agm/2023) and lodged with the Australian

Securities Exchange (ASX).

Attending the AGM Virtually

The Lumi Online Platform will allow Shareholders and proxyholders to participate in the AGM, ask questions during the meeting, and vote in real-time during the meeting. Further details on how to participate and

an online user guide will be published on the Company's website.

To participate in the meeting via the Lumi Online Platform, Shareholders and proxyholders will need the following details:

|

Meeting ID: 349-221-399

|

|

Australian Residents

|

1. Username – Voting Access Code (VAC)

Your VAC can be located on your personalised Proxy Form or on your Notice of Meeting email.

2. Password

This is the postcode of your registered address.

|

| |

|

|

Overseas Residents

|

1. Username – Voting Access Code (VAC)

Your VAC can be located on your personalised Proxy Form or on your Notice of Meeting email.

2. Password

Three-character country code e.g. New Zealand – NZL.

|

|

|

|

Proxyholders

|

To receive you Username and Password, please contact our share registry, Boardroom Pty Ltd on 1300 737 760 or +61 2 9260 9600 between 8.30AM and 5.30PM (AEDT)

Monday to Friday before the meeting.

|

Attending the AGM in person

We are pleased to be able to invite Shareholders to join us in person for the 2023 AGM. The meeting will be held at 10.00AM (AEDT) on Friday 3 November 2023 at the Vibe Hotel North Sydney, 171 Pacific Highway,

North Sydney NSW 2060.

The Company's Board and Management look forward to providing an update on ioneer’s activities at the AGM.

Notice of Annual General Meeting

ioneer Ltd ABN 76 098 564 606

The Explanatory Memorandum to this Notice provides additional information on business to be considered at the AGM. The Explanatory Memorandum and the Proxy Form form part of this Notice. Terms and abbreviations

used in this Notice and Explanatory Memorandum are defined in the Definitions section.

This Notice of Meeting should be read in its entirety. If Shareholders are in doubt as to how they should vote, they should seek advice from their accountant, solicitor or other professional adviser prior to

voting.

Business of the Annual General Meeting

Ordinary Business

|

1. |

Financial Statements and Reports

|

To receive and consider the consolidated financial statements of the Company and its controlled entities, the Directors' Report, and the Auditor's Report for the financial year ended 30 June 2023.

There is no vote on this item.

To consider and, if thought fit, pass the following resolution as an ordinary resolution:

That the Remuneration Report for the year ended 30 June 2023 be adopted.

As required by the Corporations Act 2001 (Cth) (Corporations Act), the Company will disregard any votes cast on Resolution 2:

| • |

by or on behalf of a member of the Company’s Key Management Personnel (KMP), details of whose remuneration is disclosed in the Remuneration Report for the year ended 30 June 2023 and their

closely related parties, regardless of the capacity in which the vote is cast; or

|

| • |

as proxy of a KMP at the date of the AGM and their closely related parties.

|

However, the Company need not disregard a vote cast on Resolution 2 if it is cast as proxy for a person entitled to vote on Resolution 2:

| • |

in accordance with the directions on the proxy form; or

|

| • |

by the Chairman of the AGM in accordance with an express authorisation in the proxy form to exercise the proxy even though the resolution is connected directly or indirectly with the remuneration of a KMP.

|

|

3. |

Re-election of Directors

|

To consider and, if thought fit, pass the following resolutions as separate ordinary resolutions:

(a) That Rose McKinney-James (who retires in accordance with Rule 6.4(a) of the Company’s Constitution and being eligible) is re-elected as an

Independent Non-Executive Director.

(b) Margaret R. Walker (who retires in accordance with Rule 6.4(a) of the Company’s Constitution and being eligible) is re-elected as an Independent Non-Executive Director.

Special Business

|

4. |

Approval of issue of Performance Rights to Directors in lieu of Directors’ fees

|

To consider and, if thought fit, pass the following resolutions as separate ordinary resolutions:

(a) That, for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders approve and authorise the Board to issue Performance

Rights to James D. Calaway (or his nominees) in lieu of directors’ fees on the terms and conditions set out in the Explanatory Memorandum.

(b) That, for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders approve and authorise the Board to issue Performance

Rights to Alan Davies (or his nominees) in lieu of directors’ fees on the terms and conditions set out in the Explanatory Memorandum.

(c) That, for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders approve and authorise the Board to issue Performance

Rights to Stephen Gardiner (or his nominees) in lieu of directors’ fees on the terms and conditions set out in the Explanatory Memorandum.

(d) Subject to the resolution in item 3(a) being approved, that, for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders

approve and authorise the Board to issue Performance Rights to Rose McKinney-James (or her nominees) in lieu of directors’ fees on the terms and conditions set out in the Explanatory Memorandum.

(e) Subject to the resolution in item 3(b) being approved, that, for the purposes of Listing Rule 10.11 and for all other purposes, Shareholders

approve and authorise the Board to issue Performance Rights to Margaret R. Walker (or her nominees) in lieu of directors’ fees on the terms and conditions set out in the Explanatory Memorandum.

In accordance with ASX Listing Rule 14.11.1, the Company will disregard any votes cast in favour of:

| • |

Resolution 4(a) by James D. Calaway or any of his associates;

|

| • |

Resolution 4(b) by Alan Davies or any of his associates;

|

| • |

Resolution 4(c) by Stephen Gardiner or any of his associates;

|

| • |

Resolution 4(d) by Rose McKinney-James or any of her associates; and

|

| • |

Resolution 4(e) by Margaret R. Walker or any of her associates.

|

The Company will also disregard any votes cast in favour of Resolutions 4(a) to (e) by any other person who will obtain a material benefit as a result of the issue of the Performance Rights under Resolutions

4(a) to (e) (except a benefit solely by reason of being a holder of ordinary shares in the Company).

However, the Company need not disregard a vote if:

| • |

it is cast in favour of a resolution by a person as proxy or attorney for a person who is entitled to vote on the resolution, in accordance with the directions given to the proxy or attorney to vote on the resolution in that way;

|

| • |

it is cast by the Chairman of the meeting as proxy or attorney for a person who is entitled to vote on the resolution, in accordance with a direction given to the Chairman to vote on the resolution as the Chairman decides; or

|

| • |

it is cast by a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

|

|

o |

the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting on the resolution; and

|

|

o |

the holder votes on the resolution in accordance with directions given by the beneficiary to the holder to vote in that way.

|

For the purposes of section 250BD(1) of the Corporations Act 2001 (Cth):

1. a vote must not be cast on Resolution 4 by a KMP, or a closely related party of a KMP, acting as proxy, if their appointment does not specify the way the proxy is to vote on the

resolution However, this voting exclusion does not apply if the KMP is the Chairman of the AGM acting as proxy and their appointment expressly authorises the Chairman of the AGM to exercise the proxy even if the Resolution is connected

directly or indirectly with the remuneration of a member of the KMP of the Company; and

2. if you appoint the Chairman of the AGM as your proxy, and you do not direct your proxy how to vote on Resolution 4 on the Proxy Form, you will be expressly authorising the Chairman of

the AGM to exercise your proxy even if Resolution 4 is connected directly or indirectly with the remuneration of a member of the KMP of the Company, which includes the Chairman of the AGM.

|

5. |

Approval of Grant of Performance Rights to Bernard Rowe

|

To consider and, if thought fit, to pass with or without amendment, the following resolution as an ordinary resolution:

That, for the purposes of Listing Rule 10.14, and for all other purposes, Shareholders approve and authorise the Board to grant 3,736,218 Performance Rights to Bernard

Rowe (and/or his nominees) on the terms outlined in the Company's 2023 Annual Report and under the Equity Incentive Plan, on the terms and conditions set out in the Explanatory Memorandum.

