UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: November 30, 2008

¨

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from to

Commission file number: 000-52959

Sterling Oil & Gas Company

(Exact name of small business issuer as specified in its charter)

|

Nevada

|

20-8999059

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

121 W. Merino St.

Upton, WY 82730

(Address of principal executive offices)

(307) 468-9368

(Issuer’s telephone number)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

þ

No

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

Accelerated filer

|

|

Non-accelerated filer

|

þ

Smaller reporting company

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes

¨

No

þ

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 15,925,000 shares of common stock, $.00001 par value and 0 shares of preferred stock, $.00001 par value as of January 9, 2009

1

|

STERLING OIL & GAS COMPANY

|

|

|

|

INDEX

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

PART 1.

|

FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

|

|

|

|

Condensed Balance Sheets as of November 30, 2008 (Unaudited) and February

|

|

|

|

|

29, 2008

|

3

|

|

|

|

|

|

|

|

|

Condensed Statements of Operations for the three months ended November 30,

|

|

|

|

|

2008and 2007 and for the nine months ended November 30, 2008 and Inception

|

|

|

|

|

(May 1, 2007) through November 30, 2007 and for the cumulative period from

|

|

|

|

|

Inception (May 1, 2007) through November 30, 2008(Unaudited)

|

4

|

|

|

|

|

|

|

|

|

Condensed Statements of Cash Flows for the nine months ended November 30,

|

|

|

|

|

2008 and Inception (May 1, 2007) through November 30, 2007, and for the

|

|

|

|

|

cumulative period from May 1, 2007 (inception) through November 30, 2008

|

5

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Condensed Statement of Shareholders’ Equity for the nine months ended

|

|

|

|

|

November 30, 2008 and the cumulative period from inception (May 1, 2007) to

|

|

|

|

|

November 30, 2008 (Unaudited)

|

6

|

|

|

|

|

|

|

|

|

Notes to Unaudited Financial Statements

|

7

|

|

|

|

|

|

|

|

ITEM 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of

|

|

|

|

|

Operations

|

14

|

|

|

|

|

|

|

ITEM 4T. CONTROLS AND PROCEDURES

|

19

|

|

|

|

|

|

PART II.

|

OTHER INFORMATION

|

20

|

|

|

|

|

|

|

|

ITEM 1.

|

Legal Proceedings

|

20

|

|

|

|

|

|

|

|

ITEM 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

20

|

|

|

|

|

|

|

|

ITEM 3.

|

Default Upon Senior Securities

|

20

|

|

|

|

|

|

|

|

ITEM 4.

|

Submission of Matters to a Vote of Security Holders

|

20

|

|

|

|

|

|

|

|

ITEM 5.

|

Other Information

|

20

|

|

|

|

|

|

|

|

ITEM 6.

|

EXHIBITS

|

20

|

|

|

|

|

|

|

SIGNATURES

|

21

|

2

|

ITEM 1.

FINANCIAL STATEMENTS.

|

|

|

|

|

|

|

Sterling Oil & Gas Company

|

|

(An Exploration Stage Company)

|

|

Condensed Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

November 30,

|

|

|

February 29, 2008

|

|

|

|

|

2008

|

|

|

|

|

|

Assets

|

|

(Unaudited)

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

103,859

|

|

$

|

6,426

|

|

Marketable securities

|

|

2,867

|

|

|

285,666

|

|

|

Total current assets

|

|

106,726

|

|

|

292,092

|

|

|

|

|

|

|

|

Oil and Gas Properties-Unevaluated Properties, full cost method (less $55,000 and $571,000

|

|

|

|

|

|

|

impairment respectively)

|

|

1,107,125

|

|

|

1,071,322

|

|

|

|

|

|

Total Assets

|

|

$

|

1,213,851

|

|

$

|

1,363,414

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

14,696

|

|

$

|

29,493

|

|

|

|

|

|

Commitment and Contingencies (Notes 2 and 8)

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

Preferred stock, $.00001 par value; 100,000,000 shares authorized, 0 shares

|

|

|

|

|

|

|

issued and outstanding

|

|

--

|

|

|

--

|

|

|

|

Common stock, $.00001 par value; 100,000,000 shares authorized,

|

|

|

|

|

|

|

15,925,000 and 15,000,000 shares issued and outstanding

|

|

|

|

|

|

|

at November 30, 2008 and February 29, 2008, respectively

|

|

159

|

|

|

150

|

|

Additional paid-in capital

|

|

2,263,982

|

|

|

2,074,091

|

|

Deficit accumulated during development stage

|

|

(1,064,986)

|

|

|

(740,320)

|

|

|

|

|

Total shareholders’ equity

|

|

1,199,155

|

|

|

1,333,921

|

|

|

|

Total Liabilities and Shareholders’ Equity

|

$

|

1,213,851

|

|

$

|

1,363,414

|

|

|

|

|

|

|

|

See accompanying notes to condensed financial statements

.

|

|

3

|

|

Sterling Oil & Gas Company

|

|

(An Exploration Stage Company)

|

|

Condensed Statements of Operations

|

|

(Unaudited)

|

|

|

|

|

|

For the Three Months

|

|

|

For the Nine months ended

|

|

|

May 1, 2007

|

|

|

|

ended November 30,

|

|

|

November 30,2008 and

|

|

|

(Inception)

|

|

|

|

|

|

|

|

|

|

Inception (May 1, 2007)

|

|

|

Through

|

|

|

|

|

|

|

|

|

|

through November 30, 2007

|

|

|

November 30,

|

|

|

|

2008

|

|

|

2007

|

|

|

2008

|

|

|

2007

|

|

|

2008

|

|

Revenues

|

$

|

--

|

|

$

|

--

|

|

$

|

--

|

|

$

|

--

|

|

$

|

--

|

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel costs

|

|

--

|

|

|

--

|

|

|

175,602

|

|

|

--

|

|

|

214,727

|

|

Professional fees

|

|

27,754

|

|

|

35,808

|

|

|

135,942

|

|

|

48,608

|

|

|

180,020

|

|

Impairment expense

|

|

|

|

|

--

|

|

|

--

|

|

|

--

|

|

|

571,000

|

|

Other general and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

administrative

|

|

1,731

|

|

|

2,615

|

|

|

15,895

|

|

|

9,016

|

|

|

107,877

|

|

|

|

Operating loss

|

|

(29,485)

