UPDATE: Jardine Matheson 2011 Profit Up 12%; Expect More Fragility In Some Markets

02 March 2012 - 11:32PM

Dow Jones News

HONG KONG (Dow Jones)--Conglomerate Jardine Matheson Holdings

Ltd. (JAR.LN), one of Asia's oldest trading companies, said Friday

its net profit rose 12% last year but that growth would be more

challenging in some of its markets in 2012 because of the

uncertainties in the global economy.

The firm, whose businesses range from hotels and property to

supermarkets, posted a net profit of US$3.45 billion for the 12

months ended Dec. 31, up from US$3.08 billion the previous

year.

"There may be increasing fragility in some of the group's

markets in the year ahead as the present uncertain economic

conditions show little sign of improvement," Chairman Sir Henry

Keswick said in a statement.

Managing Director Anthony Nightingale said the group plans to

have substantial commitments in the real-estate sector in

China.

"We are still at the early stage of residential development in

China. In other words, there's a lot more to come," Nightingale,

who will step down in April as managing director, told reporters

Friday. Having joined Jardine in 1969, Nightingale will retire from

the position of managing director in April and be succeeded by Ben

Keswick, a nephew of the Jardine chairman.

Hongkong Land Holdings Ltd. (H78.SG), Jardine's property unit,

has residential projects in Beijing, Chongqing, Chengdu and

Shenyang, and acquired several development sites including a

commercial site in Wangfujing, Beijing last year. It is the largest

commercial landlord in Hong Kong's upmarket Central business

district and also has properties in Singapore.

Nightingale said the group is looking to broaden its property

portfolio to one or two new Southeast Asian markets.

The Singapore- and London-listed company, which generates most

of its earnings in Greater China and Southeast Asia, posted an

underlying profit of US$1.50 billion for 2011, up 10% from US$1.36

billion in 2010.

Analysts prefer to look at underlying profit because net profit

can be distorted by revaluation gains or losses, which don't affect

cash flow.

The Hong Kong-based conglomerate derived 57% of its 2011

underlying profit from Southeast Asia and about 40% from Greater

China.

Nightingale said Southeast Asia's share of the group's

underlying profit was bigger than that of Greater China for the

second consecutive year, largely due to the strong performance of

its Indonesian automobile unit, Astra International (ASII.JK).

Astra contributed US$561 million to Jardine's underlying profit

in 2011, up from US$437 million in the previous year.

Hongkong Land, which posted its results Thursday, accounted for

US$289 million of the group's underlying profit, down from US$332

million in the previous year, as fewer residential projects were

completed. Dairy Farm International contributed US$301 million, up

from US$259 million the previous year.

-By Polly Hui, Dow Jones Newswires; 852-2802-7002;

polly.hui@dowjones.com

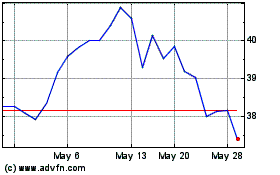

Jardine Matheson (PK) (USOTC:JMHLY)

Historical Stock Chart

From Jul 2024 to Aug 2024

Jardine Matheson (PK) (USOTC:JMHLY)

Historical Stock Chart

From Aug 2023 to Aug 2024