In accordance with ASX Listing Rule 14.11.1, the Company will disregard any votes cast in favour of this Resolution by Bernard Rowe or any of his associates. The Company will also disregard any votes cast in

favour of this Resolution by any Director of the Company, or their associates, who are eligible to participate in the Equity Incentive Plan.

However, the Company need not disregard a vote if:

| • |

it is cast in favour of a resolution by the person as proxy or attorney for a person who is entitled to vote on the resolution, in accordance with the directions given to the proxy or attorney to vote on the resolution in that way;

|

| • |

it is cast by the Chairman as proxy or attorney for a person who is entitled to vote on the resolution, in accordance with a direction given to the Chairman to vote on the resolution as the Chairman decides; or

|

| • |

it is cast by a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

|

|

o |

the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting on the resolution; and

|

|

o |

the holder votes on the resolution in accordance with directions given by the beneficiary to the holder to vote in that way.

|

For the purposes of section 250BD(1) of the Corporations Act 2001 (Cth):

1. a vote must not be cast on Resolution 5 by a KMP, or a closely related party of a KMP, acting as proxy, if their appointment does not specify the way the proxy is to vote on the

resolution However, this voting exclusion does not apply if the KMP is the Chairman of the AGM acting as proxy and their appointment expressly authorises the Chairman of the AGM to exercise the proxy even if the Resolution is connected

directly or indirectly with the remuneration of a member of the KMP of the Company; and

2. if you appoint the Chairman of the AGM as your proxy, and you do not direct your proxy how to vote on Resolution 5 on the Proxy Form, you will be expressly authorising the Chairman of the

AGM to exercise your proxy even if Resolution 5 is connected directly or indirectly with the remuneration of a member of the KMP of the Company, which includes the Chairman of the AGM.

|

6. |

Approval of Grant of Performance Rights to James D. Calaway

|

To consider and, if thought fit, to pass with or without amendment, the following resolution as an ordinary resolution:

That, for the purposes of Listing Rule 10.14, and for all other purposes, Shareholders approve and authorise the Board to grant 1,992,077 Performance Rights to James D.

Calaway (and/or his nominees) on the terms outlined in the Company's 2023 Annual Report and under the Equity Incentive Plan, on the terms and conditions set out in the Explanatory Memorandum.

In accordance with ASX Listing Rule 14.11.1, the Company will disregard any votes cast in favour of this Resolution by James D. Calaway or any of his associates. The Company will also disregard any votes cast

in favour of this Resolution by any Director of the Company, or their associates, who are eligible to participate in the Equity Incentive Plan.

However, the Company need not disregard a vote if:

| • |

it is cast in favour of a resolution by the person as proxy or attorney for a person who is entitled to vote on the resolution, in accordance with the directions given to the proxy or attorney to vote on the resolution in that way;

|

| • |

it is cast by the Chairman as proxy or attorney for a person who is entitled to vote on the resolution, in accordance with a direction given to the Chairman to vote on the resolution as the Chairman decides; or

|

| • |

it is cast by a holder acting solely in a nominee, trustee, custodial or other fiduciary capacity on behalf of a beneficiary provided the following conditions are met:

|

|

o |

the beneficiary provides written confirmation to the holder that the beneficiary is not excluded from voting, and is not an associate of a person excluded from voting on the resolution; and

|

|

o |

the holder votes on the resolution in accordance with directions given by the beneficiary to the holder to vote in that way.

|

For the purposes of section 250BD(1) of the Corporations Act 2001 (Cth):

1. a vote must not be cast on Resolution 6 by a KMP, or a closely related party of a KMP, acting as proxy, if their appointment does not specify the way the proxy is to vote on the

resolution However, this voting exclusion does not apply if the KMP is the Chairman of the AGM acting as proxy and their appointment expressly authorises the Chairman of the AGM to exercise the proxy even if the Resolution is connected

directly or indirectly with the remuneration of a member of the KMP of the Company; and

2. if you appoint the Chairman of the AGM as your proxy, and you do not direct your proxy how to vote on Resolution 6 on the Proxy Form, you will be expressly authorising the Chairman of the

AGM to exercise your proxy even if Resolution 6 is connected directly or indirectly with the remuneration of a member of the KMP of the Company, which includes the Chairman of the AGM.

By Order of the Board

Ian Bucknell

Company Secretary

20 September 2023

Notes and voting instructions

Action to be taken by Shareholders and how to vote

Shareholders should read the Notice and the Explanatory Memorandum carefully before deciding how to vote on the resolutions.

Attending the Meeting

The Company will be holding a hybrid AGM this year. The Company invites you to attend the AGM either in-person or online via the Lumi platform https://web.lumiagm.com/349221399 (Lumi

Online Platform). If you choose to participate online, you will be able to participate in the AGM, direct questions to the Board or Auditor, and vote in real-time during the meeting.

Each vote on the business to be conducted at the meeting will be conducted by way of a poll. As such, each Shareholder is entitled to one vote on each resolution for each fully paid ordinary share in the

Company held by such Shareholder.

Voting in person or by attorney

An individual attending the AGM as corporate representative must present satisfactory evidence of his or her appointment to attend on the company’s behalf, unless previously lodged with the Company or the

Company’s share registry, Boardroom Pty Ltd (ABN: 14 003 209 836) (the "Share Registry"). All documents must be submitted to the Share Registry by no later than 10.00AM (AEDT) on Wednesday, 1 November

2023, being not less than 48 hours before the AGM.

Attorneys should provide the original or certified copies of the power of attorney under which they have been authorised to attend and vote at the AGM, unless previously lodged with the Company or the Share

Registry. All documents must be submitted to the Share Registry by no later than 10.00AM (AEDT) on Wednesday, 1 November 2023, being not less than 48 hours before the AGM.

Proxies

Shareholders may appoint a proxy as their representative to attend the AGM and vote in their place. All Shareholders are invited and encouraged to attend the AGM either in person, virtually or, if they are

unable to attend, sign the personalised Proxy Form posted to Shareholders and return the signed form to the Company in accordance with the instructions on the Proxy Form. Lodgement of a Proxy Form will not preclude a Shareholder from

attending and voting at the AGM.

Please note that:

(a) a member of the Company entitled to attend and vote at the AGM is entitled to appoint a proxy;

(b) a proxyholder need not be a member of the Company; and

(c) a member of the Company entitled to cast two or more votes may appoint two proxies and may specify the proportion or number of votes each proxy is appointed to

exercise, but where the proportion or number is not specified, each proxy may exercise half of the votes.