|

|

|

(38,423)

|

|

|

(327,439)

|

|

|

(57,624)

|

|

|

(1,073,624)

|

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

108

|

|

|

1,446

|

|

|

2,773

|

|

|

2,546

|

|

|

8,638

|

|

|

|

Net loss

|

$

|

(29,377)

|

|

$

|

(36,977)

|

|

$

|

(324,666)

|

|

$

|

(55,078)

|

|

$

|

(1,064,986)

|

|

|

|

Basic and diluted loss per share

|

$

|

(0.00)

|

|

$

|

(0.00)

|

|

$

|

(0.02)

|

|

$

|

(0.00)

|

|

|

|

|

|

|

Weighted average common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

shares outstanding, basic and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

diluted

|

|

15,549,176

|

|

|

14,780,220

|

|

|

15,205,364

|

|

|

13,271,127

|

|

|

|

See accompanying notes to condensed financial statement

s.

4

|

Sterling Oil & Gas Company

|

|

(An Exploration Stage Company)

|

|

Condensed Statements of Cash Flows

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

From

|

|

|

From

|

|

|

|

|

|

|

Inception

|

|

|

Inception

|

|

|

|

For the Nine

|

|

|

(May 1, 2007)

|

|

|

(May 1, 2007)

|

|

|

|

months ended

|

|

|

through

|

|

|

through

|

|

|

|

November 30,

|

|

|

November 30,

|

|

|

November 30,

|

|

|

|

2008

|

|

|

2007

|

|

|

2008

|

|

Cash Flows From Operating Activities:

|

|

|

|

|

|

|

|

|

|

Net Loss

|

$

|

(324,666)

|

|

$

|

(55,078)

|

|

$

|

(1,064,986)

|

|

Adjustments to reconcile net loss to net cash used by

|

|

|

|

|

|

|

|

|

|

operating activities:

|

|

|

|

|

|

|

|

|

|

Contributed services

|

|

4,900

|

|

|

25,300

|

|

|

35,700

|

|

Impairment expense

|

|

--

|

|

|

--

|

|

|

571,000

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trading securities

|

|

282,799

|

|

|

--

|

|

|

(2,867)

|

|

Accounts payable

|

|

(14,797)

|

|

|

24,301

|

|

|

14,696

|

|

|

|

Net cash (used in)

|

|

|

|

|

|

|

|

|

|

operating activities

|

|

(51,764)

|

|

|

(5,477)

|

|

|

(446,457)

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Unevaluated oil and gas properties-purchases

|

|

(35,803)

|

|

|

(133,547)

|

|

|

(172,983)

|

|

Refund of purchase deposit

|

|

--

|

|

|

80,856

|

|

|

80,856

|

|

Undeveloped oil and gas properties-sales

|

|

--

|

|

|

22,968

|

|

|

208,233

|

|

Net cash provided by (used in)

|

|

|

|

|

|

|

|

|

|

investing activities

|

|

(35,803)

|

|

|

(29,723)

|

|

|

116,106

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from the sale of common stock

|

|

185,000

|

|

|

250,000

|

|

|

435,000

|

|

Payments for offering costs

|

|

--

|

|

|

(790)

|

|

|

(790)

|

|

Net cash provided by

|

|

|

|

|

|

|

|

|

|

financing activities

|

|

185,000

|

|

|

249,210

|

|

|

434,210

|

|

Net Increase (Decrease) in cash and

|

|

|

|

|

|

|

|

|

|

cash equivalents

|

|

97,433

|

|

|

214,010

|

|

|

103,859

|

|

Cash and cash equivalents:

|

|

|

|

|

|

|

|

|

|

Beginning of period

|

|

6,426

|

|

|

0

|

|

|

0

|

|

End of period

|

$

|

103,859

|

|

$

|

214,010

|

|

$

|

103,859

|

|

|

|

Noncash investing and financing transaction:

|

|

|

|

|

|

|

|

|

|

Transfer of oil and gas properties from Big Cat

|

$

|

--

|

|

$

|

1,794,231

|

|

$

|

1,794,231

|

See accompanying notes to condensed financial statements

.

5

|

Sterling Oil & Gas Company

|

|

(An Exploration Stage Company)

|

|

Condensed Statement of Shareholder Equity

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D

EFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I

NCURRED

|

|

|

|

|

|

C

OMMON

S

TOCK

|

|

|

A

DDITIONAL

|

|

|

D

URING

|

|

|

|

|

|

|

|

|

P

AR VALUE

|

|

|

P

AID

-

IN

|

|

|

E

XPLORATION

|

|

|

|

|

|

S

HARES

|

|

|

$.00001

|

|

|

C

APITAL

|

|

|

S

TAGE

|

|

|

T

OTAL

|

|

|

|

Balance, at Inception (May 1, 2007)

|

--

|

|

$

|

--

|

|

$

|

--

|

|

$

|

--

|

|

$

|

--

|

|

Stock issued for properties transferred

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from Big Cat at inception, 5/1/2007,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$0.1794 per share

|

10,000,000

|

|

|

100

|

|

|

1,794,131

|

|

|

–

|

|

|

1,794,231

|

|

Private placement June 2007, $0.05 per

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

share

|

5,000,000

|

|

|

50

|

|

|

249,950

|

|

|

–

|

|

|

250,000

|

|

Other-contributed services

|

–

|

|

|

–

|

|

|

30,800

|

|

|

–

|

|

|

30,800

|

|

Other costs-issuance fees

|

|

|

|

|

|

|

(790)

|

|

|

|

|

|

(790)

|

|

Net loss

|

–

|

|

|

–

|

|

|

–

|

|

|

(740,320)

|

|

|

(740,320)

|

|

|

|

Balance

, February 29, 2008

|

15,000,000

|

|

|

150

|

|

|

2,074,091

|

|

|

(740,320)

|

|

|

1,333,921

|

|

Public offering August 2008, $0.20 per

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

share

|

325,000

|

|

|

3

|

|

|

64,997

|

|

|

–

|

|

|

65,000

|

|

Public offering October 2008, $0.20 per

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

share

|

600,000

|

|

|

6

|

|

|

119,994

|

|

|

--

|

|

|

120,000

|

|

Other-contributed services

|

--

|

|

|

--

|

|

|

4,900

|

|

|

--

|

|

|

4,900

|

|

Net loss-nine months ended November

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30, 2008

|

–

|

|

|

–

|

|

|

–

|

|

|

(324,666)

|

|

|

(324,666)

|

|

|

|

Balance

, November 30, 2008

|

15,925,000

|

|

$

|

159

|

|

$

|

2,263,982

|

|

$

|

(1,064,986)

|

|

$

|

1,199,155

|

|

|

|

|

|

See accompanying notes to condensed financial statement

s.

