UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-Q

_________________

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June

30, 2015

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_________________

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No þ

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer o |

Accelerated filer o |

Non-accelerated filer o |

Smaller reporting company þ |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

APPLICABLE ONLY TO REGISTRANTS

INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the

Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No þ

APPLICABLE ONLY TO CORPORATE

ISSUERS

Indicate the number of shares outstanding of each of

the issuer’s classes of common stock, as of the latest practicable date.

The Company’s stock is traded

on the OTC “Pinksheets” Markets under the trading symbol: HHSE. The Cusip number for the Company is: 410686 101. The

following is true and correct, per our transfer agent, as of and at the period ending on June 30, 2015:

| a. | Total Common Stock Shares in issue as of June 30, 2015: 713,927,966* |

| b. | Above Shares Restricted from Sale: 103,860,595* |

TOTAL COMMON STOCK SHARES

IN MARKET: 610,067,374*

| c. | Series “A” Preferred Shares: 3,000,000 |

Shareholders of Record: 2,012

(Standard Registrar count)

Total Beneficial Shareholders:

343 (Broadridge, ICS count)

Total Authorized Common Stock Shares:

800,000,000**

Total Authorized Series "A"

Preferred Shares: 10,000,000

* Share count includes 10-mm restricted

stock shares issued as collateral to TCA Global Master Fund, which are subject to return to treasury stock.

** (Note: Following the reporting

period covered by this filing, the total Authorized Common Stock Shares level was increased to 800,000,000 - in April, 2015 - following

a discussion at the Annual Meeting of Shareholders, and a waiting period of more than thirty days, as per the guidelines detailed

in the corporate by-laws). Company also established a mechanism to empower the Transfer Agent, under very special and unlikely

circumstances, to issue up to an additional 100-million “Reserve Shares” in compliance with the need for such a mechanism

to service “Convertible Notes” that could be demanded, and if unpaid, converted into shares. The creation of the “Reserve

Shares” represents a mechanism that is more than 7-times the maximum potential amount of shares that could, theoretically,

be issued is all convertible note holders demanded shares (instead of cash) and if the Company’s share price remained at

its current, historic low pricing – all of which circumstances are extremely unlikely.

The Transfer Agent for the Company’s

stock is:

Standard Registrar

& Transfer Company, Inc.

12528 South 1840 East

Draper, UT 84020

Tel. 801-571-8844

/ Fax 801-571-2551

Page 2

| |

|

|

|

| |

|

|

|

| PART I. FINANCIAL INFORMATION |

|

| |

|

|

|

| |

ITEM 1. |

FINANCIAL STATEMENTS |

|

| |

|

|

|

| |

|

Consolidated Statements of Income and Retained Earnings |

5 |

| |

|

|

|

| |

|

Consolidated General and Administrative Expenses |

6 |

| |

|

|

|

| |

|

Consolidated Balance Sheets |

7 - 8 |

| |

|

|

|

| |

|

Shareholders’ Equity & Statement of Cash Flows |

9-10 |

| |

|

|

|

| |

ITEM 2. |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS |

11 |

| |

|

|

|

| |

ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

14 |

| |

|

|

|

| |

ITEM 4. |

CONTROLS AND PROCEDURES |

15 |

| |

|

|

|

| PART II. OTHER INFORMATION |

|

| |

|

|

|

| |

ITEM 1. |

LEGAL PROCEEDINGS |

16 |

| |

|

|

|

| |

ITEM 1A. |

RISK FACTORS |

16 |

| |

|

|

|

| |

ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

16 |

| |

|

|

|

| |

ITEM 3. |

DEFAULTS UPON SENIOR SECURITIES |

16 |

| |

|

|

|

| |

ITEM 4. |

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

16 |

| |

|

|

|

| |

ITEM 5. |

OTHER INFORMATION |

16 |

| |

|

|

|

| |

ITEM 6. |

EXHIBITS |

19-22 |

| |

|

|

|

| SIGNATURES |

|

18 |

| |

|

|

Page 3

FORWARD-LOOKING STATEMENTS

This disclosure statement contains

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases

you can identify forward-looking statements by terms such as “may”, “intend”, “will”, “could”,

“would”, “expects”, “believe”, “estimate”, or the negative of these terms, and

similar expressions intended to identify forward-looking statements. These forward-looking statements reflect our current views

with respect to future events and are based on assumptions and are subject to risks and uncertainties. Also, these forward-looking

statements present our estimates and assumptions only as of the date of this disclosure statement. Except for our ongoing obligation

to disclose material information as required by federal securities laws, we do not intend to update you concerning any future revisions

to any forward-looking statements to reflect events or circumstances occurring after the date of this disclosure statement.

