UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 2

to

Registration Number 333-260463 and

POST-EFFECTIVE

AMENDMENT NO. 1

to

Registration Statement No. 333-265892

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

SideChannel,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

86-0837077 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

146

Main Street, Suite 405

Worcester,

MA |

|

01608 |

(Address

of principal executive offices) |

|

(Zip

Code) |

Cipherloc

Corporation 2021 Omnibus Equity Incentive Plan

(Full

title of the plan)

Brian

Haugli

Chief Executive Officer

SideChannel, Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

(Name

and address of agent for service)

(508)

925-0114

(Telephone

number, including area code, of agent for service)

Copies

to:

Laura

Anthony, Esq..

Anthony,

Linder & Cacomanolis, PLLC

1700

Palm Beach Lakes Blvd, Suite 820

West

Palm Beach, FL 33401

844-281-2863

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

|

Non-accelerated

filer ☒ |

| |

|

Smaller

reporting company ☒ |

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

registration statement on Form S-8 registers the issuance of additional securities pursuant to the Plan (as defined below), which are

securities of the same class relating to the same plan for which a registration statement on Form S-8 (Registration No. 333-260463) was

filed with the Securities and Exchange Commission (the “SEC”) on October 25, 2021 (the “Plan”), and to which

post-effective amendment No. 1 was filed on Form S-8 (Registration No.333-265892) on June 29, 2022 with the SEC. This Post-Effective

Amendment is being filed by SideChannel, Inc. (the “Registrant”) pursuant to General Instruction E to Form S-8 to register

an additional 13,599,334 shares of the Registrant’s common stock, par value $0.001 per share (“Common Stock”), of the

Registrant (the “Ordinary Shares”) for which a registration statement on Form S-8 of the Registrant relating to the same

employee benefit plan is effective.

Previously,

the Registrant, f./k./a. Cipherloc Corporation, set up the Cipherloc Corporation 2021 Omnibus Equity Incentive Plan (the “Plan”)

to provide for grants of equity awards to designated employees, directors and other service providers of the Registrant and its affiliates.

The number of shares of the Registrant’s common stock available for issuance under the Plan is subject to an automatic annual increase

on the first day of each of the Registrant’s fiscal years beginning on January 1, 2022 and ending on the last January 1st during

the initial ten-year term of the Plan by an amount equal to the lesser of: (i) 5% of the Registrant’s shares of common stock outstanding

(on an as-converted basis, which shall include shares of the Registrant’s common stock issuable upon the exercise or conversion

of all outstanding securities or rights convertible into or exercisable for shares of the Registrant’s common stock, including,

without limitation, preferred stock, warrants and employee options to purchase any shares of the Registrant’s common stock) on

the final day of the immediately preceding calendar year and, (ii) such lesser number of shares of the Registrant’s common stock

as determined by the Registrant’s board of directors.

For

the 2024 year, the Registrant’s board of directors authorized an increase of 13,599,334 shares of the Registrant’s common

stock under the Plan, consisting of the full 5% increase. These shares are in addition to the 8,000,000 shares of common stock

registered on the Registrant’s Form S-8 filed with the Securities and Exchange Commission (“SEC”) on October 25, 2021

(Registration No. 333-260463) and the 8,186,106 shares of common stock registered on the Registrant’s Form S-8 filed with the SEC

on June 29, 2022 (Registration No.333-265892) collectively referred to as the “post-effective amendments”.

The

information contained in the 2021 Registration Statement and the 2022 Registration Statement, in each case as amended, is hereby incorporated

by reference to these Post-Effective Amendments, except as modified in Part II, below.

This

Registration Statement contains Part II. Part II contains information required to be set forth in the Registration Statement pursuant

to Part II of Form S-8.

The

Registrant will provide, without charge, to any person, upon written or oral request of such person, a copy of each document incorporated

by reference in Item 3 of Part II of this Registration Statement, other than exhibits to such documents that are not specifically incorporated

by reference.