|

6

|

1.

|

P

RESENTATION

, O

RGANIZATION AND

N

ATURE OF

O

PERATIONS

:

|

|

|

|

|

Presentation

|

|

|

|

|

The accompanying unaudited financial statements of Sterling Oil & Gas Company (the “Company”) at November 30, 2008 and 2007 have been prepared in accordance with generally accepted accounting principles (“GAAP”) for interim financial statements pursuant to instructions to Form 10-Q and Regulation S-X. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted. These condensed financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s annual report on Form 10-K for the year ended February 29, 2008. In management’s opinion, all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair presentation to make the Company’s financial statements not misleading have been included. The results of operations for the period ended November 30, 2008 and 2007 presented are not necessarily indicative of the results to be expected for the full year. The February 29, 2008 balance sheet has been derived from the Company’s audited financial statements included in the Company’s annual report on Form 10-K for the year ended February 29, 2008.

|

|

|

|

|

Description of Operations

|

|

|

|

|

Sterling Oil & Gas Company (“Sterling”) is an independent energy company engaged in the exploration and acquisition of natural gas and crude oil prospects in the western United States. On May 1, 2007, Big Cat Energy Corporation (“Big Cat”) formed Sterling as a wholly owned subsidiary and transferred its unevaluated oil and gas properties, consisting of various mineral leases and related costs, to Sterling in return for 10 million shares of Sterling restricted common stock. On April 2, 2008, Big Cat spun off Sterling by distributing the 10 million shares it held pro rata to the Big Cat shareholders.

|

|

|

|

|

The Company is in the exploration stage in accordance with Statement of Financial Accounting Standards (‘SFAS”) No. 7. The Company has been in the exploration stage since inception and has yet to enter revenue- producing operations. Activities since its inception have primarily involved organization and development of the Company.

|

|

|

|

2.

|

L

IQUIDITY

:

|

|

|

Going Concern

As of November 30, 2008, the Company had working capital of $92,030 and shareholders’ equity of $1,199,155. Sterling has relied upon outside investor funds to maintain its operations and develop its business. Sterling’s plan for continuation anticipates continued funding from investors. This funding would be used for operations, for working capital, as well as business expansion during the upcoming fiscal year. The Company can provide no assurance that additional investor funds will be available on terms acceptable to the Company and there is substantial doubt about the ability of the Company to continue as a going concern.

Sterling’s ability to continue as a going concern is dependent upon raising capital through debt or equity financing and ultimately by producing revenue and achieving profitable operations. The Company can offer no assurance that it will be successful in its efforts to raise additional proceeds or achieve profitable operations. The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities in the normal course of business, and no adjustments have been made as a result of this uncertainty.

3.

S

IGNIFICANT

A

CCOUNTING

P

OLICIES

:

7

Use of Estimates

The preparation of the financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amounts of any oil and gas reserves, assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on historical experience and on various assumptions it believes to be reasonable under the circumstances. Although actual results may differ from these estimates under different assumptions or conditions, the Company believes that its estimates are reasonable.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, amounts held in banks and highly liquid investments purchased with an original maturity of three months or less. The Company may have cash in banks in excess of federally insured amounts.

Concentrations of Credit Risk

The Company’s cash equivalents and short-term investments are exposed to concentrations of credit risk. The Company manages and controls this risk by investing these funds with major financial institutions.

Short-Term Investments and Marketable Securities

The Company has purchased unsecured commercial paper (floating rate demand notes) of Ford Motor Credit Company, which is classified as trading securities. These securities are stated at fair value based on interest rates that approximate market rates and the short term maturity of the notes. The income earned on these investments is included in interest income in the accompanying financial statements. In accordance with Statement of Financial Accounting Standards No. 159, (SFAS No. 159), The Fair Value Option for Financial Assets and Financial Liabilities, the Company has classified all purchase and sales of these financial instruments as operating activities in the Statement of Cash Flows.

Oil and Gas Properties

The Company follows the full cost method of accounting whereby all costs related to the acquisition and exploration of oil and gas properties are capitalized into a single cost center (“full cost pool”). Such costs include lease acquisition costs, geological and geophysical expenses, overhead directly related to exploration activities and costs of drilling both productive and non-productive wells. Proceeds from property sales are generally credited to the full cost pool without gain or loss recognition unless such a sale would significantly alter the relationship between capitalized costs and the proved reserves attributable to these costs. A significant alteration would typically involve a sale of 25% or more of the proved reserves related to a single full cost pool. Generally, any such sale of unevaluated properties will also be recognized on a cost recovery basis with no gain or loss.

As of November 30, 2008, the Company does not have any proven oil and gas reserves and all of its properties are unevaluated. The costs of unevaluated properties will be withheld from the depletion base until such time as they are either developed or abandoned. Unevaluated properties are assessed at least annually by the Company for impairment. Impairment is estimated by the Company by applying factors based on historical experience and other data such as primary lease terms of the properties, average holding periods of unproved properties, and geographic and geologic data of groupings of individually insignificant properties and projects. Therefore, any impairment of said unevaluated properties would result in an expense to the Company.

8

After completion of the Company’s 2008 impairment assessment, the Company determined that some of its holdings in Montana, primarily in Rosebud and Custer Counties, are subject to impairment. As a result the Company recorded a non-cash impairment expense of $571,000 for the year ending February 29 2008.

