Nighthawk Systems, Inc. (OTCBB: NIHK), a leading provider of

wireless and IP-based control devices and solutions, reported

record financial results for the year ended December 31, 2008 with

the filing of its Form 10-K with the Securities and Exchange

Commission yesterday. The Company generated more revenue during

2008 than in any previous fiscal year in the Company�s history,

nearly doubling revenues from 2007. Increased revenues, coupled

with reduced manufacturing costs, led to record gross profits

during 2008, more than doubling the total from 2007. Selling,

general and administrative costs fell from 2007 to 2008, helping

the Company improve its operating cash flow results by more than

50% between years.

Revenues generated during 2008 were $3.3 million as compared to

$1.7 million for 2007. While sales of the Company�s high-definition

set top boxes contributed significantly to the record results,

sales of its legacy power control products also produced record

results during the 2008 year.

As a result of improvements made in the manufacturing of its set

top boxes during the last half of 2008, the Company�s gross margin

increased from 23% to 27% from 2007 to 2008, and the Company

produced more gross profit, $889,150, during 2008 than in any

previous fiscal year in the Company�s history. The Company expects

the improved margins on the set top boxes to continue going

forward. The Company also expects to generate improvement in

margins on the sale of power control products in the coming months

as it nears completion of new circuit boards to be used in those

products.

Selling, general and administrative expenses declined 14% from

$2.5 million in 2007 to $2.1 million in 2008. As a result, the

Company�s cash loss from operations was reduced from $2.1 million

in 2007 to $925,000 in 2008, an improvement of 60%. The Company�s

EBITDA loss improved from $2.1 million in 2007 to $1.2 million in

2008, an improvement of 43% between years.

The Company�s recognized an impairment charge to the carrying

value of its set top box operations at December 31, 2008 of

approximately $1.6 million. The Company�s evaluation of the

business at year end included a reduction in anticipated cash flows

from the set top box operation during 2009 due to the negative

impact the economy is having on technology purchases within the

hospitality industry. While the Company anticipates that set top

box purchases may accelerate during the latter half of 2009, actual

sales have declined from 2008 levels during the first few months of

2009, and the Company recognized an impairment in the value of

goodwill originally recorded when it purchased the set top box

operation in 2007. Primarily as a result of this impairment charge,

the Company�s net loss increased from $3.3 million in 2007 to $4.1

million in 2008. Excluding the impairment charge of $1.6 million

from 2008 results, the net loss was reduced 24% from 2007 to

2008.

H. Douglas Saathoff, Nighthawk�s CEO, commented, �We

accomplished many great things at Nighthawk during 2008 as the

results show, producing twice the revenue than in the previous

year. Improved revenues had a positive impact on cash flows, as we

also increased margins and cut overhead expenses at the same time.

As I have stated previously, there is much cause for optimism at

the Company in spite of the impact the economy has had on business

early in 2009, and positive cash flows remain a realistic near term

goal for the Company. Alongside our new relationship with Itron, we

have started introducing new products to the utility industry in

2009 that firmly position the Company as a provider of Smart Grid

solutions, further enhancing the Company�s standing with the

electric utility industry. We began to build a significant backlog

of business again during the first quarter of 2009, and I expect

great results from the electric utility industry in 2009.�

Mr. Saathoff continued, �I also expect to see improvement during

the year from the set top box operations as our customers adjust to

the economic environment. During the latter stages of 2008, we

began exposing our products to new potential customers in an effort

to strengthen our customer base and lessen our dependency on the

hospitality industry. I expect those efforts to pay off throughout

2009. A recent sale of our IP3000 set top boxes to ESPN validates

these efforts, as well as our superior technology. ESPN chose

Nighthawk�s set top box technology for use in displaying 1080p

broadcasts within their new, state-of-the-art LA Live campus, which

opened with a live broadcast of ESPN�s Sportscenter on April 9,

2009. ESPN�s Los Angeles studio is the first in the world capable

of 1080p production, the best resolution for high definition

broadcasting available. ESPN purchased Nighthawk boxes to enable

the display of the 1080p broadcasts throughout the studio

facilities, and I expect them to expand their use to other

ESPN-owned facilities in the future.�

About Nighthawk Systems,

Inc.

Nighthawk is a leading provider of intelligent devices and

systems that allow for the centralized, on-demand management of

assets and processes. Nighthawk products are used throughout the

United States in a variety of mission critical applications,

including remotely turning on and off and rebooting devices,

activating alarms, and emergency notification, including the

display of custom messages. Nighthawk�s IPTV set top boxes are

utilized by the hospitality industry to provide in-room standard

and high definition television and video on demand. Individuals

interested in Nighthawk Systems can sign up to receive email alerts

by visiting the Company�s website at www.nighthawksystems.com.