A Shareholder can direct its proxy to vote for, against or abstain from voting on Resolutions 2 to 6 by marking the appropriate box on the Proxy Form for each of those items of business.

Shareholders who complete and return their Proxy Form but do not nominate the identity of the proxy will be taken to have appointed the Chairman of the AGM as their proxy to vote on their

behalf. If a Proxy Form is returned but the nominated proxy does not attend the AGM or does not vote, the Chairman will act in place of the nominated proxy. In each case, the Chairman will vote in accordance with any voting directions

specified by the Shareholder in the Proxy Form. Undirected proxies able to be voted will be voted in accordance with the Chairman’s voting intentions (see Undirected Proxies below).

The Proxy Form contains further details on appointing proxies and lodging Proxy Forms.

Undirected proxies

If you appoint the Chairman as your proxy (including by default) and you do not specify how the proxy is to vote, you expressly authorise the Chairman to cast your vote “for” each item of

business, even where the resolutions are connected directly or indirectly with the remuneration of one or more members of KMP, which includes the Chairman.

The Chairman intends to vote undirected proxies able to be voted in favour of all resolutions on the agenda for the meeting.

Any undirected proxy given to a Director (other than the Chairman), any “Associate” of a Director, or a KMP of the Company or their related parties for resolutions connected directly or

indirectly with the remuneration of KMP will not be cast, unless Shareholders specify how the proxy should vote on the Proxy Form.

Entitlement to vote

The Board has determined pursuant to regulation 7.11.37 of the Corporations Regulations 2001 (Cth) that the persons eligible to vote at the AGM are those who are registered as Shareholders on Friday 1 November

2023, at 7.00PM (AEDT).

Annual Report

Shareholders will be offered the opportunity to discuss the Annual Report at the AGM. Copies of the report can be found on the Company’s website (www.ioneer.com) or by contacting the Company on (02) 9922 5800.

There is no requirement for Shareholders to approve the Annual Report.

At the scheduled AGM, Shareholders will have an opportunity to:

|

(a) |

discuss the Annual Report;

|

|

(b) |

direct questions or comment on the management of the Company to the Chairman; and

|

|

(c) |

direct questions to the auditor regarding:

|

|

a. |

the preparation and the content of the Auditor's Report;

|

|

b. |

the conduct of the audit;

|

|

c. |

the accounting policies adopted by the Company in relation to the preparation of the financial statements; and

|

|

d. |

the independence of the auditor in relation to the conduct of the audit.

|

In addition to taking questions at the AGM, written questions to the Chairman about the management of the Company, or to the Company's auditor about the content of the Auditor's Report and

the conduct of the audit may be submitted no later than 5 business days before the AGM by emailing questions to enquiries@boardroomlimited.com.au.

Introduction

This Explanatory Memorandum has been prepared for the information of Shareholders in connection with the business to be conducted at the AGM to be held on Friday, 3 November 2023 at 10.00AM (AEDT).

This Explanatory Memorandum should be read in conjunction with, and forms part of, the accompanying Notice. The purpose of this Explanatory Memorandum is to provide information to Shareholders in deciding

whether or not to pass the resolutions set out in the Notice.

Resolution 1 – Financial Statements and Reports

The Corporations Act requires the Financial Report (which includes Financial Statements and Directors’ Declaration), the Directors’ Report and the Auditor’s Report to be laid before the AGM.

There is no requirement either in the Corporations Act or in the Company’s Constitution for Shareholders to approve the Company's Financial Report, Directors’ Report or Auditor’s Report (together the "Reports").

Shareholders will have a reasonable opportunity at the AGM to ask questions and make comments on the Reports and on the business and operations of the Company. Shareholders will also be given a reasonable

opportunity to ask the auditor questions about:

|

• |

the preparation and the content of the Auditor's Report;

|

|

• |

the conduct of the audit;

|

|

• |

the accounting policies adopted by the Company in relation to the preparation of the financial statements; and

|

|

• |

the independence of the auditor in relation to the conduct of the audit.

|

Resolution 2 – Remuneration Report

The Directors' Report for the year ended 30 June 2023 contains a Remuneration Report which sets out the remuneration policy for the Company and reports on the remuneration arrangements in place for the

appointed executive and non-executive directors of the Board as well as other KMP. The Company’s Annual Report (which includes the Directors’ Report) is available on the ioneer website (www.ioneer.com).

The Corporations Act provides that the Company is required to put the Remuneration Report to the vote of Shareholders. The Corporations Act expressly provides that the vote is advisory only and does not bind

the Directors or the Company.

Shareholders attending the AGM will be given a reasonable opportunity to ask questions about or make comments on the Remuneration Report.

The Chairman intends to exercise all undirected proxies able to be voted in favour of Resolution 2. If the Chairman is appointed as your proxy and you have not specified the way the Chairman is to vote on

Resolution 2 by signing and returning the Proxy Form, you are considered to have provided the Chairman with an express authorisation to vote the proxy in accordance with the Chairman’s intention.

The Board unanimously recommends that Shareholders vote in favour of the resolution.

Resolution 3 – Re-election of Directors

The Company’s Constitution and the ASX Listing Rules require that an election of Directors must take place each year. Each year:

| (a) |

one third of the Directors (or the nearest whole number); and

|

| (b) |

any Director who has held office without re-election past the third annual general meeting,

|

(excluding the Managing Director), must retire as Director. If eligible, that Director may then offer themselves for re-election. Certain other requirements apply as to which Director must retire for the

purposes of re-election.

Pursuant to rule 6.4(a) of the Company’s Constitution:

|

(a) |

Rose McKinney-James retires as a Non-Executive Director at the AGM. Being eligible, Rose McKinney-James offers herself for re-election as a Non-Executive Director; and

|

|

(b) |

Margaret R. Walker retires as a Non-Executive Director at the AGM. Being eligible, Margaret R. Walker offers herself for re-election as a Non-Executive Director.

|

Information on the skills and experience for each of Rose McKinney-James, and Margaret R. Walker is set out in the Company’s 2023 Annual Report.

Directors who are not the subject of a re-election or election resolution, support the re-election of Rose McKinney-James, and Margaret R. Walker.

Resolution 4 – Grant of Performance Rights to Directors

These resolutions seek Shareholder approval for the issue of Performance Rights to James D. Calaway, Alan Davies, Stephen Gardiner, Rose E McKinney-James and Margaret R. Walker (or their nominees) in lieu of

receipt of their directors’ fees in cash from time to time. No consideration will be payable for the issue of Performance Rights.

ASX Listing Rule 10.11 requires shareholder approval to be obtained where an entity issues, or agrees to issue, securities to a related party; a person who is, or was at any time in the 6 months before the

issue, a substantial (30%+) holder in the Company; a person who is or was at any time in the 6 months before the issue of securities a substantial (10%) holder in the Company and who has nominated a director the Board of the Company pursuant

to a relevant agreement which gives them a right or expectation to do so; an associate of a person referred to in ASX Listing Rules 10.11.1 to 10.11.3; or a person whose relationship with the entity or a related party is, in ASX’s opinion,

such that approval should be obtained unless an exception in ASX Listing Rule 10.12 applies. It is the view of the Directors that the exceptions set out in ASX Listing Rule 10.12 do not apply in the current circumstances.