In

accordance with General Instruction E of Form S-8, the contents of the Prior Registration Statements are incorporated herein by reference

and made part of this Registration Statement, except as amended hereby.

PART

I

The

information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions

of Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), and the introductory note to Part I of Form

S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the equity benefit

plans covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

following documents filed by SideChannel, Inc. (the “Company”) with the Securities and Exchange Commission (“SEC”)

are incorporated herein by reference:

| |

● |

The

Registrant’s Annual Report on Form

10-K for the year ended September 30, 2023, filed with the SEC on December 27, 2023; |

| |

|

|

| |

● |

The

Registrant’s Quarterly Reports on Form 10-Q for the quarters ended December

31, 2023, March

31, 2024, and June

30, 2024 filed with the SEC on February 7, 2024, May 7, 2024, and August 7, 2024 respectively; |

| |

|

|

| |

● |

The

Registrant’s Current Reports on Form 8-K filed with the SEC on December

27, 2023, January

9, 2024, January

30, 2024, February

1, 2024, February

7, 2024, February

20, 2024, February

21, 2024, April

15, 2024, May

2, 2024, May

7, 2024/May

7, 2024, June

24, 2024, July

25, 2024, August

7, 2024, and September

9, 2024; |

| |

|

|

| |

● |

The

Registrant’s definitive proxy statement on Schedule

14A filed with the SEC on January 5, 2024; and |

| |

|

|

| |

● |

All

documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Exchange Act on or after the date of this Registration Statement and prior to the filing

of a post-effective amendment to this Registration Statement that indicates that all securities

offered have been sold or that deregisters all securities then remaining unsold shall be

deemed to be incorporated by reference in this Registration Statement and to be part hereof

from the date of filing of such documents; provided, however, that documents

or information deemed to have been furnished and not filed in accordance with the rules of

the Commission shall not be deemed incorporated by reference into this Registration Statement.

Any statement contained in a document incorporated or deemed to be incorporated by reference

herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein or in any subsequently filed document which

also is deemed to be incorporated by reference herein modifies or supersedes such statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or

superseded, to constitute a part of this Registration Statement. |

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

Section

145 (“Section 145”) of the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended

(the “General Corporation Law”) provides that a Delaware corporation may indemnify any person who was or is a party or is

threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of such corporation) by reason of the fact that such person is or was a director,

officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee

or agent of another corporation or enterprise. The indemnity may include expenses (including attorney’s fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided

such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best

interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal.

Section

145 further authorizes a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee

or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another

corporation or enterprise, against any liability asserted against such person and incurred by such person in any such capacity, arising

out of such person’s status as such, whether or not the corporation would otherwise have the power to indemnify such person against

such liability under Section 145.

The

Registrant’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the Registrant will

indemnify to the fullest extent permitted by law any person made or threatened to be made a party to an action or proceeding, whether

criminal, civil, administrative or investigative, by reason of the fact that he or she, his or her testator or intestate is or was a

director, officer or employee of the Registrant or any predecessor of the Registrant, or serves or served at any other corporation, partnership,

joint venture, trust or other enterprise as a director, officer, employee or agent at the request of the Registrant or any predecessor

of the Registrant.

The

Registrant’s Amended and Restated Bylaws provide for mandatory indemnification to the fullest extent permitted by General Corporation

Law against all expense, liability and loss including attorney’s fees, judgments, fines, ERISA excise taxes or penalties and amounts

paid in settlements, provided that the Registrant shall not be required to indemnify in a proceeding initiated by a director, officer,

employee or agent of the corporation unless the proceeding in which indemnification is sought was authorized in advance by our board

of directors.

The

Registrant’s directors and officers are covered by insurance maintained by the Registrant against specified liabilities for actions

taken in their capacities as such, including liabilities under the Securities Act. In addition, the Registrant has entered into contracts

with its directors and officers providing indemnification of such directors and officers by the Registrant to the fullest extent permitted

by law, subject to certain limited exceptions.

Item

7. Exemption from Registration Claimed.

Not

applicable.

