Current Report Filing (8-k)

01 February 2022 - 10:09PM

Edgar (US Regulatory)

0001605481

false

0001605481

2022-01-27

2022-01-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported) January 27, 2022

NEVADA

CANYON GOLD CORP.

(Exact

Name of Registrant as Specified in its Charter)

|

Nevada

|

|

000-55600

|

|

46-5152859

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File number)

|

|

(IRS Employer

Identification No.)

|

316

California Ave., Suite 543, Reno, NV 89509

(Address

of principal executive offices) (zip code)

Registrant’s

telephone number, including area code (888) 909-5548

(Former

name or former address, if changed since last report.)

Copies

to:

Janus

Capital Law Group

Attn.:

Deron Colby, Esq.

22

Executive Park, Suite 250

Irvine,

California 92614

Phone:

(949) 633-8965

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(g) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.0001 par value

|

|

NGLD

|

|

OTC

Markets (Pinks)

|

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Purchase

agreement to acquire net smelter returns royalty.

On

January 27, 2022, Nevada Canyon Gold Corp. (“Nevada Canyon” or the “Company”), through its wholly owned subsidiary,

Nevada Canyon, LLC, entered into a Royalty Purchase Agreement (the “Agreement”) with Smooth Rock Ventures, LLC, a wholly

owned subsidiary of Smooth Rock Ventures Corp. (“Smooth Rock”), to acquire a 2% net smelter returns royalty (“NSR”)

on the Palmetto Project (the “Project”), located in Esmeralda County, Nevada.

To

acquire the 2% NSR on the Palmetto Project, Nevada Canyon agreed to pay Smooth Rock a one-time cash payment of USD$350,000. The agreement

is subject to final documentation and the Company expects the transaction to close on or before February 7, 2022.

Mr.

Alan Day, the Company’s member of the board of directors, is also a member of the board of directors of Smooth Rock, therefore

Mr. Day abstained from voting on approval of the Agreement for both companies.

A

copy of the Agreement dated January 27, 2022, is attached as Exhibit 10.14 hereto.

ITEM

7.01 REGULATION FD DISCLOSURE

On

January 31, 2022, the Company issued a news release announcing it had entered into a Royalty Purchase Agreement with Smooth Rock Ventures,

LLC, a wholly owned subsidiary of Smooth Rock Ventures Corp. (“Smooth Rock”), to acquire a 2% NSR on the Palmetto Project,

located in Esmeralda County, Nevada, and further described in Item 1.01 of this Form 8-K. A copy of the news release is attached as Exhibit

99.1 hereto.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

NEVADA

CANYON GOLD CORP.

|

|

|

|

|

|

By:

|

/s/

Jeffrey Cocks

|

|

|

|

Jeffrey Cocks

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

Date:

January 31, 2022

|

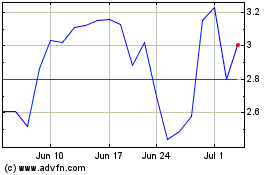

Nevada Canyon Gold (PK) (USOTC:NGLD)

Historical Stock Chart

From Oct 2024 to Nov 2024

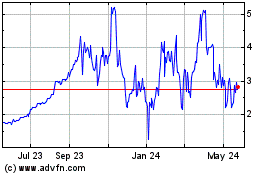

Nevada Canyon Gold (PK) (USOTC:NGLD)

Historical Stock Chart

From Nov 2023 to Nov 2024