Actual results in the future could

differ materially and adversely from those described in the forward-looking statements as a result of various important factors,

including the substantial investment of capital required to produce and market films and television series, increased costs for

producing and marketing feature films, budget overruns, limitations imposed by our credit facilities, unpredictability of the commercial

success of our motion pictures and television programming, the cost of defending our intellectual property, difficulties in integrating

acquired businesses, and technological changes and other trends affecting the entertainment industry.

PART I — FINANCIAL INFORMATION

The Company's Financial Statements for the three-month period

ending June 30, 2015 are contained within the following pages. In compliance with regulations governing FORM 10-Q reports, the

information contained within these financial statements is unaudited.

Page 4

HANNOVER HOUSE, INC.

CONSOLIDATED STATEMENT OF INCOME &

RETAINED EARNINGS

FOR THE THREE-MONTH PERIOD ENDING JUNE

30, 2015 (UNAUDITED)

* International Sales Contracts are

allocated based on gross revenue amounts, less accrued third party participations or assignments. However, Q2 revenues do not include

any international sales.

** Corporate tax returns are calculated

on a cash basis, however, the applicable reserve for accrued earnings has been applied for the purposes of properly recording the

company’s accrued profitability.

Page 5

Page 6

HANNOVER HOUSE, INC.

Consolidated Balance Sheet /

As of June 30, 2015 (Unaudited)

Page 7

Consolidated Balance Sheet /

As of June 30, 2015 (Unaudited) / Continued

Page 8

HANNOVER HOUSE, INC. – STATEMENT

OF CASH FLOWS

For the Three Month Period Ending

June 30, 2015

Page 9

HANNOVER HOUSE, INC.

Change In Shareholder’s

Equity

For the Three Month Period Ending

June 30, 2015

Page 10

Item 2. Management’s Discussion

and Analysis of Financial Condition and Results of Operations

The following discussion should be read

in conjunction with the unaudited interim consolidated financial statements and related notes to the unaudited interim consolidated

financial statements included elsewhere in this report. This discussion contains forward-looking statements that relate to future

events or our future financial performance. These statements involve known and unknown risks, uncertainties and other factors that

may cause our actual results, levels of activity, performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by these forward-looking statements. These forward-looking

statements are based largely on our current expectations and are subject to a number of uncertainties and risks including the Risk

Factors identified in our Annual OTC Markets filing for the year ending December 31, 2014. Actual results could differ materially

from these forward-looking statements. Hannover House, Inc. is sometimes referred to herein as "we," "us,"

"our" and the "Company."

The nature of the issuer’s business

is driven by the operating entity, Hannover House, which is a full-service producer and distributor of entertainment products (i.e.,

feature films for theatrical, video, television and international distribution, and a publisher of books).

Hannover House, Inc., is a Wyoming Corporation.

Truman Press, Inc., d/b/a “Hannover House” is an Arkansas Corporation.

Hannover House, Inc., f/k/a Target Development

Group, Inc. (which was also formerly known as "Mindset Interactive Corp.") was registered as a corporation in Wyoming

on January 29, 2009. Truman Press, Inc., d/b/a “Hannover House” was registered as a corporation in California on September

15, 1993, and re-registered in Arkansas effective June 2008. The Ecklan Corporation, registered on March 25, 1998, in the State

of Texas, was the predecessor entity to Target Development Group, Inc.

The Company, Hannover House, Inc., as

well as Truman Press, Inc., d/b/a “Hannover House” each have an effective fiscal year-end date of December 31.

Neither the Company, Hannover House, Inc.,

nor the operating entity, Truman Press, Inc., d/b/a “Hannover House” have ever been in bankruptcy. To the best of management’s

knowledge, no predecessor entity has ever been in bankruptcy.