During the nine months ended November 30, 2008, the Company completed an impairment review of its oil and gas leaseholds and elected not to pay delay rentals on leases in Rosebud and Custer counties of Montana and therefore abandoned the leases. The effect of the abandonment of these leases was a reduction in our net mineral acreage of 54,614.29 to 22,511.094. The Company wrote off $516,000 against its impairment reserve to reflect the reduction in acreage. The Company has determined that the remaining leaseholds are appropriately valued in the financial statements.

Depletion of exploration and development costs and depreciation of production equipment is computed using the units of production method based upon estimated proved oil and gas reserves. Total well costs, if and when drilled, will be transferred to the depletable pool even when multiple targeted zones have not been fully evaluated. For depletion and depreciation purposes, relative volumes of oil and gas production and reserves are converted at the energy equivalent rate of six thousand cubic feet of natural gas to one barrel of crude oil.

Under the full cost method of accounting, capitalized oil and gas property costs, less accumulated depletion and net of deferred income taxes (full cost pool), may not exceed an amount equal to the present value, discounted at 10%, of estimated future net revenues from proved oil and gas reserves less the future cash outflows associated with the asset retirement obligations that have been accrued in the balance sheet plus the cost, or estimated fair value, if lower of unproved properties and the costs of any properties not being amortized. Should the full cost pool exceed this ceiling, an impairment is recognized. The present value of estimated future net revenues is computed by applying current oil and gas prices to estimated future production of proved oil and gas reserves as of period end, less estimated future expenditures to be incurred in developing and producing the proved reserves assuming the continuation of existing economic conditions. However, subsequent commodity price increases may be utilized to reduce or eliminate any impairment.

The unevaluated oil and gas properties were initially recorded at the historical cost basis, based on cash paid by Big Cat.

Asset Retirement Obligations

The Company will follow the provisions of SFAS No. 143,

Accounting for Asset Retirement (ARO) Obligations

at such time it acquires or drills oil and gas wells. The estimated fair value of the future costs associated with dismantlement, abandonment and restoration of oil and gas properties will be recorded when incurred, generally upon acquisition or completion of a well. The net estimated costs will be discounted to present values using a risk adjusted rate over the estimated economic life of the oil and gas properties. Such costs will be capitalized as part of the related asset. The asset will be depleted on the units-of-production method on a field-by-field basis. The associated liability will be classified in other long-term liabilities in the accompanying balance sheets. The liability will be periodically adjusted to reflect (1) new liabilities incurred, (2) liabilities settled during the period, (3) accretion expense, and (4) revisions to estimated future cash flow requirements. The accretion expense will be recorded as a component of depreciation, depletion and amortization expense in the accompanying statements of operations. As of November 30, 2008, the Company has no ARO obligation.

Income Taxes

The Company uses the asset and liability method of accounting for deferred taxes. Deferred tax assets and liabilities are determined based on the temporary differences between the financial statement and the tax basis of the assets and liabilities. Deferred tax assets or liabilities at the end of each period are determined using the tax rate in effect at that time. The Company adopted FASB Interpretation No. 48 (FIN 48),

Accounting for Uncertainty in Income Taxes,

effective May 1, 2008. FIN 48 requires that amounts recognized in the balance sheet related to uncertain tax positions be classified as current or noncurrent liability, based upon the expected

9

timing of the payment to a taxing authority. The Company had no material uncertain tax positions as of November 30, 2008 or 2007.

Risks and Uncertainties

Historically, oil and gas prices have experienced significant fluctuations and have been particularly volatile in recent years. Price fluctuations can result from variations in weather, levels of regional or national production and demand, availability of transportation capacity to other regions of the country and various other factors. Increases or decreases in prices received could have a significant impact on future results.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, accounts receivable and accounts payable. The fair market value of these financial instruments approximates or is equal to the book value.

In the first quarter of fiscal year 2009, the Company adopted Statement of Financial Accounting Standard (SFAS) No. 157, “Fair Value Measurement” (SFAS No. 157) as amended by FASB Statement of Position (FSP) FAS 157-1 and FSP FAS 157-2. SFAS No. 157 defines fair value, establishes a framework for measuring fair value, and enhances fair value measurement disclosure. FSP FAS 157-2 delays, until the first quarter of fiscal year 2010, the effective date for SFAS 157 for all non-financial assets and non-financial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually).

The following table provides information regarding the source of data used by the Company to develop fair value measurements:

|

|

Fair Value Measurements at Reporting Date Using

|

|

|

|

Quoted Prices in

|

Significant Other

|

Significant

|

|

|

|

Active Markets for

|

Observable Inputs

|

Unobservable Inputs

|

|

|

|

Identical Assets

|

|

(Level 3)

|

|

Description

|

November 30, 2008

|

(Level 1)

|

(Level 2)

|

|

|

Cash and cash

|

|

|

|

|

|

equivalents

|

$103,859

|

$103,859

|

|

|

|

Trading securities

|

$2,867

|

$2,867

|

|

|

|

Total

|

$106,726

|

$106,726

|

|

|

Net Loss Per Share

Basic net loss per share is computed using the weighted average number of common shares outstanding during the period. Contingently issuable shares are included in the computation of basic net income (loss) per share when the related conditions are satisfied. Diluted net income (loss) per share is computed using the weighted average number of common shares and potentially dilutive securities outstanding during the period. Potentially dilutive securities are excluded from the computation if their effect is anti-dilutive.

As of November 30, 2008 the Company had 15,925,000 shares of common stock outstanding. At November 30, 2008, warrants for the purchase of 3,425,000 shares were excluded from the calculation of diluted earnings per share, due to the fact that they were anti-dilutive.

Reclassifications

10

Certain amounts for the period May 1, 2007 (Inception) to February 29, 2008 have been reclassified to conform to the November 30, 2008 presentation. Such reclassifications had no effect on net loss.

Other Comprehensive Income

The Company does not have any material items of other comprehensive income for the nine months ended November 30, 2008 or November 30, 2007. Therefore, total comprehensive income (loss) is the same as net income (loss) for these periods.

Recently Issued Accounting Pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations

In May 2008, the FASB issued SFAS No. 162,

The Hierarchy of Generally Accepted Accounting Principles

.

This Statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (GAAP) in the United States (the GAAP hierarchy). We do not anticipate that the adoption of SFAS 162 will materially impact the Company

In May 2008, the FASB issued SFAS No. 163

Accounting for Financial Guarantee Insurance Contracts—an interpretation of FASB Statement No. 60.