If Resolutions 4(a) to (e) are passed by the Shareholders, then the issue of Performance Rights to the Directors will not be included in the 15% calculation of the Company’s annual placement capacity pursuant

to Exception 14 of ASX Listing Rule 7.2.

If Resolutions 4(a) to (e) are not passed by the Shareholders, then the Performance Rights will not be issued to the Directors and the Company will be required to pay the Director fees in cash.

The Board believes that providing remuneration to Directors in the form of Performance Rights in consideration for their services as Directors preserves cash and aligns the interests of Directors with those of

Shareholders, by giving the Directors an opportunity to share in the success of the Company. Director remuneration in this form can motivate and reward long-term decision making, through the aim of creating and maximising Shareholder value.

The value of the Performance Rights at the time of issue, taken together with all other Director remuneration, cannot exceed the then applicable maximum annual remuneration that can be paid to all of the

Directors (known as the directors’ remuneration cap).

Section 208 of the Corporations Act

In accordance with section 208 of the Corporations Act, to give a financial benefit to a related party (including Directors), the Company must obtain Shareholder approval unless the giving of the financial

benefit falls within an exception in sections 210 to 216 of the Corporations Act.

The Board considers that shareholder approval under section 208 of the Corporations Act is not required as the exception in section 211 of the Corporations Act applies. The Performance Rights to be issued to

the Directors are considered to be reasonable remuneration for the purposes of section 211 of the Corporations Act.

Specific Information Required by Listing Rule 10.13

ASX Listing Rule 10.13 requires certain information to be provided in relation to approval sought under ASX Listing Rule 10.11. This information is set out below:

|

Name of persons proposed to

receive performance rights:

|

Resolution 4(a) – James D. Calaway (Executive Director, Chairman and related party), or his nominee.

Resolution 4(b) – Alan Davies (Independent Non-Executive Director and related party), or his nominee.

Resolution 4(c) – Stephen Gardiner (Independent Non-Executive Director and related party), or his nominee.

Resolution 4(d) – Rose McKinney-James (Independent Non-Executive Director and related party), or her nominee.

Resolution 4(e) – Margaret R. Walker (Independent Non-Executive Director and related party), or her nominee.

|

| |

|

|

|

Formula for calculating the

number of securities to be

issued to persons listed above:

|

The number of Performance Rights to be issued to each Non-Executive Director is equal to the value of 27.7% of the total Non-Executive Director fees payable to the Director divided by the 10-day

Value-Weighted Average Price (VWAP) adjusted by the closing exchange rate as at the date of the AGM.

The number of Performance Rights to be issued to the Chairman (Executive-Director) is equal to the value of 18.9% of the total Chairman fees (excluding James D. Calaway's executive remuneration) payable to

the Chairman divided by the 10-day VWAP as at the date of the AGM.

For example, if the 10-day VWAP as at the date of the AGM is AUD0.337 and the AUD:USD exchange rate is AUD0.664, each Director would receive the number of Performance Rights set out below.

|

|

|

Name

|

Value of Performance

Rights

|

Number of

Performance Rights

|

|

James D. Calaway

|

USD35,000

|

156,189

|

|

Alan Davies

|

USD25,000

|

111,563

|

|

Stephen Gardiner

|

USD25,000

|

111,563

|

|

Rose McKinney-James

|

USD25,000

|

111,563

|

|

Margaret R. Walker

|

USD25,000

|

111,563

|

| |

|

|

|

|

Assuming a 10-day VWAP of AUD0.337 and an FX rate of AUD0.69, the total number of Performance Rights to be issued to the Directors would be 602,443, which would amount to 0.0001% of the total number of Shares on issue as at the date of

this Explanatory Memorandum.

|

| |

|

|

|

Date by which the securities

will be issued (Issue Date):

|

If Shareholder approval is obtained, the Performance Rights to be issued to Directors (or their nominees) will be issued on a date no later than one month after the date of the 2023 AGM, as required by ASX

Listing Rule 10.13.5, unless otherwise extended by way of ASX granting a waiver to the Listing Rules.

|

|

|

|

|

Issue price:

|

The issue price will be determined at a price equal to the VWAP for the Company's Shares over the 10 Trading Days immediately before the date of the 2023 AGM.

|

|

|

|

|

Terms of the equity securities:

|

The Performance Rights will be issued at a price equal to the VWAP for the Company's Shares over the 10 Trading Days immediately before the date of the 2023 AGM.

The Performance Rights will vest 12 months after the date of issuance.

On vesting, Directors will be entitled to be allocated one fully paid ordinary share in the Company for each vested Performance Right.

|

|

|

|

|

Purpose of issue:

|

Performance Rights are issued in lieu of paying Directors’ remuneration in cash.

|

|

|

|

|

Details of the Directors' current

remuneration package:

|

Name

|

Total remuneration package

|

|

James D. Calaway:

|

USD497,000(1)

|

|

Alan Davies:

|

USD90,000

|

|

Stephen Gardiner:

|

USD90,000

|

|

Rose McKinney-James:

|

USD90,000

|

|

Margaret R. Walker:

|

USD90,000

|

|

(1) James D. Calaway's total fixed remuneration package consists of USD185,000 in remuneration for his role as Chairman of the Company and USD312,000 of executive remuneration. James D.

Calaway is also eligible to participate in the Equity Incentive Plan in respect of short and Long-Term Incentives (LTI).

Directors’ fees are set in USD – the Chairman's fees being USD185,000 and Independent Non-Executive Directors each being USD90,000 which includes USD5,000 for each of the respective chairs of the Board

Committees. The Chairman, as an Executive Director of the Company also receives USD312,000 in executive remuneration.

The above total remuneration package assumes the award of USD25,000 of Performance Rights to all Independent Non-Executive Directors and an award of USD35,000 in Performance Rights to the Chairman.

|

| |

|

|

|

Price or other consideration for

issue

|

Nil – the Performance Rights will be issued in lieu of paying Directors' remuneration in cash.

|

|

|

|

|

Material terms

|

Other than those terms set out in this Explanatory Memorandum, including that the Performance Rights are issued in lieu of paying Directors' remuneration in cash, there are no other material terms in

relation to the issue.

|

| |

Voting exclusion statement:

|

A voting exclusion statement is contained on page 4 of this Notice of Meeting. Votes cast by Shareholders contrary to the voting exclusion statement will be disregarded.

|

Board recommendation

Other than:

|

(a) |

James D. Calaway in relation to Resolution 4(a) because of his interest in that resolution;

|

|

(b) |

Alan Davies in relation to Resolution 4(b) because of his interest in that resolution;

|

|

(c) |

Stephen Gardiner in relation to Resolution 4(c) because of his interest in that resolution;

|

|

(d) |

Rose McKinney-James in relation to Resolution 4(d) because of her interest in that resolution; and

|

|

(e) |

Margaret R. Walker in relation to Resolution 4(e) because of her interest in that resolution,

|

the Board unanimously supports the issue of Performance Rights (and when vested, Shares) to James D. Calaway, Alan Davies, Stephen Gardiner, Rose McKinney-James and Margaret R. Walker in lieu of cash remuneration.