Effective January 1, 2010, Target Development

Group, Inc., acquired all of the shares of Truman Press, Inc., d/b/a “Hannover House” in a stock-swap agreement. The

details of this acquisition venture are described in detail within the information statement posted on the OTC Markets Disclosure

Statement of December 14, 2009.

Over the past four years, the Company

has defaulted on several loan or credit obligations, but none representing a material event to the Company or falling outside of

the ordinary course of business. As previously disclosed through the Company's filings with the OTC Markets, the Company had incurred

debt relating to the theatrical releasing costs of the film "Twelve" (debt obligations were accrued with Andersons, AOL,

Bedrock Ventures, 42 West, Technicolor, Tribune Ent. and others). As of December 31, 2014 the Company had reduced the cumulative

total of the outstanding debt balances for this film from an original gross of $4.2-million (inclusive of obligations to the production

company / licensor), down to less than $850,000 as of this reporting period. Other significant obligations of the Company include

"P&A" for the release of the film, "Hounddog" (Weinreb loan), "P&A" for the release of "All's

Faire In Love" (NBCal Loan), producer / licensor obligations to Interstar Releasing, Fantastic Films and E.E. Smith, all of

which are itemized or otherwise included within the Company's financials.

Page 11

As of 6-30-2015, there were no further

changes of “control”.

As of 6-30-2015, there were no increases

of 10% or more of the same class of outstanding equity securities.

During the quarterly reporting period

ending 6-30-2015, the Company issued a total of 33,027,317 shares of stock, including 5-million shares restricted from sale under

rule 144, which were issued for the benefit of key suppliers (including 1-million shares to Tom Sims, V.P. of Sales). The

new issuances consisted of 11,892,920 shares issued to Magna Investments, in a debt conversion transaction to reduce the balance

owed to TCA Global Master Fund; 8,750,830 to JSJ Investments in consideration of debt reductions for National Bank of California

and Graham Financial Services (which note was reissued and renewed); 4,100,000 shares to Macallan Partners for purchases of qualified,

aged-debt; and 3,284,567 shares to Bach Capital in satisfaction of aged convertible notes issued to the company in May of 2014.

The Company has not experienced any delisting

of the issuer’s securities. As of the 6-30-2015, there were no current, past, pending or threatened legal proceedings or

administrative actions that could have a material effect on the issuer’s business, financial condition or operations other

than those items specifically described hereunder or otherwise disclosed in OTC Markets Filings. As of 6-30-2015 and remaining

true through the date of this filing, there were no past or pending trading suspensions by a securities regulator. The legal proceedings,

whether past, pending or threatened, all fall under the guidelines of being within the ordinary course of business, and are disclosed

in detail in this filing or incorporated within previously filed disclosures with the OTC Markets.

Business of Issuer -- The SIC Codes

most closely conforming to the Company’s business activities are: 7822 (Services – Motion Picture & Video Tape

Distribution) and 2731 (Books: Publishing). The Company is currently operating. At no time has the Company ever been

a “shell company” as defined in the guidelines.

Through the operating entity of “Hannover

House,” the Company is actively involved with the production, acquisition and distribution of entertainment products into

the USA and Canadian markets, including theatrical films, home video releases, rights licenses of films and videos to Video-On-Demand

platforms and television, as well as book publishing (including printed editions and electronic “E-Book” formats).

FILMS & VIDEOS – Most

of the film and video titles that are distributed by the Company are “acquired” or otherwise licensed from third-party

suppliers, often production companies or media companies seeking to expand their income and market reach through a relationship

with Hannover House or through the company’s recently formed multi-studio sales cooperative, Medallion Releasing, Inc.. Some

of the properties distributed by the Company are “sales agency” ventures, in which the Company performs certain

sales & marketing functions on behalf of the owners of the properties, as opposed to having the Company actually purchase or

otherwise license rights into the property. In 2010 with the merger of Hannover House and Target Development Group, Inc., the Company

began moving away from “sales agency” ventures and pursuing actual rights-licensing / acquisition structures

for new titles being released under the Hannover House label, as this form of licensing arrangement can ultimately be more lucrative

for the company. Most of the titles being distributed by the Medallion Releasing division are under sales agency agreements, ranging

from 15% to 50% revenue splits with the program suppliers and outside labels.

