With Coronavirus Lockdown Lifted, Chinese Splurge on Big Luxury Brands

17 April 2020 - 5:55AM

Dow Jones News

By Matthew Dalton

PARIS -- Spending in China on some of the biggest high-end

brands has surged since the country's lockdown ended, luxury goods

companies said, offering hope to an industry that has been slammed

by the coronavirus pandemic.

LVMH Moët Hennessy Louis Vuitton SE, the industry's biggest

company, Thursday said Chinese shoppers have flocked back to its

boutiques in mainland China when most of them reopened in March.

LVMH owns Louis Vuitton, the world's biggest luxury label, Dior,

Fendi and dozens of other brands.

Sales in China for most of LVMH's brands turned positive

compared with a year ago in the second half of March, said

Jean-Jacques Guiony, LVMH's chief financial officer.

"In April, for the large brands, we've seen very high growth

rates in mainland China," Mr. Guiony said, "sometimes in excess of

50%. So it really shows the appetite of Chinese people after two

months of lockdown to come back to stores and come back to their

previous patterns of consumption."

Still, overall spending by Chinese shoppers was down for the

quarter, Mr. Guiony said. That is because Chinese shoppers do most

of their luxury spending on trips abroad to European capitals, big

U.S. cities and elsewhere. With international travel locked down,

it is unclear when Chinese will have the chance, or the desire, to

splurge again overseas.

Overall sales at LVMH were EUR10.6 billion ($11.5 billion) in

the first quarter, down 17% after accounting for currency

fluctuations and other factors. That was in line with analysts'

expectations. LVMH's boutiques in China were closed for February

and the first half of March, when the coronavirus swept through

Wuhan province and threatened the entire country. Boutiques across

Europe and the U.S. were shut in March, when Western governments

locked down their economies to contain the pandemic.

L'Oréal SA, the world's biggest cosmetics company by sales, also

said the Chinese market for luxury goods was rebounding. Sales at

its luxury cosmetics division, whose brands include Armani and Yves

Saint Laurent, were down 8% in the quarter. But in China, they

showed "clear and encouraging signs of a recovery in consumption,"

the company said Thursday.

When China locked down in January, luxury brands' reliance on

Chinese consumers was seen as a liability. Now those shoppers have

become the industry's bulwark against catastrophe, analysts say.

High-end brands have reopened most of their Chinese boutiques, as

the West remains locked down.

Chinese shoppers are the industry's most important clientele,

representing more than a third of all revenue, according to Bain

& Co. Some of them have already begun documenting on social

media lavish purchases with the reopening of the country's luxury

boutiques.

LVMH is considered a bellwether for the global luxury industry,

with 75 brands operating in dozens of countries. In recent years,

however, LVMH's biggest brands have outperformed the industry;

smaller, independent labels lack the resources to compete with the

French conglomerate.

Analysts expect that the crisis could magnify the advantage

enjoyed by bigger companies such as LVMH and the industry's most

well-known brands -- such as Louis Vuitton, Hermès, Chanel and

Gucci.

"The bigger brands will exit this crisis with a massive

advantage from pent-up demand," said Erwan Rambourg, luxury analyst

at HSBC. "People might be thinking, 'I'll buy less but

better.'"

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

April 16, 2020 15:40 ET (19:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

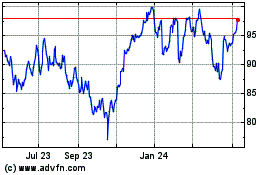

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

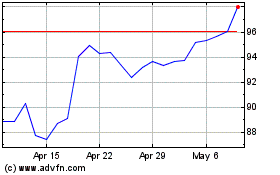

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Jan 2024 to Jan 2025