Imperial Industries, Inc. Announces it Has Entered Into a Loan Agreement and Commenced Acquisition Discussions With Q.E.P. Co...

20 June 2012 - 11:30PM

Imperial Industries, Inc. (OTCBB:IPII) (the "Company") announced

today that it had entered into a loan agreement with QEP Co., Inc.

("QEPC.PK"), a worldwide manufacturer, marketer and distributor of

hardwood flooring, flooring installation tools, adhesives and

flooring related products, to provide the Company with a line of

credit up to $500,000. The line of credit is secured by a lien on

substantially all the assets of the Company and is subject to

certain financial covenants and other customary restrictions. The

line of credit, which would mature no later than on December 14,

2012, is intended to provide the Company funds for its current

working capital needs and any transaction costs that may be

incurred as a result of a subsequent merger between the Company and

QEP Co., Inc.

In connection with the Line of Credit the Company and QEP

entered into a non-binding Letter of Intent (the "LOI") with regard

to a proposed acquisition of the Company by QEP. QEP has the right

to terminate the LOI at any time for any reason. The LOI would

automatically terminate on July 12, 2012, if a definitive binding

merger agreement has not been executed by that date unless extended

by mutual consent of the parties. The LOI provides, among other

things, that QEP would agree to purchase 100% of the Common Stock

of the Company for a price of no more than $.30 per share. The

proposed merger transaction would be subject to a number of

customary closing conditions, including obtaining approval from the

holders of a majority of the Company's outstanding shares of common

stock at a Company shareholder meeting to be held. There can be no

assurance that the Company will eventually enter into a definitive

merger agreement, or that QEP will ultimately pay $.30 per

share.

S. Daniel Ponce, Imperial's Chairman of the Board, stated, "This

Loan Agreement provides the Company with the necessary funds to

address the immediate liquidity needs of its operations during this

difficult period in the construction industry. We are excited about

the potential acquisition of our Company by QEP. Should our Company

join forces with QEP, I believe it would strengthen our operations

and greatly enhance our Company's ability to improve our market

position."

For more information, please refer to the Company's Form 8-K

which is being filed with the Securities and Exchange Commission on

June 20, 2012 and which will be available on the Company's website

www.imperialindustries.com shortly thereafter.

Imperial Industries, Inc., through its subsidiary,

Premix-Marbletite Manufacturing Co., is engaged in the manufacture

and distribution of pool, stucco, plaster and roofing products to

building materials dealers, contractors and others and sells

products primarily in the State of Florida and to a lesser extent

the rest of the Southeastern United States and the Caribbean, with

facilities in the State of Florida. See our website at

www.imperialindustries.com for more information about the

Company.

The Imperial Industries, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=3041

Q.E.P. Co., Inc. is a leading worldwide manufacturer, marketer

and distributor of a comprehensive line of hardwood flooring,

flooring installation tools, adhesives and flooring related

products targeted for the professional installer as well as the

do-it-yourselfer. Under brand names including QEP®, ROBERTS®,

Capital®, Harris® Wood, Vitrex®, PRCI®, BRUTUS®, Porta-Nailer® and

Elastiment®, the Company markets over 3,000 flooring and flooring

related products. In addition to a complete hardwood flooring line,

QEP products are used primarily for surface preparation and

installation of wood, laminate, ceramic tile, carpet and vinyl

flooring. The Company sells its products to home improvement retail

centers and specialty distribution outlets in 50 states and

throughout the world.

The statements in this press release contain certain

forward-looking statements, which are subject to risks and

uncertainties. Such statements, including those regarding, among

other things, the success of the Company's sales and marketing

efforts, improvements in productivity, the Company's strategy and

future prospects, are dependent on a number of factors, including

changes in economic, business, and competitive market conditions,

and availability of financing, only some of which are within the

Company's control. Actual results could differ materially from

those currently anticipated due to a number of factors, including

those set forth in the Company's Securities and Exchange Commission

filings under "Risk Factors." The Company assumes no obligation to

update forward-looking information to reflect actual results,

changes in assumptions or changes in other factors affecting

forward-looking information. A more detailed discussion of risks

attendant to the forward-looking statements included in this press

release are set forth in the "Forward-Looking Statements and Risk

Factors" sections of the Company's Annual Report on Form 10-K for

the year ended December 31, 2011, filed with the Securities and

Exchange Commission ("SEC"), and in other reports already filed

with the SEC.

CONTACT: 954-917-4114

Howard L. Ehler, Jr.

Chief Operating Officer

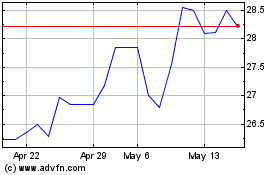

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

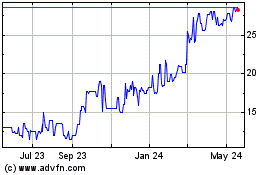

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025