BOOKS / E-BOOKS – The Company

remains active in the acquisition and licensing of publishing rights to printed books and e-Books. The gross margins earned by

the Company in the release of Books are generally much higher than the margins derived from the release of Film and Video properties;

however, the upside revenue potential for books is usually not as high as the potential for Films. So the Company seeks to maintain

a balance in its release slate of high-margin book properties, with high-revenue Film and Video properties.

Page 12

The use of the term "Company"

refers to the combined entities, as reported on a consolidated basis, of Hannover House, Inc., Truman Press, Inc., d/b/a “Hannover

House” and Bookworks, Inc. (a special purpose entity utilized for Screen Actors Guild activities and productions), as

well as VODWIZ, Inc. (the special purpose video-on-demand portal venture), and Medallion Releasing, Inc. (the multi-studio

sales venture). Each of the corporate entities files separate income tax returns with the federal government and respective

states of registration; however, financial statements and reports, as of January 1, 2010, refer to the combined and consolidated

results of all entities. Hannover House, Inc. is the publicly-traded entity for all operating divisions. Truman Press, Inc., d/b/a

“Hannover House” is the operating and releasing division entity for all consumer products. Bookworks, Inc., is a special

purpose entity established for the servicing of book and publishing ventures, and more recently, used for Screen Actors Guild productions.

As of 6-30-2015 and remaining true through

the date of this filing, the Company does not foresee any probable or existing governmental regulations as having an adverse or

material impact to the operations.

During calendar year 2009 (and specifically

limited to activities for Truman Press, Inc., d/b/a “Hannover House”), the Company invested approximately $15,000 on

activities that could be characterized as ‘research and development.’ During the calendar year of 2010, and under the

consolidated reporting of all entities, the Company invested approximately $20,000 on projects and activities that could be characterized

as ‘research and development.’ During the calendar year of 2011 and under consolidated reporting of all entities, the

Company invested approximately $166,000 on projects and activities that could be characterized as ‘research and development.’

(specifically, the production of feature film / video products). During 2012, the Company invested approximately $287,114 on production

projects / R&D assignable; during 2013, the Company made no new investments in production or activities that would be R&D

assignable. The company has been involved in some feature film productions during 2014 and the first quarter of 2015, including

development, pre-production and post-production work on “Bonobos: Back to the Wild” (nature docudrama),

“Mother Goose: Journey to Utopia” (live-action fantasy adventure), “Dinosaurs of the Jurassic”

(Documentary), “Shadow Vision” (Sci-Fi Thriller), “The Summoning” (Horror-Thriller),

“Shuck and Jive” (Urban Drama) and “Clown Town” (Horror). The Company is also

working on structuring financing and distribution ventures for three additional features, “Extreme Operative”

(action-adventure), “Dog and Pony Show” (Family-Animal Adventure), and “Bridge To Redemption”

(Action-Thriller). The company feels that its participation in facilitating the production of these and other higher-end

titles generates many benefits: longer license periods (usually perpetuity), greater revenue opportunities (including

international rights), and higher-end titles to serve as locomotives to elevate the company’s stature with theatrical

exhibition chains and video mass merchants which can help with catalog and secondary title placements.

The Company has not incurred any non-negligible

costs relating to compliance with environmental laws, whether to federal, state or local. As of 6-30-2015, the Company had 7 full-time

employees.

The nature of products and services

offered:

| |

A. |

The principal products of the Company, and their respective markets are: |

| |

i. |

Theatrical films – released to theatres in the United States |

| |

ii. |

Home Video Products (DVDs, Blu-Rays, Digital Copies) – released to video specialty retailers, mass-merchandisers, bookstores, schools, libraries and rental outlets (including kiosks) in the United States and Canada; |

| |

iii. |

Video-On-Demand releases – films and videos offered for direct ‘in-home viewing’ by consumers via a variety of service providers. |

| |

iv. |

Books and E-Books – sold through bookstores, schools, libraries, internet retailers and streamed through a variety of e-Book platforms. |