Resolution 5 – Approving the issue of Performance Rights to Mr Bernard Rowe

The Company is seeking Shareholder approval for the issue of 3,736,218 Performance Rights to Bernard Rowe (CEO & Managing Director of the Company) under the Company's Equity Incentive Plan.

ASX Listing Rule 10.14 provides that a listed company must obtain shareholder approval to allow a director to acquire securities under an employee incentive scheme, unless an exception in ASX Listing Rule 10.16

applies. The Company is seeking approval for Resolution 5 for the purposes of ASX Listing Rule 10.14.

In addition, if Resolution 5 is passed by the Shareholders, the issue of shares to Bernard Rowe on vesting of the Performance Rights will not be included in the 15% calculation of the Company's annual placement

capacity pursuant to Listing Rule 7.1.

If Resolution 5 is not passed by the Shareholders, the Performance Rights will not be issued to Bernard Rowe and the Company will be required to pay the fair value of the Performance Rights in cash to Bernard Rowe.

Specific Information Required by Listing Rule 10.15

ASX Listing Rule 10.15 requires certain information to be provided in relation to approval sought under ASX Listing Rule 10.14. This information is set out below:

| |

Name of the person proposed

to receive performance rights:

|

Bernard Rowe (CEO & Managing Director of the Company), or his nominee.

|

| |

|

|

| |

Category in which ASX Listing

Rules the person falls within

and why

|

10.14.1 as Bernard Rowe as Managing Director of the Company.

|

| |

|

|

| |

Number and class of securities

to be issued to the person

|

3,736,218 Performance Rights.

|

| |

|

|

| |

Ioneer’s compensation

framework

|

ioneer’s executive compensation framework aims to provide for fair, competitive remuneration that aligns potential rewards with the Company’s objectives while being transparent to shareholders. Most of our

people are based in the U.S., driving us to align our remuneration framework with U.S. standards. Typically, this means proportionately less cash and higher equity than the Australian market standard, with some of the equity contingent

on service to make up for the relatively low cash proportion. Performance objectives for STI and equity vesting are set such that achievement would accelerate development during our current pre-production phase for higher shareholder

value. This means that the value of remuneration realised at vesting is highly aligned with the value realised by investors.

|

| |

Details of Bernard Rowe's

current total remuneration

package

|

ioneer’s remuneration framework and executive reward strategy provides a mix of fixed and variable remuneration with a blend of short and long-term incentives. The key elements of the remuneration package

for Bernard Rowe is as follows:

• Fixed: Annual base salary of AUD557,400.

• Variable STI: annual cash bonus of up to 80% of base salary.

• Variable LTI: targeted at 120% of base salary.

• Additional employment benefits: superannuation contributions of 11% of base salary.

|

| |

|

|

| |

Number of securities

previously issued to Bernard

Rowe under the plan and the

average acquisition price (if

any) paid for those securities:

|

Bernard Rowe was issued with:

• 8,893,834 Performance Rights under the Company's Equity Incentive Plan on 16 November 2020 following shareholder approval at the 2020 AGM of the Company;

• 1,350,551 Performance Rights under the Company's Equity Incentive Plan on 5 November 2021 following shareholder approval at the 2021 AGM of the Company; and

• 1,400,209 Performance Rights under the Company's Equity Incentive Plan on 4 November 2022 following shareholder approval at the 2022 AGM of the Company.

The Performance Rights were issued for nil consideration in accordance with the terms of the Equity Incentive Plan.

|

| |

|

|

|

Summary of the material terms

of the securities:

|

The Performance Rights will be granted for nil consideration. On vesting, each performance right entitles the holder to be allocated one ordinary share in the Company.

If a vesting condition of a performance right is not achieved by the milestone date, then the performance right will lapse.

|

|

Grant description

|

Hurdle

|

Vesting date

|

Number

|

|

2023 STI Grant(1)

|

Time-based

|

01/07/24

|

1,753,764

|

|

2023 LTI Grant

|

Time-based

|

01/07/26

|

792,982

|

|

2023 LTI Grant

|

Performance-based

|

01/07/26

|

1,189,472

|

| |

|

Total

|

3,736,218

|

|

(1) Executive KMP were not paid FY2023 Short-Term Incentives (STIs) in cash. Instead, the Company elected to issue 12-month Performance Rights in lieu of cash payment in order to conserve funds.

In consideration for this delay ioneer has uplifted the STI awarded by an additional 20% in value.

The Board will employ discretion when assessing the vesting of the Performance Rights; below, at or above targets based on the following performance conditions:

• Sustainability Performance: Top quartile HSE & Community performance (North American Mining Projects)

• Construction: Construction delivery compared to schedule as stated at Final Investment Decision (FID)

• Cost Control: Construction spend compared to budget at FID

• Share price: Ioneer share price compared to comparator group

Should Bernard Rowe cease to be employed by the Company prior to the vesting date, the Board may determine at its discretion to vest the Performance Rights on a pro-rated basis, in accordance with the terms of the Equity Incentive Plan

For further information see the Remuneration Report included in the 2023 Annual Report.

|

| |

|

|

| |

Explanation of why the type of

security is being used:

|

The purpose of issuing Performance Rights is to provide eligible persons the opportunity to participate in the growth and profits of the Company and to attract, motivate and retain their services to promote

the Company’s long-term success.

|

|

Value attributed by the

Company to the security and

basis for valuation:

|

Grant description

|

Number of

Performance

Rights

|

Market value

per

Performance

Right

AUD

|

Market value

AUD

|

|

2023 STI Grant

|

1,753,764

|

AUD0.3374

|

AUD591,720

|

|

2023 LTI Grant

|

792,982

|

AUD0.3374

|

AUD267,552

|

|

2023 LTI Grant

|

1,189,472

|

AUD0.3374

|

AUD401,328

|

|

Total

|

3,736,218

|

AUD0.3374

|

AUD1,260,600

|

|

The Market Value per Performance Right is the market value of a fully paid ordinary share in the Company, calculated using a 10-day VWAP, up to and including 30 June 2023. An independent valuation will be obtained should Shareholders

approve this resolution to determine the fair value of the Performance Rights. This fair value may differ from the Market Value shown above.

|

| |

|

|

|

Date on which the securities

will be issued:

|

If Shareholder approval is obtained, as required by ASX Listing Rule 10.15.7, the securities to be issued to Bernard Rowe (or his nominee) will be issued:

(a) in relation to the 2023 STI Grants, on a date which will be no later than one year after the date of the 2023 AGM, unless otherwise extended by way of ASX

granting a waiver to the Listing Rules; and

(b) in relation to the 2023 LTI Grants, on a date which will be no later than three years after the date of the 2023 AGM, unless otherwise extended by way of

ASX granting a waiver to the Listing Rules.

|

| |

|

|

|

Price at which the securities

will be issued:

|

Nil consideration.

|

| |

|

|

|

Summary of the material terms

of the incentive scheme:

|

The key features of the Equity Incentive Plan are as follows:

(a) the Board will determine the number of awards to be granted to eligible persons (or their nominees), the vesting conditions, and expiry date of the awards

in its sole discretion;

(b) the awards are not transferable unless the Board determines otherwise, or the transfer is required by law and provided that the transfer complies with the

Corporations Act; and

(c) subject to the Corporations Act, ASX Listing Rules, and restrictions on reducing the rights of a holder of awards, the Board will have the power to amend

the Equity Incentive Plan as it sees fit.

