GE Keeps Trimming Finance Business -- WSJ

08 September 2017 - 5:02PM

Dow Jones News

By Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 8, 2017).

General Electric Co. sold the last of its stake in Penske Truck

Leasing Co. for $674 million, the companies said Thursday, as part

of the industrial conglomerate's plan to refocus its GE Capital

business.

Penske Automotive Group Inc. and a Mitsui & Co. subsidiary

bought the 15.5% stake, with Penske Automotive buying 35% of it and

MBK USA Commercial Vehicles Inc. buying 65%, GE said.

Penske Truck Leasing, which was established in 1988 through a

joint venture between Penske Corp. and GE Capital, was one of the

last remaining pieces of the former GE Capital business. At its

peak in the late 1990s, GE Capital was one of the country's largest

banks. However, following the Great Recession, the company has been

scaling down the size of its financial-services business and in

2015 announced it would exit banking.

GE Capital includes aviation-finance, industrial-finance and

energy-finance businesses.

"To date, we have sold more than $201 billion in assets as we

refocus GE Capital on financing businesses directly related to GE's

industrial businesses," GE Capital Chief Executive and Chairman

Rich Laxer said in prepared remarks.

Shares in GE were down 2.4% to $24.31 in Thursday trading.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

September 08, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

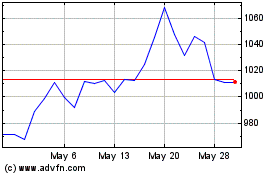

Mitsui (PK) (USOTC:MITSY)

Historical Stock Chart

From Nov 2024 to Dec 2024

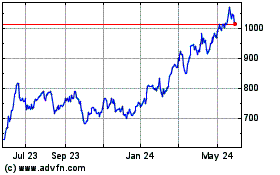

Mitsui (PK) (USOTC:MITSY)

Historical Stock Chart

From Dec 2023 to Dec 2024