Page 13

| |

B. |

The primary distribution methods used by the Company for all consumer product goods can be categorized as: “two-step wholesale” distribution (wherein the Company sells its products to an authorized wholesale distributor, which in turn, resells the products to retailers or consumers) and “direct distribution” wherein the Company sells its products directly to consumers or directly to the end-user retailer. |

| |

C. |

The Company has announced, and included in previously published disclosures, a listing of some of the principal, upcoming theatrical films that will also be released onto home video formats. |

| |

D. |

Competitive Position – The Company competes for theatrical screens and retail (home video) shelf space against seven (7) Major Studio suppliers and approximately eight (8) independent studio suppliers. While all of the Major Studio competitors operate their own (in-house) home video distribution divisions, only three of the independent studio suppliers operate both theatrically and in the home video markets. Operating a home video releasing label “in-house” provides the Company with an advantage in the solicitation of titles for acquisition, as well as provides greater control over the Company’s cash-flow and corporate goals. |

| |

E. |

Materials and Suppliers – The principal service providers to the Company are listed in detail in this disclosure, below. The principal suppliers of new release film and video products include the following production companies and programming sources (listed alphabetically): Allegheny Image Factory; American Family Movies; Associated Television; Atlas Films; BerVon Entertainment; Cinetic Media; Daybreak Pictures; Empire Film Group, Inc.; Eurocine International; Gaumont, SA; Origin Motion Pictures; Plaza Entertainment, Inc.; Phoenix Entertainment; Phoenix Releasing Group; Sola-Media, GmbH; Shoreline Entertainment; Studio 3 Entertainment; PWI-Veracruz Entertainment. The principal suppliers of books for the Company to publish include (listed alphabetically): James Danielson, Phil Goodman, Brenda Hancock, Vivian Kaplan, Barr McClellan and Vivian Schilling. The Company sees no shortage of properties available for acquisition in any of the applicable media. |

| |

F. |

Dependence on Major Customers – Two of the Company's current customers as of 12-31-2014 contributed fifteen percent (15%) or more to the overall, annualized sales revenues. Wal-Mart Stores, Inc. (inclusive of sales to their SAM’S Clubs division), has been purchasing most of the Company's new release DVD titles.. The Company does not see the Wal-Mart market share as an unhealthy dependence on a key customer, as Wal-Mart constitutes a much smaller share of the Company’s overall revenues than for many Major Studios, and the Company does not anticipate that the growth in sales to Wal-Mart Stores, Inc., will grow disproportionately with the Company’s other customers. Medallion Releasing has commenced activities for the international sales and licensing of higher-end properties owned or controlled by the Company, the revenue results for which also exceed the fifteen percent (15%) threshold of total, annualized revenues. The Company does not feel that the rapidly growing sales revenues being realized from the international markets poses an unreasonable or viable threat to operations, as sales are cumulative over multiple licensing agreements for specific territories, media and titles. |

| |

G. |

The Company does not own or control any patents, franchise or concessions. The licenses and royalty agreements fall under the category of being part of the ordinary course of business. |

| |

H. |

The company does not need any government approvals of principal products or services. |

The nature and extent of the

issuer’s facilities include a primary office and warehouse combo unit (under lease from Elder Properties, Springdale,

AR), comprising approximately 6,000 square feet.

Item 3 Quantitative and Qualitative

Disclosures About Market Risk

Investment in the Company's Stock bears

similar risks as may exist with other stocks trading on the OTC Markets board. The trading price for Company's Stock Shares can

vary significantly based upon a variety of factors unrelated to the Company's actual value or revenue achievements. On an accrual

basis, the Company is generating profits each quarter, with regular DVD and Blu-Ray product sales supplemented with long-term

receivables for Subscription Video-On-Demand and Television sales. However, on a cash-flow basis, the Company's cash resources

are often strained by immediate and long-term debt obligations. Some investors and shareholders have expressed discomfort with

the Company's persistently tight cash position, which

has

Page 14

been the result of balancing

ongoing operational needs with debt management and new release activities against product cash flows. Conversely, many

shareholders have also expressed resistance to the concept of issuing equity shares under "debt

conversion" structures, which would relieve much of the cash-flow burdens but would result in a dilution of shareholder

equity. Accordingly, management has worked to find the best balance of maximizing shareholder value and return, while

minimizing equity dilution activities. There can be no assurance that ongoing cash flow from product sales will, by itself,

be sufficient to meet the Company's combined operational, debt-management and growth needs. To address the Company's cash

position, management has initiated an agreement with an Accounts Receivable-based lender, to accelerate cash flow from

current product sales and thus facilitate faster growth into new areas (such as the Company's "VODwiz.com"

streaming venture), as well as to provide working capital to enable the Company's Film and Television Rights Library to

be more efficiently exploited.

