false

0001016504

0001016504

2024-05-10

2024-05-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

May 10, 2024

________________

INTEGRATED BIOPHARMA, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Delaware

(STATE OR OTHER JURISDICTION OF INCORPORATION)

|

001-31668

|

22-2407475

|

|

(COMMISSION FILE NUMBER)

|

(I.R.S. EMPLOYER IDENTIFICATION NO.)

|

225 Long Avenue

Hillside, New Jersey 07205

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(973) 926-0816

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

None

|

None

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 10, 2024, Integrated Biopharma, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto and is hereby incorporated by reference into this Item 2.02.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit relating to Item 2.02 shall be deemed to be furnished, and not filed:

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

EXHIBIT INDEX

| |

|

|

|

Exhibit

|

|

Description

|

| |

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INTEGRATED BIOPHARMA, INC.

|

| |

|

|

Date: May 10, 2024

|

By: /s/ Dina L Masi

|

| |

Dina L Masi

|

| |

Chief Financial Officer

|

NEWS RELEASE for May 10, 2024

Contact: Dina Masi, CFO

Integrated BioPharma, Inc.

investors@ibiopharma.com

888.319.6962

Integrated BioPharma Reports Results for its Quarter Ended March 31, 2024

HILLSIDE, NEW JERSEY (May 10, 2024) - Integrated BioPharma, Inc. (OTCQX: INBP) (the “Company” or “INBP”) reports its financial results for the quarter ended March 31, 2024.

Revenue for each of the quarters ended March 31, 2024 and 2023 were approximately $13.1 million. The Company had operating income for the quarter ended March 31, 2024 and 2023 of approximately $0.4 million and $44,000, respectively.

Revenue for the nine-month period ended March 31, 2024 was $37.6 million compared to $37.7 million for the nine-month period ended March 31, 2023, a decrease of $0.1 million or 0.3%. The Company had an operating loss of approximately $0.2 million for the nine-month period ended March 31, 2024 compared to operating income of approximately $41,000 in the nine-month period ended March 31, 2023.

For the quarter ended March 31, 2024, the Company had net income of approximately $0.3 million or $0.01 per share of common stock, compared with net income of $16,000 or $0.00 per share of common stock for the quarter ended March 31, 2023. The Company’s basic and diluted net income per share of common stock for the quarters ended March 31, 2024 and 2023 was $0.01 and $0.00 per share of common stock, respectively.

For the nine-month periods ended March 31, 2024 and 2023, the Company had a net loss of approximately $0.2 million and $74,000, respectively. The Company’s basic and diluted net loss per share of common stock for the nine months ended March 31, 2024 and 2023 was $(0.01) and $(0.00) per share of common stock, respectively.

“Our revenue from our two largest customers in our Contract Manufacturing Segment increased from representing approximately 88% of total revenue in the nine-month period ended March 31, 2023, to representing approximately 90% of total revenue in the nine-month period ended March 31, 2024”, stated the Co-Chief Executive Officers of the Company, Riva Sheppard and Christina Kay. “We will continue to focus on our core businesses and expanding our customer base. We believe that this focus will reduce our reliance on our two significant customers in our fiscal year ending June 30, 2025,” the Co-CEOs further stated.

A summary of our financial results for the three and nine months ended March 31, 2024 and 2023 follows:

|

INTEGRATED BIOPHARMA, INC. AND SUBSIDIARIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

|

|

March 31,

|

|

|

March 31,

|

|

| |

|

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue

|

|

$ |

13,147 |

|

|

$ |

13,098 |

|

|

$ |

37,571 |

|

|

$ |

37,678 |

|

|

Cost of sales

|

|

|

11,899 |

|

|

|

12,090 |

|

|

|

34,971 |

|

|

|

34,603 |

|

|

Gross profit

|

|

|

1,248 |

|

|

|

1,008 |

|

|

|

2,600 |

|

|

|

3,075 |

|

|

Selling and administrative expenses

|

|

|

893 |

|

|

|

964 |

|

|

|

2,751 |

|

|

|

3,034 |

|

|

Operating income (loss)

|

|

|

355 |

|

|

|

44 |

|

|

|

(151 |

) |

|

|

41 |

|

|

Other income (expense), net

|

|

|

(3 |

) |

|

|

2 |

|

|

|

5 |

|

|

|

(24 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

352 |

|

|

|

46 |

|

|

|

(146 |

) |

|

|

17 |

|

|

Income tax (expense) benefit, net

|

|

|

(67 |

) |

|

|

(30 |

) |

|

|

(10 |

) |

|

|

(91 |

) |

|

Net income (loss)

|

|

$ |

285 |

|

|

$ |

16 |

|

|

$ |

(156 |

) |

|

$ |

(74 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.00 |

) |

|

Diluted

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.00 |

) |

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

30,099,610 |

|

|

|

29,929,610 |

|

|

|

30,054,883 |

|

|

|

29,929,610 |

|

|

Diluted

|

|

|

30,764,222 |

|

|

|

31,463,309 |

|

|

|

30,054,883 |

|

|

|

29,929,610 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About Integrated BioPharma Inc. (INBP)

Integrated BioPharma, Inc. (“INBP”) is engaged primarily in the business of manufacturing, distributing, marketing and sales of vitamins, nutritional supplements and herbal products. Further information is available at ir.ibiopharma.com.

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, as well as assumptions, that, if they never materialize or prove incorrect, could cause the results of INBP to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements generally are identified by the words “expects,” “anticipates,” believes,” intends,” “estimates,” “should,” “would,” “strategy,” “plan” and similar expressions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements and are not guarantees of future performance. Such statements speak only as of the date hereof, are subject to change and should not be relied upon for investment purposes. INBP undertakes no obligation to revise or update any statements for any reasons. The risks, uncertainties and assumptions include, among others, changes in general economic and business conditions; loss of market share through competition; introduction of competing products by other companies; the timing of regulatory approval and the introduction of new products by INBP; changes in industry capacity; pressure on prices from competition or from purchasers of INBP’s products; regulatory changes in the pharmaceutical manufacturing industry and nutraceutical industry; regulatory obstacles to the introduction of new technologies or products that are important to INBP; availability of qualified personnel; the loss of any significant customers or suppliers; inflation and the tightened labor markets; the impact of the war in Ukraine; the impact of the Israel-Hamas war; our ability to expand our customer base and other risks and uncertainties described in the section entitled “Risk Factors” in INBP’s most recent Annual Report on Form 10-K and its subsequent Quarterly Reports on Form 10-Q. Accordingly, INBP cannot give assurance that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of INBP.

v3.24.1.1.u2

Document And Entity Information

|

May 10, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

INTEGRATED BIOPHARMA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 10, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-31668

|

| Entity, Tax Identification Number |

22-2407475

|

| Entity, Address, Address Line One |

225 Long Avenue

|

| Entity, Address, City or Town |

Hillside

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

07205

|

| City Area Code |

(973)

|

| Local Phone Number |

926-0816

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001016504

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

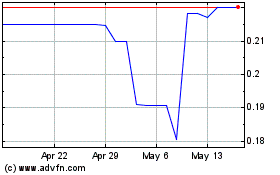

Integrated BioPharma (QX) (USOTC:INBP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Integrated BioPharma (QX) (USOTC:INBP)

Historical Stock Chart

From Feb 2024 to Feb 2025