Item

8. Exhibits.

EXHIBIT

INDEX

*

Filed herewith

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in Worcester, Massachusetts, on the 27th day of September 2024.

| |

SIDECHANNEL,

INC. |

| |

|

|

| |

By:

|

/s/

Brian Haugli |

| |

|

Brian

Haugli |

| |

|

Chief

Executive Officer (Principal Executive Officer) and Director |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Brian Haugli as his or her true

and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in their name, place and

stead, in any and all capacities, to sign any and all amendments (including post-effective amendments), and to file the same, with all

exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact

and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith,

as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact

and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities

and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Brian Haugli |

|

Chief

Executive Officer and Director |

|

September

27, 2024 |

| Brian

Haugli |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Ryan Polk |

|

Chief

Financial Officer |

|

September

27, 2024 |

| Ryan

Polk |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Deborah MacConnel |

|

Chairwoman

of the Board of Directors |

|

September

27, 2024 |

| Deborah

MacConnel |

|

|

|

|

| |

|

|

|

|

| /s/

Robert Brown |

|

Director |

|

September

27, 2024 |

| Robert

Brown |

|

|

|

|

| |

|

|

|

|

| /s/

Nicholas Hnatiw |

|

Director |

|

September

27, 2024 |

| Nicholas

Hnatiw |

|

|

|

|

| |

|

|

|

|

| /s/

Hugh Regan, Jr. |

|

Director |

|

September

27, 2024 |

| Hugh

Regan, Jr. |

|

|

|

|

Exhibit

5.1

| LAURA

ANTHONY, ESQ. |

WWW.ALCLAW.COM |

| CRAIG

D. LINDER, ESQ.* |

WWW.SECURITIESLAWBLOG.COM |

| JOHN

CACOMANOLIS, ESQ.** |

|

| |

|

| Associates

and OF COUNSEL: |

DIRECT

E-MAIL: JHAGGARD@ALCLAW.COM |

| CHAD

FRIEND, ESQ., LLM |

|

| MICHAEL

R. GEROE, ESQ., CIPP/US*** |

|

| JESSICA

HAGGARD, ESQ. **** |

|

| christopher

t. hines ***** |

|

| PETER

P. LINDLEY, ESQ., CPA, MBA |

|

| JOHN

LOWY, ESQ.****** |

|

| STUART

REED, ESQ. |

|

| LAZARUS

ROTHSTEIN, ESQ. |

|

| SVETLANA

ROVENSKAYA, ESQ.******* |

|

| HARRIS

TULCHIN, ESQ. ******** |

|

*licensed

in CA, FL and NY

**licensed

in FL and NY

***licensed

in CA, DC, MO and NY

****licensed

in Missouri

*****licensed

in CA and DC

******licensed

in NY and NJ

*******licensed

in NY and NJ

********licensed

in CA and HI (inactive in HI)

September

27, 2024

SideChannel,

Inc.

146

Main Street, Suite 405

Worcester,

MA 01608

Re:

Registration Statement on Form S-8

Ladies

and Gentlemen:

We

have examined the Registration Statements on Form S-8 (the “Registration Statement”) to be filed by SideChannel, Inc.(the

“Company”) with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as

amended (the “Securities Act”), relating to an additional 13,599,334 shares of the Company’s common stock, par value

$0.001 per share (“Common Stock”), issuable pursuant to the Cipherloc Corporation 2021 Omnibus Equity Incentive Plan (the

“2021 Plan”).

The

shares of Common Stock issuable pursuant to the 2021 Plan are collectively referred to herein as the “Shares”.

In

that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents, corporate

records and other instruments as we have deemed necessary or appropriate for the purposes of this opinion, including, without limitation:

(a) the Amended and Restated Articles of Incorporation, as amended, of the Company; (b) the Bylaws of the Company; (c) certain resolutions

adopted by the Board of Directors of the Company; and (d) the 2021 Plan.