This Statement requires that an insurance enterprise recognize a claim liability prior to an event of default (insured event) when there is evidence that credit deterioration has occurred in an insured financial obligation. This Statement also clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities. Those clarifications will increase comparability in financial reporting of financial guarantee insurance contracts by insurance enterprises. This Statement requires expanded disclosures about financial guarantee insurance contracts. The accounting and disclosure requirements of the Statement will improve the quality of information provided to users of financial statements. This Statement is effective for financial statements issued for fiscal years beginning after December 15, 2008, and all interim periods within those fiscal years, except for some disclosures about the insurance enterprise’s risk-management activities. We do not anticipate the adoption of SFAS 163 will have any effect on the Company’s future financial position or results of operations.

In September 2008 the FASB issued FSP FAS 133-1 and FIN 45-4

Disclosures about Credit Derivatives and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the Effective Date of FASB Statement No. 161.

The credit derivatives market has expanded significantly over the past few years. Financial statement users and others have expressed concerns that the current disclosure requirements for derivative instruments and certain guarantees do not adequately address the potential adverse effects of changes in credit risk on the financial position, financial performance, and cash flows of the sellers of credit derivatives and certain guarantees. This FSP amends FASB Statement No. 133,

Accounting for Derivative Instruments and Hedging Activities,

to require disclosures by sellers of credit derivatives, including credit derivatives embedded in a hybrid instrument. This FSP also amends FASB Interpretation No. 45,

Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others,

to require an additional disclosure about the current status of the payment/performance risk of a guarantee. Further, this FSP clarifies the Board’s intent about the effective date of FASB Statement No. 161,

Disclosures about Derivative Instruments and Hedging Activities

. We do not anticipate the adoption of this FSP will have a material effect on the Company’s future financial position or results of operations.

11

|

4.

|

O

IL AND

G

AS

P

ROPERTY

A

CQUISITIONS

:

|

|

|

|

|

Costs directly associated with the acquisition and exploration of unevaluated properties are excluded from the full cost amortization pool, until they are evaluated. The Company acquired various unproven oil and gas leases in Montana and Wyoming from Big Cat on May 1, 2007. The unevaluated oil and gas properties were initially recorded at the historical cost basis, based on cash paid by Big Cat of $1,794,231.

|

|

|

|

|

During the three months ended November 30, 2008, the Company did not have any expenditure for delay rentals and title work compared to $10,611 for the three months ended November 30, 2007. The Company also received a refund of a deposit on leaseholds of $80,856 for the three months ended November 30, 2007.

|

|

|

|

|

During the nine months ended November 30, 2008, the Company completed a review of its oil and gas leaseholds and elected not to pay delay rentals on leases in Rosebud and Custer counties of Montana and therefore abandoned the leases. The effect of abandonment of these leases was a reduction in our net mineral acreage of 54,614.29 to 22,511.094. The Company wrote off $516,000 against its impairment reserve to reflect the reduction in acreage.

|

|

|

|

|

During the nine months ended November 30, 2008, the Company paid joint venture title work costs, and delay rentals of $35,803.

|

|

|

|

|

During the period May 1, 2007 (Inception) to November 30, 2007, the Company sold one oil and gas leasehold interest consisting of 184 net mineral acres. The Company received gross proceeds of $22,968, and retained a two percent overriding royalty interest on the transferred leasehold interest. The Company also received a refund of a deposit on leaseholds of $80,856 during the three months ended November 30, 2007. The proceeds from these transactions were applied to the carrying value of the asset on the Company’s books.

|

|

|

|

|

During the period May1, 2007 (Inception) through November 30, 2007, the Company purchased net mineral acres, paid title work expenses and paid delayed rentals in the amount of $133,547. The expenses for these transactions were applied to the carrying value of the asset on the Company’s books.

|

|

|

|

5

.

|

Related Party Transactions:

|

|

|

|

|

On May 1, 2007, Big Cat formed a subsidiary, Sterling, and transferred its unevaluated oil and gas properties, consisting of various mineral leases and related costs, in return for 10 million shares of Sterling restricted common stock. Effective April 2, 2008, Big Cat distributed the Sterling shares pro rata to Big Cat’s shareholders, including the current directors of the Company.

|

|

|

|

|

In May 2007, Big Cat advanced $1,500 to Sterling to open Sterling’s bank accounts. This amount was repaid to Big Cat in June 2007 by Sterling.

|

|

|

|

6.

|

S

HAREHOLDERS

’ E

QUITY

:

|

|

|

|

|

On May 1, 2007, Big Cat formed Sterling as a wholly owned subsidiary. In connection with the organization, Big Cat transferred to Sterling its unevaluated oil and gas properties, consisting of various mineral leases and related costs, in return for 10 million shares of Sterling restricted common stock. The unevaluated oil and gas properties were initially recorded at the historical cost basis, based on cash paid by Big Cat of $1,794,231.

|

|

|

|

|

|

During the nine months ended November 30, 2008 the Company sold 925,000 units for $.20 per unit, each unit consisting of one free trading share of its common stock and one warrant to purchase one share of free trading common stock exercisable at $.50 per share. The Company received proceeds of $185,000 from the sale of units. The offering was made as part of the Form S-1 Post Effective Amendment 3 which became effective on July 14, 2008. Following the above sale, the Company’s outstanding common stock increased to 15,925,000 shares.

|

12

During the nine months ended November 30, 2007, the Company completed a private placement of 5,000,000 units of Sterling for $.05 per unit. Each unit consists of one (1) share of Sterling common stock and one (1) warrant for half (1/2) a share of Sterling common stock exercisable at $.25 per share. The Company received cash of $250,000 and recorded offering cost of $790. The Purchase Agreement for the units committed the Company to file a registration for the Sterling shares within 180 days of the date of the Purchase Agreement. The registration statement was filed in December, 2007 and became effective March 17, 2008.