While there are no material threats at

present to the Company's ongoing viability, there can be no assurance that the majority of long-term creditors will continue to

comply with debt reduction and installment payment agreements. And while the Company continues to generate DVD and Blu-Ray sales

to major retailers (and Video-On-Demand contracts through the major VOD portals), there can be no assurance that current and past

sales performance will continue into the future. The remedies available to the Company for continued viability and growth are revenues

from product sales and licenses, credit arrangements (both with lenders and suppliers) and stock-equity opportunities (ranging

from shelf-registration of new shares to "debt-conversion" ventures to alleviate the cash-flow burden from older, qualifying

payables). Investment in the Company's Stock Shares bears significant risks, as well as significant upside potential. The "Price-Earnings

Ratio" for publicly-traded entertainment stocks in the Company's area of activity results in an average P/E rate of 22-times.

The current P/E ratio for Company's (Hannover House's) is 3.1, based on an annualized projection of the current reporting period.

This extremely low P/E rate for Hannover House shares relative to the other publicly traded companies operating in the same business

sector, suggests that the shares are currently trading at a price that is undervalued by a factor of approximately 6-times when

compared to the industry average.

During the most recent ten trading days

tracked for this disclosure filing (specifically, August 1 – August 14, 2015), trading volume in Company's stock was averaging

approximately 912,000 shares per day, suggesting that investments in the Company's stock may not be as easily or quickly resold

as some other stock offerings.

Item 4. Controls and Procedures

- Evaluation of Disclosure Controls and Procedures

The term “disclosure controls

and procedures” is defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934 as amended (the “Exchange

Act”). These rules refer to the controls and other procedures of a company that are designed to ensure that information required

to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized

and reported within required time periods specified in the SEC’s rules and forms, and that such information is accumulated

and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely

decisions regarding required disclosure.

As of June 30, 2015, the end of the

period covered by this report, the Company carried out an evaluation under the supervision and with the participation of our Chief

Executive Officer and President of the effectiveness of our disclosure controls and procedures. Our Chief Executive Officer and

Chief Financial Officer have concluded that such controls and procedures continued to be effective as of June 30, 2015 .

Page 15

Item 4T. Controls and Procedures

Changes in Internal Control over

Financial Reporting

As required by Rule 13a-15(d) of the

Exchange Act, the Company, under the supervision and with the participation of the Company’s management, including the Chief

Executive Officer and Chief Financial Officer, also evaluated whether any changes occurred to the Company’s internal control

over financial reporting during the period covered by this report that have materially affected, or are reasonably likely to materially

affect, such control. Based on that evaluation, there has been no such change during the period covered by this report.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

As of June 30, 2015, the Company was not

involved in any open or non-adjudicated litigation matters. In early May, a lawsuit was filed on behalf of Elder Properties (the

landlord for the Company’s primary office / warehouse facility). A settlement was effected and announced almost immediately,

and Company remitted payments in May totaling $29,350, with subsequent monthly installments on a negotiated settlement. Subsequent

to the end of the reporting period, on or about August 3, 2015, to the surprise of HHSE and its counsel, the attorney for Elder

Properties filed a “default judgment” against Company in this resolved matter, instead of either withdrawing

the lawsuit or filing Satisfaction documentation. The attorney for HHSE responded immediately with a demand for sanctions and damages

against the opposing counsel for having made a significant filing error. Ultimately, the demand for sanctions was dropped, which

triggered the filing of the Satisfaction paperwork, and the matter was finally closed (August 14, 2015). Also subsequent

to the close of the reporting period, on August 5, 2015, Company was served a demand for “accounting” and applicable

payments by an attorney for Northbank Entertainment, producer / licensor of the DVD release “Amityville Asylum.”

Company had previously provided a full and complete accounting of the sales and royalties due for this title to a totally different

attorney, ostensibly also representing Northbank Entertainment, including a payment installment agreement and bank cashier’s

check. The Company will respond to this lawsuit filing in a timely manner, and may seek sanctions and damages for filing a lawsuit

on this previously resolved matter.