A summary of the Equity Incentive Plan is provided in Annexure A. A copy of the Equity Incentive Plan can be obtained by contacting the Company.

|

| |

|

|

|

Summary of the material terms

of any loan made to Bernard

Rowe in relation to the

acquisition:

|

N/A

|

The Company notes that details of any securities issued under the relevant incentive scheme to Bernard Rowe will be published in the Company's annual report for the period in which the securities were issued and

will note that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in an issue of shares under these incentive plans after this Resolution

is approved and who are not named in this Notice will not participate until approval is sought under that rule.

Resolution 6 – Approving the issue of Performance Rights to Mr James D. Calaway

The Company is seeking Shareholder approval for the issue of 1,992,077 Performance Rights to James D. Calaway (Chairman of the Board and Executive Director of the Company) under the Company's Equity Incentive Plan.

ASX Listing Rule 10.14 provides that a listed company must obtain shareholder approval to allow a director to acquire securities under an employee incentive scheme unless an exception in ASX Listing Rule 10.16

applies. The Company is seeking approval for Resolution 6 for the purposes of ASX Listing Rule 10.14.

In addition, if Resolution 6 is passed by the Shareholders, the issue of shares to James D. Calaway on vesting of the Performance Rights will not be included in the 15% calculation of the Company's annual placement

capacity pursuant to Listing Rule 7.1.

If Resolution 6 is not passed by the Shareholders, the Performance Rights will not be issued to James D. Calaway and the Company will be required to pay the fair value of the Performance Rights in cash to James D.

Calaway.

Specific Information Required by Listing Rule 10.15

ASX Listing Rule 10.15 requires certain information to be provided in relation to approval sought under ASX Listing Rule 10.14. This information is set out below:

| |

Name of the person proposed

to receive performance rights:

|

James D. Calaway (Chairman of the Board and an Executive Director of the Company), or his nominee.

|

| |

|

|

| |

Category in which ASX Listing

Rules the person falls within

and why

|

10.14.1 as James D. Calaway as an Executive Director of the Company.

|

| |

|

|

| |

Number and class of securities

to be issued to the person

|

1,992,077 Performance Rights.

|

| |

|

|

| |

Ioneer’s compensation

framework

|

ioneer’s executive compensation framework aims to provide for fair, competitive remuneration that aligns potential rewards with the Company’s objectives while being transparent to shareholders. Most of our

people are based in the U.S., driving us to align our remuneration framework with U.S. standards. Typically, this means proportionately less cash and higher equity than the Australian market standard, with some of the equity contingent

on service to make up for the relatively low cash proportion. Performance objectives for STI and equity vesting are set such that achievement would accelerate development during our current pre-production phase for higher shareholder

value. This means that the value of remuneration realised at vesting is highly aligned with the value realised by investors.

|

| |

|

|

| |

Details of James D. Calaway's

current total remuneration

package

|

ioneer’s remuneration framework and executive reward strategy provides a mix of fixed and variable remuneration with a blend of STIs and LTIs. The key elements of the remuneration package for James D.

Calaway is as follows:

• Fixed: annual Board Chairman remuneration of USD185,000 and executive base salary of USD312,000.

• Variable STI: annual cash bonus of up to 60% of base salary.

• Variable LTI: targeted at 60% of base salary.

|

| |

|

|

| |

Number of securities

previously issued to James D.

Calaway under the plan and

the average acquisition price

(if any) paid for those

securities:

|

James D. Calaway was issued:

• 1,262,740 Performance Rights under the Company's Equity Incentive Plan on 5 November 2021 following shareholder approval at the 2021 AGM of the Company; and

• 682,194 Performance Rights under the Company's Equity Incentive Plan on 4 November 2022 following shareholder approval at the 2022 AGM of the Company.

The Performance Rights were issued for nil consideration in accordance with the terms of the Equity Incentive Plan.

|

| |

|

|

| |

Summary of the material terms of the securities:

|

The Performance Rights will be granted for nil consideration. On vesting, each performance right entitles the holder to be issued with one ordinary share in the Company.

If a vesting condition of a performance right is not achieved by the milestone date, then the performance right will lapse.

|

| |

|

Grant description

|

Hurdle

|

Vesting

date

|

Number

|

|

2023 STI Grant(1)

|

Time-based

|

01/07/24

|

1,156,690

|

|

2023 LTI Grant

|

Time-based

|

01/07/26

|

334,155

|

|

2023 LTI Grant

|

Performance-based

|

01/07/26

|

501,232

|

| |

|

Total

|

1,992,077

|

|

(1) Executive KMP were not paid FY2023 STIs in cash. Instead, the Company elected to issue 12-month Performance Rights in lieu of cash payment in order to conserve funds. In consideration for this delay Ioneer has uplifted the STI

awarded by an additional 20% in value.

The Board will employ discretion when assessing the vesting of the performance based Performance Rights; below, at or above targets based on the following performance conditions:

• Sustainability Performance: Top quartile HSE & Community performance (North American Mining Projects)

• Construction: Construction delivery compared to schedule as stated at FID

• Cost Control: Construction spend compared to budget at FID

• Share price: ioneer share price compared to comparator group

Should James D. Calaway cease to be employed in an executive position in the Company prior to the vesting date, the Board may determine at its discretion to vest the Performance Rights on a pro-rated basis, in accordance with the terms

of the Equity Incentive Plan.

For further information see the Remuneration Report included in the 2023 Annual Report.

|

| |

|

|

|

Explanation of why the type of

security is being used:

|

The purpose of issuing Performance Rights is to provide eligible persons the opportunity to participate in the growth and profits of the Company and to attract, motivate and retain their services to promote

the Company’s long-term success.

|

| |

|

|

|

Value attributed by the

Company to the security and

basis for valuation:

|

Grant

description

|

Number of

Performance

Rights

|

Market value per

Performance Rights

AUD

|

Market value

AUD

|

|

2023 STI Grant

|

1,156,690

|

AUD0.3374

|

AUD390,267

|

|

2023 LTI Grant

|

334,155

|

AUD0.3374

|

AUD112,744

|

|

2023 LTI Grant

|

501,232

|

AUD0.3374

|

AUD169,116

|

|

Total

|

1,992,077

|

AUD0.3374

|

AUD672,127

|

|

The Market Value per Performance Right is the market value of a fully paid ordinary share in the Company, calculated using a 10-day VWAP, up to and including the 30 June 2023. An independent valuation will be obtained should

Shareholders approve this resolution to determine the fair value of the Performance Rights. This fair value may differ from the Market Value shown above.

