Macquarie Infrastructure and Real Assets Wins Bid for KCOM Group

13 July 2019 - 2:54AM

Dow Jones News

By Oliver Griffin

Macquarie Infrastructure and Real Assets (Europe) Ltd. has

outbid its rival, Universities Superannuation Scheme, in an auction

to buy KCOM Group PLC (KCOM.LN).

On Friday, Macquarie once again increased its bid, this time to

120.3 pence per KCOM share, or 627 million pounds ($785.7 million).

The bid was placed by MEIF 6 Fibre Ltd., a wholly owned subsidiary

of Macquarie European Infrastructure Fund 6 SCSp, which is managed

by the company.

At the same time, Universities Superannuation Scheme said

subsidiary Humber Bidco Ltd. raised its bid to buy KCOM to 113

pence a share, or GBP589 million, up from its most recent offer of

110 pence a share on Wednesday.

The bids form the closing stages of a battle to buy KCOM, a

London-listed telecommunications company, after the U.K. Takeover

Panel ruled that an auction would be used to end the bidding

war.

Last week, regulators said the auction would end by 1600 GMT on

July 12 at the latest.

Universities Superannuation Scheme, a university private-pension

plan, first made a recommended 97 pence per share offer for KCOM in

April, but was outbid by Macquarie--a subsidiary of Macquarie Group

Ltd. (MQG.AU)--which came forward with a 108 pence per share

proposal.

Write to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

July 12, 2019 12:39 ET (16:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

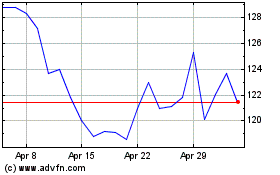

Macquarie (PK) (USOTC:MQBKY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Macquarie (PK) (USOTC:MQBKY)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Macquarie Group Ltd (PK) (OTCMarkets): 0 recent articles

More Macquarie Group, Ltd. (PC) News Articles