7.

|

I

NCOME

T

AXES

:

|

|

|

|

|

The federal net operating loss (NOL) carryforward of approximately $971,000 as of November 30, 2008 expires on various dates through 2028. Internal Revenue Code Section 382 places a limitation on the amount of taxable income which can be offset by NOL carryforwards incurred before a change in control. “Change in control” for these purposes generally means greater than a 50% change in ownership of the corporation. After a change in control, a loss corporation cannot deduct NOL carryforwards existing at the time of the change in control in excess of the Section 382 limitations. Due to these “change in ownership” provisions, utilization of NOL carryforwards may be subject to an annual limitation in future periods. We have not performed a Section 382 analysis, however approximately ninety percent of the present NOL was incurred during the fiscal years beginning March 1, 2007, and thereafter.

|

|

|

|

|

We have established a full valuation allowance against the deferred tax assets because, based on the weight of available evidence including our continued operating losses, it is more likely than not that all of the deferred tax assets will not be realized. Because of the full valuation allowance, no income tax expense or benefit is reflected on the statement of operations.

|

|

|

8.

|

C

OMMITMENTS AND

C

ONTINGENCIES

:

|

|

|

Environmental Issues

– The Company is engaged in oil and gas exploration and production and may become subject to certain liabilities as they relate to environmental clean up of well sites or other environmental restoration procedures as they relate to the drilling of oil and gas wells and the operation thereof. If the Company acquires existing or previously drilled well bores, the Company may not be aware of what environmental safeguards were taken at the time such wells were drilled or during such time the wells were operated. Should it be determined that a liability exists with respect to any environmental clean up or restoration, the liability to cure such a violation could fall upon the Company. Management believes its properties, all of which are currently unevaluated, are operated in conformity with local, state and federal regulations. No claim has been made, nor is the Company aware of any uninsured liability which the Company may have, as it relates to any environmental clean up, restoration or the violation of any rules or regulations relating thereto.

13

ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This Quarterly Report includes certain statements that may be deemed to be “forward-looking statements” that reflect our current views with respect to future events and financial performance. All statements include in this Quarterly Report, other than statements of historical facts, address matters that we reasonably expect, believe or anticipate will or may occur in the future. Forward-looking statements may relate to, among other things:

|

|

§

|

our future financial position, including working capital and anticipated cash flow;

|

|

|

|

|

|

§

|

the risks of the oil and gas industry, such as operational risks in exploring for, developing and producing crude oil and natural gas;

|

|

|

|

|

|

§

|

market demand;

|

|

|

|

|

|

§

|

risks and uncertainties involving geology of oil and gas deposits;

|

|

|

|

|

|

§

|

the uncertainty of any reserve estimates and reserves life;

|

|

|

|

|

|

§

|

the uncertainty of estimates and projections relating to any production, costs and expenses;

|

|

|

|

|

|

§

|

potential delays or changes in plans with respect to exploration or development projects or capital expenditures;

|

|

|

|

|

|

§

|

fluctuations in oil and gas prices;

|

|

|

|

|

|

§

|

health, safety and environmental risks;

|

|

|

|

|

|

§

|

uncertainties as to the availability and cost of financing; and

|

|

|

|

|

|

|

§

|

the possibility that government policies or laws may change or governmental approvals

may be delayed or withheld.

|

|

|

|

Other sections of this Quarterly Report may include reference to additional factors that could adversely affect our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Our forward looking statements contained in this Quarterly Report are made as of the respective dates set forth in this Quarterly Report. Such forward-looking statements are based on the beliefs, expectations and opinions of management as of the date the statements are made. We do not intend to update these forward-looking statements, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Plan of Operations

14

The Company acquired various unevaluated oil and gas leases in Montana and Wyoming from Big Cat on May 1, 2007. The unevaluated oil and gas properties were initially recorded at the historical cost basis, based on cash paid by Big Cat of $1,794,231.

During the period May 1, 2007 (inception) to November 30, 2007, the Company paid delay rentals and expenses associated with our leaseholds in the amount of $133,547 and sold one oil and gas leasehold interest consisting of 184 net mineral acres. The Company received gross proceeds of $22,968, and retained a two percent overriding royalty interest on the transferred leasehold interest. The Company also received a refund of a deposit on certain leaseholds of $80,856. During the nine months ended November 30, 2008, the Company paid delay rentals and title work expenses on our Wyoming joint venture in the amount of $35,803.

During the nine months ended November 30, 2008, the Company completed a review of its oil and gas leaseholds and elected not to pay delay rentals on leases in Rosebud and Custer counties of Montana and therefore abandoned the leases. The effect of abandonment of these leases was a reduction in our net mineral acreage of 54,614.29 to 22,511.094. The Company wrote off $516,000 against its impairment reserve to reflect the reduction in acreage.

For the fiscal year ending February 28, 2009, the Company’s plan of operation is to evaluate new oil and gas projects that are available to the Company and evaluate utilization of the Company’s existing Montana and Wyoming leasehold interests.

With regard to developing our Wyoming interests, effective December 31, 2007, the company entered into a joint venture agreement with Cedar Resources Corporation, a gas producer in the Powder River Basin. We sold 50% of our leasehold interests in our Wyoming properties to Cedar Resources for cash and a 50% working interest in future development of the company’s Wyoming leaseholds.

The Company has also retained the services of American Oil and Gas Corporation, a privately held oil and gas consulting company, to assist the Company with obtaining potential oil and gas ventures in the Rocky Mountain area. American Oil and Gas will perform initial analysis of potential projects and recommend to the Company those projects that should be evaluated further by management.

During the nine months ended November 30, 2008 the Company sold 925,000 units at $.20 per unit, each unit consisting of one free trading share of its common stock and one warrant to purchase one share of free trading common stock exercisable at $.50 per share. The Company received proceeds of $185,000 from the sale of the units. The offering was made as part of the Form S-1 Post Effective Amendment 3 which became effective on July 14, 2008. Following the above sale, the Company’s outstanding common stock increased to 15,925,000 shares.

We may conduct our own field tests or exploration on one or more of our properties in Montana to determine the appropriate structure for possible development. There is, however, no assurance that we will.

Limited operating history; need for additional capital

There is limited historical financial information about our current operations upon which to base an evaluation of our performance. We are in exploration stage operations and have not generated any revenues from current operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, the possibility that there is a lack of a sales market for our products, and possible cost overruns due to price and cost increases in services and products. We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Results of Operations

15

Three Months Ended November 30, 2008 compared to the Three Months ended November 30, 2007

We reported a net loss for the three months ended November 30, 2008 of $29,377 compared to net loss of $36,977 for the same period in 2007.