|

| |

|

|

| |

Date on which the securities

will be issued:

|

If Shareholder approval is obtained, as required by ASX Listing Rule 10.15.7, the securities to be issued to James D. Calaway (or his nominee) will be issued:

(a) in relation to the 2023 STI grants, on a date which will be no later than one year after the date of the AGM, unless otherwise extended by way of ASX

granting a waiver to the Listing Rules; and

(b) in relation to the 2023 LTI grants, on a date which will be no later than three years after the date of the AGM, unless otherwise extended by way of ASX

granting a waiver to the Listing Rules.

|

| |

Price at which the securities

will be issued:

|

Nil consideration.

|

|

|

|

| |

Summary of the material terms

of the incentive scheme:

|

The key features of the Equity Incentive Plan are as follows:

(a) the Board will determine the number of awards to be granted to eligible persons (or their nominees) and the vesting conditions, expiry date of the awards in its

sole discretion;

(b) the awards are not transferable unless the Board determines otherwise, or the transfer is required by law and provided that the transfer complies with the

Corporations Act; and

(c) subject to the Corporations Act, ASX Listing Rules, and restrictions on reducing the rights of a holder of awards, the Board will have the power to amend

the Equity Incentive Plan as it sees fit.

A summary of the Equity Incentive Plan is provided in Annexure A. A copy of the Equity Incentive Plan can be obtained by contacting the Company.

|

|

|

|

| |

Summary of the material terms

of any loan made to James D.

Calaway in relation to the

acquisition:

|

N/A

|

The Company notes that details of any securities issued under the relevant incentive scheme to James D. Calaway will be published in the Company's annual report for the period in which the securities were issued

and will note that approval for the issue was obtained under ASX Listing Rule 10.14. Any additional persons covered by ASX Listing Rule 10.14 who become entitled to participate in an issue of securities under these incentive plans after this

resolution is approved and who are not named in this notice will not participate until approval is sought under that rule.

.

AGM or Annual General Meeting means the Company’s 2023 annual meeting of Shareholders.

Annual Report means the Directors' Report, the Financial Report and Auditor's Report in respect to the financial year ended 30 June 2023.

Associate has the meaning given in the Corporations Act.

ASX means ASX Limited (ACN 008 624 691) and, where the context permits, the Australian Securities Exchange operated by ASX.

AUD means Australian Dollars.

Auditor's Report means the auditor's report in the Financial Report.

Award means an award of Options or Performance Rights under the Equity Incentive Plan.

Board means the board of Directors of ioneer Ltd (ABN 76 098 564 606).

Chairman means the chairman of the Annual General Meeting.

Company means ioneer Ltd (ABN 76 098 564 606)

Corporations Act means the Corporations Act 2001 (Cth).

Director means a director of the Company.

Directors' Report means the annual directors' report prepared under Chapter 2M of the Corporations Act for the Company and its controlled entities.

Eligible Persons means executive directors, executive officers, employees, contractors and consultants of the Company identified by the Board to participate in the

Equity Incentive Plan.

Explanatory Memorandum means the explanatory memorandum attached to the Notice.

Equity Incentive Plan means the equity incentive plan established by the Company.

Financial Report means the annual financial report prepared under Chapter 2M of the Corporations Act of the Company and its controlled entities.

Key Management Personnel means a person having authority and responsibility for planning, directing and controlling the activities of the Company, directly or

indirectly, including any Director (whether executive or otherwise) of the Company.

Listing Rules means the listing rules of ASX.

Notice means this Notice of meeting.

Option means an option to acquire a Share.

Participants means any Eligible Persons participating in the Equity Incentive Plan

Performance Right means a right to be allocated a Share on the satisfaction of particular hurdles.

Remuneration Report means the remuneration report of the Company contained in the Directors' Report.

Share means a fully paid ordinary share in the capital of the Company.

Share Registry means the Share Register of the Company, or Boardroom Pty Ltd (ABN: 14 003 209 836).

Shareholder means a shareholder of the Company.

Trading Day means a day determined by ASX to be a trading day in accordance with the Listing Rules.

USD means United States Dollars.

VWAP means volume weighted average price.

In this Notice, words importing the singular include the plural and vice versa.

ANNEXURE A – SUMMARY OF EQUITY INCENTIVE PLAN

Purpose

The purpose of the Plan is to give Eligible Persons the opportunity to participate in the growth and profits of the Company and to attract, motivate and retain the services of such persons to promote the

long-term success of the Company.

Eligible Persons

Participation may be offered to executive directors, executive officers, employees, contractors and consultants of the Company identified by the Board to encourage alignment of interests with Shareholders.

Form of Awards

Awards may be paid in the form of cash or equity (which may include Performance Rights or Options) to Eligible Persons. Each Option represents a right to acquire a Share for a fixed exercise price per Option

following the vesting date and prior to the expiry date of the Option. Each Performance Right represent a right to have a Share issued to the holder of the Performance Right on the vesting date.

Shares may be subject to disposal restrictions or vesting conditions determined by the Board at the time of the invitation. Subject to the terms of the invitation, the Company may issue new Shares or arrange a

transfer or purchase of existing Shares.

Awards do not attract dividends or distributions and voting rights in respect of Shares, until the Award vests and Shares are allocated to the holder upon vesting.

A grant of Awards under the Equity Incentive Plan is subject to both the Equity Incentive Plan rules and the terms of the specific grant.

Overseas Participants

Where an Award is granted under the Equity Incentive Plan to a person who is not a resident of Australia, the provisions of the Plan will apply subject to alterations as determined by the Board having regard to

any applicable or relevant laws, matters of convenience and desirability and similar factors.

Lapse of Awards

An Award will lapse:

|

(a) |

in respect of an Option, on the expiry date; or

|

|

(b) |

the date the applicable vesting conditions are not met and are no longer able to be met.

|

An Award will undergo an acceleration of lapse where the Participant is a bad leaver. A bad leaver includes where a person: (i) commits fraudulent or other dishonest acts which brings disrepute upon the

Company; (ii) is found guilty of any criminal offence; or (iii) is determined by the Board to be treated as a bad leaver.

Vesting, exercise and good leaver

An Award will vest at the time when the vesting conditions are satisfied or waived by the Board in its absolute discretion.

On exercise of an Award, the Board may determine in its absolute discretion whether to deliver the value of the Award in the form of Shares (either through a new issue or on market acquisition), cash or a

combination of Shares and cash.

No Shares acquired by Participants on exercise may be disposed of if to do so would breach the Company's share trading policy or insider trading prohibitions. In addition, Shares allocated on vesting of an

Award may be subject to specified disposal restrictions (as set out in the terms of the relevant Award) which prevent the acquired Share being disposed of for a specified period following acquisition.

The Board will have discretion to determine that a Participant's Awards will undergo an acceleration of vesting where the Participant is a good leaver. A good leaver is a person who ceases to be a director,

officer, employee, contractor or consultant by any reason other than as a bad leaver.

Bonus issues, rights issues and reorganisation

In the case of bonus share issues by the Company, the number of Shares to which the Awards held by Participants relates will be increased by the number of bonus shares that would have been received by the

Participants had the Award been Shares (except in the case that the bonus share issue is in lieu of a dividend payment, in which case no adjustment will apply).

