Current Report Filing (8-k)

24 June 2023 - 6:56AM

Edgar (US Regulatory)

0001434601

false

0001434601

2023-04-10

2023-04-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 10, 2023

THE MARQUIE GROUP, INC.

(Exact Name of Registrant as Specified in Charter)

| Florida |

000-54163 |

26-2091212 |

| (State of Other Jurisdiction |

(Commission File |

(IRS Employer |

| Of Incorporation) |

Number) |

Identification No.) |

|

7901 4th Street North, Suite 4000

St. Petersburg, Florida |

33702 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (800) 351-3021

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities

Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1. 01 Entry into a Material Definitive Agreement.

On April 10, 2023 (the “Closing Date”),

The Marquie Group, Inc. (the “Company”) entered into a Securities Purchase Agreement (“SPA”) in connection with

the issuance of a discounted convertible promissory note (“Note”) in the aggregate principal amount of $61,100 for cash consideration

of $55,000. The Note matures on April 10, 2024 (the “Maturity Date”), and bears interest at the rate of 12% per annum. The

Note may be prepaid prior to its Maturity Date. The Note, together with all interest as accrued, is convertible into shares of the Company’s

common stock at a price equal to $0.003, and is subject to adjustment for stock dividends, stock splits, stock combinations, rights offerings,

reclassifications or similar transaction stock consolidations. The SPA and the Note have piggy-back registration rights should the Company

file a registration statement. The SPA and the Note also contain certain representations, warranties, conditions, restrictions, and covenants

of the Company that are customary in such transactions with smaller companies.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On April 10, 2023, the Company executed the SPA

and issued the Note as described in Item 1.01 above. The Note may be accelerated by the holder in the event of default and the rate of

interest on the Note will increase to 16% per annum. In addition, the amount due and payable under the Note (and, consequently, the number

of shares of common stock convertible thereunto) may be increased to 125% of the principal amount of the Note, plus default interest

as accrued thereon, in the event of default. The Note is a direct financial obligation of the Company and is considered a current liability

of the Company for accounting purposes.

Item 3.02 Unregistered Sales of Equity Securities.

On April 10, 2023, the Company issued a Note convertible

into equity securities of the Company as described in Item 1.01 above. The purchaser of the Note was an “accredited investor”

as such term is defined by rules promulgated by the Securities and Exchange Commission (“SEC”). No solicitation was made

and no underwriting discounts were given or paid in connection with this transaction. The Company believes that the issuance of shares

pursuant to the Acquisition was exempt from registration with the SEC pursuant to Section 4(2) of the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

The Marquie Group, Inc. |

| |

|

|

| Date: June 23, 2023 |

|

By: /s/ Marc Angell |

| |

|

Marc Angell |

| |

|

Chief Executive Officer |

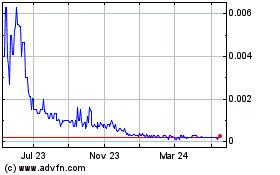

Marquie (PK) (USOTC:TMGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

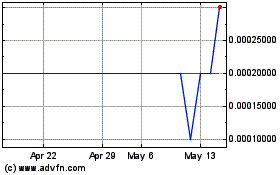

Marquie (PK) (USOTC:TMGI)

Historical Stock Chart

From Dec 2023 to Dec 2024