Our other general and administrative costs were $1,731 during the three month period ended November 30, 2008. There was $2,615 of general and administrative expense for the period three months ended November 30, 2007.

We had $27,754 of professional fess, $4,900 of which were non-cash, during the three months ended May 31, 2008, compared to $35,808 of professional fees, $12,500 of which were non-cash, for the three months ended November 30, 2007. The professional fees in 2008 are for consultants paid to locate future lease opportunities and for required SEC filings and legal fees associated with Company stock offerings.

Nine months ended November 30, 2008 compared to the Period May 1, 2007 (inception) to November 30, 2007

We reported a net loss for the nine months ended November 30, 2008 of $324,666 compared to net loss of $55,078 for the period May 1, 2007 (inception) to November 30, 2007.

We had personnel expense of $175,602 in the nine months ended November 30, 2008 compare to no personnel expense for the period May 1, 2007 (inception) to November 30, 2007.

Our other general and administrative costs were $15,895 during the six month period ended November 30, 2008. There was $9,016 of general and administrative expense for the period May 1, 2007 (inception) to November 30, 2007.

We had $135,942 of professional fess, $4,900 of which were non-cash, during the nine months ended November 30, 2008, compared to $48,608 of professional fees, $25,300 of which were non-cash for the period May 1, 2007 (inception) to November 30, 2007. The professional fees in 2008 are for consultants paid to locate future lease opportunities and for required SEC filings and legal fees associated with Company stock offerings.

Liquidity and Capital Resources

As of November 30, 2008, we had working capital of $92,030, and it is uncertain whether this amount will be sufficient to fund operations. Therefore, we may seek additional sources of capital for the coming year.

For the nine months ended November 30, 2008, we used cash from operations of $51,764. Cash used in operations was primarily a result of our net loss offset by activity in trading securities, compared to cash used from operations of $5,477 for the period May 1, 2007 (inception) to November 30, 2007 which was primarily due to our net loss offset by contributed services..

Cash used in investing activities was $35,803 for the nine months ended November 30, 2008, primarily from payment of delay rentals and joint venture title costs, compared to cash used of $29,723 for the period May 1, 2007 (inception) to November 30, 2007, primarily from payment of delay rentals offset by the sale of one leasehold and a deposit refund.

Cash flow provided by financing activities was $185,000 for the nine months ended November 30, 2008 compared to $249,210 for the period May 1, 2007 (inception) to November 30, 2007. Cash provided was from the placement of Company stock in both periods.

16

During the nine months ended November 30, 2008 the Company sold 925,000 units, each unit consisting of one free trading share of its common stock and one warrant to purchase one share of tree trading common stock exercisable at $.50 per share. The Company received proceeds of $185,000 from the sale of the units. The offering was made as part of the Form S-1 Post Effective Amendment 3 which became effective on July 14, 2008. Following the above sale, the Company’s outstanding common stock increased to 15,925,000 shares.

During the period May 1, 2007 (inception) to November 30, 2007, the Company completed a private placement of 5,000,000 units of Sterling at $.05 per unit. Each unit consists of one (1) share of Sterling restricted common stock and one (1) warrant for half (1/2) a share of Sterling common stock exercisable at $.25 per share. The company received cash of $250,000 and recorded offering costs of $790. The Purchase Agreement for the units committed the Company to file a registration for the Sterling shares within 180 days of the date of the Purchase Agreement. The registration statement was filed in December, 2007 and became effective March 17, 2008

As of the date of this report, we have yet to generate revenues from our current business operations.

Financial Instruments and Other Information

As of November 30, 2008 and November 30, 2007 we had cash, marketable securities, accounts payable and accrued liabilities, which are each carried at approximate fair value due to the short maturity date of those instruments. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Critical Accounting Polices and Estimates

Use of Estimates in the Preparation of Financial Statements

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of any oil and gas reserves, assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates on historical experience and on various assumptions it believes to be reasonable under the circumstances. Although actual results may differ from these estimates under different assumptions or conditions, the Company believes that its estimates are reasonable.

Oil and Gas Properties

The Company follows the full cost method of accounting whereby all costs related to the acquisition and exploration of oil and gas properties are capitalized into a single cost center (“full cost pool”). Such costs include lease acquisition costs, geological and geophysical expenses, overhead directly related to exploration activities and costs of drilling both productive and non-productive wells. Proceeds from property sales are generally credited to the full cost pool without gain or loss recognition unless such a sale would significantly alter the relationship between capitalized costs and the proved reserves attributable to these costs. A significant alteration would typically involve a sale of 25% or more of the proved reserves related to a single full cost pool. Generally, any such sale of unevaluated properties will also be recognized on a cost recovery basis with no gain or loss.

As of November 30, 2008, the Company does not have any proven oil and gas reserves and all of its properties are unevaluated. The costs of unevaluated properties will be withheld from the depletion base until such time as they are either developed or abandoned. Unevaluated properties are assessed at least annually by the Company for impairment. Impairment is estimated by the Company by applying factors based on historical experience and other data such as primary lease terms of the properties, average holding periods of unproved properties,

17

and geographic and geologic data of groupings of individually insignificant properties and projects. Therefore, any impairment of said unevaluated properties would result in an expense to the Company.

After completion of the Company’s 2008 impairment assessment, the Company determined that some of its holdings in Montana, primarily in Rosebud and Custer Counties, are subject to impairment. As a result the Company recorded a non-cash impairment expense of $571,000 for the year ending February 29 2008.

During the nine months ended November 30, 2008, the Company completed an impairment review of its oil and gas leaseholds and elected not to pay delay rentals on leases in Rosebud and Custer counties of Montana and therefore abandoned the leases. The effect of the abandonment of these leases was a reduction in our net mineral acreage of 54,614.29 to 22,511.094. The Company wrote off $516,000 against its impairment reserve to reflect the reduction in acreage. The Company has determined that the remaining leaseholds are appropriately valued in the financial statements.

