Integrated Ventures is set to report 254% annual revenue growth, fueled by expansion of crypto mining operations

27 September 2022 - 11:22PM

InvestorsHub NewsWire

Philadelphia, PA -- September 27,

2022 -- InvestorsHub NewsWire -- Integrated Ventures, Inc,

(OTCQB:

INTV) ("Company") is pleased to annonce filing of its Annual

Report (Form 10K) and provide commentary on the latest operational

developments.

The Annual Report is

scheduled to be posted on 09/27/2022,

after market close.

The Company is set to report a

significant revenue increase vs 2021, from $1,851,390 to

$6,550,133.

Key margins (2022 vs 2021) as

follow:

-

Cryptocurency Mining was up

172%

-

Sales of Mining Equipment was up

2,791%

-

Total Revenues were up

254%

The growth was fueled by BTC's

higher pricing, hosting agreements with Compute North, launch of PA

operations and INTV's timely acqusition of 2,400 Antminers S19J

100+TH, from Bitmain.

-

Mining operations accounted for

$4,871,473 in revenue, jumping from $1,793,316 for 2021. Mining

revenue growth is a direct reflection of the self-mining

hashrate.

-

The remaining revenue was sourced

from the equipment reselling business, posting $1,793,316 in 2022,

up from $58,074 in 2021.

-

Gross profit for 2022 was

$2,731,743 vs $931,014 for 2021.

-

As of 06/30/2022, INTV's assets are

valued at $16,331,144 vs $13,363,965.

> 2022 -

Operational Highlights

In July, INTV has completed an

annual contract with Bitmain, resulting in the purchase and full

payment of 2,400, high performance, Antminer S19J 104TH

rigs.

Recently, INTV has executed an

equipment hosting agreement with Compute North, for a mining

capacity of 5.25MW, located at Wolf Hollow, TX facility. The

agreement, executed on July 1, 2022 is scheduled to launch at the

middle of October with connection of 1675 miners.

> 2023 -

Management's Commentary

Steve Rubakh, CEO of Integrated

Ventures offers the following commentary: "At approximately $13M in

market cap, INTV slots on the smaller side with zero institutional

coverage, but positions itself well as an undervalued, under

followed but efficiently managed and hard-working small cap, with

focus on growing a crypto-focused business. With FY22 revenues at

$6.56M, up from $1.85M, INTV is confident that its annual mining

revenues, based on BTC's trading range of 24k+, will approach $9M.

INTV's estimates are based on operating 8.5MW of power, 2700+

miners being online and generating 195 PH.

About:

Integrated Ventures, Inc is

Technology Portfolio Holdings Company with focus on Blockchain

Technology and Cryptocurrency Mining.

For more details, please visit the

Company's website: www.integratedventuresinc.com.

Statement:

The information posted in this

release may contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of1995. You can

identify these statements by use of the words "may," "will,"

"should," "plans," "explores," "expects," "anticipates,"

"continue," "estimate," "project," "intend," and similar

expressions. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected or anticipated. These risks and uncertainties

include, but are not limited to, general economic and business

conditions, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of

marketing, and various other factors beyond the company's

control.

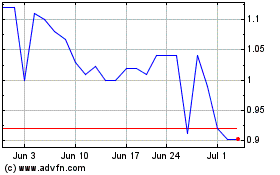

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Dec 2024 to Dec 2024

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Dec 2023 to Dec 2024