Kyocera Corporation (NYSE:KYO)(TOKYO:6971) today announced its

consolidated third-quarter financial results for the fiscal year

ending March 31, 2018. Results are summarized below, both as an

aggregation of Kyocera’s first three fiscal quarters (the “period,”

i.e., nine months), and as the third quarter alone (the “quarter,”

i.e., three months), ended Dec. 31, 2017. Complete details are

available at: https://global.kyocera.com/ir/

Consolidated Financial Highlights: Nine

Months Ended December 31, 2017

Unit: Millions (except percentages and per-share amounts)

Nine Months Ended December 31,

2016(FY17)in JPY

2017(FY18)in JPY

Increase

2017(FY18)in USD

2017(FY18)in EUR

Amountin JPY

% Net sales: 1,014,628 1,145,016 130,388 12.9 10,133 8,482

Profit from operations: 67,102 108,984 41,882 62.4 964 807 Income

before income taxes: 98,706 144,864 46,158 46.8 1,282 1,073

Net income attributable toKyocera

Corporation'sshareholders:

70,852 90,267 19,415 27.4 799 669

Diluted earnings per shareattributable to

KyoceraCorporation's shareholders:

192.88 245.49

-

-

2.17 1.82 Note on exchange rates: U.S. dollar (USD)

and euro (EUR) conversions are provided above as a convenience to

the reader, based on the rates of USD1 = JPY113 and EUR1 = JPY135,

rounded to the nearest unit (as of December 29, 2017)

SummaryDuring this nine-month period, robust demand for

information and telecommunications equipment, automobiles, and

industrial machinery fueled a significant increase in the company’s

revenue from electronic devices and automotive/industrial

components. Revenue in the document solutions business increased as

well, following new product launches and related sales promotions.

Additionally, merger and acquisitions made a further contribution

to the company’s business expansion.

As a result, the company attained record nine-month sales of

JPY1,145,016 (USD10,133) million, an increase of JPY130,388

(USD1,154) million, or 12.9%, over the same period of the prior

year. Most profit metrics showed significant increases as well, due

mainly to stronger sales and successful cost reduction measures.

Profit from operations increased 62.4%, to JPY108,984 (USD964)

million; and income before income taxes increased 46.8%, to

JPY144,864 (USD1,282) million. Net income attributable to Kyocera

Corporation's shareholders increased 27.4%, to JPY90,267 (USD799)

million, despite third-quarter expenses at U.S. subsidiaries

including AVX Corporation, primarily resulting from tax law

revisions in the U.S., which amounted to a decrease of

approximately JPY11,000 (USD97) million.

Average exchange rates for the nine months reflected the

Japanese yen’s weakening against the U.S. dollar by approximately

4.7%, to JPY112, and against the euro by approximately 9.3%, to

JPY129, as compared with the same period of the prior year. As a

result, net sales and income before income taxes increased by

approximately JPY39 billion (USD345 million) and JPY13 billion

(USD115 million), respectively, as compared with the prior-year

period.

Consolidated Financial Highlights:

Third Quarter

Unit: Millions (except percentages) Three Months

Ended December 31,

2016(FY17-Q3)in JPY

2017(FY18-Q3)in JPY

Increase(Decrease)

2017(FY18-Q3)in USD

2017(FY18-Q3)in EUR

Amountin JPY

% Net sales: 361,385 406,671 45,286 12.5 3,599 3,012 Profit

from operations: 33,317 39,479 6,162 18.5 349 292 Income before

income taxes: 50,128 57,024 6,896 13.8 505 422

Net income attributable toKyocera

Corporation'sshareholders:

34,699 28,880 (5,819) (16.8) 256

214

(See note above regarding exchange

rates.)

Expectations for the Full Fiscal YearFor the fiscal year

ending March 31, 2018, Kyocera makes no change to the forecasts for

net sales, profit from operations, or income before income taxes

that it announced on October 30, 2017, since its business results

are generally in line with those projections. However, net income

attributable to Kyocera Corporation's shareholders has been revised

as shown below, in reflection of the aforementioned expenses

related to U.S. tax law revisions.

Regarding average exchange rates for the full fiscal year,

Kyocera’s October 30, 2017 forecast of JPY111 against the U.S.

dollar remains unchanged, while Kyocera’s forecast of JPY128

against the euro has been revised to JPY130 , marking depreciation

of JPY2 (1.6%).

Consolidated Forecast: Year Ending

March 31, 2018

Unit: Yen in millions (except percentages, per-share amounts and

exchange rates)

Fiscal 2017Results

Fiscal 2018ForecastAnnounced onOctober

30,2017

Fiscal 2018ForecastAnnounced onFebruary

1,2018

Increase(%) toFiscal 2017Results

Net sales: 1,422,754 1,560,000 1,560,000 9.6 Profit from

operations: 104,542 135,000 135,000 29.1 Income before income

taxes: 137,849 170,000 170,000 23.3

Net income attributable toKyocera

Corporation'sshareholders:

103,843 119,000 108,000 4.0

Diluted earnings per shareattributable to

KyoceraCorporation's shareholders:

282.62 323.62 * 293.71 ** - Average USD exchange rate: 108 111 111

- Average EUR exchange rate: 119 128 130 - *Forecast of “Diluted

earnings per share attributable to Kyocera Corporation's

shareholders” is based on the diluted average number of shares

outstanding during the six months ended September 30, 2017.

**Forecast of “Diluted earnings per share attributable to Kyocera

Corporation's shareholders” is based on the diluted average number

of shares outstanding during the nine months ended December 31,

2017.

FORWARD-LOOKING STATEMENTSExcept for historical

information contained herein, the matters set forth in this press

release are forward-looking statements that involve risks and

uncertainties including, but not limited to, product demand,

competition, regulatory approvals, the effect of economic

conditions and technological difficulties, and other risks detailed

in the Company’s filings with the U.S. Securities and Exchange

Commission.

About KYOCERAKyocera Corporation (NYSE:KYO; TOKYO:6971;

https://global.kyocera.com/), the parent and global headquarters of

the Kyocera Group, was founded in 1959 as a producer of fine

ceramics (also known as “advanced ceramics”). By combining these

engineered materials with metals and integrating them with other

technologies, Kyocera has become a leading supplier of industrial

and automotive components, electronic devices, semiconductor

packages, solar power generating systems, printers, copiers, and

mobile phones. During the year ended March 31, 2017, the company’s

consolidated net sales totaled 1.42 trillion yen (approx. USD 12.7

billion). Kyocera appears on the “Top 100 Global Innovators” list

by Clarivate Analytics and is ranked #522 on Forbes magazine’s 2017

“Global 2000” listing of the world’s largest publicly traded

companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180201005466/en/

KYOCERA Corporation (Japan)Kenichi Hara,

+81-(0)75-604-3416Corporate

Communicationswebmaster.pressgl@kyocera.jpFax:+81-(0)75-604-3516https://global.kyocera.com/

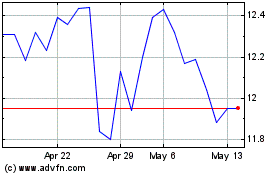

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

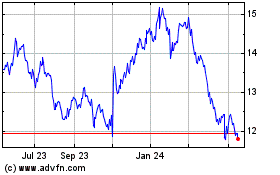

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Nov 2023 to Nov 2024