In

rendering our opinion, we have assumed the genuineness of all signatures, the legal capacity and competency of all natural persons, the

authenticity of all documents submitted to us as originals and the conformity to authentic original documents of all documents submitted

to us as duplicates or copies. As to all questions of fact material to this opinion that have not been independently established, we

have relied upon certificates or comparable documents of officers and representatives of the Company.

Based

on the foregoing and in reliance thereon, and subject to compliance with applicable state securities laws, we are of the opinion that

the Shares when, and if, issued pursuant to the terms of the 2021 Plan will be validly issued, fully paid and non-assessable.

Our

opinion expressed herein is limited to the internal laws of the State of Delaware and the federal laws of the United States, and we do

not express any opinion herein concerning any other law.

We

hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. In giving this consent,

we do not hereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or

the rules and regulations of the Commission promulgated thereunder.

| | Very

Truly Yours, |

| | |

| | ANTHONY,

LINDER & CACOMANOLIS, PLLC |

| | |

| | /s/

Anthony, Linder & Cacomanolis, PLLC |

1700

PALM BEACH LAKES BLVD., SUITE 820 ● WEST PALM BEACH, FLORIDA ● 33401 ● PHONE: 561-514-0936

Exhibit

23.1

|

805

Third Avenue Suite 1430

New

York, NY 10022

www.rbsmllp.com

|

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

SideChannel,

Inc.

San

Francisco, California

We

consent to the incorporation by reference in this Registration Statement on Form S-8 dated September 27, 2024, of our report dated December

27, 2023, relating to the consolidated financial statements of SideChannel, Inc. as of September 30, 2023 and 2022, and for each of the

two years in the period ended September 30, 2023.

RBSM,

LLP

101

Larkspur Landing Suite 321

Larkspur,

CA 94939

September

27, 2024

New

York NY, Washington DC, San Francisco CA, Las Vegas Nevada

Mumbai

& Pune India, Beijing China, Athens Greece

Member

of ANTEA International with affiliated offices worldwide

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-8

(Form

Type)

SideChannel,

Inc.

(Name

of Issuer)

SideChannel,

Inc.

(Name

of Person(s) Filing Statement)

Table

1: Transaction Valuation

| | |

Transaction Valuation | | |

Fee rate | | |

Amount of Filing Fee | |

| Fees to Be Paid | |

$ | 543,973.36 | (1) | |

$ | 0.00014760 | | |

$ | 80.29 | (2) |

| Fees Previously Paid | |

| | | |

| | | |

| | |

| Total Transaction Valuation | |

$ | 543,973.36 | | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 80.29 | |

| Total Fees Previously Paid | |

| | | |

| | | |

| | |

| Total Fee Offsets | |

| | | |

| | | |

| | |

| Net Fee Due | |

| | | |

| | | |

$ | 80.29 | |

(1)

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall

also cover any additional shares of common stock, par value $0.001 per share (“Common Stock”), of SideChannel, Inc. (the

“Registrant”) that become issuable under the Cipherloc Corporation 2021 Omnibus Equity Incentive Plan (the “Plan”),

by reason of any stock dividend, stock split, recapitalization or other similar transaction that increases the number of the outstanding

shares of the Registrant’s common stock. In addition, pursuant to Rule 416(c) under the Securities Act, this Registration Statement

shall also cover an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plan described herein. Estimated

solely for purposes of calculating the registration fee in accordance with Rule 457(h) of the Securities Act by averaging the high and

low sales prices of the Registrant’s common stock reported on the OTCQB on February 15, 2024 which was $0.04.

(2)

The amount of the filing fee, calculated in accordance with Rule 0-11(b) under the Exchange Act, equals $147.60 per million dollars

of the transaction valuation.

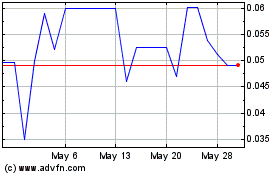

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Oct 2024 to Nov 2024

SideChannel (QB) (USOTC:SDCH)

Historical Stock Chart

From Nov 2023 to Nov 2024