Statements contained in this release, which are not

historical facts, including statements about plans and expectations

regarding business areas and opportunities, acceptance of new or

existing businesses, capital resources and future business or

financial results are "forward-looking" statements. You

should not place undue reliance on these forward-looking

statements. Such forward-looking statements are subject to risks

and uncertainties, including, but not limited to, customer

acceptance of our products, our ability to raise capital to fund

our operations, our ability to develop and protect proprietary

technology, government regulation, competition in our industry,

general economic conditions and other risk factors which could

cause actual results to differ materially from those projected or

implied in the forward-looking statements. Although we believe the

expectations reflected in the forward-looking statements are

reasonable, they relate only to events as of the date on which the

statements are made, and our future results, levels of activity,

performance or achievements may not meet these expectations.

We do not intend to update any of the forward-looking

statements after the date of this press release to conform these

statements to actual results or to changes in our expectations,

except as required by law.

**** Financial Statements Follow

****

NIGHTHAWK SYSTEMS, INC.

CONSOLIDATED BALANCE

SHEETS

� �

December 31, December 31, 2008 2007

ASSETS � CURRENT ASSETS Cash $ 36,199 $ 428,484 Accounts

receivable, net 251,392 313,644 Inventories 179,258 359,636 Prepaid

expenses 87,747 93,683 TOTAL CURRENT ASSETS 554,596 1,195,447 �

FIXED ASSETS Furniture, fixtures and equipment, net 318,070 269,619

Debt issuance cost 316,567 310,428 Intangible assets, net 848,031

1,218,677 Goodwill 1,837,138 3,397,537 Other assets 4,320 - NET

FIXED ASSETS $ 3,324,126 $ 5,196,261 � �

TOTAL ASSETS

$

3,878,722

$ 6,391,708 �

LIABILITIES AND STOCKHOLDERS'

EQUITY CURRENT LIABILITIES Accounts payable $ 553,202 $ 327,668

Accrued interest 652,323 299,374 Accrued expenses 186,763 203,448

Deposits and other 13,107 218,148 Line of credit and notes Payable:

Line of credit 6,221 18,892 Convertible notes, net of discount of

$582,138 in 2008 And $883,117 in 2007 1,716,553 1,135,061 Other

notes 767,295 558,320 TOTAL CURRENT LIABILITIES 3,895,464 2,760,911

Long-term notes payable 26,240 - � STOCKHOLDERS' EQUITY (DEFICIT)

���Series A Preferred stock;

$0.001 par value; 5,000,000 sharesauthorized; no shares issued and

outstanding

-

-

���Series B Preferred stock;

$0.001 par value; 1,000,000 sharesauthorized; 672,000 shares issued

and outstanding at September30, 2008 and 618,000 shares issued and

outstanding at December 31,2007; liquidation preference of

$6,000,000

6,152,000 5,417,699

���Common stock; $0.001 par value;

200,000,000 sharesauthorized; 137,663,727 issued and outstanding at

September 30,2008 and 134,433,060 issued and outstanding at

December 31,2007

138,514 134,433 Additional paid in capital 12,780,376 13,091,713

Accumulated deficit (19,113,872) (15,013,048) � TOTAL STOCKHOLDERS'

EQUITY (DEFICIT) (42,982) 3,630,797

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 3,878,722 $

6,391,708

NIGHTHAWK SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

�

Year Ended

December 31,

�

2008 � �

2007 � Revenue $ 3,284,174 � $ 1,655,098 �

Cost of revenue � 2,395,024 � � 1,276,813 � Gross profit 889,150

378,285 � Selling, general and administrative expenses � 2,131,199

� � 2,455,645 � EBITDA (1,242,049) (2,077,360) � Depreciation and

amortization 381,428 114,677 Impairment expense � 1,591,703 � �

19,550 Loss from operations � (3,215,180) � � (2,211,587) �

Interest expense � 885,644 � � 1,076,450 Net loss (4,100,824)

(3,288,037) � Dividends on preferred stock (734,301) (165,699)

Beneficial conversion feature on preferred stock � - � �

(2,490,000) � Net loss applicable to common stockholders $

(4,835,125)

� $ (5,943,736) � Net loss per basic and diluted common share $

(0.04) � $ (0.05) � Weighted average number of common shares

outstanding, basic and diluted � 136,362,108 � � 116,318,716

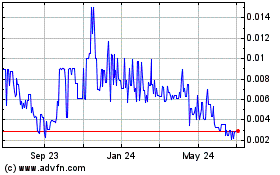

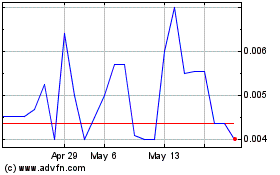

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Feb 2024 to Feb 2025