In the case of general rights issues to Shareholders there will be no adjustment to the Awards. However, the Board may consider issuing Awards of a number up to the number of Shares to which the Participant

would have been entitled had the Awards been Shares. The exercise period of such Awards will be equal to the amount payable by Shareholders under the rights issue.

In the case of an issue of rights other than to the Company's shareholders, there will be no adjustment to the Awards.

In the case of other capital reorganisations, the Board may make such adjustments to the Awards as it considers necessary to comply with the Listing Rules.

Change of control

In the event of a change of control, the Board, in its absolute discretion, may determine that some or all of the Awards granted under the Equity Incentive Plan vest.

Amendment of Equity Incentive Plan

The Board may amend or terminate the Equity Incentive Plan at any time provided that the rights of Participants to Awards earned prior to the amendment or termination are not affected, unless otherwise agreed

in writing by the Participants.

.

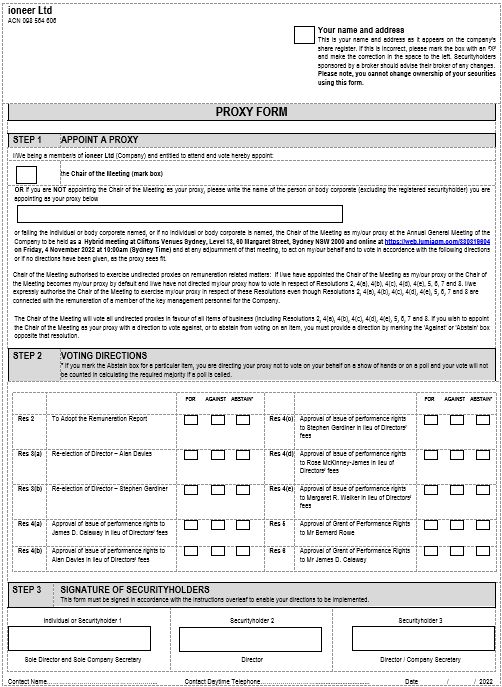

All

Correspondence to: * By MailBoardroom

Pty Limited GPO Box 3993 Sydney NSW 2001 Australia7 By Fax: +61 2 9290 9655 : Online: www.boardroomlimited.com.au ( By Phone: (within Australia) 1300 737 760(outside Australia) +61 2 9290 9600 YOUR VOTE IS IMPORTANT You

are encouraged to vote before the meeting by lodging a proxy. For your proxy appointment to be effective it must be recorded before 10:00am (Sydney Time) on Wednesday, 2 November 2022. : TO SUBMIT YOUR

PROXY VOTE ONLINE STEP 1: VISIT https://www.votingonline.com.au/ioneeragm2022 STEP 2: Enter your Postcode OR Country of Residence (if outside Australia) STEP

3: Enter your Voting Access Code (VAC):BY SMARTPHONE Scan QR Code using smartphone TO VOTE BY COMPLETING THE PROXY FORM To be valid, this proxy form must be received by 10:00am (Sydney Time) on

Wednesday, 2 November 2022. If you appoint a body corporate as your proxy, the body corporate should appoint a person as its representative at the Annual General Meeting in accordance with section 250D of the Corporations Act

2001. Your proxy's authority to speak and vote for you at the meeting is suspended if you are present at the meeting. STEP 1 APPOINTMENT OF PROXY Indicate who you want to appoint as your Proxy. If

you wish to appoint the Chair of the Meeting as your proxy, mark the box. If you wish to appoint someone other than the Chair of the Meeting as your proxy please write the full name of that individual or body corporate. If you leave this

section blank, or your named proxy does not attend the meeting, the Chair of the Meeting will be your proxy. A proxy need not be a securityholder of the company. Do not write the name of the issuer company or the registered securityholder

in the space. Appointment of a Second Proxy You are entitled to appoint up to two proxies to attend the meeting and vote. If you wish to appoint a second proxy, an additional Proxy Form may be

obtained by contacting the company’s securities registry or you may copy this form. To appoint a second proxy you must: (a) complete two Proxy Forms. On each Proxy Form state the percentage of your voting rights or the number of securities

applicable to that form. If the appointments do not specify the percentage or number of votes that each proxy may exercise, each proxy may exercise half your votes. Fractions of votes will be disregarded. (b) return both forms together in

the same envelope. STEP 2 VOTING DIRECTIONS TO YOUR PROXY To direct your proxy how to vote, mark one of the boxes opposite each item of business. All your securities will be voted in accordance with

such a direction unless you indicate only a portion of securities are to be voted on any item by inserting the percentage or number that you wish to vote in the appropriate box or boxes. If you do not mark any of the boxes on a given item,

your proxy may vote as he or she chooses. If you mark more than one box on an item for all your securities your vote on that item will be invalid. Proxy which is a Body Corporate Where a body

corporate is appointed as your proxy, the representative of that body corporate attending the meeting must have provided an “Appointment of Corporate Representative” prior to admission. An Appointment of Corporate Representative form can be

obtained from the company’s securities registry. Any proxy form (and any Power of Attorney under which it is signed) received after that time will not be valid for the scheduled meeting. QR Reader App STEP

3 SIGN THE FORM The form must be signed as follows: Individual: Where the holding is one name, this form must be signed by the securityholder. Joint Holding: Where the holding is in more than one name, all the securityholders should sign. Power of Attorney: To sign under a Power of Attorney, you must have

already lodged the Power of Attorney with the registry. If you have not previously lodged the Power of Attorney with the registry, please attach a certified photocopy of the Power of Attorney to this form when you return it. Companies: This form must be signed by a Director jointly with either another Director or a Company Secretary. Where the company has a Sole Director who is also the Sole Company Secretary, this form must

be signed by that person. Please indicate the office held by signing in the appropriate place. STEP 4 LODGEMENT Proxy forms (and any Power of Attorney under

which it is signed) must be received no later than 48 hours before the commencement of the meeting, therefore by 10:00am (Sydney Time) on Wednesday, 2 November 2022. Any Proxy Form received after

that time will not be valid for the scheduled meeting. Proxy forms may be lodged using the enclosed Reply Paid Envelope or:

https://www.votingonline.com.au/ioneeragm2022 + 61 2 9290 9655 Boardroom Pty Limited GPO Box 3993, Sydney NSW 2001 Australia Boardroom Pty Limited Level 12, 225 George Street, Sydney NSW 2000

Australia Privacy Personal information is collected in this document to administer member investment and voting rights in the Company which may not be possible if some or all of the information is

not collected. The name of your nominated proxy is required under section 250A of the Corporations Act for the appointment of a proxy. Chapter 2C of the Corporations Act requires information about members (including name, address and

details of the shares held) to be included in the Company's public register of members. This information must continue to be included in the public register for seven years after a member ceases to hold shares. This information is

collected by Boardroom Pty Ltd on behalf of the Company. Boardroom's privacy policy is available at www.boardroomlimited.com.au. This privacy policy contains information about how an individual may access, seek correction of, or complain

about the handling of their personal information. : Online 7 By Fax * By Mail In Person