Depletion of exploration and development costs and depreciation of production equipment is computed using the units of production method based upon estimated proved oil and gas reserves. Total well costs, if and when drilled, will be transferred to the depletable pool even when multiple targeted zones have not been fully evaluated. For depletion and depreciation purposes, relative volumes of oil and gas production and reserves are converted at the energy equivalent rate of six thousand cubic feet of natural gas to one barrel of crude oil.

Under the full cost method of accounting, capitalized oil and gas property costs, less accumulated depletion and net of deferred income taxes (full cost pool), may not exceed an amount equal to the present value, discounted at 10%, of estimated future net revenues from proved oil and gas reserves less the future cash outflows associated with the asset retirement obligations that have been accrued in the balance sheet plus the cost, or estimated fair value, if lower of unproved properties and the costs of any properties not being amortized. Should the full cost pool exceed this ceiling, an impairment is recognized. The present value of estimated future net revenues is computed by applying current oil and gas prices to estimated future production of proved oil and gas reserves as of period end, less estimated future expenditures to be incurred in developing and producing the proved reserves assuming the continuation of existing economic conditions. However, subsequent commodity price increases may be utilized to reduce or eliminate any impairment.

The unevaluated oil and gas properties were initially recorded at the historical cost basis, based on cash paid by Big Cat.

Risks and Uncertainties

Historically, oil and gas prices have experienced significant fluctuations and have been particularly volatile in recent years. Price fluctuations can result from variations in weather, levels of regional or national production and demand, availability of transportation capacity to other regions of the country and various other factors. Increases or decreases in prices received could have a significant impact on future results.

Recently Issued Accounting Pronouncements:

In May 2008, the FASB issued SFAS No. 162,

The Hierarchy of Generally Accepted Accounting Principles

.

This Statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (GAAP) in the United States (the GAAP hierarchy). We do not anticipate that the adoption of SFAS 162 will materially impact the Company

18

In May 2008, the FASB issued SFAS No. 163

Accounting for Financial Guarantee Insurance Contracts—an interpretation of FASB Statement No. 60.

This Statement requires that an insurance enterprise recognize a claim liability prior to an event of default (insured event) when there is evidence that credit deterioration has occurred in an insured financial obligation. This Statement also clarifies how Statement 60 applies to financial guarantee insurance contracts, including the recognition and measurement to be used to account for premium revenue and claim liabilities. Those clarifications will increase comparability in financial reporting of financial guarantee insurance contracts by insurance enterprises. This Statement requires expanded disclosures about financial guarantee insurance contracts. The accounting and disclosure requirements of the Statement will improve the quality of information provided to users of financial statements. This Statement is effective for financial statements issued for fiscal years beginning after December 15, 2008, and all interim periods within those fiscal years, except for some disclosures about the insurance enterprise’s risk-management activities. We do not anticipate the adoption of SFAS 163 will have any effect on the Company’s future financial position or results of operations.

In September 2008 the FASB issued FSP FAS 133-1 and FIN 45-4

Disclosures about Credit Derivatives and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the Effective Date of FASB Statement No. 161.

The credit derivatives market has expanded significantly over the past few years. Financial statement users and others have expressed concerns that the current disclosure requirements for derivative instruments and certain guarantees do not adequately address the potential adverse effects of changes in credit risk on the financial position, financial performance, and cash flows of the sellers of credit derivatives and certain guarantees. This FSP amends FASB Statement No. 133,

Accounting for Derivative Instruments and Hedging Activities,

to require disclosures by sellers of credit derivatives, including credit derivatives embedded in a hybrid instrument. This FSP also amends FASB Interpretation No. 45,

Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others,

to require an additional disclosure about the current status of the payment/performance risk of a guarantee. Further, this FSP clarifies the Board’s intent about the effective date of FASB Statement No. 161,

Disclosures about Derivative Instruments and Hedging Activities

. We do not anticipate the adoption of this FSP will have a material effect on the Company’s future financial position or results of operations.

Off-Balance Sheet Arrangements

From time-to-time, we may enter into off-balance sheet arrangements and transactions that can give rise to off-balance sheet obligations. As of November 30, 2008 and November 30, 2007, there were no off –balance sheet arrangements.

ITEM 4T.

CONTROLS AND PROCEDURES

The Company’s Chief Executive Officer and the Principal Financial Officer evaluated the effectiveness of the Company’s disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended) as of November 30, 2008. Based on this evaluation, the Chief Executive Officer and Principal Financial Officer concluded that, as of November 30, the Company’s disclosure controls and procedures were effective.

There were no changes in the Company’s internal controls over financial reporting that occurred during the quarter ended November 30, 2008, that have materially affected, or are reasonably likely to materially affect, the Company’s internal controls over financial reporting,

19

PART II. OTHER INFORMATION

ITEM 1. Legal Proceedings

None

ITEM 2. (a) Unregistered Sales of Equity Securities.

None

(b) Use of Proceeds:

Working capital

$185,000

ITEM 3. Default Upon Senior Securities

None

ITEM 4. Submission of Matters to a Vote of Security Holders

None

ITEM 5. Other Information

None

ITEM 6. EXHIBITS.

|

Exhibits

|

Document Description

|

|

31.1

|

Section 302 Certification of Principal Executive Officer.

|

|

31.2

|

Section 302 Certification of Principal Financial Officer.

|

|

32.1

|

Section 906 Certification of Chief Executive Officer.

|

|

32.2

|

Section 906 Certification of Chief Financial Officer.

|

20

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities and Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on this 9th day of January, 2009.

Sterling Oil & Gas Company

BY:

TIMOTHY BARRITT

Timothy Barritt, President and Principal Executive Officer

BY:

RICHARD G. STIFEL

Richard G. Stifel, Principal Accounting Officer and Principal Financial Officer

21

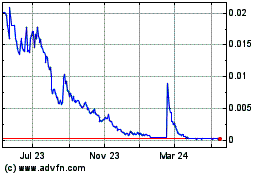

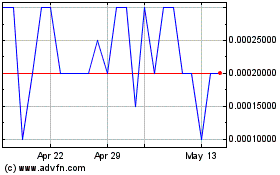

Solar Integrated Roofing (PK) (USOTC:SIRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Solar Integrated Roofing (PK) (USOTC:SIRC)

Historical Stock Chart

From Jul 2023 to Jul 2024