Since the end of the applicable reporting

period, Company has grown concerned with the status of a services-agreement entered into in 2013 with Nanotech Entertainment for

the operational (technical upload and delivery) needs for the upcoming VODWIZ digital-streaming service. HHSE is concerned

that the insufficient attention and resources may have been committed to uploading new titles to VODWIZ, and is currently, actively

seeking to address these concerns and to work towards establishing a mutually acceptable framework for a moving-forward relationship.

HHSE acknowledges that Nanotech may also have concerns about masters and other delivery elements from HHSE and HHSE supplier studios

that are participating in the VODWIZ launch. The establishment of the VODWIZ site and portal is complex, and involved literally

thousands of feature films and more than a dozen suppliers, each delivering elements in a wide assortment of formats. It is not

unreasonable that the task of uploading titles has proven time-consuming and, at times, problematic. It is HHSE’s intention

to continue working with Nanotech, provided that an acceptable game-plan and schedule can be agreed. HHSE has been approached by

other technical services providers, and anticipates that there would be no negative impact to the consumer roll-out of the VODWIZ

site and portal if, for any reason, including mutual dissolution, that the services agreement with Nanotech is not continued. There

are no other material disputes or lawsuits requiring Company’s response.

Item 1A. Risk Factors

Other than as set forth in this FORM 10-Q

filing, there are no specific risk factors relating to the Company's securities that are not universally applicable to other equities

trading on the OTC Markets.

Page 16

Key Man / Principals - The Company

is reliant upon the continued employment and work performance of the two, principal managers, Eric Parkinson (CEO) and D. Frederick

Shefte (President). As an accommodation to benefit the Company's cash flow, both Parkinson and Shefte have been deferring a majority

of their salaries. Additionally, as has been required by many third-party program suppliers, Parkinson has often been listed as

a "key man" to the rights licenses or sales venture agreements for specific acquisitions, due to his successful home

video sales track record. Additionally, the engagement of Tom Sims as VP of Sales for both Hannover House, Inc. and Medallion Releasing,

Inc., makes him into an important and key man employee. The cessation of employment by any of these principals could have a material

and negative impact on the Company, as current cash flows would not facilitate the hiring of comparably qualified executives, and

the loss of Parkinson as "key man" could result in multiple title agreement cancellations.

Item 2. Unregistered Sales of Equity

Securities and Use of Proceeds.

Not applicable to Issuer.

Item 3. Defaults Upon Senior Securities

Not applicable to Issuer, although a previously

active credit arrangement with TCA Global Master Fund has since been terminated by mutual consent.

Item 4. Submission of Matters to

a Vote of Security Holders.

Not applicable to Issuer.

Item 5. Other Information.

None.

Item 6. Exhibits

Examples of billboards, print ads, in-theatre promotions and

key media coverage for current Hannover House, Inc. theatrical releases: “THE ALGERIAN” and “BONOBOS:

BACK TO THE WILD.”

Page 17

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| Date: August 15, 2015 |

Hannover House, Inc. |

| |

By: /s/ Eric F. Parkinson |

| |

Eric F. Parkinson,

Chairman & Chief Executive Officer |

Page 18

CERTIFICATION

I, Eric F. Parkinson certify that:

| 1. |

|

I have reviewed this quarterly report on Form 10-Q of Hannover House, Inc.; |

| 2. |

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. |

|

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) |

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) |

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) |

|

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| (d) |

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. |

|

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent function): |

| (a) |

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| (b) |

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: August 15, 2015 |

Hannover House, Inc |

| |

By: /s/ Eric F. Parkinson |

| |

Eric F, Parkinson

Chairman Chief Executive Officer |

Page 19

EXHIBITS

NEW YORK, WASHINGTON, D.C. and

Other Markets

ADVERTISING & BILLBOARD EXAMPLES

OF CURRENT HHSE RELEASES,

“The Algerian” and

“Bonobos: Back to the Wild”

Page 20

Page 21

Page 22

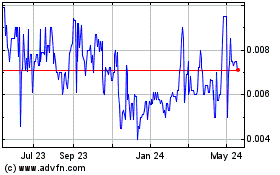

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Nov 2024 to Dec 2024

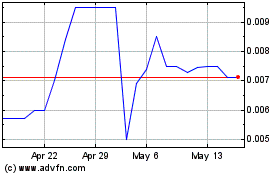

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Dec 2023 to Dec 2024